Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: OpenAI and $NVDA unveil “UAE Stargate”

• Massive 5 GW AI campus planned for Abu Dhabi • 200 MW AI cluster set to launch in 2026 • Oracle, SoftBank, and Cisco onboard to help build out the datacenter infrastructure Source: Stocktwits

🚨BREAKING: Trump's $1.2T Qatar Deal - The BIGGEST deal in US-Gulf history.

➡️ Boeing and GE Aerospace Deal: The centerpiece of the agreements is a $96 billion deal with Qatar Airways for the purchase of up to 210 Boeing 787 Dreamliner and 777X aircraft, powered by GE Aerospace engines. This is described as the largest widebody aircraft order in Boeing’s history, expected to support approximately 154,000 U.S. jobs annually during production and delivery. ➡️ Defense and Security Investments: The deal includes a statement of intent for $38 billion in future investments in Qatar’s Al Udeid Air Base, as well as other air defense and maritime security capabilities, strengthening U.S.-Qatar security cooperation. ➡️ Other Commercial Agreements: Additional private sector deals include: McDermott’s $8.5 billion in energy infrastructure projects in Qatar. Parsons securing 30 projects worth up to $97 billion for engineering services. A joint venture between Quantinuum and Al Rabban Capital for up to $1 billion in quantum technologies and workforce development in the U.S.

Trump says he’d rescind global chip curbs amid ai restrictions debate -- bullish for $nvda 🤩

▶️ Nvidia shares rose on Wednesday on a report that the Trump administration plans to revise a set of chip trade restrictions called the “AI diffusion” rule. ▶️ The rule, which was proposed in the last days of the Biden administration, organizes countries into three different tiers, all of which have different restrictions on whether advanced AI chips like those made by Nvidia, AMD, and Intel can be shipped to the country without a license. ▶️ The Trump administration plans to rescind the rule, Bloomberg reported on Wednesday. The chip restrictions were scheduled to take effect on May 15. ▶️ Nvidia had no comment on the reported move by the Trump administration. ▶️ Chipmakers including Nvidia and AMD have been against the rule. AMD CEO Lisa Su told CNBC on Wednesday that the U.S. should strike a balance between restricting access to chips for national security and providing access, which will boost the American chip industry. Nvidia CEO Jensen Huang said earlier this week that being locked out of the Chinese AI market would be a “tremendous loss.” 🔴 However, this is more about Middle East than China. Indeed, the changes are taking shape as Trump readies for a trip to the Middle East, where a number of nations including Saudi Arabia and the UAE have bristled at restrictions on their ability to acquire AI chips. Source: Shay Boloor, CNBC

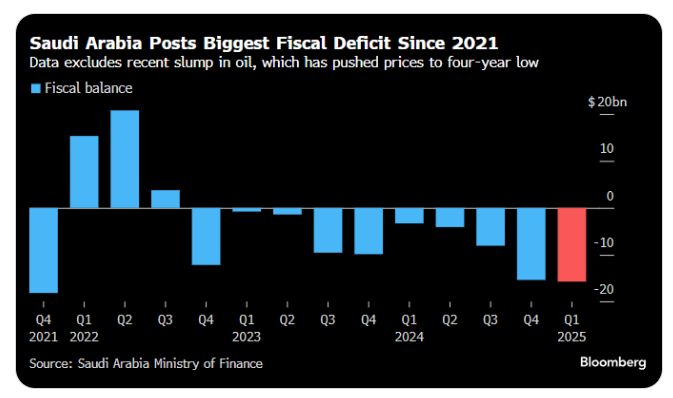

Saudiarabia posted a $16 bn budget deficit in the first 3 months of 2025

That's already well over half of the $27 bn the government had budgeted for the entire year. Oil averaged $75 in the first quarter of 2025 -- it's now near $60 Source: Ziad Daoud @ZiadMDaoud, Bloomberg

🚨BREAKING: SAUDI ARABIA TO HOST THE 2034 WORLD CUP

FIFA has officially confirmed Saudi Arabia as the host of the 2034 World Cup, marking a bold step for football’s future in the Middle East. This is a chance to showcase Saudi Arabia’s transformation and its commitment to global sports. With its growing investment in infrastructure, culture, and innovation, the kingdom is set to deliver a world-class tournament like never before. Source: The Guardian, Mario Nawfal on X

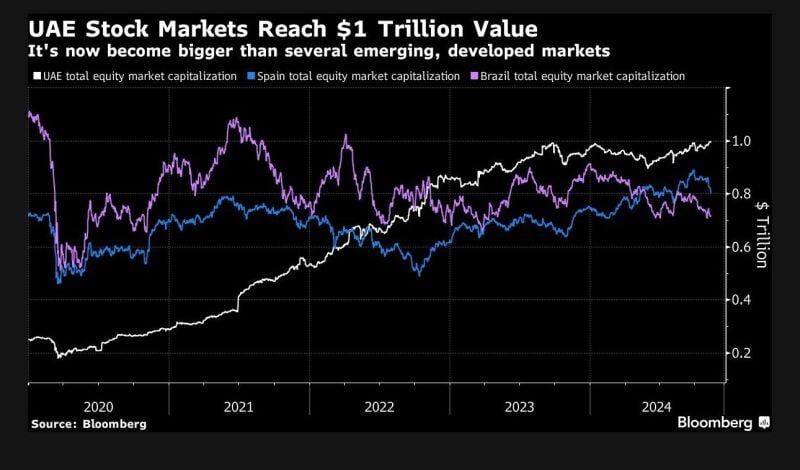

In a new milestone, the combined market capitalization of Dubai and Abu Dhabi stock exchanges has reached $1 trillion value for the first time.

The surge in market cap is driven by a string of new share listings in the last couple of years.

Saudi Arabia’s Public Investment Fund, which has about $930bn worth of assets, said it intended to cut the proportion of funds invested overseas to between 18 and 20%, down from 30%.

Yasir Al Rumayyan, governor of PIF and chairman of Saudi Aramco and the FII Institute, speaking at the start of FII8 in Riyadh on Tuesday said there needs to be a global shift in focus from short term gains to sustainable growth supported by Artificial Intelligence (AI) that could benefit both economies and societies. The head of the kingdom’s sovereign wealth fund added that in a world marred by uncertainty, countries which can bridge gaps between East and West are essential. He said Saudi Arabia is a “super connector” thanks to its unique resources and strategic geographic location, which enables it to drive investments in infrastructure and technology. Source: FT, Zawya

The world's largest oil exporter is preparing to raise output from December as it resigns itself to lower global prices.

Saudi Arabia is ready to abandon its unofficial price target of $100 a barrel for crude as it prepares to increase output, in a sign that the kingdom is resigned to a period of lower oil prices, according to people familiar with the country’s thinking. The world’s largest oil exporter and seven other members of the Opec+ producer group had been due to unwind long-standing production cuts from the start of October. But a two-month delay sparked speculation over whether the group would ever be able to raise output, with the price of Brent crude, the international benchmark, briefly dropping below $70 this month to its lowest since December 2021. Source: FT >>> https://lnkd.in/eYwDvYcQ

Investing with intelligence

Our latest research, commentary and market outlooks