Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

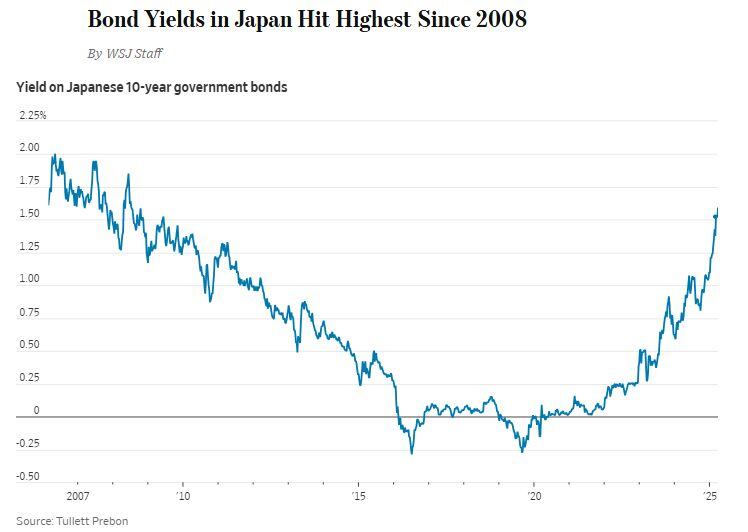

Japanese 10-Year Bond Yield jumps to highest level since the Global Financial Crisis 🚨

Source: Barchart

🔴 Germany’s 10-year bond yield rising to 4% is “entirely feasible” as a reset in the country’s borrowing costs plays out, according to Aviva Investors.

The rate surged to nearly 3% in recent weeks as Germany’s incoming chancellor spearheaded a huge spending package that is expected to lead to billions of euros in extra bond sales. Vasileios Gkionakis, senior economist and strategist at Aviva Investors, says yields are likely to keep rising as the fiscal measures boost economic growth. ➡️ 4% for German 10-Year Bund would mean German mortgages at 5% to 6% and the burst of the epic German real estate bubble. Would it also mean Italian, Spanish and French bonds yields at a level that could trigger the next Euro crisis. Good luck. Source: Bloomberg

Bonds don't love the cooler-than-expected February CPI report

Weakness in airfares may not show up in the PCE, the Fed's preferred gauge, which pulls that price data from the PPI And still-firmer goods prices could lead to core PCE, for a change, running higher than core CPI Source: Nick Timiraos @NickTimiraos

Investing with intelligence

Our latest research, commentary and market outlooks