Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

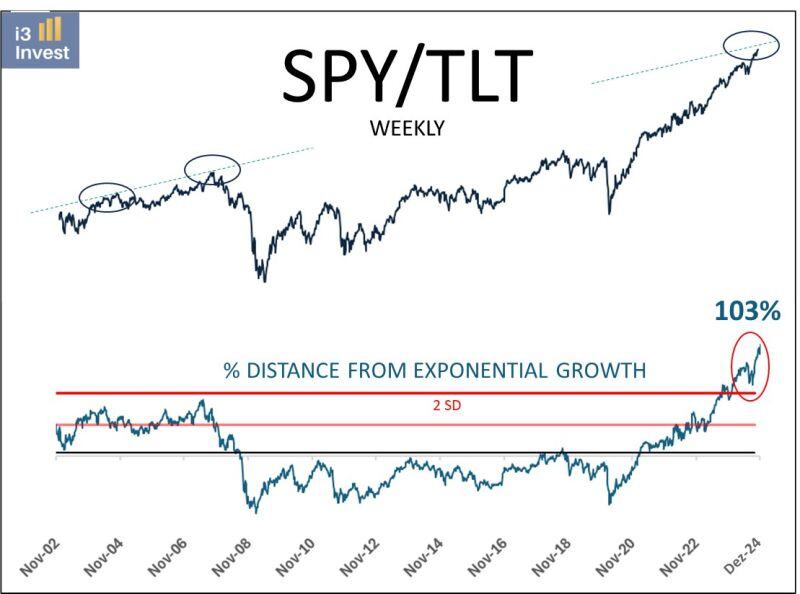

The long S&P500 ($SPY) / short US treasuries 20y+ ($TLT) makes a lot of sense from a macro perspective but is very consensual and looks very extended

See ratio below "In the end, trees don't grow to the sky, and few things go to zero." Howard Marks Source: Guilherme Tavares @i3_invest

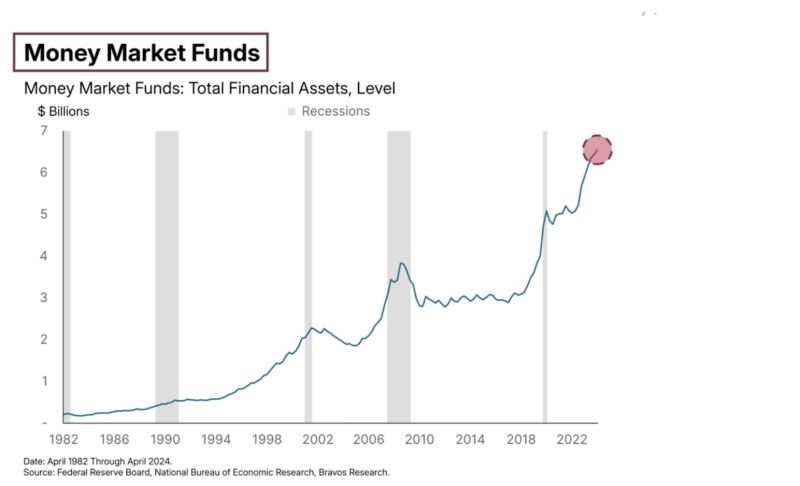

Money market funds have just hit RECORD levels

Surpassing the $6.5 trillion mark Source: Win Smart

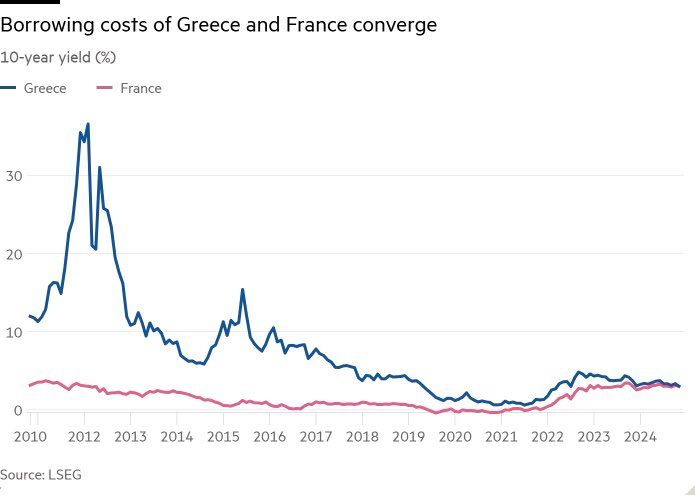

The chart of the day:

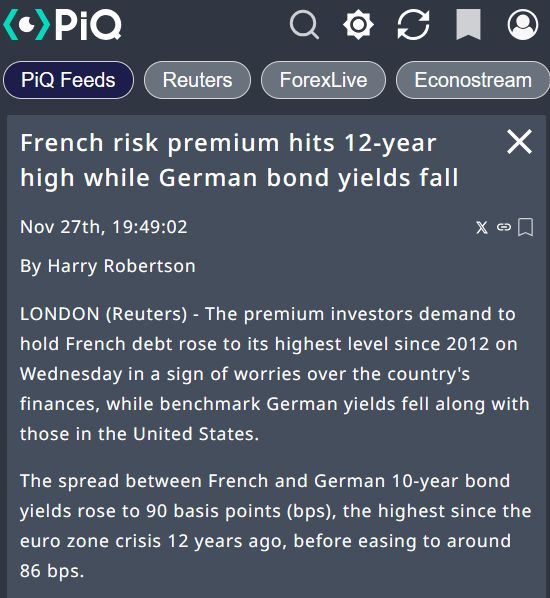

France’s benchmark bond yield matched Greece’s for the first time on record, the latest milestone in a week marked by mounting anxiety over the fate of Prime Minister Michel Barnier’s government. The rate on 10-year French notes, traditionally considered among the safest in the euro area, briefly rose to 3.03% before paring the move. That was the same as comparable Greek bonds, a country once at the heart of the European sovereign debt crisis. Investors are concerned that France may struggle to pass a budget for next year, with the far-right National Rally party threatening a no-confidence vote to bring the government down if its demands aren’t met. While French bonds rallied after Finance Minister Antoine Armand said he is prepared to make concessions on the 2025 budget, that did little to dent months of underperformance. “France is not Greece,” said finance minister Antoine Armand. "France has . . . far superior economic and demographic power which means it is not Greece.” Humility at its best... Source: FT, LSEG

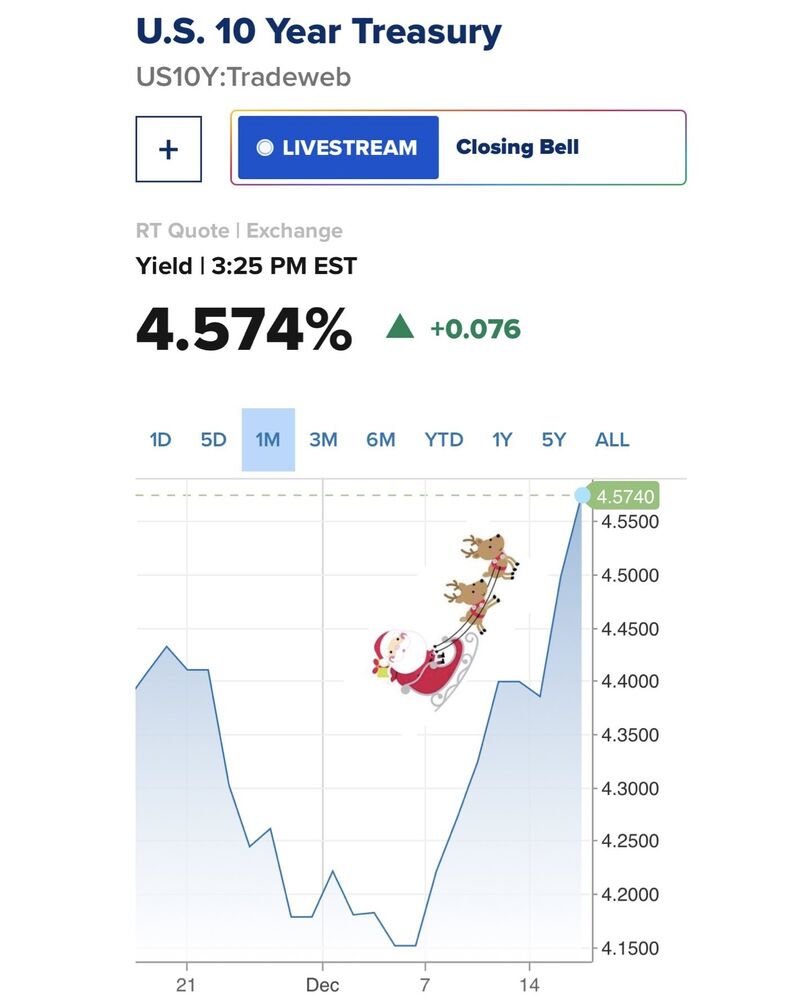

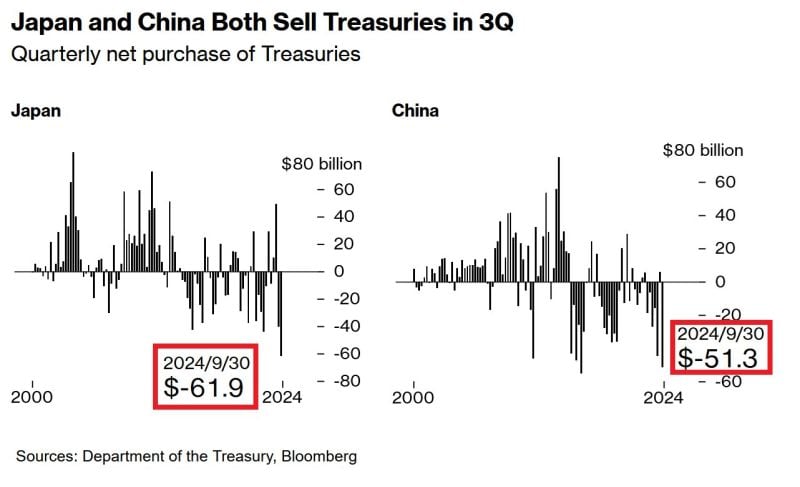

CHINA AND JAPAN ARE DUMPING US TREASURIES

Japanese investors sold $61.9 billion of Treasuries in Q3 2024, the most on RECORD. Chinese funds dumped $51.3 billion, the second largest on record. Japan and China are two world's biggest foreign holders of US government debt. Source: Global Markets Investor

Actually, bonds performed really well last week

$TLT $AGG Source: Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks