Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

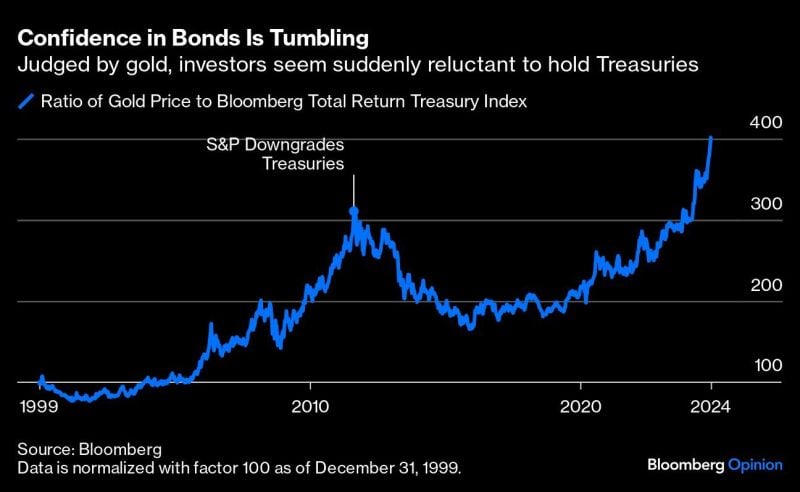

Actually, bonds performed really well last week

$TLT $AGG Source: Mike Zaccardi, CFA, CMT, MBA

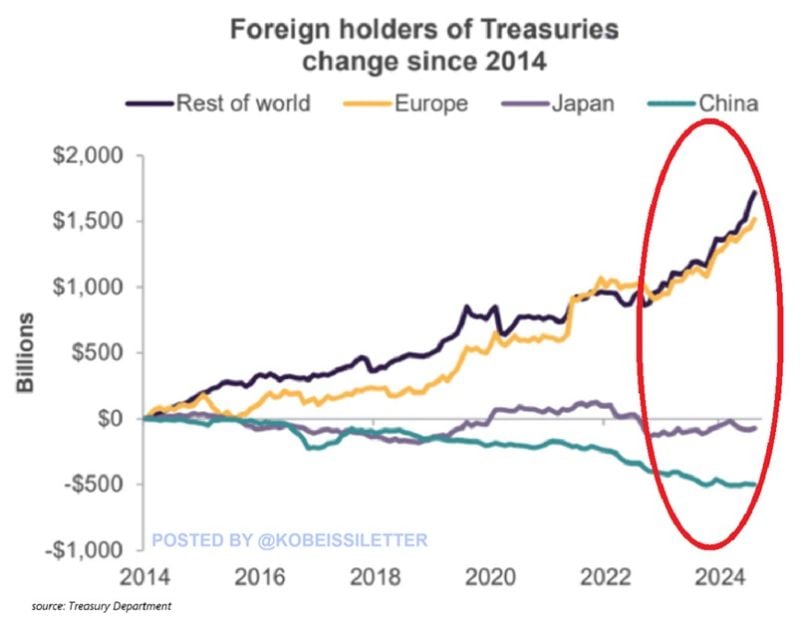

Foreign holdings of US Treasuries have jumped by $2.6 TRILLION over the last decade.

Europe’s Treasury holdings have risen by $1.5 trillion with the rest of the world acquiring $1.7 trillion of bonds. On the other hand, China and Japan's holdings have shrunk by ~$500 and ~$100 billion, respectively. Overall, total foreign holdings as a share of outstanding federal debt have dropped from 35% to 24%, near the lowest level in 18 years. This is the consequence of rapidly rising public debt with the supply of Treasuries rising ~$15 trillion over the last decade. Foreign demand for Treasuries cannot keep up with skyrocketing US debt. Source: The Kobeissi Letter

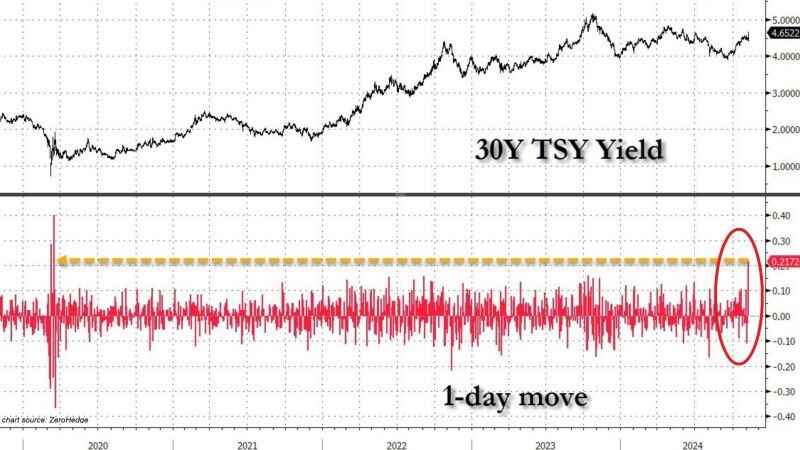

THIS IS AN ABSOLUTELY WILD MOVE >>>

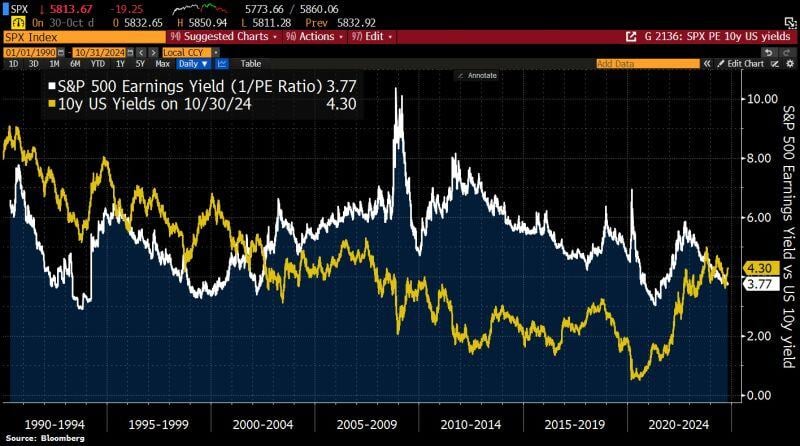

The 30-year US Treasury jumped by a massive 22 basis points, the biggest spike since the COVID CRISIS. At the same time, the 10-year yield jumped by 16 basis points, to the highest since July. Meanwhile, the Fed is going to cut today.... Source: Global Markets Investor

UK borrowing costs hit highest level this year as gilt sell-off intensifies.

This should not come as a surprise, Eurizon SLJ Research's Stephen Jen says: When the debt stock is 99% of GDP, and the govt imposes the largest tax hike post-WWII and the largest increase in spending in multi-decades, why should one be surprised that the bond market shows signs of indigestion? Source: HolgerZ, FT

Another poor US Treasuries auction yesterday.

This was the trigger that pushed yields higher (despite oil prices crashing -6%...) Bond yields no longer have much to do with how strong/weak the economy is. It’s all about deficits, high government spending, and huge Treasury auctions. Source: QE infinity

Investing with intelligence

Our latest research, commentary and market outlooks