Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

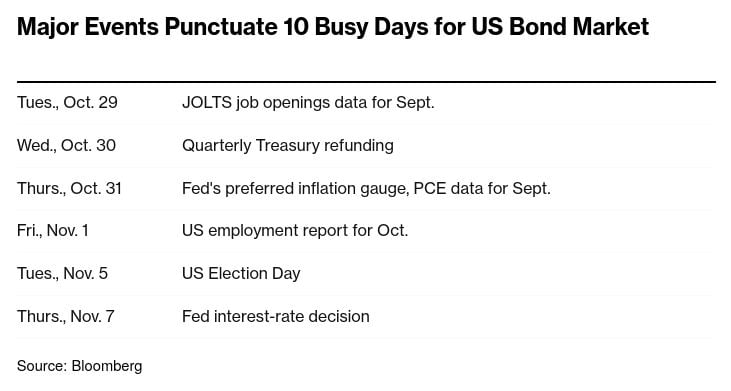

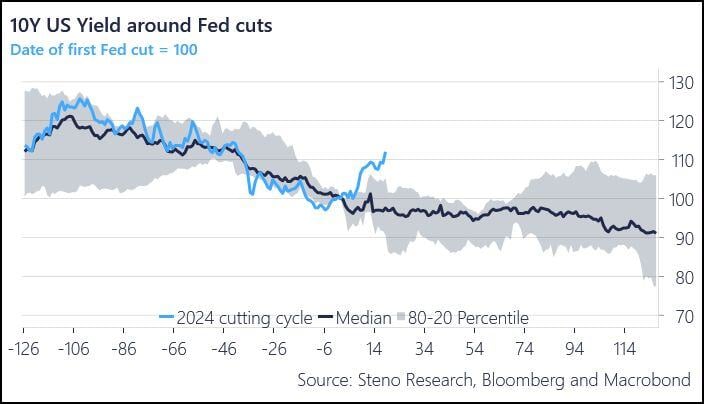

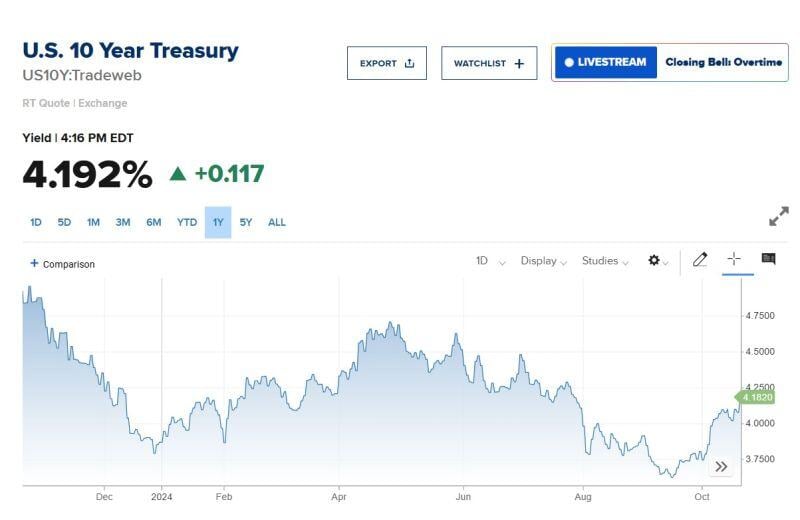

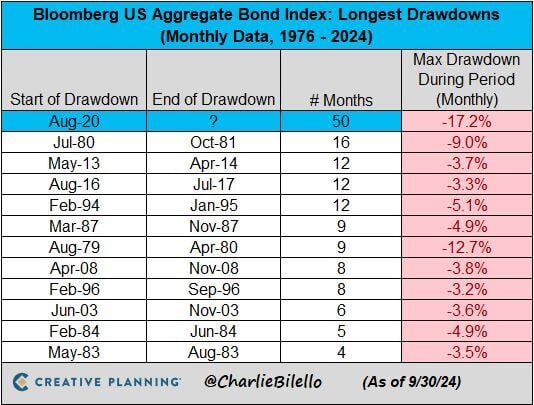

The move in bond yields after the 50bp cut is very out of the ordinary.

Source: Andreas Steno Larsen @AndreasSteno on X

Druckenmiller is shorting U.S. Treasuries with a record setting 20% of his portfolio.

He knows what's about to happen ("Interest rates could double from here.") Source: Financelot @FinanceLancelot on X

A fascinating chart by James Bianco ->

The 10-year yield (blue) and Trump's Political Betting probabilities (orange). The chart starts the day Biden dropped out. Coincidence, or are these series related? If they are related, what happens to 10-year yields if the orange line (man) goes to 100 in 14 days? Source: Bianco Research

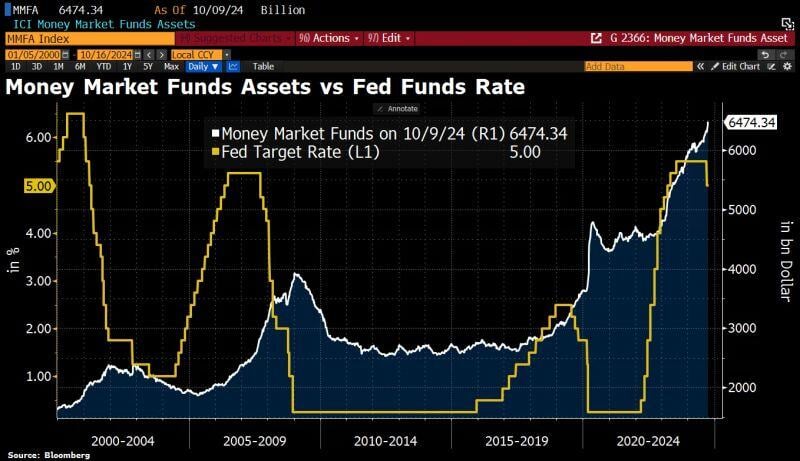

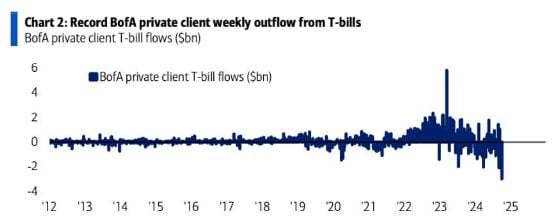

Mind the gap: Assets in US money market funds have hit a fresh ATH at $6.5tn, although the relevant Fed Funds Rates have fallen and are likely to fall further.

Note however that the "relative" figures (i.e money market funds AuMs as a % of total assets AuMs) currently stand at all-time low whereas equities weight is at all-time high... Source. Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks