Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

😱 The shocking chart of the day: The 5Y yield of Greek government bonds is now BELOW (!!!) the French ones 😱

🔊 French Prime Minister Michel Barnier announced his new government on Saturday, ending months of political uncertainty after snap elections left the country with a hung parliament. The new cabinet takes a noticeable shift to the right. But this announcement does not seem to convince markets. 🚨 Indeed, for the first time since 2007, the yield on French 10-year government bonds (2.95%) exceeded that of Spanish and Portuguese bonds. And for the first time ever, the French OAT 5Y yield is now ABOVE the 5y Greek government bonds yield. Meanwhile, the spread with the German Bund has widened to 82bps (vs. 50 at the beginning of June), and the risk of political instability accentuates this trend. 🔔 These are clear signals that markets doubt the French government's ability to reduce its public deficit. The latter stands at 5.5% of GDP in 2023, well above the EU's target of 3% by 2027. ⚠ France is just unable to convince and reassure people of its ability to maintain a budget and a sustainable financial situation in the medium to long term. Source: Bloomberg

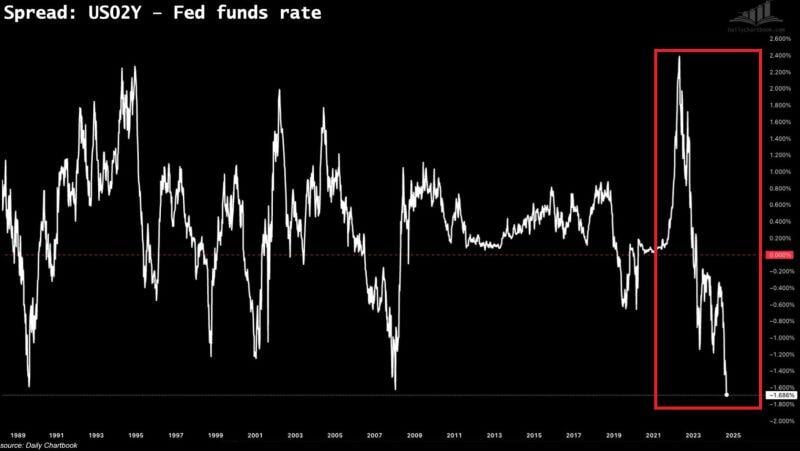

‼️THIS HAS NOT HAPPENED IN AT LEAST 35 YEARS‼️

The spread between the 2-year US government bonds and Fed's rates FELL to -1.686%, the most in over 3 decades. In other words, bond market expects the Fed to cut BIG in the next months. Question: Is the bond market too dovish? Or is the Fed too much behind the curve? Source: Global Markets Investor, Bloomberg

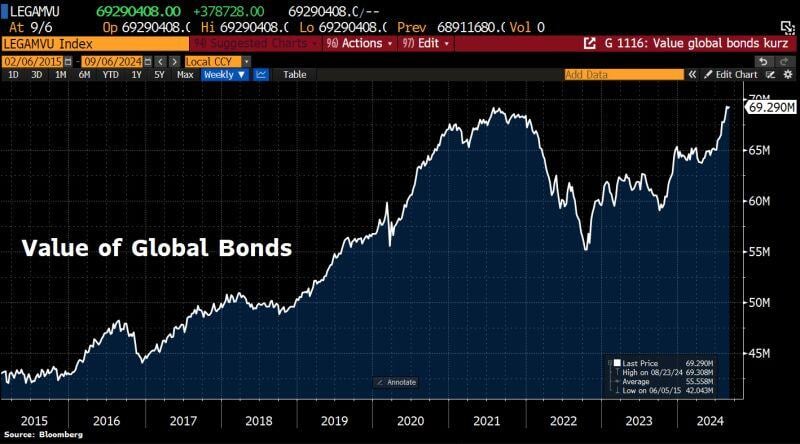

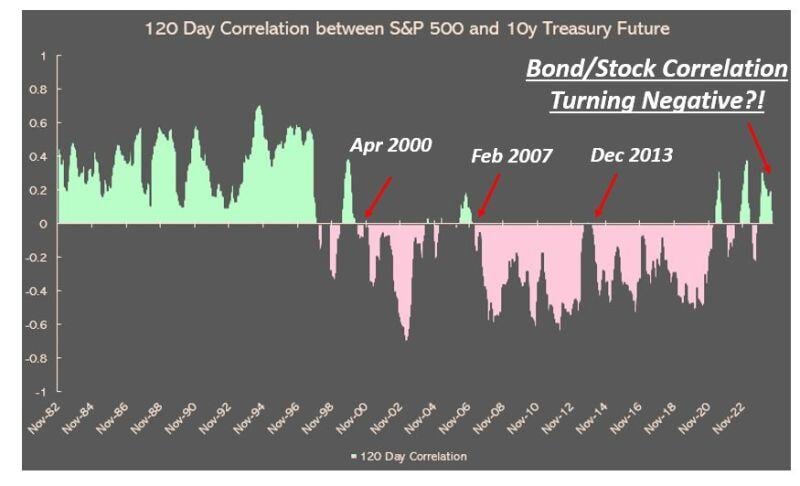

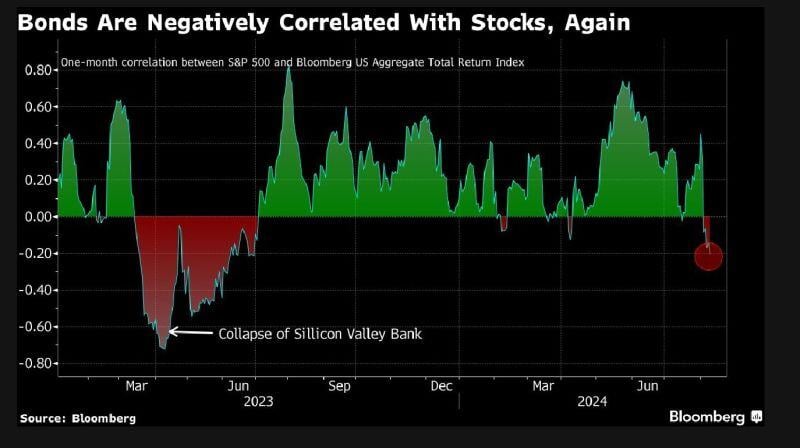

Is a massive regime change in markets taking place?

This week has again been volatile for stocks. But the big news for investors is for the first time in a few years, bonds are acting again as a hedge against stock market drawdowns. Or in other words: after a period of positive correlation which wrecked 60/40 portfolios, the stock/bond correlation is turning negative again. This is an important development. Source: Alfonso Peccatiello

Investing with intelligence

Our latest research, commentary and market outlooks