Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- china

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

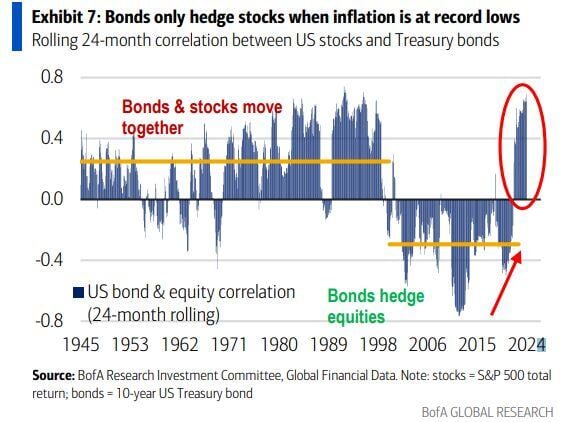

BREAKING: The 10-Year Note Yield has dropped below 4.00% for the first time since February 2024.

This comes after the July Fed meeting and ISM manufacturing data came in weaker than expected. Markets expect the first Fed rate cut since March 2020 to come at their next meeting, in September 2024. Over the last week, the 10-Year Note Yield is now down over 30 basis points. Source: The Kobeissi Letter

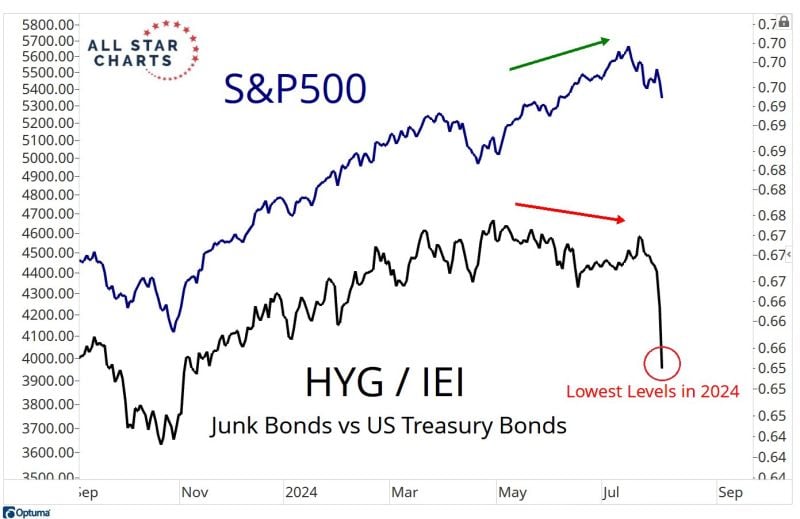

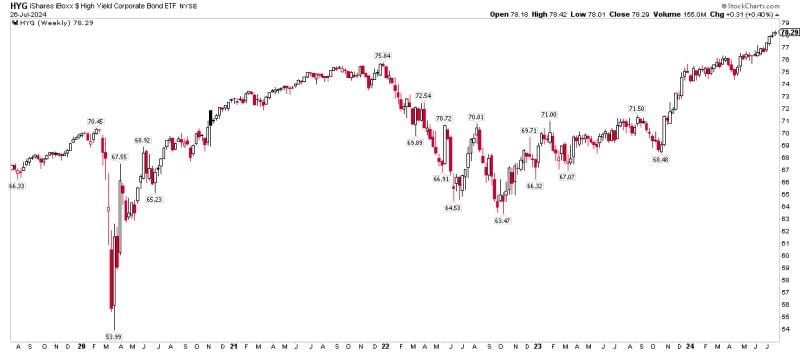

Junk bonds closed at an ATH (total return) last week $HYG

Source: Mike Z.

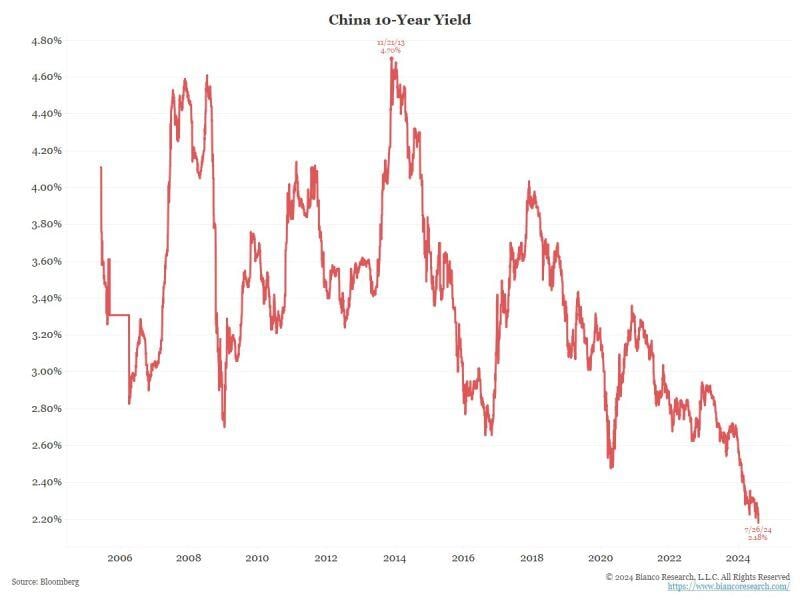

CHINA 10-YEAR YIELD FALLS TO A FRESH RECORD LOW

So, what is the Chinese bond market signaling about the Chinese economy? Source: Bianco research

Investing with intelligence

Our latest research, commentary and market outlooks