Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

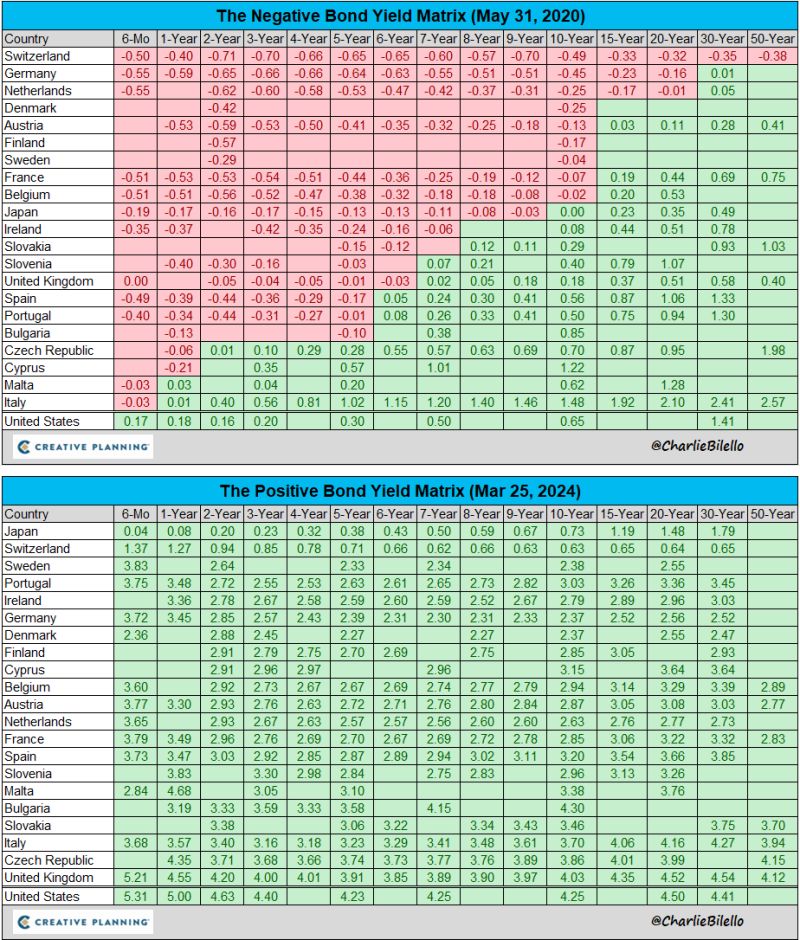

In May 2020, there were 21 countries with negative interest rates. Today there are none.

Sanity has returned to the global bond market... Source: Charlie Bilello

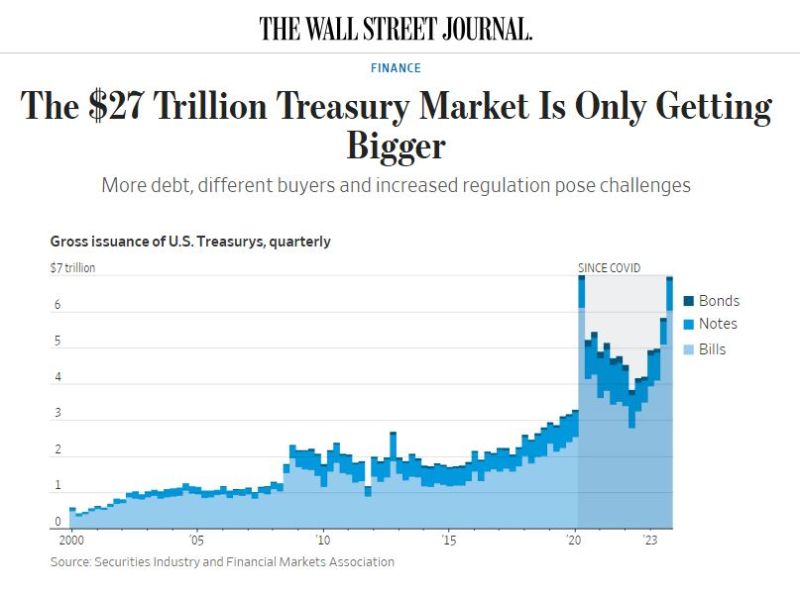

US Treasury issuance has expanded in recent years, sending the size of the US government bond market to a record ~$27tn.

Up ~70% since the end of 2019 & nearly 6x larger than before the ’08-’09 GFC. That is making some Wall Streeters nervous. Source: HolgerZ, WSJ

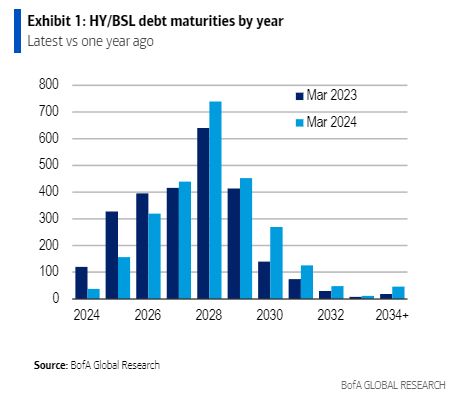

Junk bond and leveraged loan issuers have cut ttheir 2024-2026 maturity wall by 40% from a year ago, according to BOA estimates.

"This episode represents one of the most aggressive instances of maturity extension in the history of leveraged finance." Source: BofA, Tracy Alloway

#ChartOfTheDay: European High Yield Faces CCC-Rated Headwinds 📊

European High Yield markets encountered headwinds last week, particularly among the weakest issuers with CCC ratings, which experienced a notable decline of -0.7%. This downturn was fueled by renewed credit concerns, exemplified by significant drops (-30 points) in the senior unsecured debt of Altice France following debt restructuring announcements, and Ardagh Packaging exploring its debt structure. These incidents follow the recent Intrum crisis, where debt collector bonds plummeted by 20 points amid restructuring talks. These developments have erased the year-to-date gains of CCC-rated bonds in Europe, which stood at +6% before last week's events. This serves as a stark reminder of how quickly circumstances can change, especially in today's volatile interest rate environment! Stay informed and vigilant in navigating the ever-changing landscape of high yield markets. #HighYield #CreditConcerns #MarketVolatility 📉

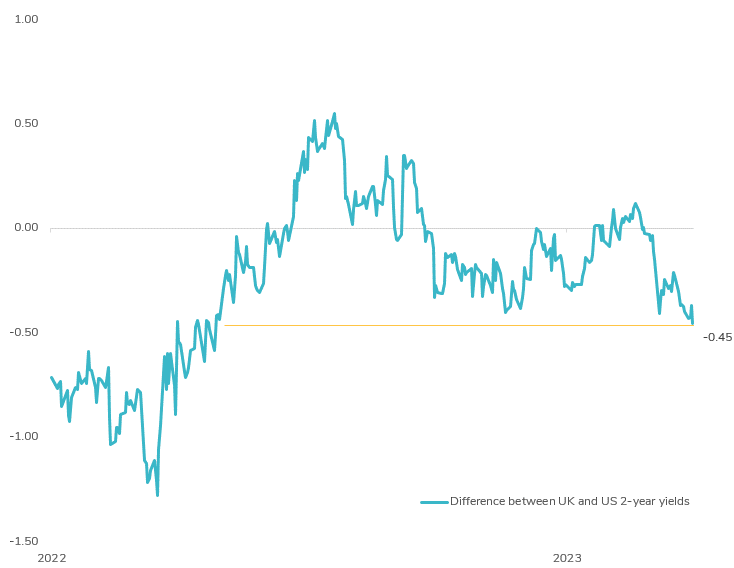

UK Yields Extend Divergence from US Yields Post-BOE Meeting 📊

The Bank of England's today meeting took a more dovish turn than anticipated. Despite holding key rates steady at 5.25%, not a single BOE member voted for a hike for the first time since September 2021. Market sentiment is swiftly adjusting, with expectations shifting from a previously anticipated rate cut in August to now eyeing possibilities in June (70% chance) and even May (15% chance). The news triggered a significant rally in UK government bonds, driving the differential between 2-year UK and US yields to its lowest level in a year! This divergence underscores the evolving dynamics in global markets. Following the surprising interest rate cut by the Swiss National Bank, central banks worldwide appear to be reassessing their strategies. Source: Bloomberg

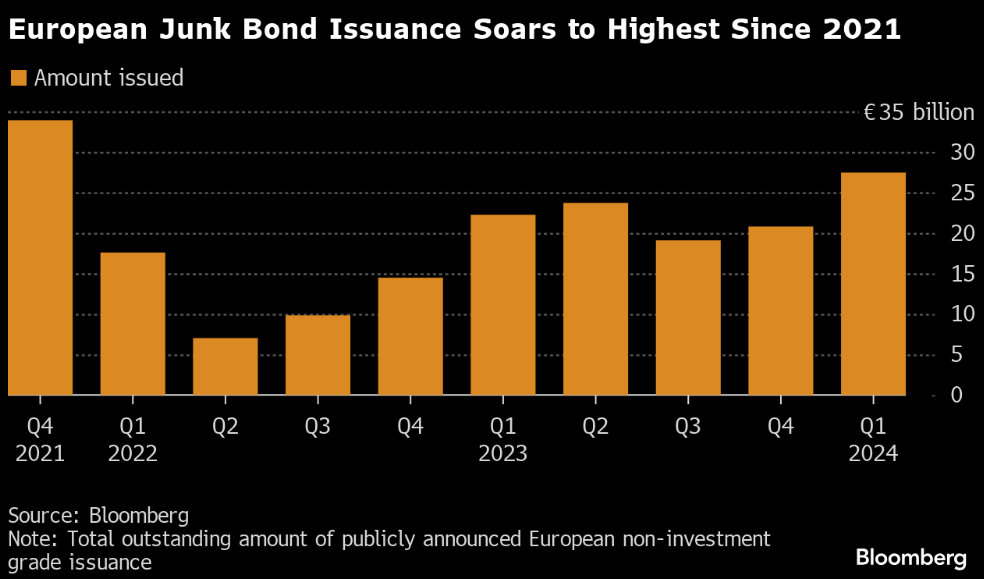

European junk bond issuance soars to highest since 2021

It is also reflected in European junk bond spreads, which are at their lowest level since January 2021.

The backdrop is a far cry from last September and October, when a slew of junk issuers, pulled bond sales as the rapid increase in interest rates made it tougher for lower-rated companies to borrow.

Source: Bloomberg

Bond markets are getting crushed this week: The bond tracking ETF, $TLT, is down 4% since Friday and on track for its worst week this year.

Why is this happening? - First, CPI inflation data showed that inflation JUMPED to 3.2% and is now up from 2 straight months. - Then, PPI inflation data nearly DOUBLED, rising to 1.6%, further igniting fears of a rebound in inflation. - Interestrate cuts are quickly being removed from market expectations. Source: The Kobeissi Letter

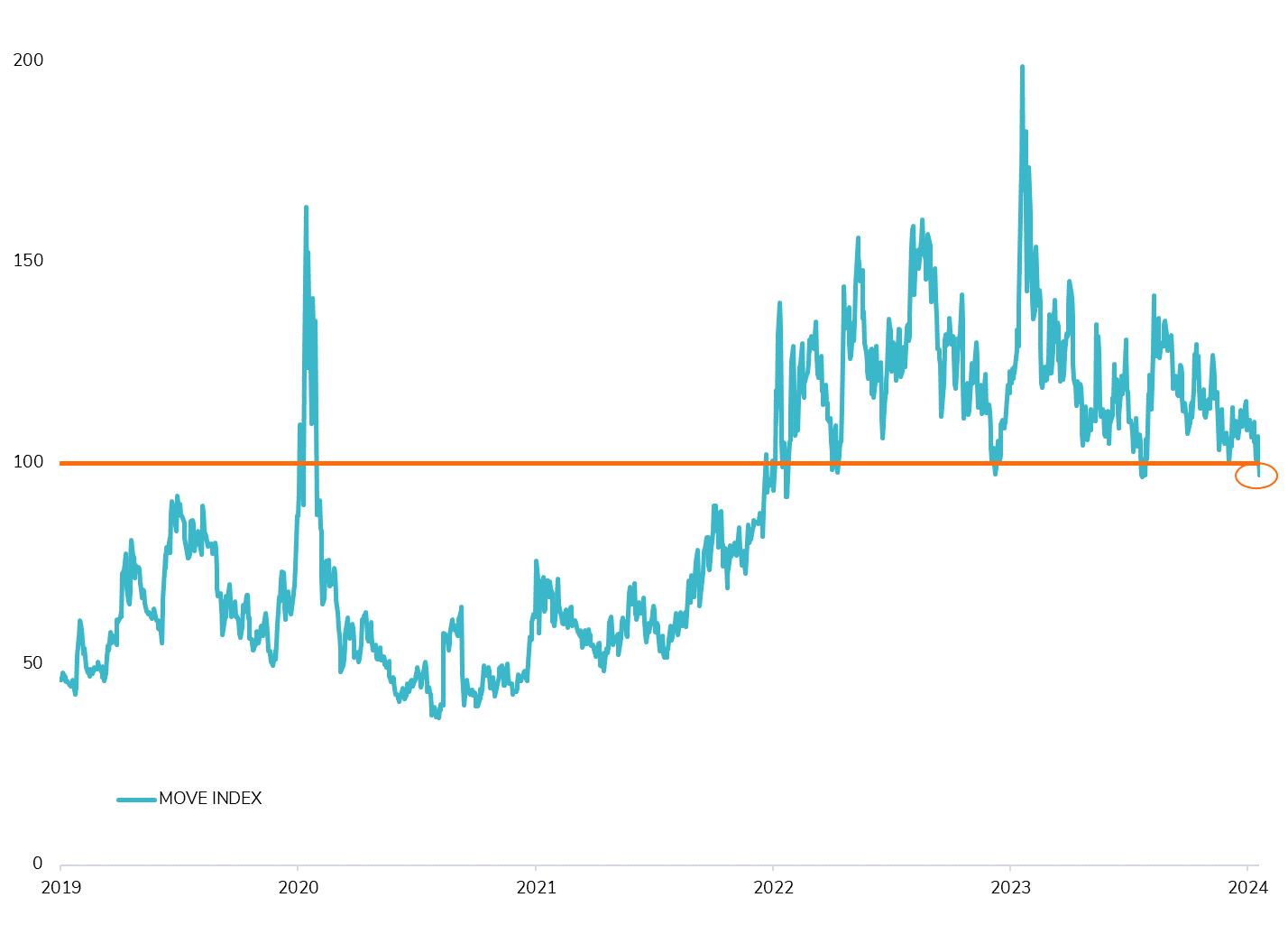

Interest Rate Volatility Drops Below 100 for the First Time in 6 Months!

The #MOVE index, a key measure of US #interestrate #volatility, has dropped below 100 for the first time since September 2023. This marks a significant shift in market dynamics. While attempts to breach this threshold have been made three times since early 2022, they were short-lived, with volatility bouncing back above 100 each time. For the past two years, the #government #bond market has been in a high volatility regime, making investing in long-term US #Treasuries challenging due to relatively low adjusted yield to volatility. The question now is whether this high volatility regime is coming to an end or if it's just another false alarm. Several indicators suggest that this could be another false signal. Growing uncertainty surrounding #inflation in the US may prompt the #Fed to adjust its monetary policy, potentially implementing a reverse operation twist (and thus steepen the yield curve). Additionally, there's still a positive #carry from #shorting bonds. However, signs of improvement are emerging as well. Recent #auctions have shown that the market is absorbing the supply effectively, and the #correlation between bonds and equities is turning negative again. Could this be a pivotal moment in the US Treasuries market? Let's keep a close eye on how things unfold. Source: Bloomberg #fixedincome #bond

Investing with intelligence

Our latest research, commentary and market outlooks