Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

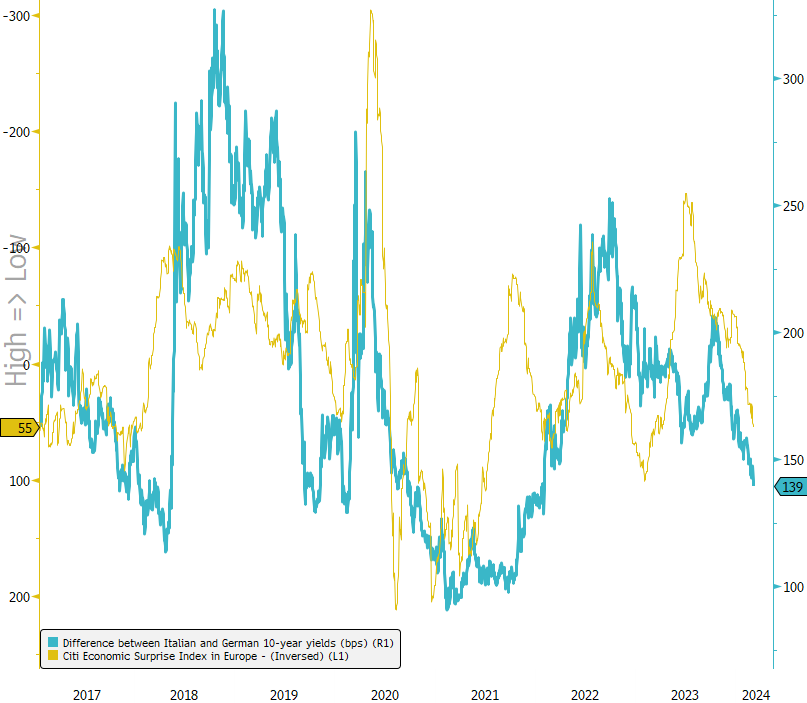

Italian 10-Year Spread Hits Lowest Level in Two Years!

The surge in investor confidence has propelled Italian spreads to their lowest point in two years. The gap between Italian and German 10-year yields dipped below 140 basis points for the first time since early 2022. The rebound in Citi's European Economic Surprise Index has undoubtedly contributed to this trend. In a reflection of the credit market, peripheral bonds are demonstrating strong outperformance compared to core government bonds. However, amidst this optimism, questions linger: Is this downward trajectory sustainable? #ItalianBonds #MarketTrends #InvestmentOpportunities 🇮🇹💼

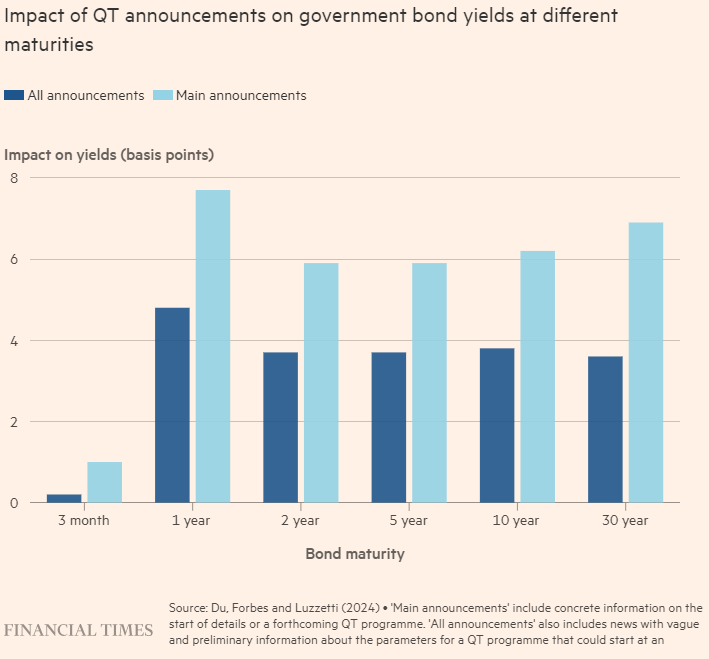

Unveiling the Impact of Quantitative Tightening: Intersting Insights from FT

🌟 Delving into recent insights from the Financial Times sheds light on the impact of Quantitative Tightening (QT) and its implications for financial markets. Let's break it down: 📊 QT's Functionality: Recent evidence from a study involving seven central banks, including the Fed's earlier QT efforts from 2017-2019, reveals that QT operates "in the background," subtly supporting central banks' endeavors to tighten financial conditions without significantly disrupting market functioning or liquidity. 💼 Market Reaction: Announcements of QT's commencement have led to slight increases in government bond yields. However, the actual implementation of QT, including outright bond sales, has had minimal disruptive effects on market dynamics and liquidity. 🔄 Passive vs. Active QT: The distinction between passive and active QT strategies is crucial. While passive QT (letting bonds mature) impacts short-end yields, active QT (outright sales) tends to steepen the yield curve, highlighting the nuanced effects of different QT approaches. 🤝 Market Support: The smooth adjustments observed in response to QT can be attributed partly to domestic nonbanks and, to a lesser extent, foreign investors stepping in to purchase securities as central banks reduce their holdings, maintaining market stability amidst changes in monetary policy. 💡 Navigating Future Challenges: What strategies will central banks employ to navigate the looming challenges posed by high government debt issuance and absorbed pandemic-era liquidity, in light of the insights gleaned from recent evidence on quantitative tightening's impact? #QuantitativeTightening #FinancialMarkets #CentralBanks #EconomicInsights

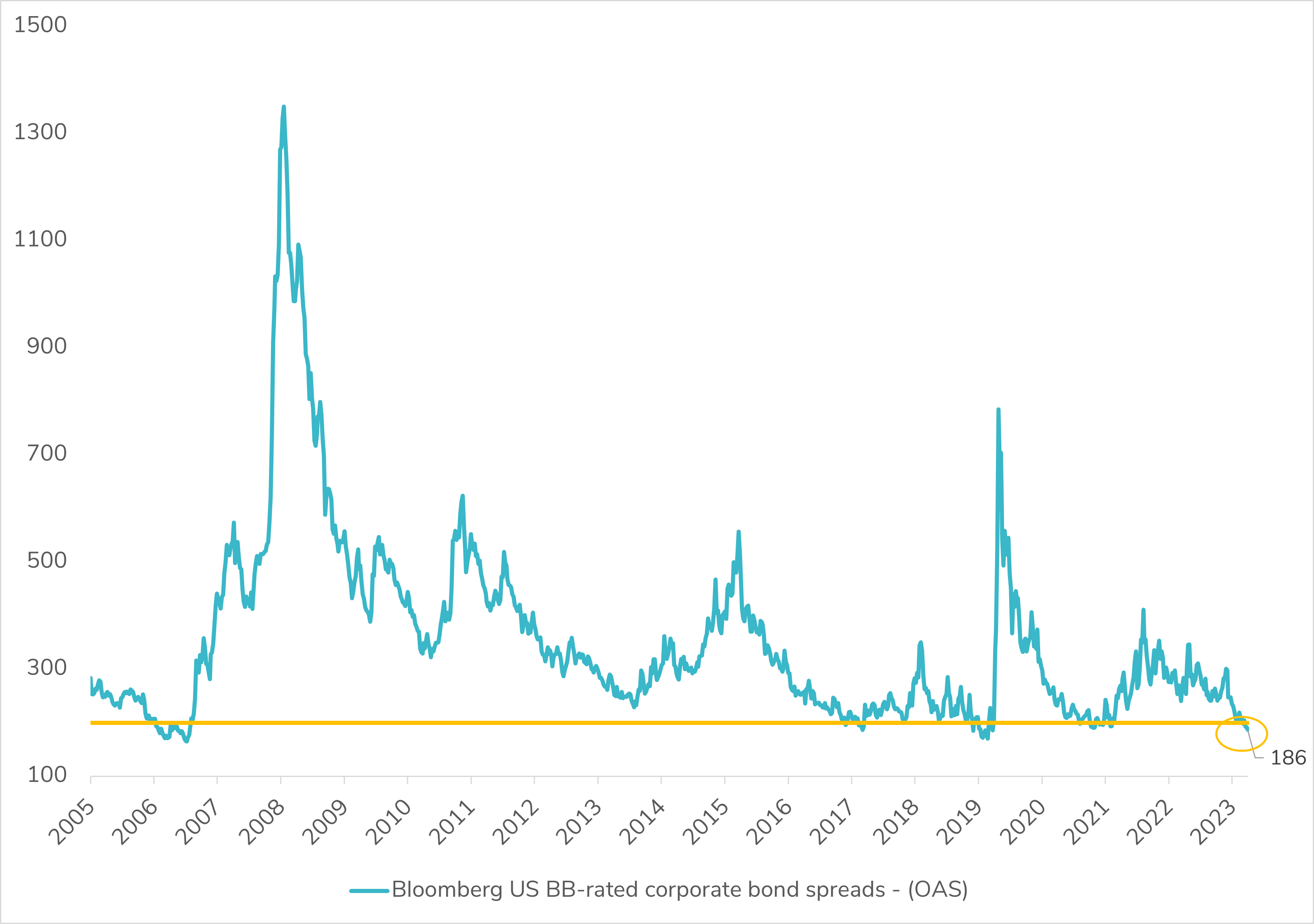

📉 US High-Yield Corporate Bond Spreads Hit Historic Lows!

In February, US credit markets surged ahead of US Treasuries as spreads tightened significantly, reflecting the resilience of the US economy and robust corporate fundamentals, highlighted by strong Q4 2023 earnings. The spread of the Bloomberg US BB-rated corporate bonds index dipped below the 200 basis points mark, entering unprecedented territory. 💼 But with spreads at historic lows, the burning question emerges: Is this move sustainable, and for how long? As investors, should we prioritize absolute yield or relative yield in this environment? 🤔 With tightening credit spreads, it's imperative to carefully weigh the options. Remember, as spreads narrow, the risk of wider credit spreads increases, leaving less room for error. Source: Bloomberg #CreditMarkets #CorporateBonds #FinanceNews

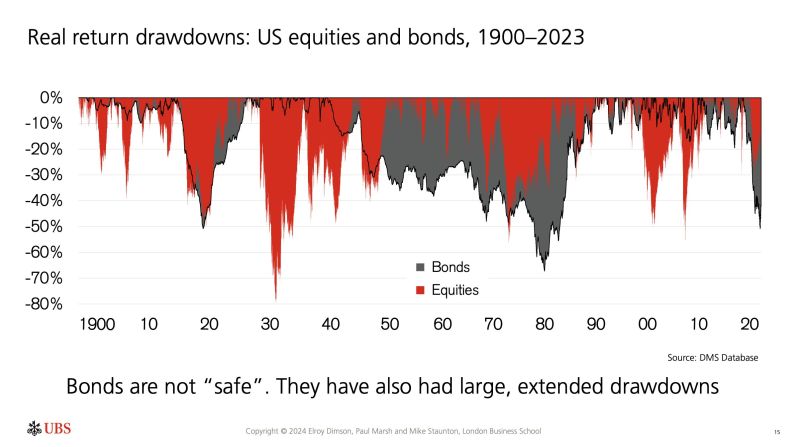

Bonds are “safe”?

Think again, they have also had large, extended drawdowns, UBS Yearbook shows.

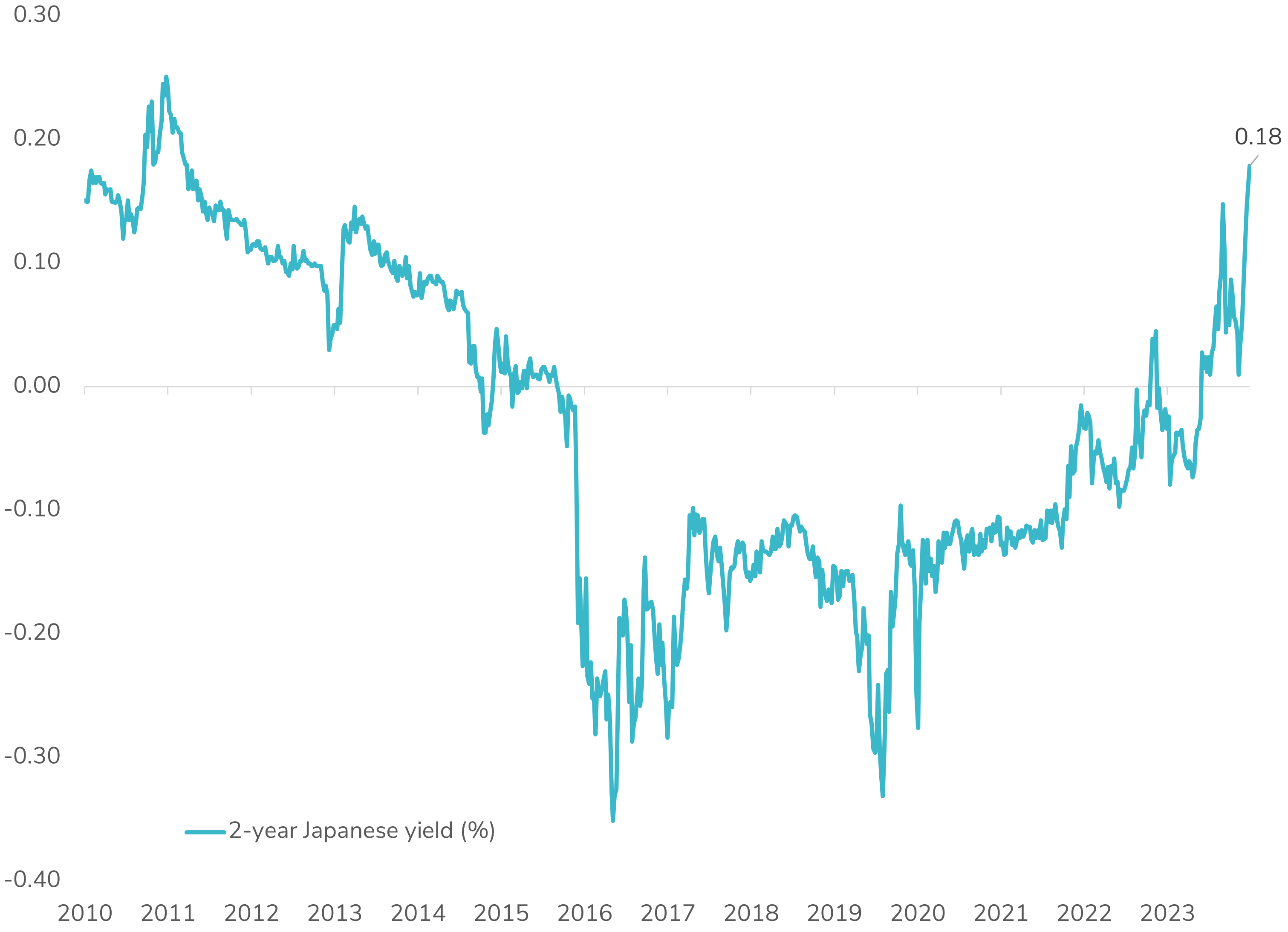

📈 Japanese 2-Year Yield Surges to 14-Year High!

Japanese government bond yields are on the rise across the curve, triggered by Bank of Japan Board Member Hajime Takata's comments hinting at a potential end to the negative interest rate policy. Takata cited progress towards achieving the price target, indicating a possible rate hike—the country's first since 2007—expected in March or April. The front end of the Japanese yield curve is particularly influenced by the BOJ's monetary policy and continues to reprice higher rates. The market anticipates a 0.25% rate hike for the full 2024 year. It appears that Japan will gradually transition away from the negative interest rate monetary policy. 🇯🇵💼 #JapanEconomy #BOJ #MonetaryPolicy #YieldCurve #FinanceNews

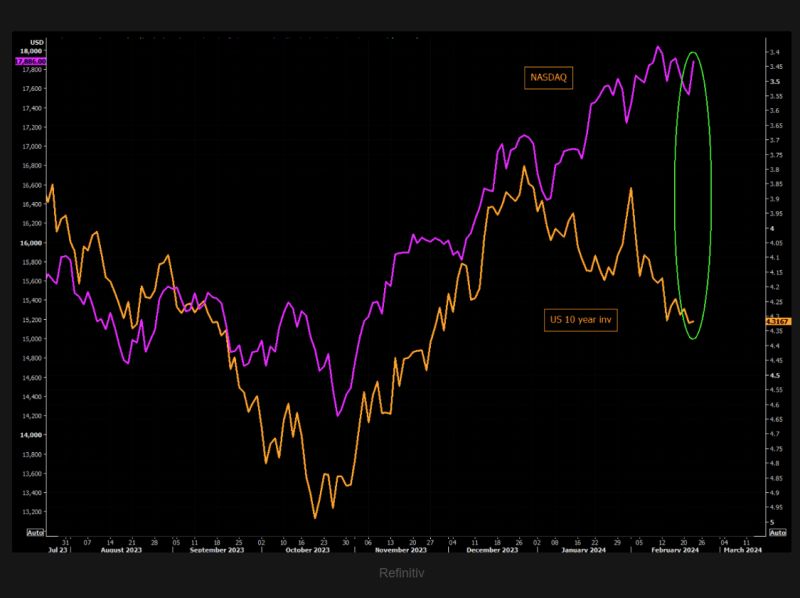

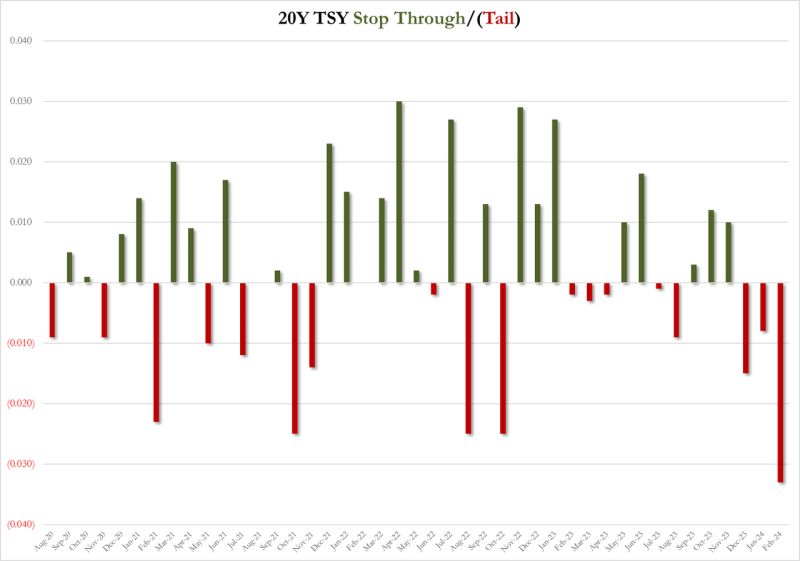

US yields surged after terrible 20Y Auction with biggest tail on record.

The high yield of 4.595% was well above last month's 4.423% but worse, it tailed the yields that prevailed when it was issued (4.562%) by a whopping 3.30bps, which was the biggest tail on record for the tenor since the 20Y auction was introduced in May 2020. The bid to cover tumbled to 2.39, down from 2.53, well below the 2.59 six-auction average, and was the lowest since August 2022. The internals were even uglier, with Indirects awarded just 59.08%, lower than last month's 62.16%, sharply lower than recent average of 68.2% and the lowest since May 2021. And with Directs taking down 19.7%, Dealers were left holding 21.2%, the most since May 2021. Overall this was a very ugly auction, perhaps one can attribute it to nerves from today's FOMC Minutes which however should be a non-event as they are already rather dated and do not reflect the latest reflationary spike. In any case, yields promptly spiked with the 10Y rising as high as 4.325% before retracing some of the move, which also sent stocks sliding briefly before recovering. Source: www.zerohedge.com

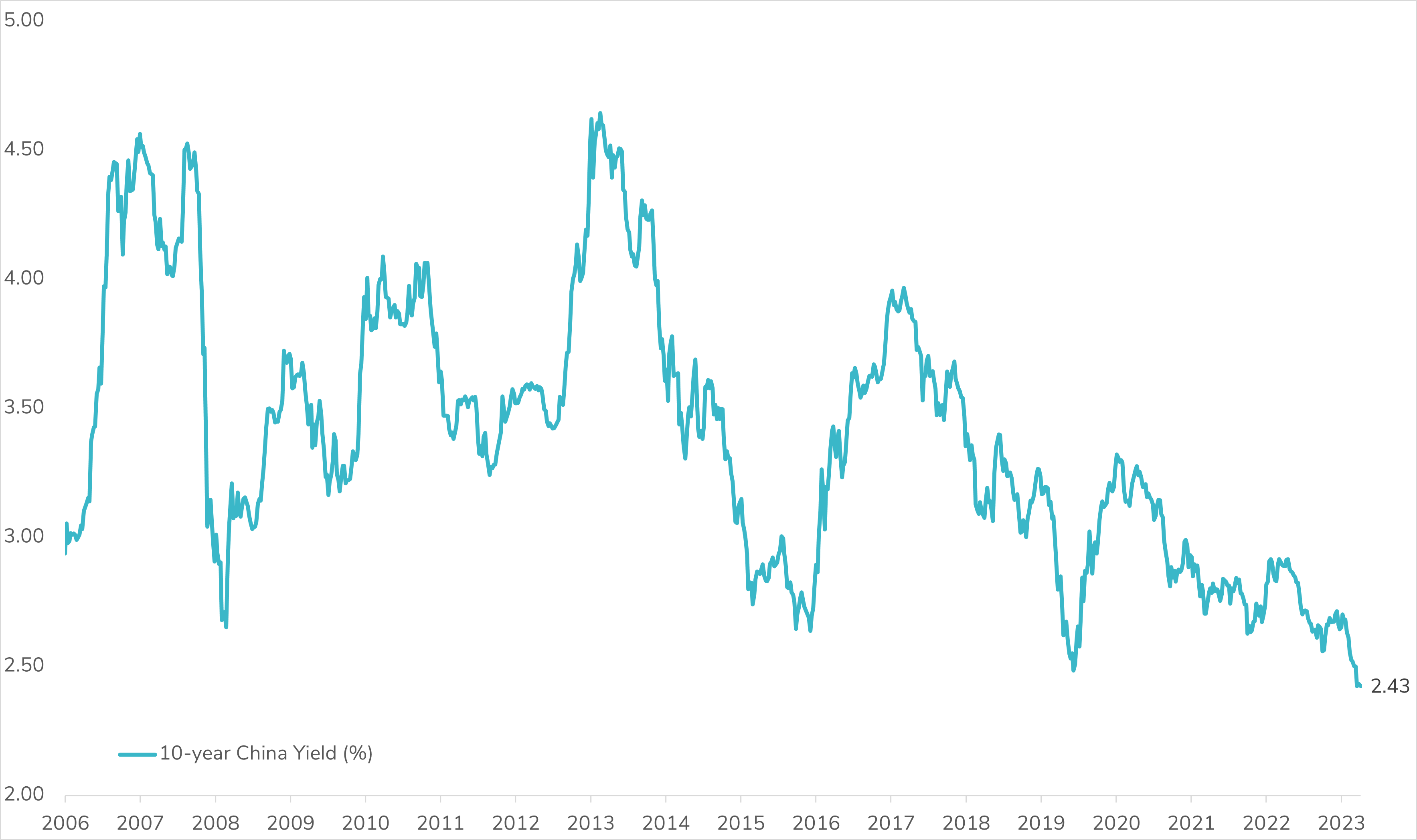

📉 China Yields Staying Stuck at Historic Lows as PBOC Slashes Mortgage Reference Rate!

China has taken bold measures to uplift its struggling property sector by implementing its most substantial reduction in a key mortgage rate to date. The five-year loan prime rate saw a notable cut of 25 basis points, plummeting to a historic low of 3.95%. This move, the largest decrease since the rate's overhaul in 2019, underscores China's commitment to stimulating economic growth through targeted measures. The decision to lower the mortgage reference rate is poised to have far-reaching effects, potentially unlocking opportunities for further economic support initiatives. By enabling more cities to lower their minimum mortgage rates, the rate cut aims to revitalize demand in the sluggish housing market. Moreover, it seeks to address the persistent property crisis, which has cast a shadow on overall economic growth. However, despite these efforts, it is not expected that the rate cut will significantly boost homebuyers' sentiment as home prices are still falling in most cities and wage growth is tepid. Following cut's announcement, market response was subdued, with equities and USDCNH experiencing minimal changes, while 10Y onshore government bond yields saw only slight decreases. How will China emerge from this slow economic agony? Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks