Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

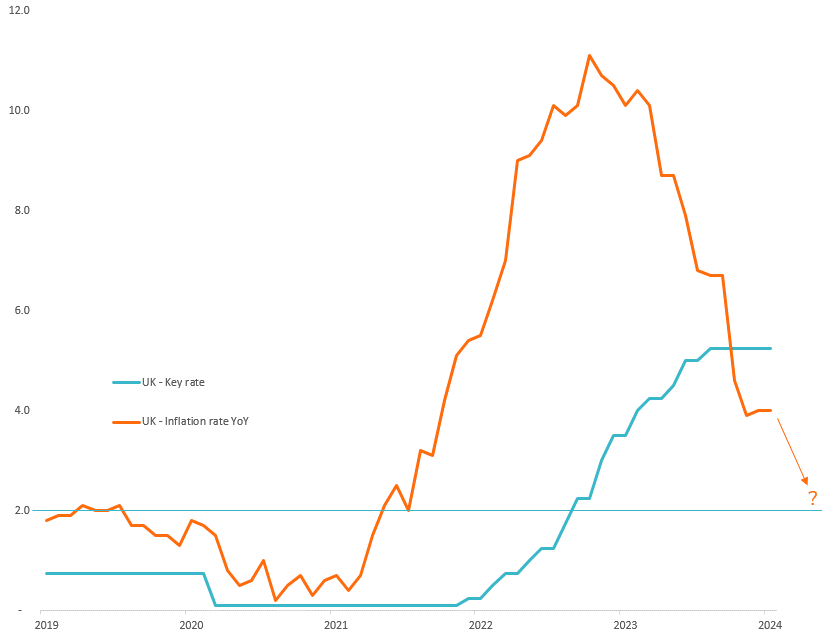

Bank of England day ! A Shift in Inflation Outlook and Monetary Policy?

💡 Today, the Bank of England (BOE) is convening for its highly anticipated meeting, and we're closely monitoring it for potential shifts in their monetary policy tone. The BOE's impending Monetary Policy Committee decision promises to be intriguing, with current expectations leaning towards maintaining the benchmark rate at 5.25%. 📉 Indeed, a significant twist in the narrative has occurred. The UK's inflation outlook has undergone a substantial revision, with current projections indicating a return to the 2% inflation target by the summer of 2024 – a whole year earlier than previously anticipated. This could have far-reaching implications. 📊 Adding to the intrigue is the possibility of a single vote in favor of a rate cut and a potential softening of the BOE's previous tightening stance. While the risk remains that the BOE might stick to its hawkish position, the evolving economic landscape could set the stage for an earlier easing cycle, potentially commencing as soon as June. 💬 The shifting dynamics of inflation and the subsequent responses by central banks are pivotal indicators for market movements. Fixed income investments may see considerable benefits from these potential developments.

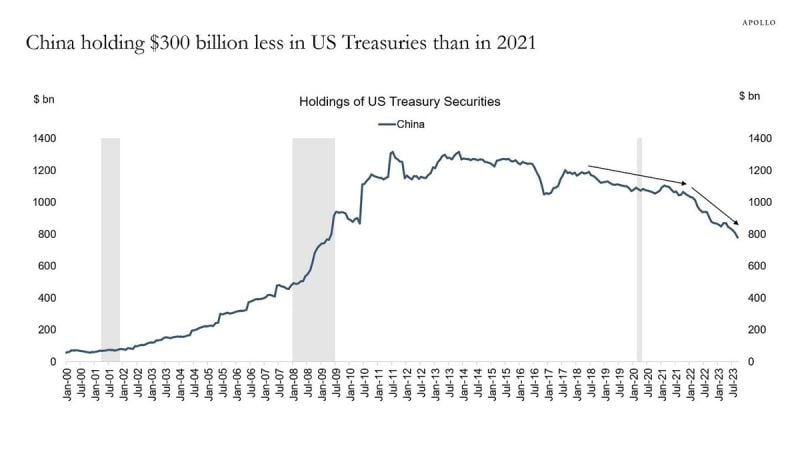

China's holdings of US Treasuries continue to move in a straight line lower

Their holdings of US Treasuries have declined by $300 billion since 2021. Currently, China holds just under $800 billion of US Treasuries, levels not seen since 2009. As interest rates are peaking, the foreign private sector has been slowing purchases. Also, as China faces increasing economic headwinds, it is likely this trend resumes.

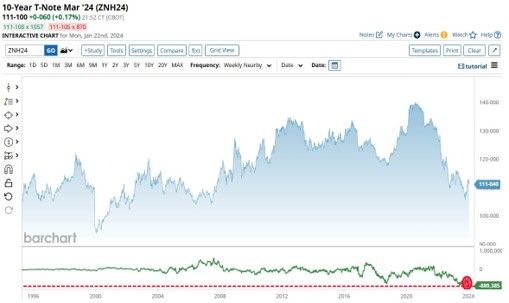

10-Year Treasury Largest Short Position in History 🚨: Hedge Funds are now short more than 889,000 contracts on the 10-Year Treasury, the largest 10-Year Treasury short position in history

Source: Barchart

📊 Fed Watch: Insights from Key Fed Members!

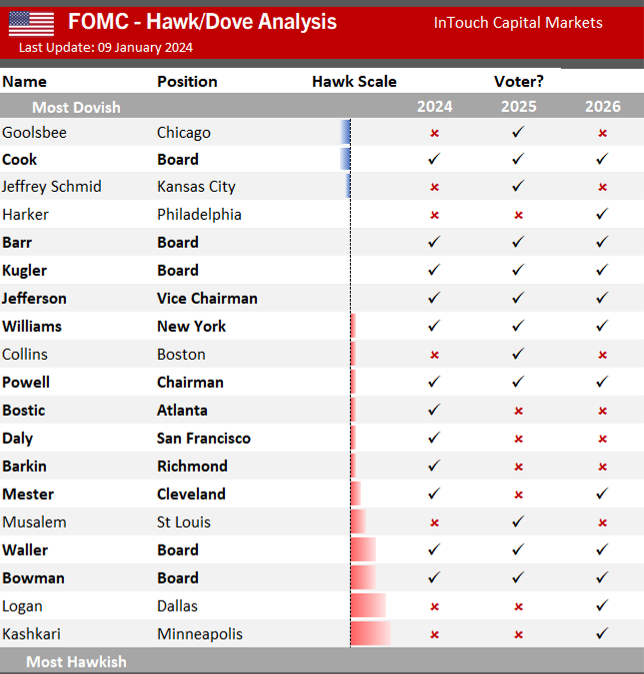

This week, several prominent Federal Reserve members shared their perspectives on monetary policy. These insights reflect a general sentiment among Fed speakers that challenges the current market expectations of numerous rate cuts in 2024. They emphasize the importance of data and a measured approach in shaping monetary policy decisions. Here's a snapshot of their views, along with a special focus on the dovish/hawkish scale by Fed members: 🔹 Austan Goolsbee (President, Chicago Fed) highlighted the need for a data-driven approach, suggesting that a continued decline in inflation would merit discussion of cutting interest rates. However, he stressed the importance of evaluating the data meeting by meeting. 🔹 Raphael Bostic (President, Atlanta Fed) urged caution on interest-rate cuts, emphasizing the need to navigate unpredictable events. He believes it would be unwise to rush into rate cuts and wants more evidence of inflation reaching the 2% target. 🔹 Patrick Harker (President, Philadelphia Fed) highlighted the importance of "soft data" from district sources, providing valuable insights for policymakers in setting monetary policy. 🔹 Christopher Waller (Fed Governor) advocated a cautious and systematic approach to rate cuts, emphasizing that the FOMC should move carefully based on data. Check out the dovish/hawkish scale by Fed members for a deeper understanding of their stances. Source: Bloomberg #FederalReserve #MonetaryPolicy #EconomicOutlook

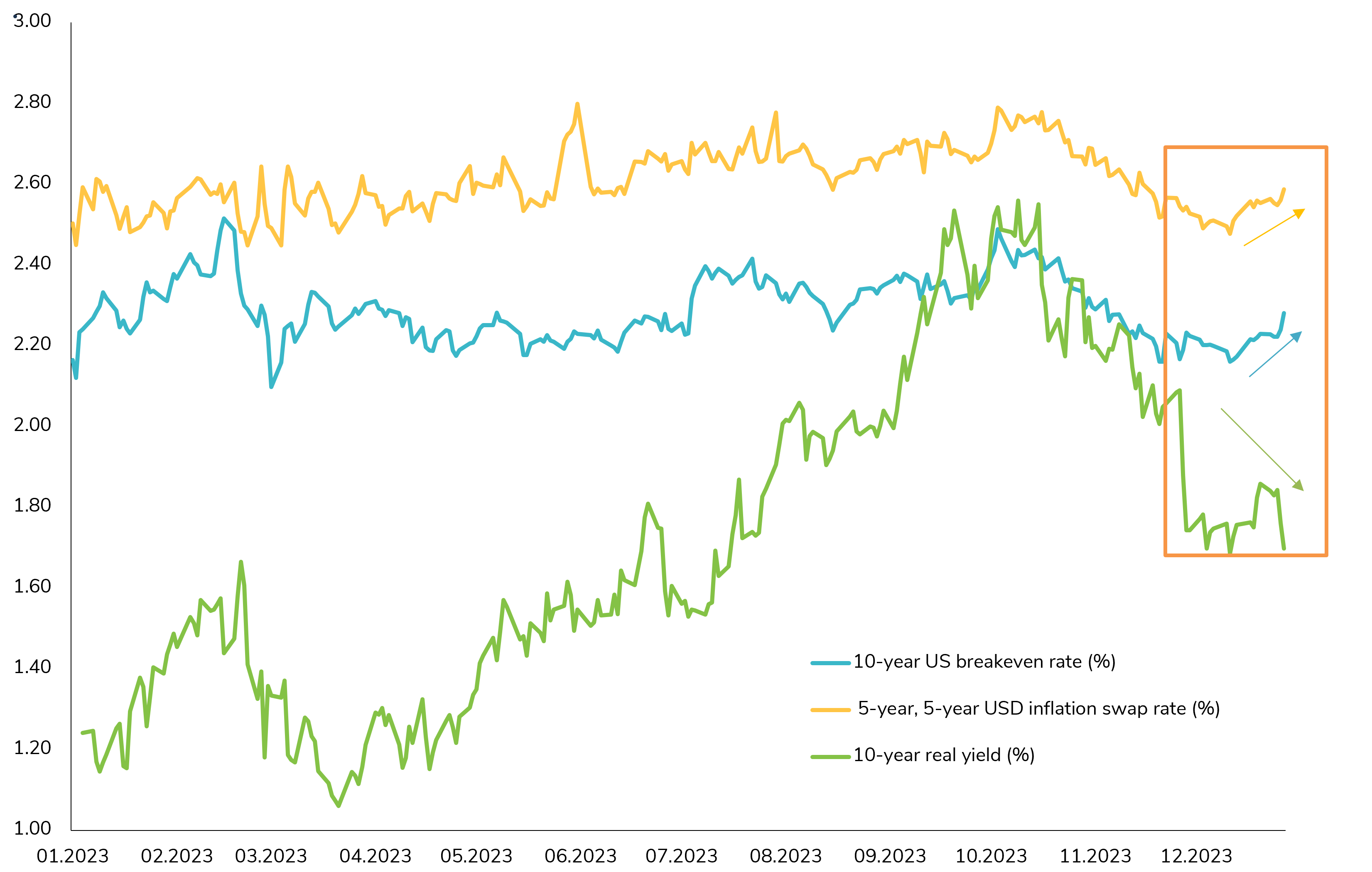

The Dynamic of Rising US Treasury Yields and Inflation Expectations 📈

As we move further into the new year, there's a noteworthy trend unfolding in the world of finance - the steady rise of the 10-year US Treasury nominal yield. However, it's not as straightforward as it may seem. While many have been discussing the prospect of strong disinflation, what's actually exerting pressure on higher rates are the increasing long-term US inflation expectations. You can see this clearly in the chart below, which tracks the 10-year US breakeven (BE) rate and the 5-year, 5-year USD inflation swap rate. Both have climbed by more than 10 basis points, while the US real rate remains lower than at the beginning of the year. So, what is the market pricing in? Is it a reflection of the Federal Reserve's successful navigation toward a soft landing for the US economy? Or is it a response to rate-cut expectations, hinting at the resilience of the US economy? The dynamics at play here are fascinating and open up a world of possibilities. As we continue to monitor these developments, it's clear that 2024 holds some intriguing questions for investors. Source: Bloomberg

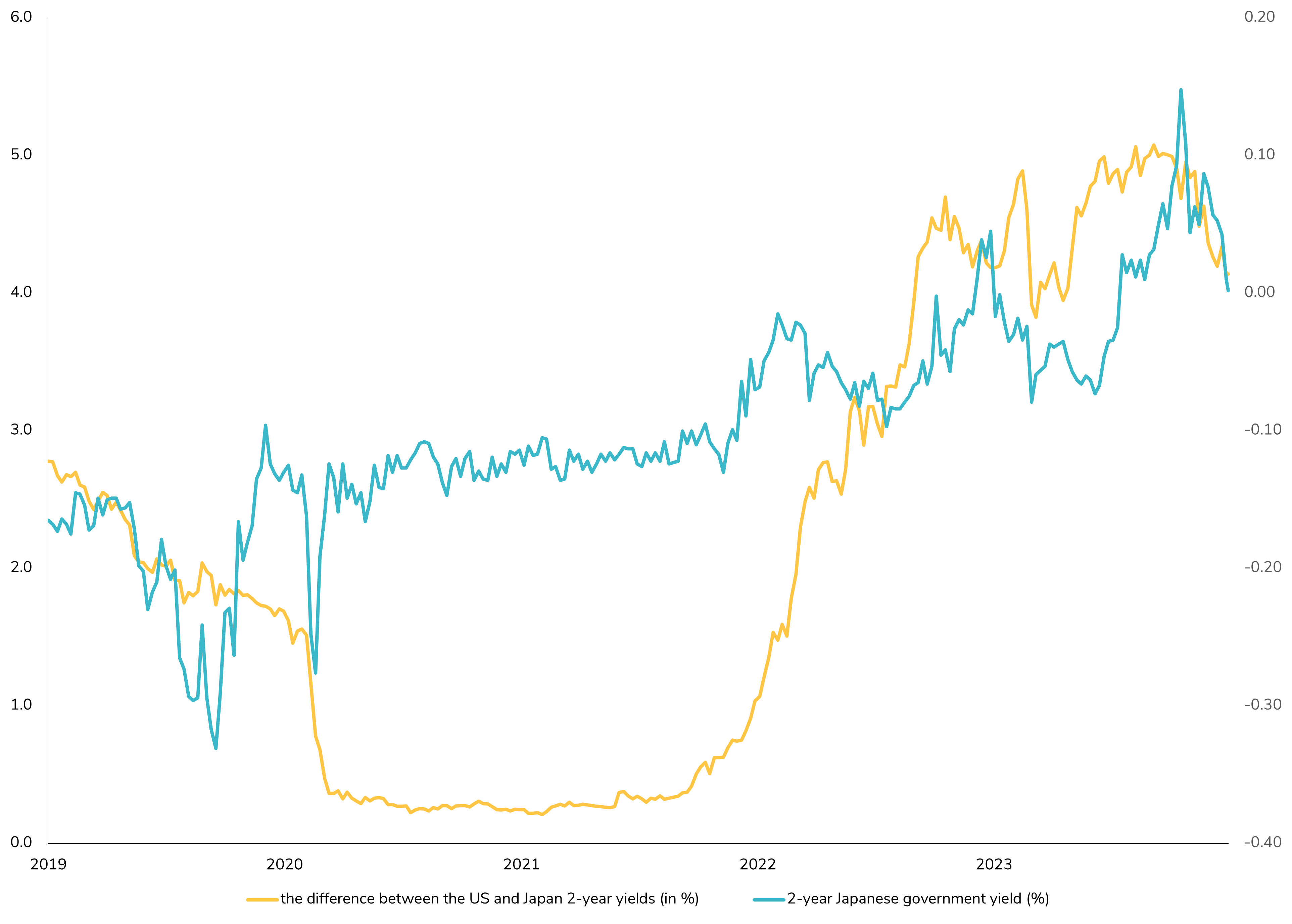

The 2-Year Japanese Yield Back in Negative Territory 📉

While the anticipation has been building for the Bank of Japan (BoJ) to exit its negative rate monetary policy in April 2024, the market seems to be taking a different turn. Today, the 2-year Japanese bond yield closed in negative territory. The BoJ has signaled its readiness to end the negative interest rate policy, but it's contingent on economic data and the outcomes of the March wage talks. Japan's path to normalization will be unique, as its economy still requires some level of monetary easing. The BoJ's terminal rate is projected to gradually reach around 0.5% over three to four years, potentially beginning with one or two rate hikes in the first year. However, the timeline for the BoJ to abandon its negative interest rate policy is now being seen as possibly extending further into 2024. Governor Kazuo Ueda's cautious statements, combined with unforeseen challenges like the recent earthquake, have led many economists to reconsider their forecasts, shifting expectations from January to potentially April or later. Stay tuned for more updates on this evolving situation. The Japanese monetary policy landscape is certainly one to watch closely in the coming months. Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks