Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

US Treasury Yield Curve Faces Crucial Test Today

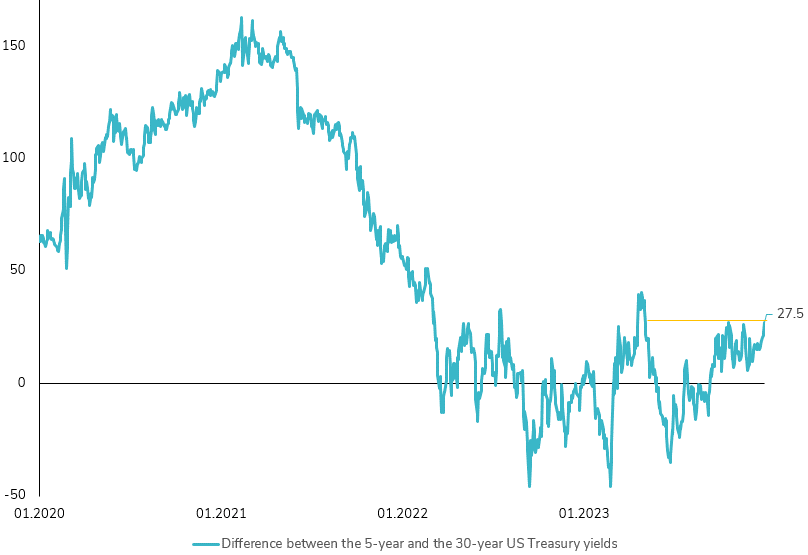

Today, the US Treasury market faces a crucial test. Since its low in early December 2023, the spread between the 5-year and 30-year US Treasury yields has surged by 20bps, now touching the highs seen in June 2023. This significant shift sets the stage for today's key event: a $21 billion auction of 30-year US Treasury bonds. 🔍 Notably, the absence of 30-year bond maturities this month suggests that demand will likely stem from investors looking to lengthen their portfolio's duration. This development comes at a time when concerns were already mounting about the long end of the US Treasury yield curve, driven by factors such as negative US term premiums, a heavy supply forecast for Q1, and a resilient US economy that had witnessed a strong rally at the end of 2023. 🏦 This evening's auction is more than just a routine procedure; it's a litmus test for the supply-demand dynamics in the Treasury market. The results will be telling, offering vital insights into market sentiment and future directions, particularly regarding long-term government debt. Keep an eye out for our analysis on the outcome and implications of this pivotal financial event. #Finance #USTreasury #EconomicIndicators"

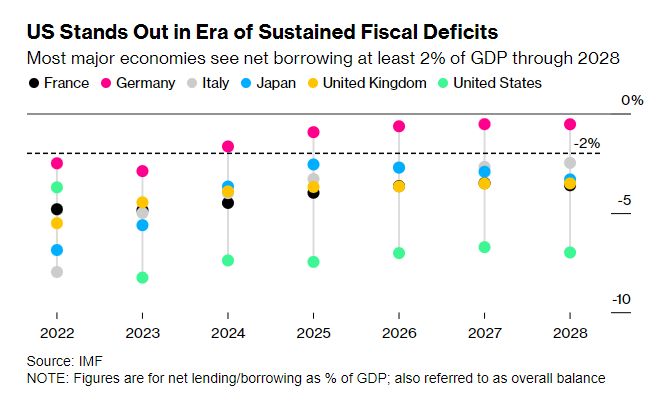

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before

Saddled with the kind of bloated deficits that were once unthinkable, these countries — along with Japan — will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.

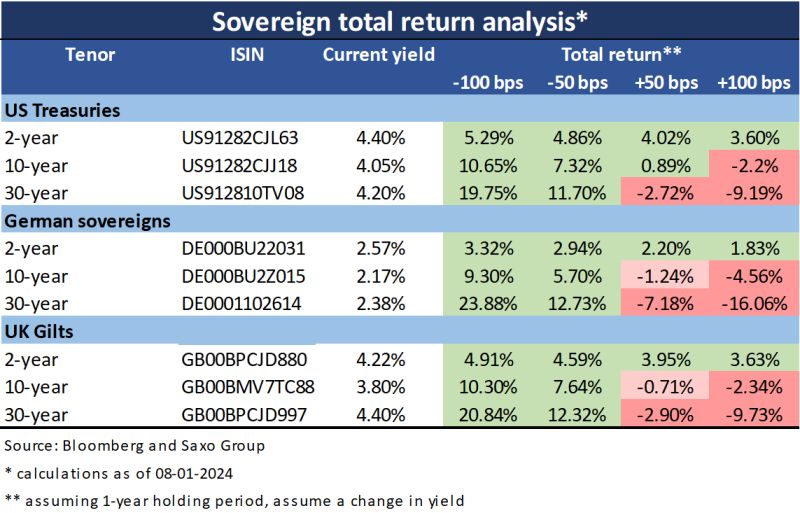

Total return bond analysis update

Source: Althea Spinozzi, Saxo, Bloomberg

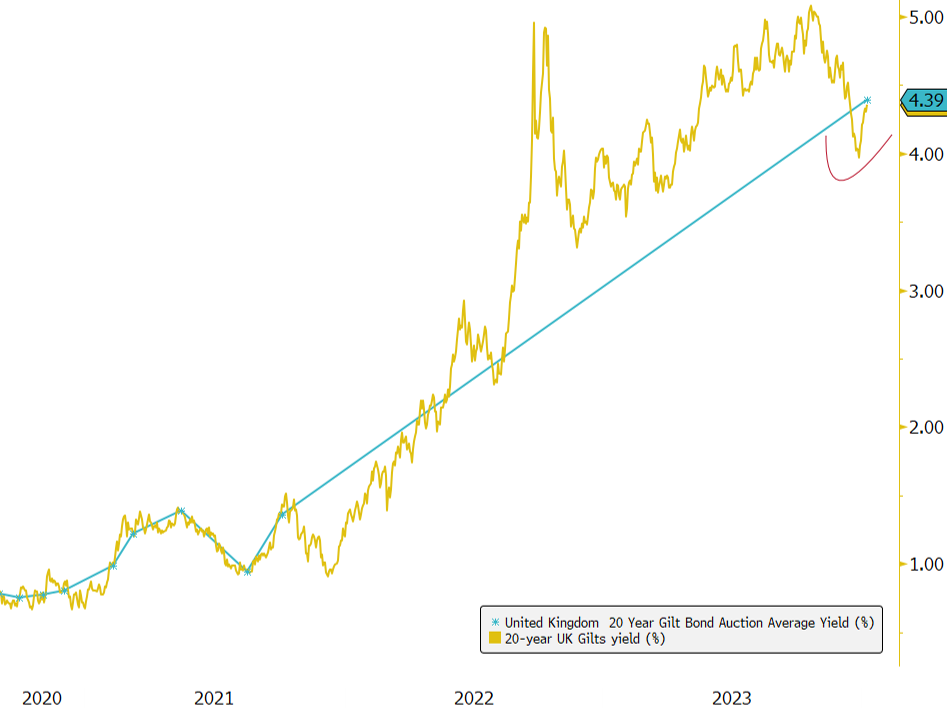

UK 20-Year Bond Auction: A Strong Start to 2024!

Today's successful auction of the UK 4.75% 2043 bonds, raising GBP 2.25 billion at a yield of 4.391%, represents a significant rise from the 1.36% yield in the previous auction in October 2021. 📈 Highlighting investor confidence, the auction achieved a strong bid-to-cover ratio of 3.6. Notably, the 20-year UK Gilt has climbed nearly 40bps from its late 2023 low. 🔍 With core inflation trends showing signs of stabilization, market participants are keenly awaiting signals from upcoming wage and inflation data. We are observing keen interest in how the yield curve will react, particularly with the anticipated new 30Y gilt syndication on the horizon. More steepening could be on the cards. 💷 Considering the estimated £76 billion gilt supply for Q1 2024, a key question emerges: Can today's robust auction mitigate the recent selloff, primarily driven by substantial global duration issuance and reassessment of aggressive rate cut expectations? Source: Bloomberg

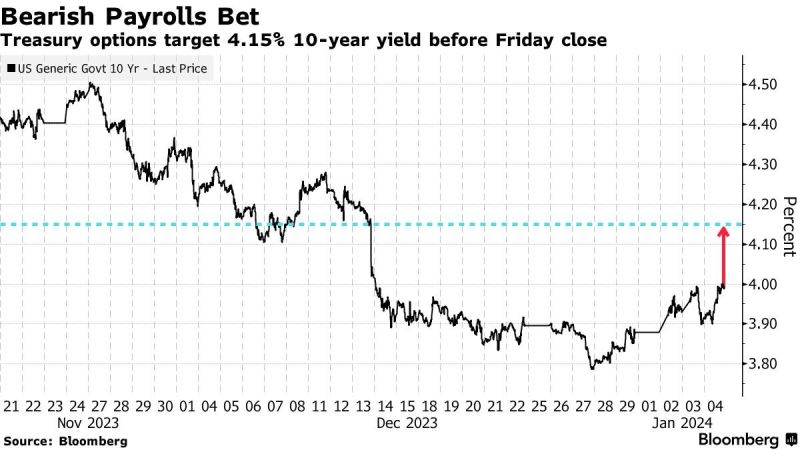

Could a hot US job print invalidate the downward trend in bond yields?

The US 10 year is flirting with the massive 4% levels again. A close above it and things could become even more "dynamic" to the upside. Note 21 day right here, while 50 day remains way higher. Source: Refinitiv, TME

10-Year Treasury Yield Options Bet

Ahead of US jobs data, an Options Trader bet $625,000 that the 10-Year Treasury Yield would surge to at least 4.15% by Friday's close. If the yield were to jump to 4.20%, the bet would pay the trader $10 million in profit. Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks