Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

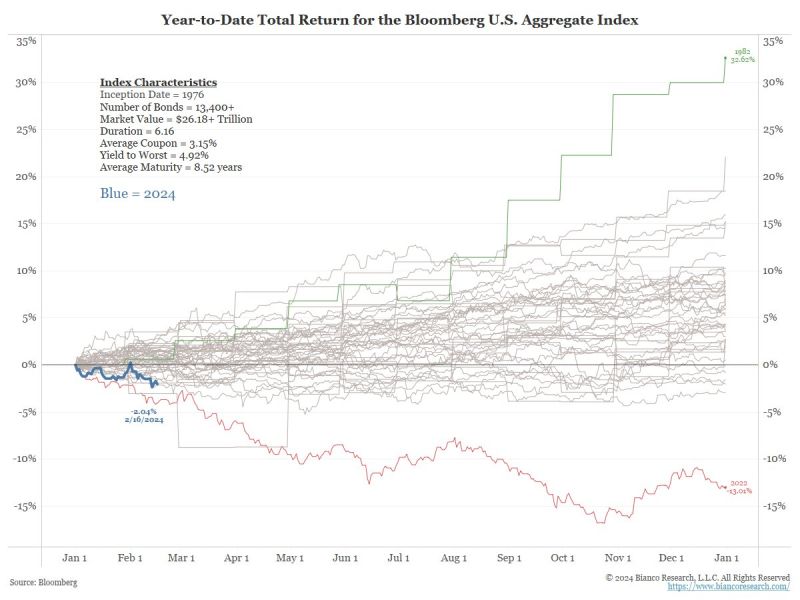

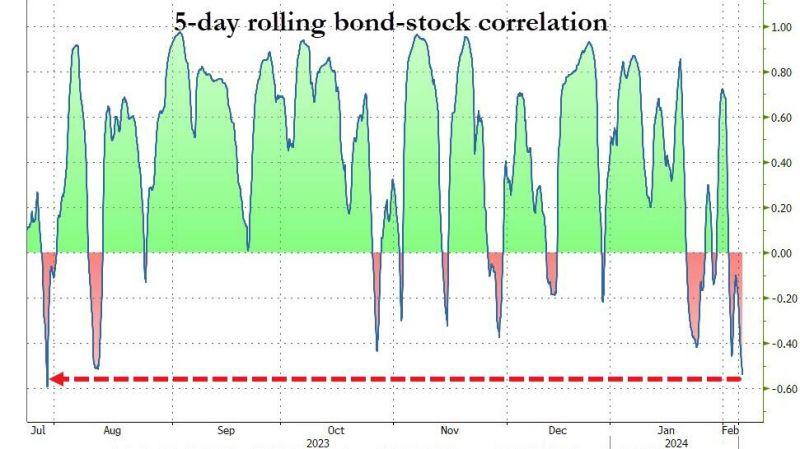

Six weeks into 2024, the bond market is struggling ... again.

YTD total return (through Feb 16) of the Bloomberg Agg Bond Index is -2.04% (blue line). Only 1980, 2018, and 2022 had a worse start. (Data started in 1976, so this is the 49th year of data). Source: Jim Bianco, Bianco Research

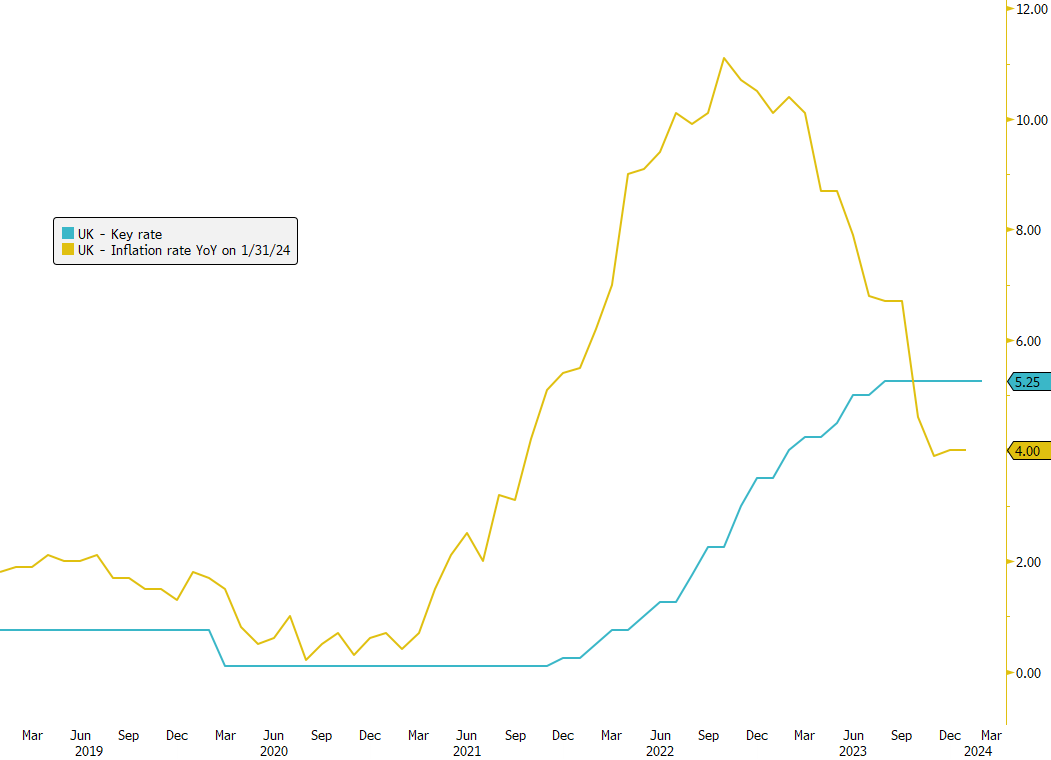

📉 UK Inflation Remains Stable, Easing Pressure on BoE!

UK inflation remained weaker than anticipated in January, holding steady at 4% year-on-year, defying forecasts of a rise to 4.1%. This unexpected outcome suggests reduced pressure on the Bank of England (BoE) from underlying price increases. Notably, services inflation reached 6.5%, slightly below the BoE's projections. Despite the stable headline rates, the BoE remains cautious amidst labor market tightness and signs of economic recovery. As a result, traders have adjusted their expectations for rate cuts, now anticipating two cuts for the year, with the first expected in September. However, amidst this cautious sentiment, the UK bond market could emerge as an attractive opportunity. Expected decreases in the Consumer Price Index (CPI) signal potential inflationary relief, supporting the case for Bank of England rate cuts by mid-2024. Furthermore, appealing yields following recent market pullbacks add to the attractiveness of the UK bond market as an investment avenue. It's worth noting that the market does not anticipate a rate cut until the first half of 2024, providing investors with ample time to position themselves strategically. #UKInflation #BankOfEngland #InvestmentOpportunity #BondMarket #EconomicOutlook

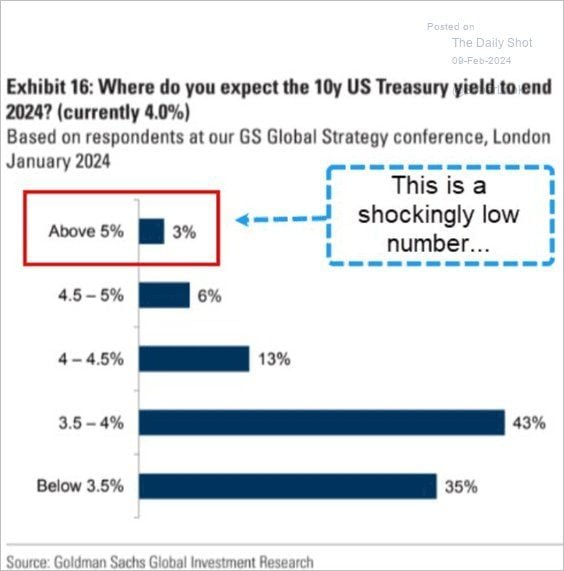

Are investors too complacent on the 10-year us treasury?

Investors expect 3% treasuries at year-end Source: Win Smart, CFA, BofA, The Daily Shot

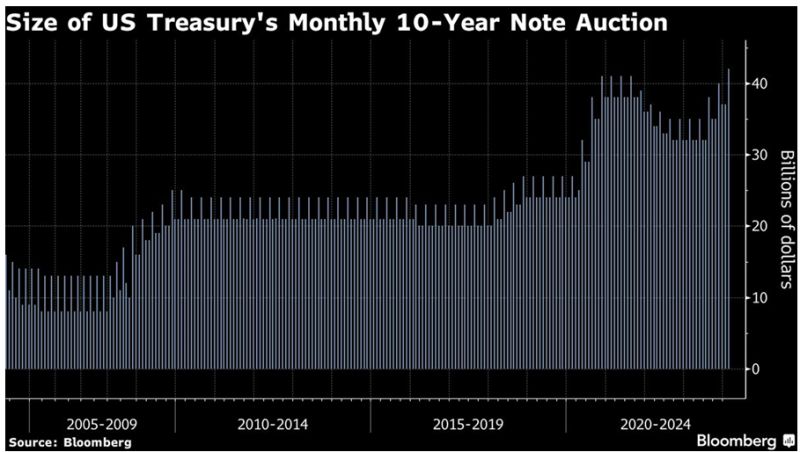

The US government sold a record $42 billion of 10-year notes Wednesday at a lower-than-anticipated yield.

The notes were awarded at 4.093%, compared with a when-issued yield of about 4.105% moments before 1 p.m. New York time, the bidding deadline. The lower yield indicates stronger demand than traders anticipated. The auction result broke a streak of tails — or a weaker result for the previous four monthly sales . source : bloomberg

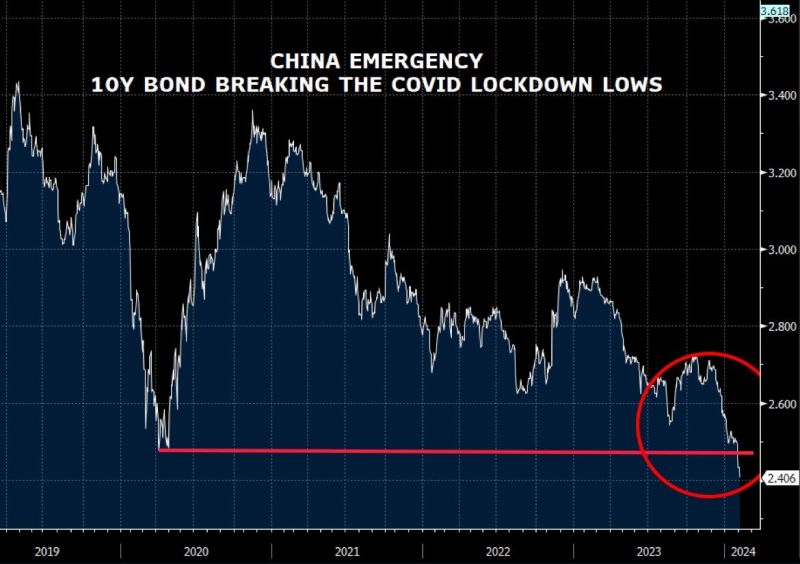

China 10Y yield moves below 2.47%, breaking Covid19 lockdown lows.

China 10Y yield moves below 2.47%, breaking Covid19 lockdown lows. With local equity market imploding and real estate in freefall, fears of a Japanese style deflationary spiral are growing. Should China devalue the renminbi ? Chart vy Sylvain Baude, CFA, Bloomberg

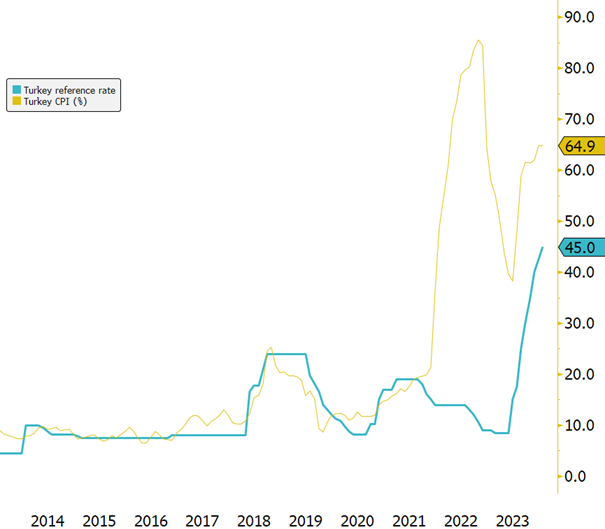

🇹🇷 A Surprise Resignation at the Central Bank of Turkey (CBT) 🌟

Governor Hafize Gaye Erkan's sudden resignation from the Central Bank of Turkey (CBT) has stirred questions about its impact on monetary policy and financial markets. Erkan, who made history as the first woman to lead the CBT, took office less than eight months ago with a mandate to adopt a more orthodox monetary policy. She swiftly raised the benchmark interest rate to 45% to combat soaring inflation. Following Erkan's exit, her deputy, Fatih Karahan, assumed leadership. With experience from the New York Federal Reserve and Amazon, Karahan is expected to maintain a strict monetary stance. He affirmed a commitment to monetary tightening until inflation aligns with the CBT's goals. This transition arrives amid high consumer price inflation, expected to remain around 65% for January. Karahan's appointment underscores the nation's policy continuity and commitment to economic stability through orthodox monetary measures. As financial markets react, we'll closely watch the CBT's policy decisions under Governor Karahan's leadership and their impact on the Turkish economy. 🇹🇷📈 Source: Bloomberg #CBT #TurkeyEconomy #MonetaryPolicy #MarketImpact

Investing with intelligence

Our latest research, commentary and market outlooks