Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

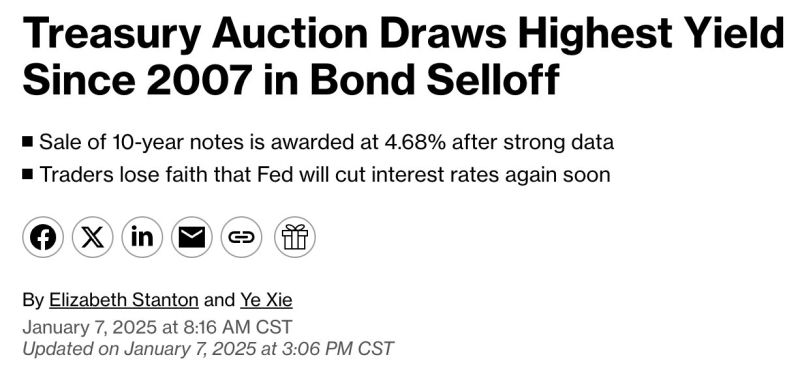

Yields on 10-yr Treasuries are now the highest vs 2-year rates since 2022.

It's unclear whether this is a healthy normalization - a reversion back to the typical relationship of long-term yields being higher than short-term ones - or a sign of stickier inflation and deficit fears. Souce: Bloomberg, Lisa Abramowicz

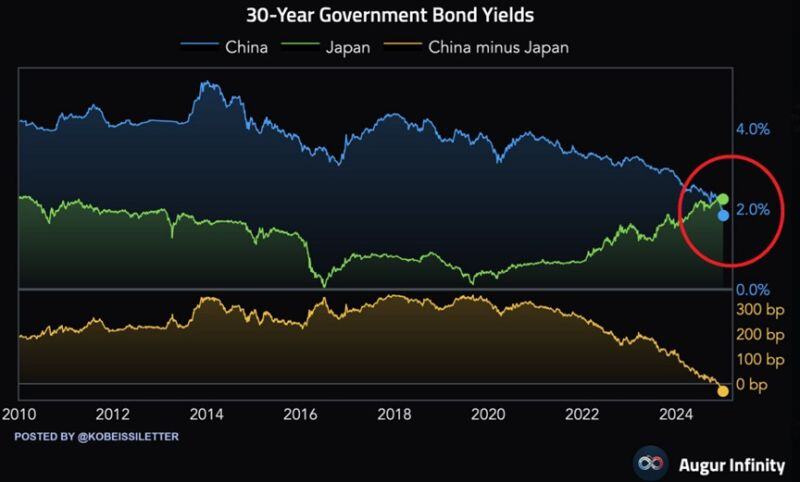

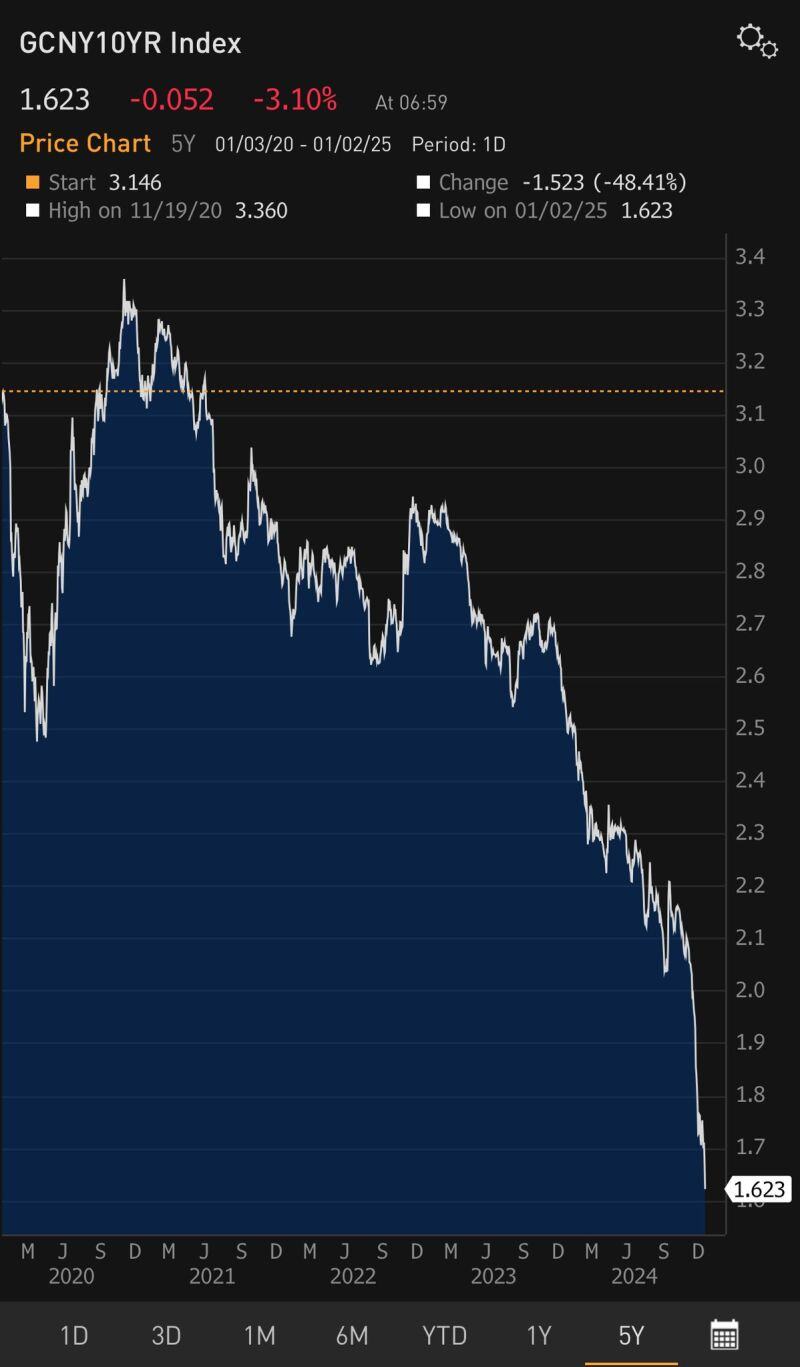

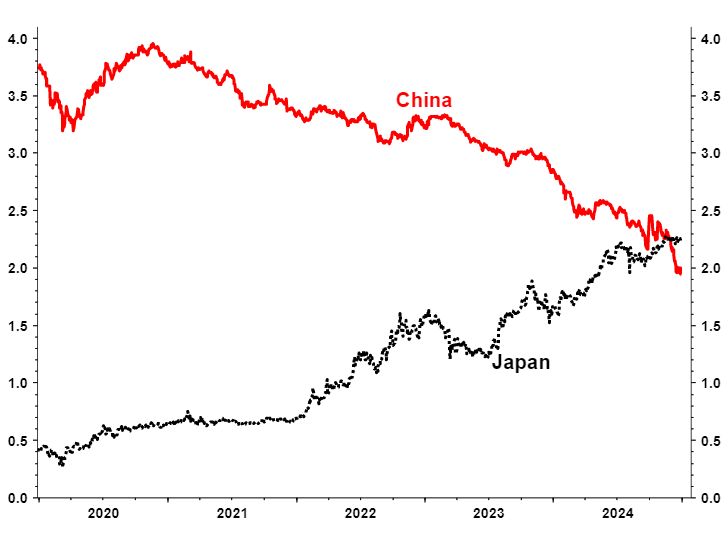

This is truly historic: China’s 30-year government bond yield has dropped below Japan’s 30-year yield for the first time ever.

Over the last 4 years, China’s bond yield has declined by a whopping 215 basis points. This comes as China’s economy has slowed and experienced 6 straight quarters of deflation, the longest streak since 1999. At the same time, Japan’s bond yield has risen 160 basis points as inflation has picked up in the country. In the past, Japan had seen 3 decades of economic stagnation and had suffered 25 years of deflation starting in the 1990s. Is China entering its own "japanification" economic phase? Source: The Kobeissi Letter, Augur Infinity

Next year, $3.08 trillion in US Treasury notes and bonds—about 12% of the total—will mature.

At current rates of ~4.46%, rolling this debt would raise the interest expense 54% over the current average coupon of 2.88%. That is an extra $48.7 billion in annual interest expense. Source: Bloomberg, Joe Consorti

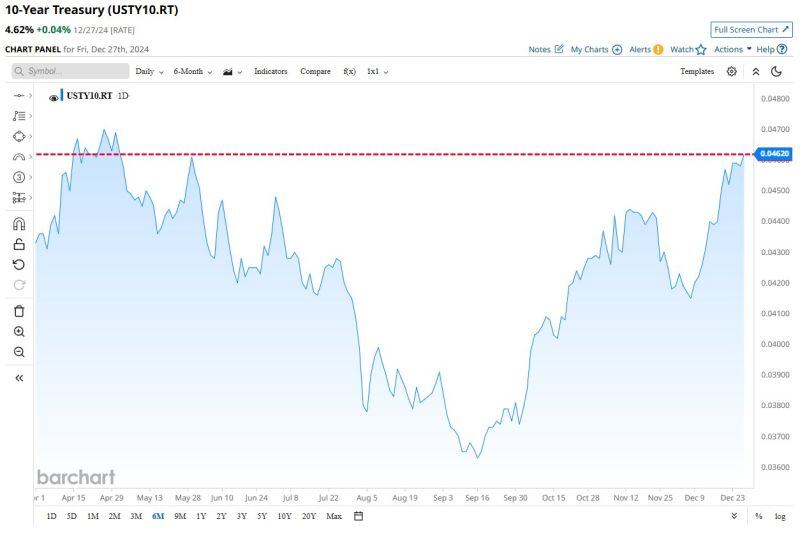

10-Year Treasury Yield closes at highest level in almost 8 months 🚨

Source. Barchart

Investing with intelligence

Our latest research, commentary and market outlooks