Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

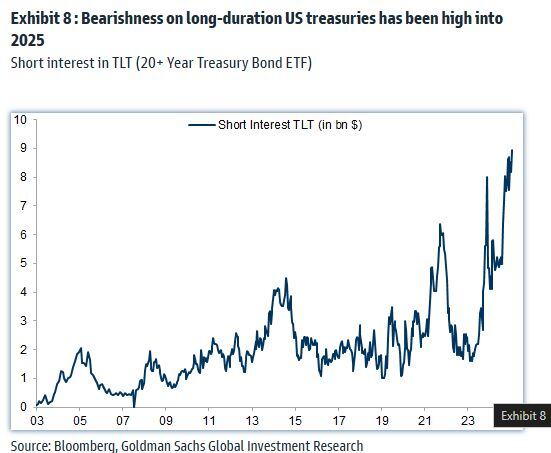

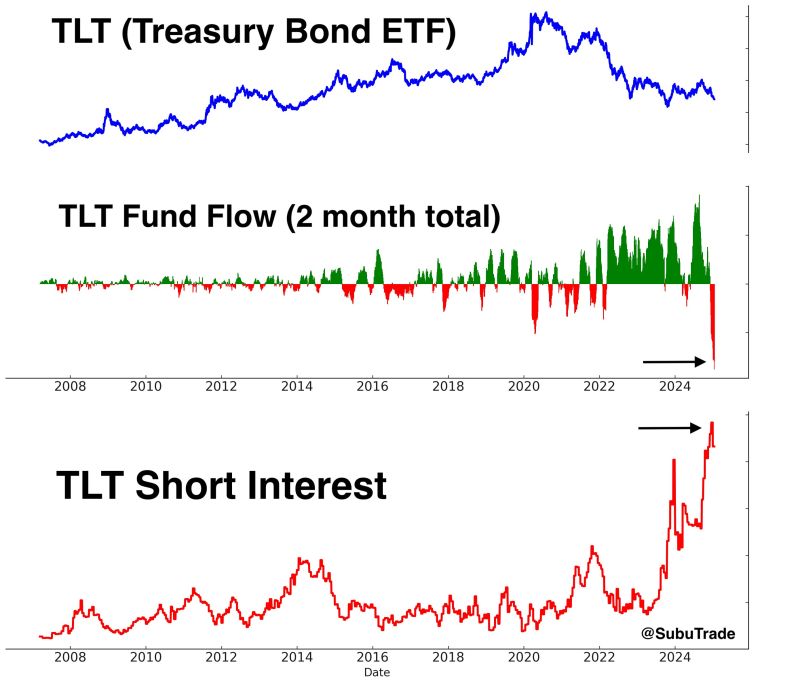

GS: Short interest in $TLT is near century-highs

Source: Mike Zaccardi, CFA, CMT, Goldman Sachs

Treasury Secretary Scott Bessent says Trump 2.0 focusing on 10Y yields, not Fed

Bessent repeated his view that expanding energy supply will help lower inflation. For working-class Americans, “the energy component for them is one of the surest indicators for long-term inflation expectations,” he said. Cheap capital is coming... Source: www.moneycontrol.com

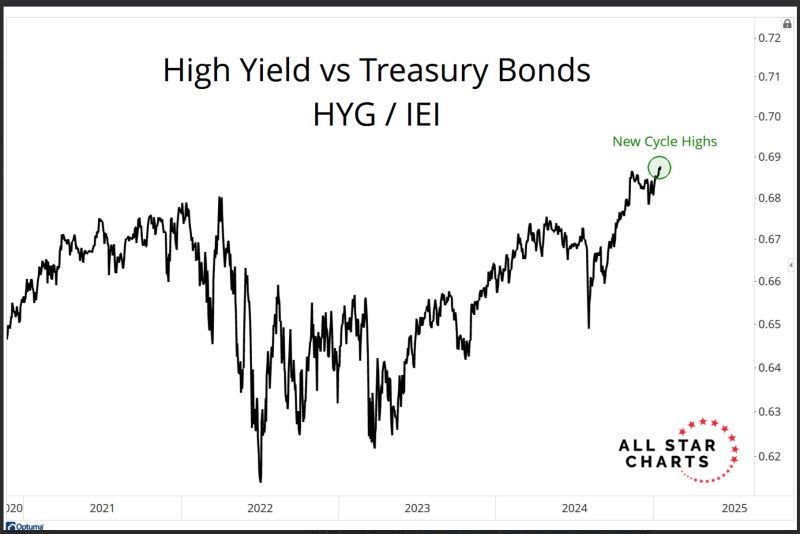

Fixed income: Credit is still the place to be

Spreads are as tight as they've been this entire bull market: Source: J-C Parets

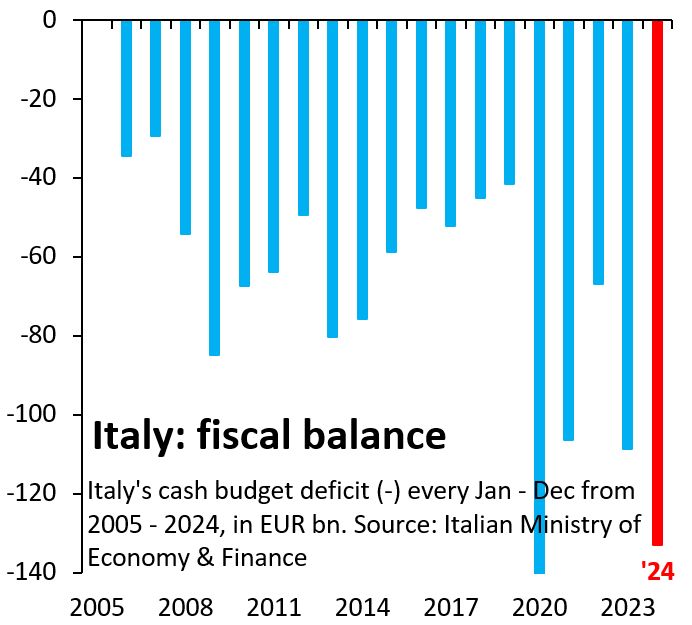

The ECB shields high debt countries from bond market crises via the combined effect of past interventions and its TPI anti-fragmentation tool.

Underlying assumption is that high debt countries will do what it takes to bring down debt without crises. That assumption is wrong... - Robin Brooks on X

Investing with intelligence

Our latest research, commentary and market outlooks