Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

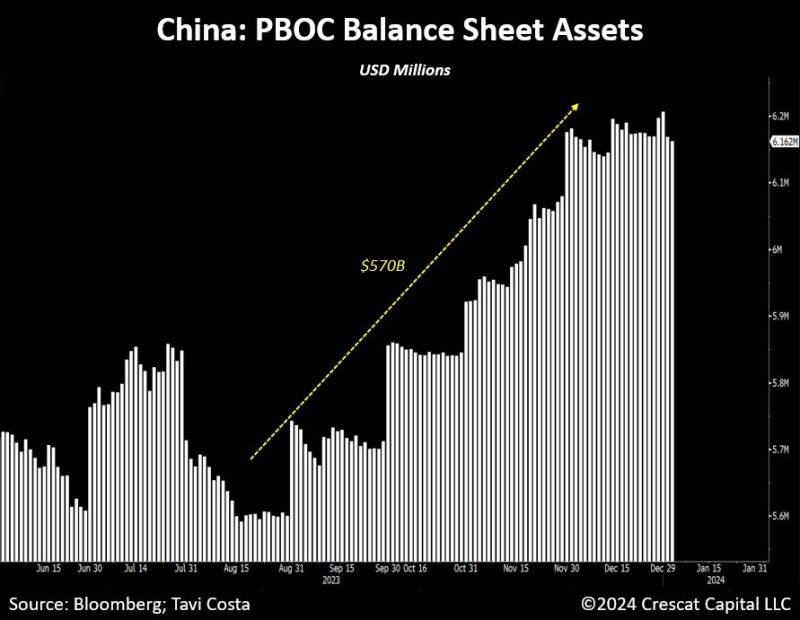

China’s central bank assets have surged by nearly $600B in the last 4 months

In yuan terms, this was the largest 4-month increase in the history of the data. The issue of a bloated government deficit and significant debt is not exclusive to the US; it resonates globally. Source: Tavi Costa, Bloomberg

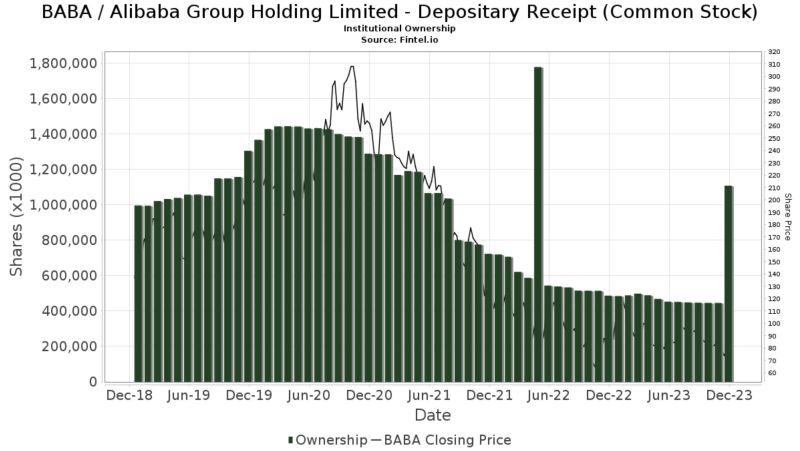

Alibaba $BABA Institutional ownership jumped 100% in the month of December '23. As the price fell to its 52 Week Low, Institutions bailed in

Source: The long investor

Tencent's stock crashes 16% in minutes after Beijing released draft guidelines aimed at curbing incentives that could lead to excessive gaming and spending

Tencent is China's largest public company and the drop erased ~$55 billion of market cap. This also marks the biggest one-day drop for the company since 2008. Note that NetEase sank by as much as 28% to HK$117.30, breaking briefly below a key technical support offered by a February low at around HK$120.70. In mid-afternoon trade, NetEase shares pared losses to trade down about 20% at HK$129. Source: The Kobeissi Letter, CNBC

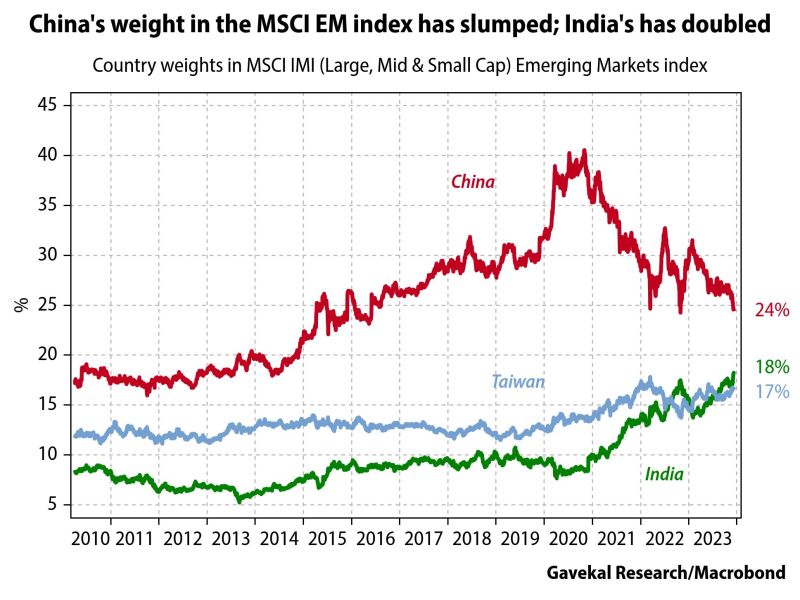

Chinese stocks made up 24.7% of the MSCI Emerging Markets index by capitalization, down from 40% three years ago

Meanwhile, India's weight has doubled... Source: Gavekal

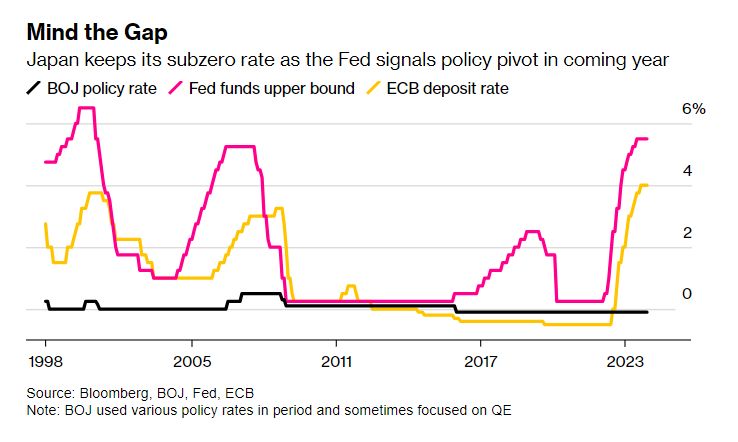

Japan | BOJ Avoids Rate Hike Signal as It Stands Pat, Driving Yen Lower – Bloomberg

As expected, no change from the BoJ this morning on rates or the YCC. The vote was 9-0, in favor of no change. There wasn’t even a hint of change to the policy statement. No change in language around wages and inflation. The Japanese Yen weakened considerably on the initial press release. Nikkei 225 is up +1.5% Source: Ayesha Tariq, Bloomberg

BREAKING: Chinese Equities

Chinese Stocks continue to nosedive and have fallen to their lowest prices in 5 years. Source: Barchart

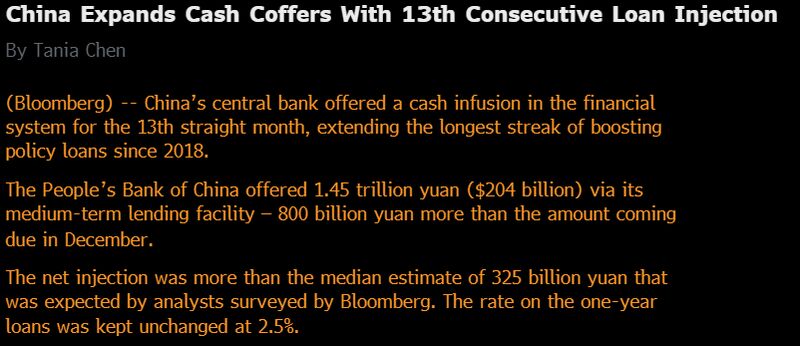

BREAKING: China's central bank injects RECORD monthly amount into money markets

Source: Bloomberg

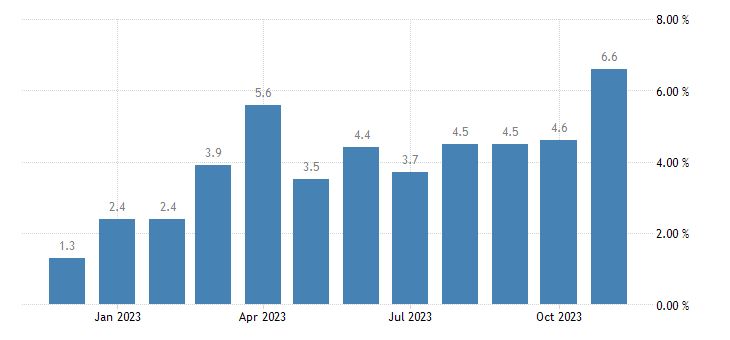

China reports fastest industrial expansion in nearly 2 years; retail sales growth misses estimates

China's industrial production advanced by 6.6% year-on-year in November 2023, following a 4.6% gain in the previous month and beating market forecasts of 5.6%. It was the fastest pace of growth since February 2022. Retail sales climbed 10.1% in November from a year ago, the fastest pace of growth since May — though analysts had expected a 12.5% spike following a low base in 2022. Retail sales rose 7.6% in October. Fixed asset investment in urban areas cumulatively grew 2.9% in the first 11 months of the year, compared to expectations for 3% growth. China’s urban unemployment rate stayed at 5% in November. Source: Trading Economics, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks