Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

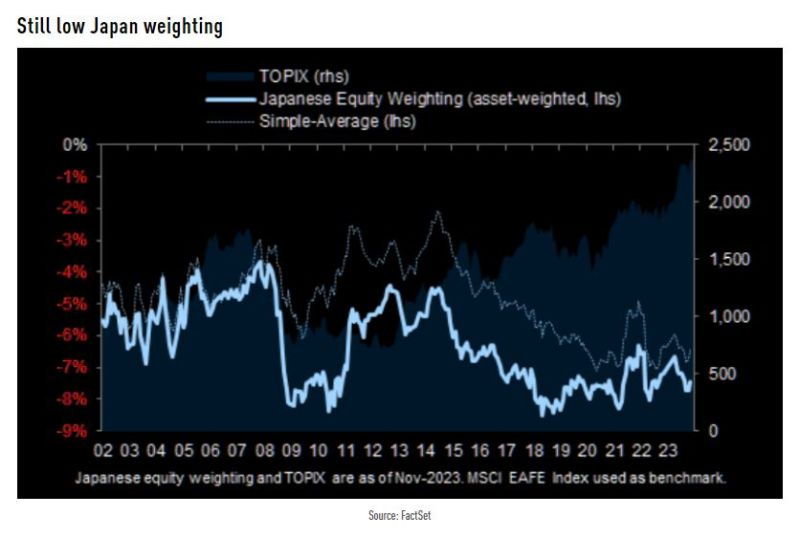

The silent bullmarket...

Global mutual funds' active weighting of Japanese stocks has not risen in the past six months. Source: TME, Factse

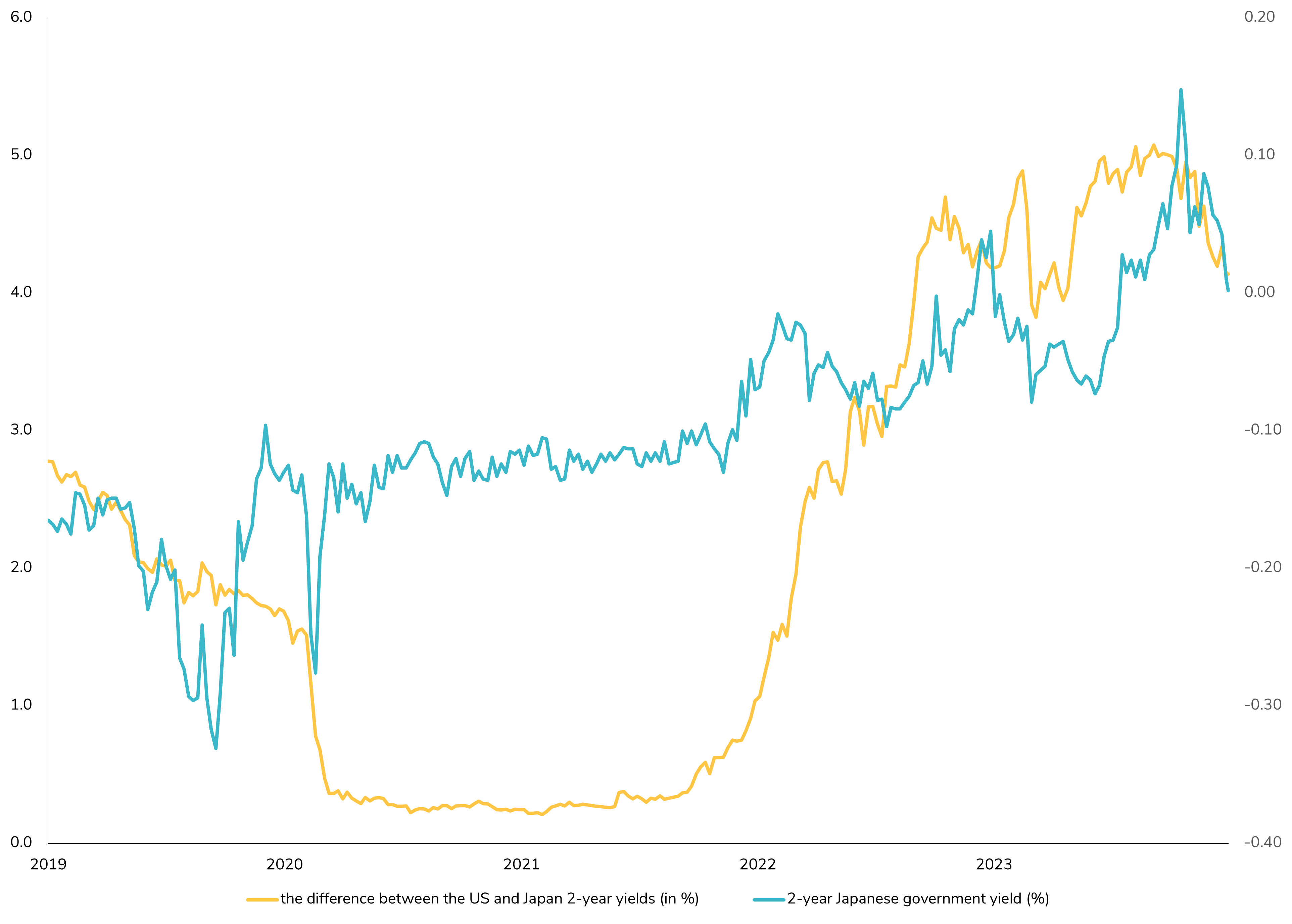

Life below zero...

JAPAN 2-YEAR YIELD FALLS BELOW ZERO FOR FIRST TIME SINCE JULY

The 2-Year Japanese Yield Back in Negative Territory 📉

While the anticipation has been building for the Bank of Japan (BoJ) to exit its negative rate monetary policy in April 2024, the market seems to be taking a different turn. Today, the 2-year Japanese bond yield closed in negative territory. The BoJ has signaled its readiness to end the negative interest rate policy, but it's contingent on economic data and the outcomes of the March wage talks. Japan's path to normalization will be unique, as its economy still requires some level of monetary easing. The BoJ's terminal rate is projected to gradually reach around 0.5% over three to four years, potentially beginning with one or two rate hikes in the first year. However, the timeline for the BoJ to abandon its negative interest rate policy is now being seen as possibly extending further into 2024. Governor Kazuo Ueda's cautious statements, combined with unforeseen challenges like the recent earthquake, have led many economists to reconsider their forecasts, shifting expectations from January to potentially April or later. Stay tuned for more updates on this evolving situation. The Japanese monetary policy landscape is certainly one to watch closely in the coming months. Source: Bloomberg.

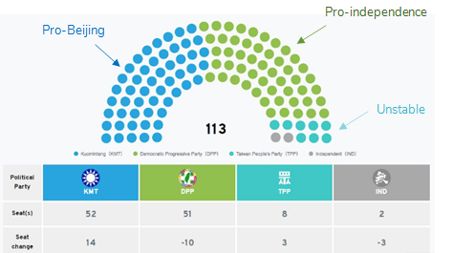

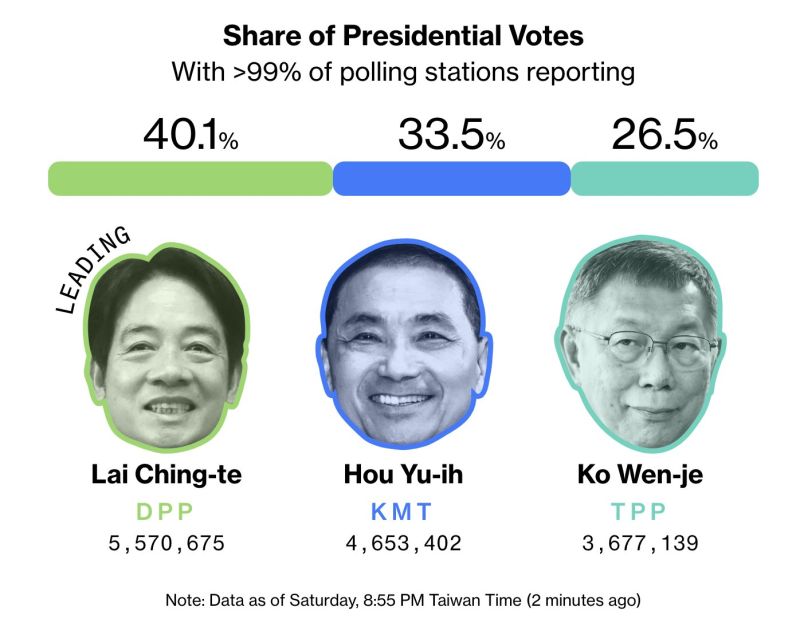

Some new developments in Taiwan's presidential & legislative elections.

The DDP’s Lai Ching-te won Taiwan’s 2024 presidential election on Saturday with 40% of the vote, but the ruling party failed to hold onto its parliamentary majority. Pro-Beijing Kuomintang, or KMT, won 52 seats in the legislature — one more than the DPP which lost 10 seats in Taiwan’s parliament from its previous 61, giving up its majority. Lai Ching-te will face a split parliament that will likely moderate his policy agenda, with Taiwan People’s Party (TPP) seen as the king maker with eight seats since neither of the two major parties won an outright majority in the 113-seat Legislative Yuan. What’s next? The split legislature) will mean the Lai administration will struggle to pass much of his agenda unless either coordinating with the TPP or just focusing on the few areas where there may be broader consensus. The outcome could see President Lai embracing a more restrained China policy — particularly since KMT and TPP have advocated a more conciliatory posture — even as Beijing is likely to ramp up pressure on Taiwan’s government when Lai is officially inaugurated as president in May. The new parliament will take office next month. Beijing will pay particular attention to signals from Lai’s inauguration speech. Apart from military exercises, Beijing may also impose new tariffs or sanction Taiwanese companies that are political donors to the DPP. Source: CNBC

Key takeaways from Taiwan's President election;

1) Re-elected President Lai Ching-te (DPP party) favors closer ties with the US and an expected status quo regarding the situation of Taiwan and the existing relationships. We don’t expect any significant change in Taiwan’s policies 2) We note that US President Biden statement post-election has been very balanced (Official congratulations to Lai-Ching Te but no support to Taiwan independence vote) Source: Bloomberg

Taiwan Semiconductor is trading at a political discount, which is unlikely to narrow after the election of the China-critical candidate Lai Ching-te.

Source: Bloomberg, HolgerZ

China skeptic Lai Ching-te wins Taiwan’s presidential election

Ruling-party candidate Lai Ching-te emerged victorious in Taiwan’s presidential election, a man Beijing has labeled an “instigator of war”, in a vote that has enormous geopolitical implications across not just the Taiwan Strait, but between the US and China, too. Lai’s victory represents an unprecedented democratic milestone: the 1st time a political party in Taiwan has won a 3rd straight presidential election. Kuomintang or KMT, Beijing’s preferred political partner, gained roughly 33% of the vote. Beijing has repeatedly labeled Lai as a “stubborn worker for Taiwan independence” and a dangerous separatist. There are also fears this could in turn influence frosty China-U.S. relations and security in the broader Indo-Pacific region. Source: HolgerZ, Bloomberg, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks