Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

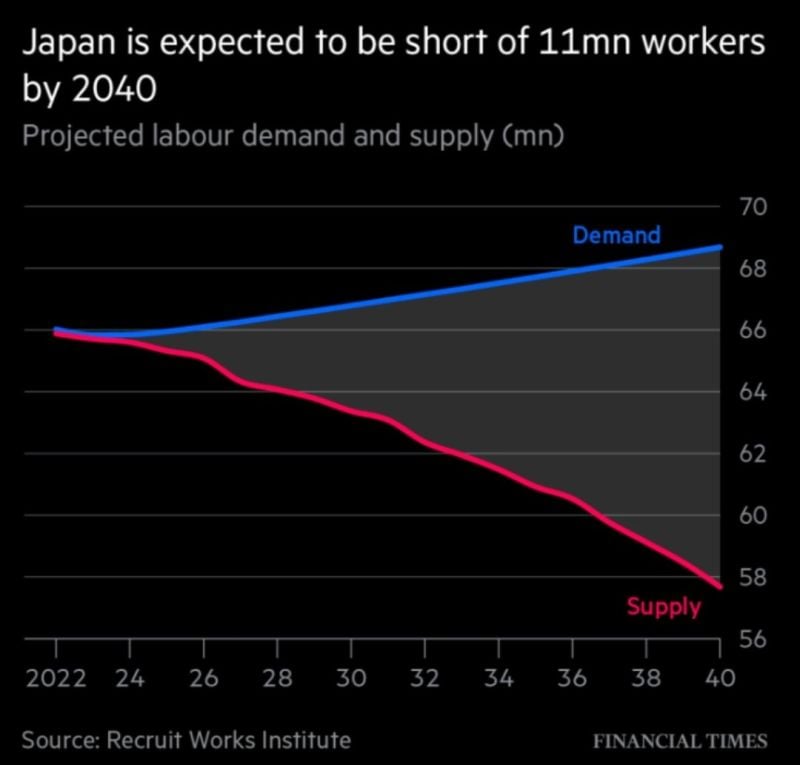

Japan is expected to be short 11 million workers by 2040

Source: Win Smart, FT

India’s stock market has overtaken Hong Kong’s for the 1st time in another feat for the South Asian nation whose growth prospects & policy reforms have made it an investor darling

Source: Bloomberg, HolgerZ

India is set to overtake Hong Kong to become the world's fourth-largest stock market. It may happen this week assuming current trajectories hold

Source: David Ingles, Bloomberg

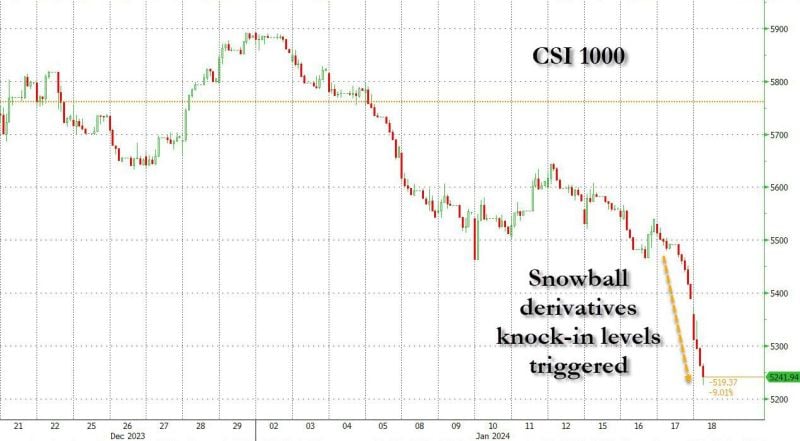

Another day, another loss for chinese stocks.

According to Guotai Junan Futures, there are about 30 billion yuan ($4.2 billion) of snowball derivatives products tied to the CSI 1000 Index are near levels that trigger losses at maturity, according to Guotai Junan Futures Co, as the stock rout in China's stock market pushes the derivatives to near knock-in levels. Another 60 billion yuan of the derivatives are 5%-10% away from their knock-in thresholds! Source: www.zerohedge.com

China’s economy spooks markets, and stocks sink.

The CSI 300 has underperformed the S&P 500 by >40ppts over the year. Source: Bloomberg, HolgerZ

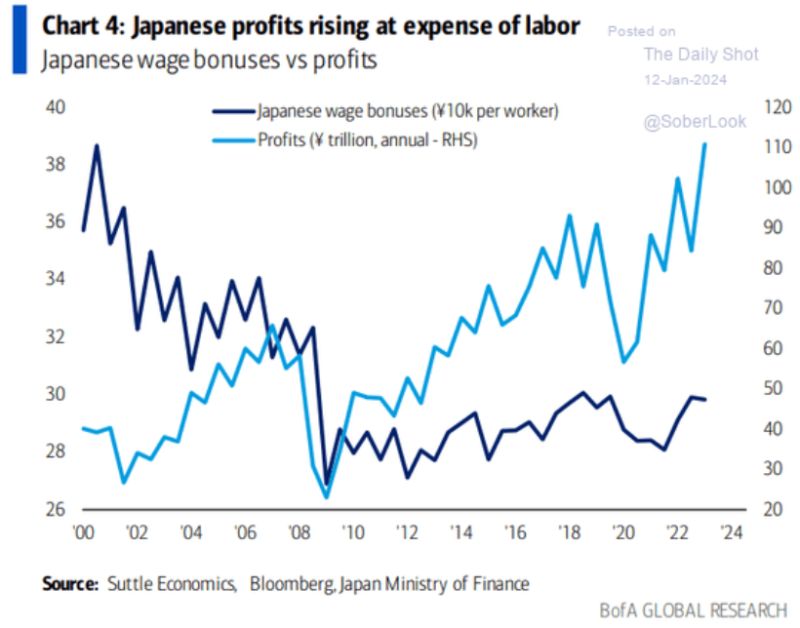

Japanese companies profits are surging

but that's not translating into rising domestic wages, keeping a lid on domestic inflationary pressures, and allowing easy monetary & FX policy to persist. The main winners are japan equity investors. Source: DB, Bob Elliott, The Daily Shot

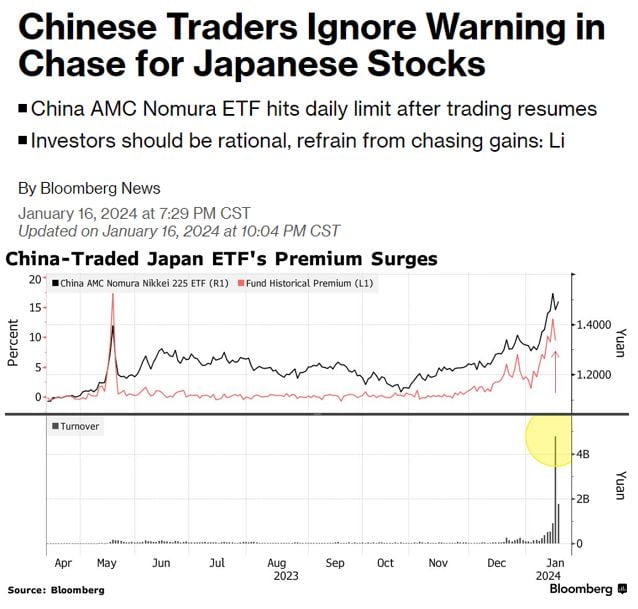

China stocks cbear market continues unabated

As Hong Kong’s Hang Seng index tumbled 3.06% afterweaker than expected GDP numbers were released, while China’s CSI 300 index shed 0.73%. Meanwhile, AMC Nomura Nikkei 225 ETF went limit up today after Chinese traders ignored warnings to avoid chasing gains in Japanese Stocks. This ETF trades with a 9.5% premium over its net asset value... Source: Bloomberg, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks