Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

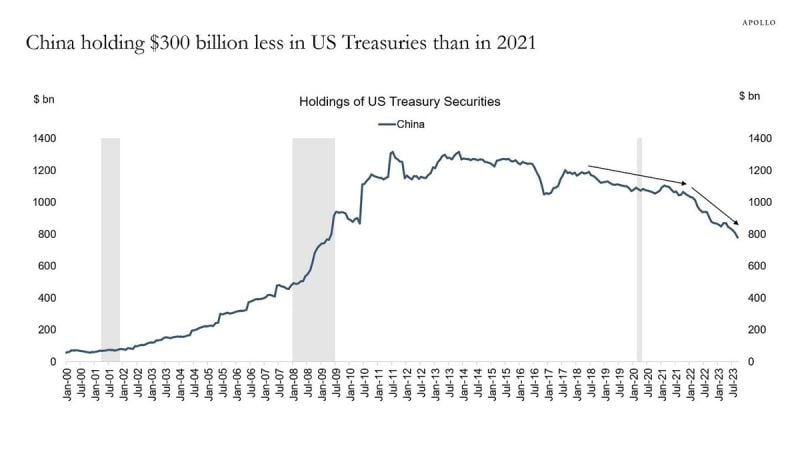

China's holdings of US Treasuries continue to move in a straight line lower

Their holdings of US Treasuries have declined by $300 billion since 2021. Currently, China holds just under $800 billion of US Treasuries, levels not seen since 2009. As interest rates are peaking, the foreign private sector has been slowing purchases. Also, as China faces increasing economic headwinds, it is likely this trend resumes.

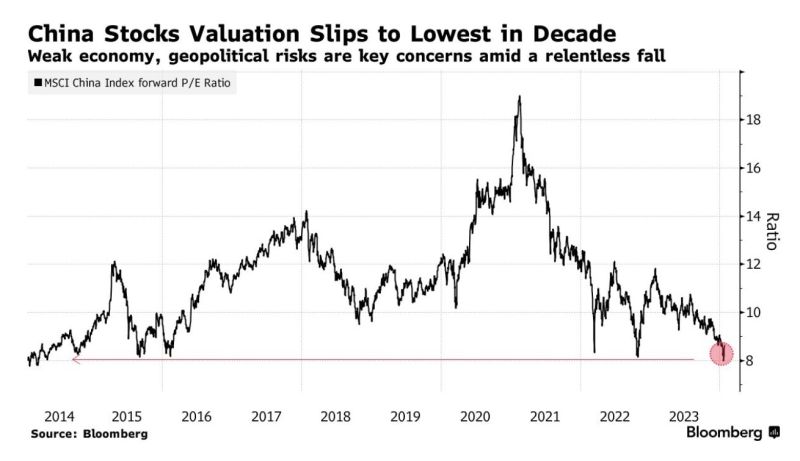

Chinese Stocks have fallen to a P/E Ratio of just 8, their lowest valuation in a decade 👀

Source: Barchart, Bloomberg

A Hong Kong court has ruled that Evergrande, China's largest real estate developer, must be liquidated

The stock is now down another 20% today on the news and trading has been halted. Evergrande is now considered the most indebted property developer in the world. This comes at a time when China's HY Real Estate Index is down 85% in 2 years. China is also preparing hundreds of billions in economic stimulus along with considering a ban on short selling. Source: The Kobeissi Letter

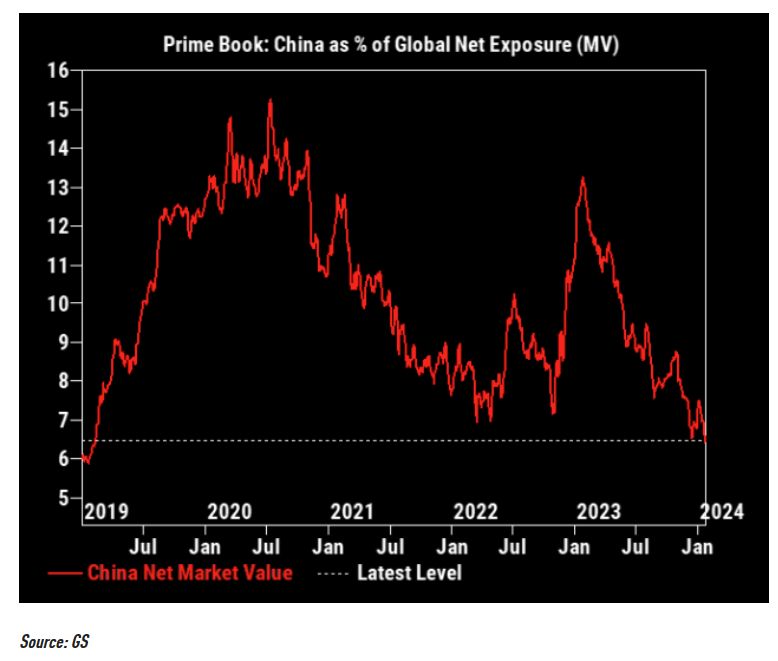

Depressed China

China as % of global net exposure is at the lowest levels in "modern times". Source: Goldman Sachs, TME

Bridgewater tells investors it is “moderately bullish” on Chinese stocks as the prolonged rout made valuations attractive, a call made days before the country’s latest stock meltdown

Source: Bloomberg

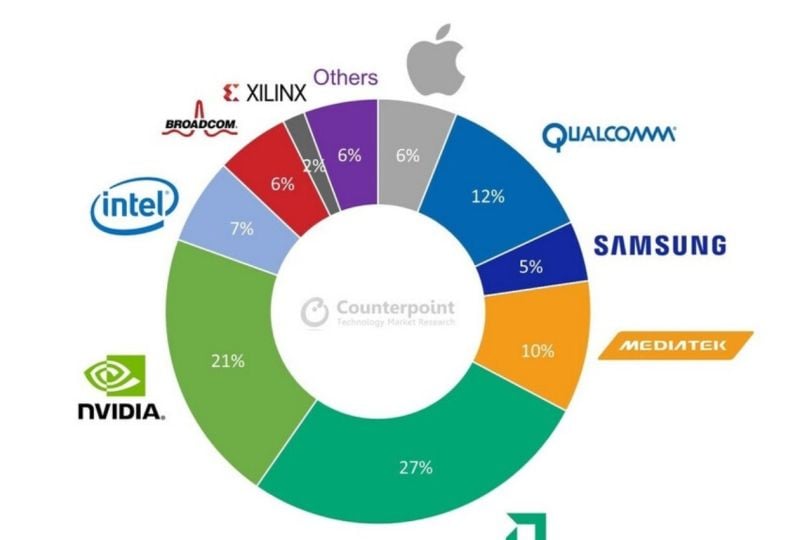

Taiwan semiconductor $TSM, the world's largest contract chip manufacturer, forecast 2024 revenue to grow more than 20% thanks to booming demands for high-end chips used in AI applications

Taiwan Semi's main customers include AMD $AMD, Nvidia $NVDA, Qualcomm $QCOM, Intel $INTC, Apple $AAPL, and Broadcom $AVGO. Source: Jesse Cohen

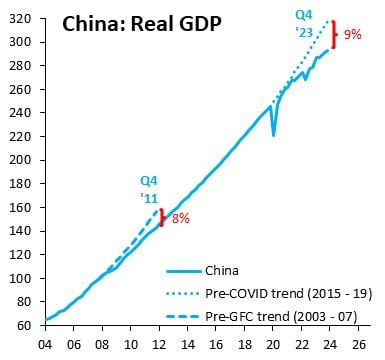

China's real GDP is now further below its pre-COVID trend than after the 2008 crisis

Will they be tempted to opt for more mercantilism (and expansionism)? Source chart: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks