Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

India is close to finalising a first-of-its-kind trade deal

This first-of-its-kind trade deal that could see a small group of European nations invest as much as $100 billion (CHF87 billion) over 15 years in exchange for easier trade access to the world’s most populous nation, according to people with knowledge of the matter. The European Free Trade Association (EFTA), which comprises Switzerland, Norway, Iceland and Liechtenstein, made a commitment to invest in India as part of a trade pact that’s in the final stages of negotiations, the people said, asking not to be identified as the talks are still ongoing. The contours of the deal have been agreed and deliberations currently centre on the final investment amount, which could be as much as $100 billion over 15 years, some of the people said. While India wants the commitment to be legally binding, one of the European officials said the amount will likely be framed as a goal, with no legal means to claim it included in the language of the agreement. If finalised, it would mark the first time an investment commitment of this nature is secured by India as part of a free trade agreement. As mentioned by Ritesh Jain, India is the biggest beneficiary of Ukraine/Russia war. A non aligned country with good relationship with everybody , young population is attracting investment commitment from across the world.

JUST IN: China's consumer prices declined at the fastest speed in 15 years in January.

CPI fell 0.8% in January on an annual basis, more than the median estimate for a 0.5% decline in a Reuters poll. This was its fourth straight decline and its biggest drop since 2009. Meanwhile, China’s PPI fell 2.5% in January from a year earlier, the National Bureau of Statistics reported Thursday, slightly better than expectations for a 2.6% decline.

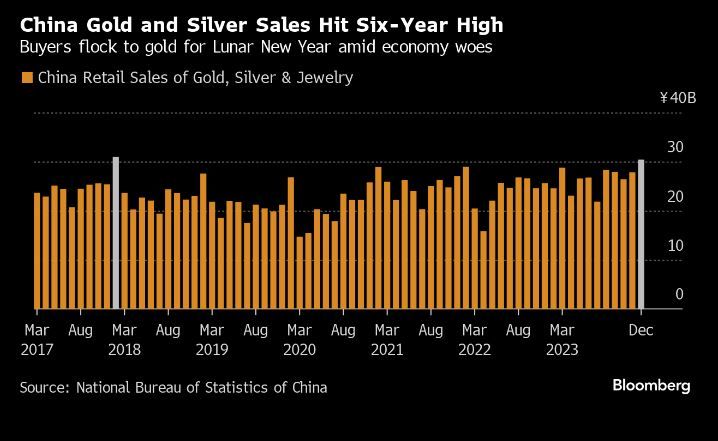

China Gold and Silver Sales Hit Six Year High

Sales of gold, silver and jewelry have been brisk for months, defying wobbles in the Chinese economy centered around the protracted crisis in the property market. Retail salesin December, the last month for which data is available, were at a six-year high. source : bloomberg

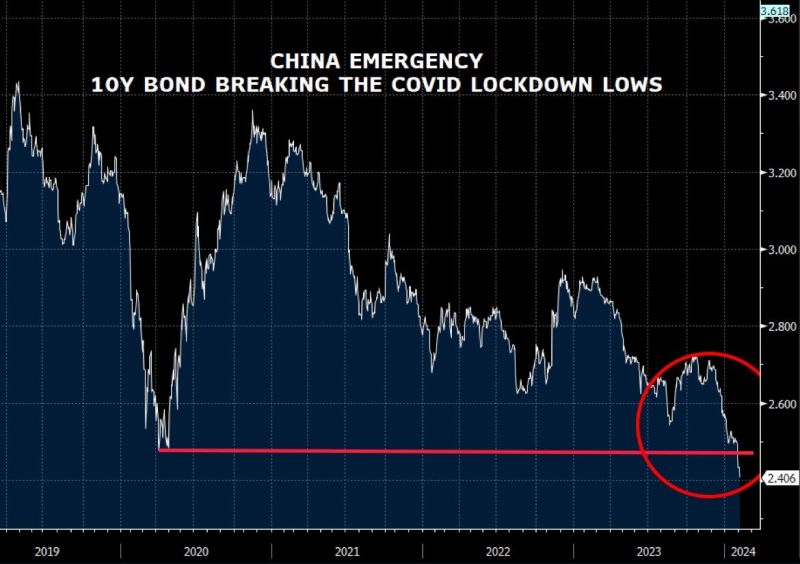

China 10Y yield moves below 2.47%, breaking Covid19 lockdown lows.

China 10Y yield moves below 2.47%, breaking Covid19 lockdown lows. With local equity market imploding and real estate in freefall, fears of a Japanese style deflationary spiral are growing. Should China devalue the renminbi ? Chart vy Sylvain Baude, CFA, Bloomberg

BREAKING: WILD morning in Chinese markets. Nearly 30% of all stocks in China have been halted as China's CSI 1000 index slides 8% in a matter of hours.

CSI 1000 was down nearly 9% at one point. The more broadly tracker indexes CSI 300, HSI, HSTECH reversed most losses in the morning Source: Bloomberg, David Ingles

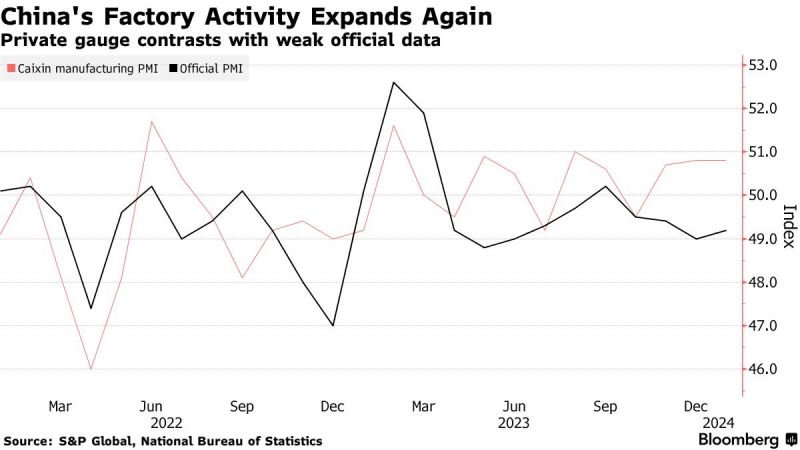

China Factory Activity Expands Again, Private Survey Shows

Source: Bloomberg, C.Barraud

Investing with intelligence

Our latest research, commentary and market outlooks