Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

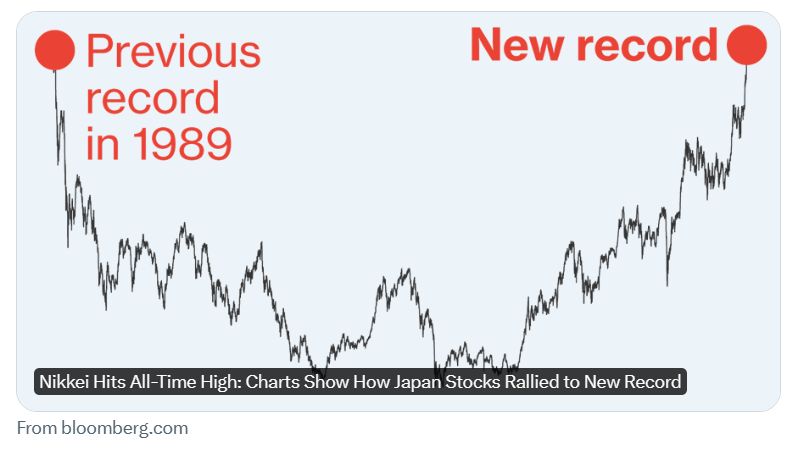

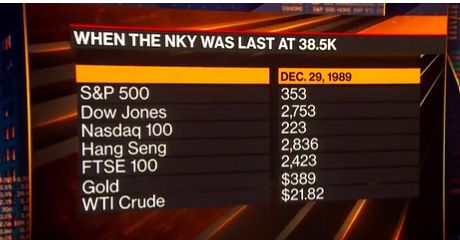

Japan's Nikkei has hit a historic high not seen since 1989, marking an epic come-back for the country's stock market.

The Nikkei 225 hit an all-time high of 38,924.88 as robust corporate earnings and steps aimed at boosting investor returns fuel a blistering rally in Japanese equities this year. Nikkei and Topix have been standout outperformers in Asia Pacific, up more than 10% in 2024 after surging more than 25% in 2023 — their respective best annual gain in at least a decade. Source: Bloomberg, CNBC

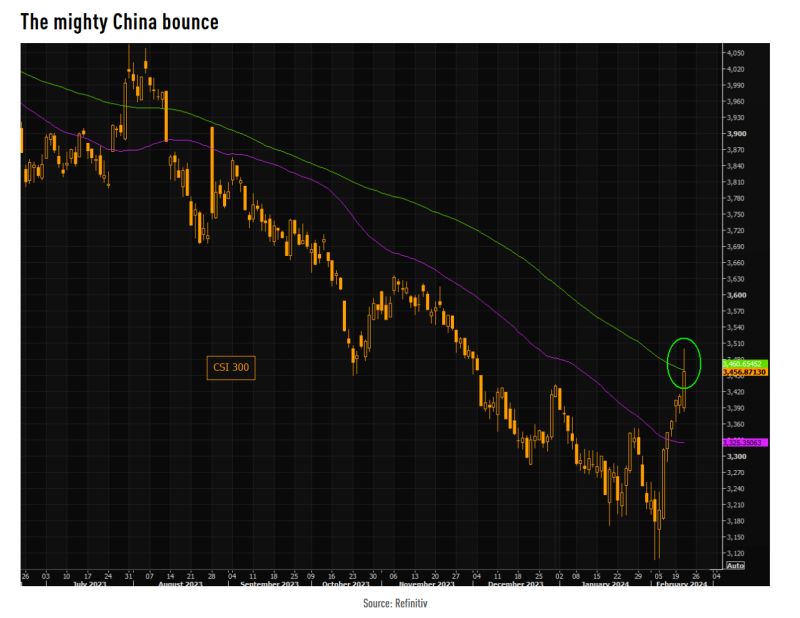

CSI 300 is up some 11% from early Feb lows.

The index is well above the 50 day, and touched the 100 day for the first time since last summer. Source: TME

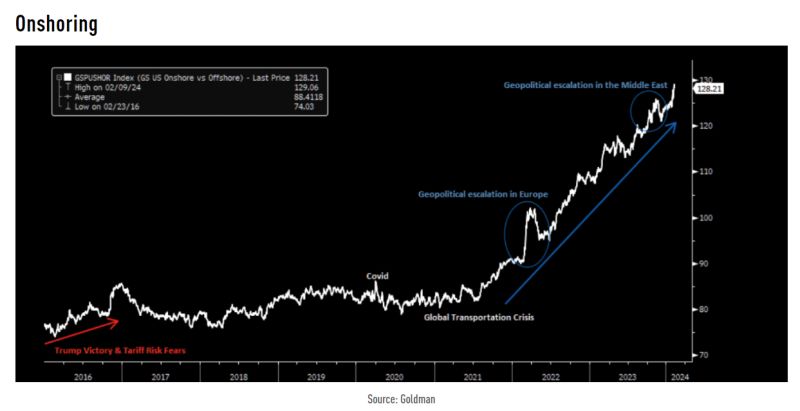

China and US elections reiterate the durability of the onshoring theme.

Source: Goldman Sachs

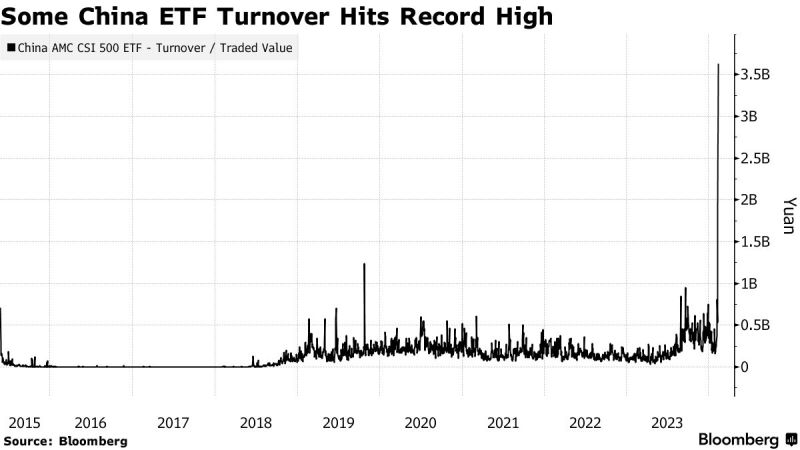

China’s National Team Is Back at Work as Stock Trading Resumes – Bloomberg

Several exchange-traded funds in China tracking the nation’s stocks saw a surge in turnover on the first trading day after the Lunar New Year holiday, a likely sign that state-backed funds continue to support the market. Traded values of China AMC CSI 500 ETF and Harvest CSI 500 ETF both surged to records, while those of Tianhong CSI 500 ETF, BOC International CSI 500 ETF and CIB CSI 500 ETF were higher than their average levels.

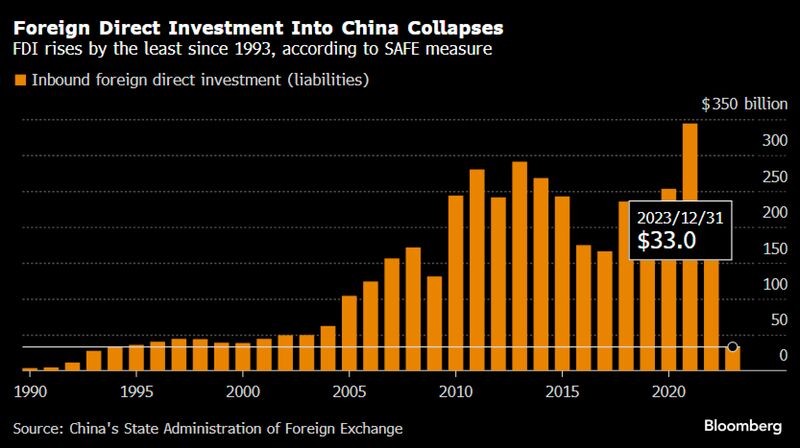

Direct foreign investment into China slumps to 30y low.

Foreign firms only added $33bn to their FDI liabilities, the lowest since 1993, indicating a lack of confidence Source: Bloomberg, HolgerZ

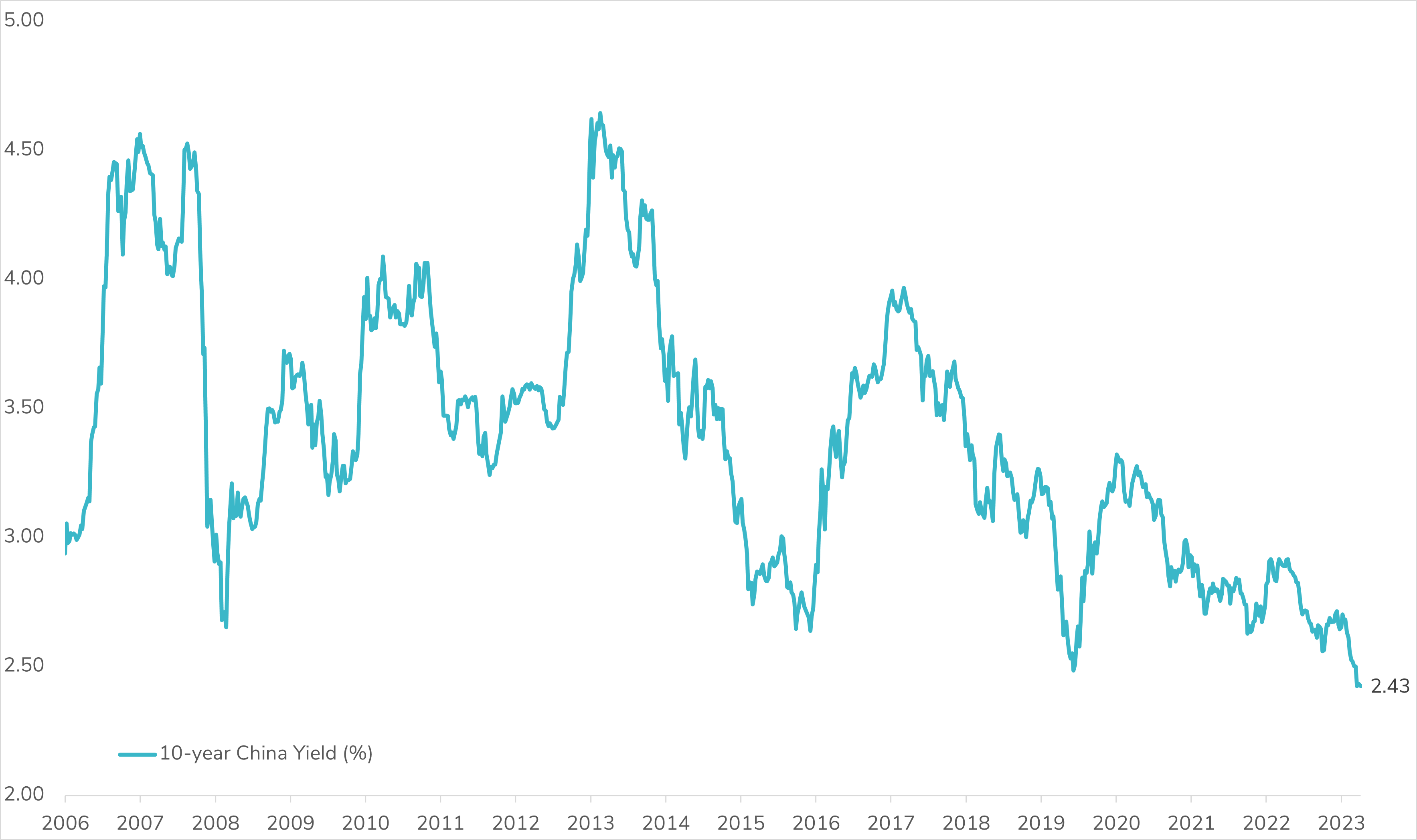

📉 China Yields Staying Stuck at Historic Lows as PBOC Slashes Mortgage Reference Rate!

China has taken bold measures to uplift its struggling property sector by implementing its most substantial reduction in a key mortgage rate to date. The five-year loan prime rate saw a notable cut of 25 basis points, plummeting to a historic low of 3.95%. This move, the largest decrease since the rate's overhaul in 2019, underscores China's commitment to stimulating economic growth through targeted measures. The decision to lower the mortgage reference rate is poised to have far-reaching effects, potentially unlocking opportunities for further economic support initiatives. By enabling more cities to lower their minimum mortgage rates, the rate cut aims to revitalize demand in the sluggish housing market. Moreover, it seeks to address the persistent property crisis, which has cast a shadow on overall economic growth. However, despite these efforts, it is not expected that the rate cut will significantly boost homebuyers' sentiment as home prices are still falling in most cities and wage growth is tepid. Following cut's announcement, market response was subdued, with equities and USDCNH experiencing minimal changes, while 10Y onshore government bond yields saw only slight decreases. How will China emerge from this slow economic agony? Source: Bloomberg

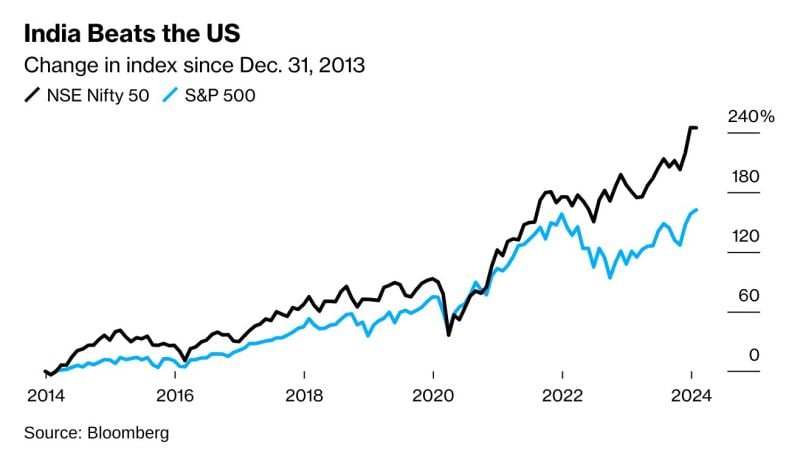

India is one of the few markets that is outperforming the US rather handily

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks