Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The decade of India?

India inks ‘watershed’ $100 billion free trade deal with four non-EU nations. India will lift most tariffs on several sectors with Switzerland, Iceland, Norway and Liechtenstein in a free trade agreement. New Delhi expects the agreement to generate $100 billion worth of investment over 15 years and 1 billion jobs in the world’s fifth-largest economy. https://lnkd.in/eTG7n-ZW Source: CNBC

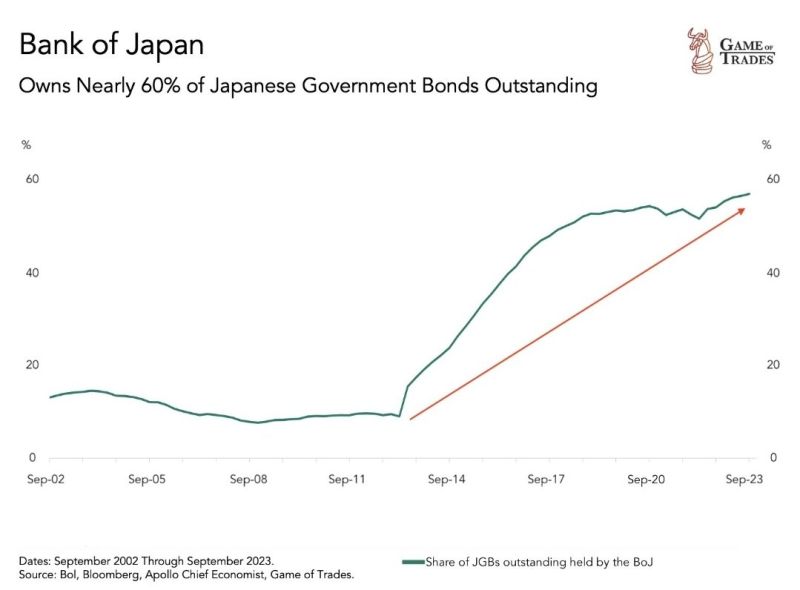

Bank of Japan boj now owns nearly 60% of the entire Japanese government bonds

Source: Game of Trades

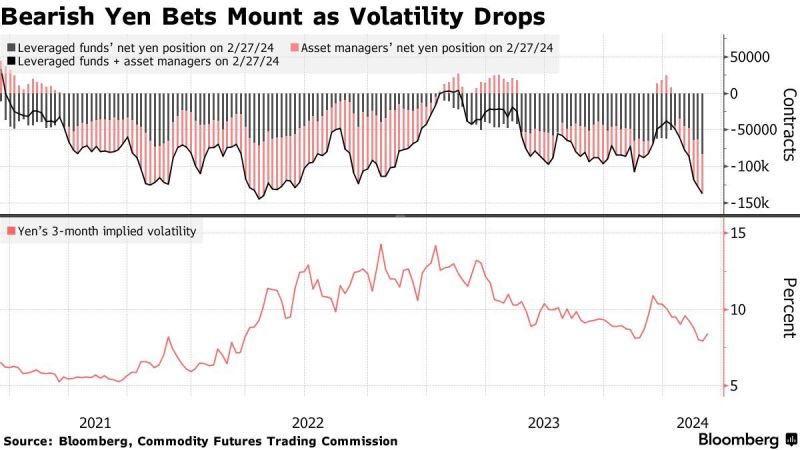

Japan | Yen Gains With Bank Stocks as Wages, BOJ Remarks Boost Hike Bets – Bloomberg

The yen climbed to a one-month high and Japanese bank shares rose after wage data and a Bank of Japan board member’s remarks bolstered speculation the authority will raise interest rates this month. Japanese government bonds extended their drop as data from an auction of 30-year debt indicated weak investor demand for long-maturity securities ahead of the expected BOJ shift. Policy-sensitive two-year notes also fell, with their yield climbing to 0.195%, the highest level since 2011.

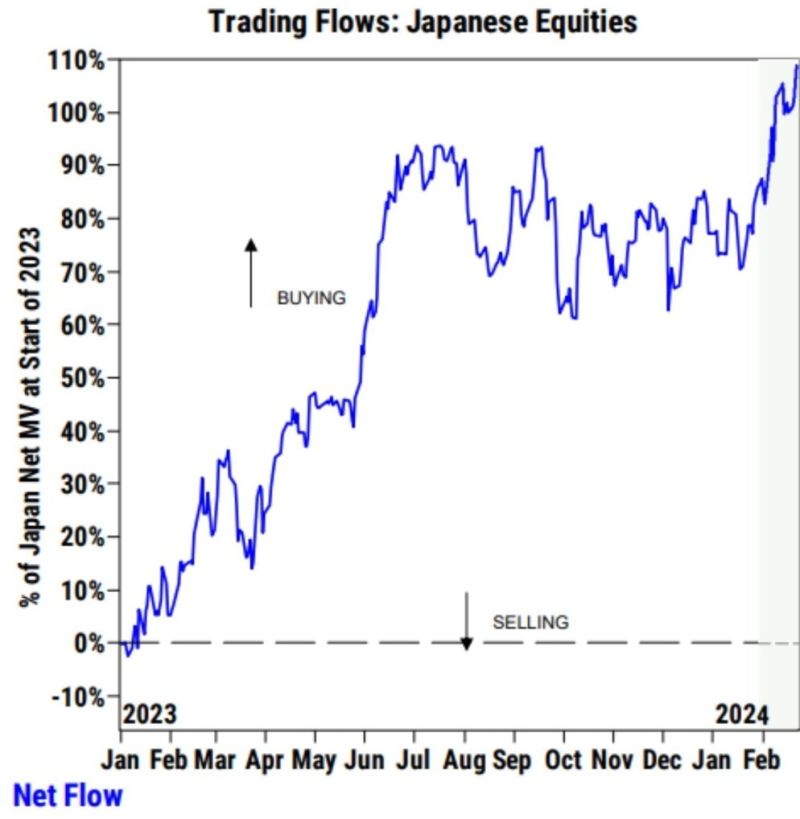

Hedge funds are loading up on japanese stocks with the Nikkei at all-time highs

Source: Win Smart, CFA

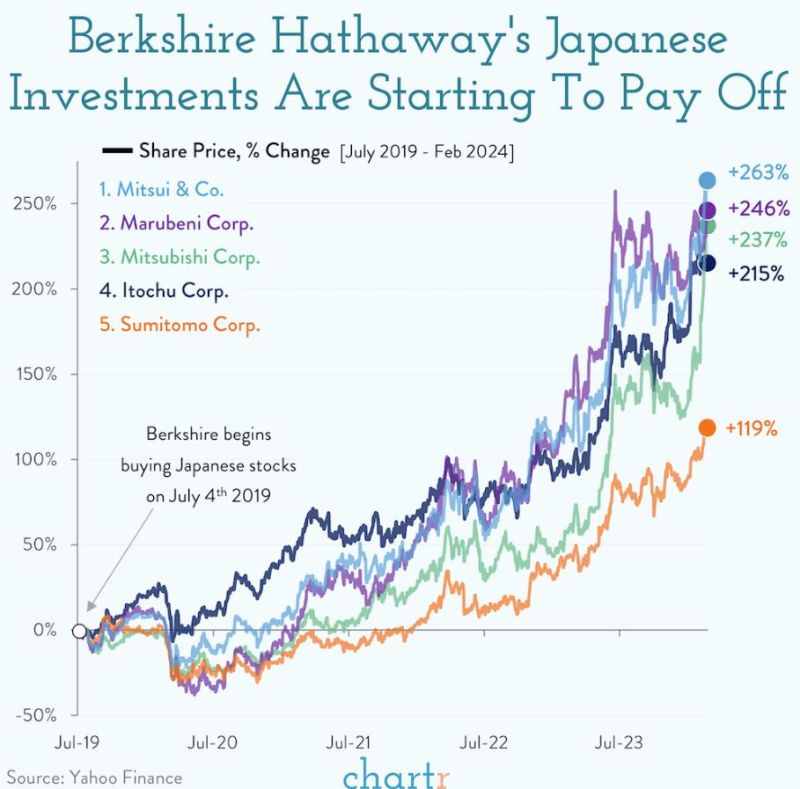

Berkshire Hathaway's Japanese Investment Are Starting To Pay Off

Source : chartr, yahoofinance

Investing with intelligence

Our latest research, commentary and market outlooks