Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

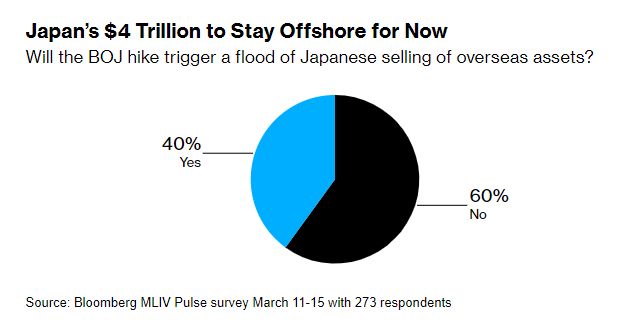

Japan’s $4 Trillion offshore funds will ignore first BOJ Hike - stocks and bonds in the US insulated from impact, survey shows

Japanese money is poised to stay offshore as the central bank creeps toward tighter policy, according to the latest Bloomberg Markets Live Pulse survey. Only about 40% of 273 respondents said the first interest-rate hike by the Bank of Japan since 2007 will prompt the nation’s investors to sell foreign assets and repatriate the proceeds back home. That’s good news for US stocks and bonds. Source: Bloomberg

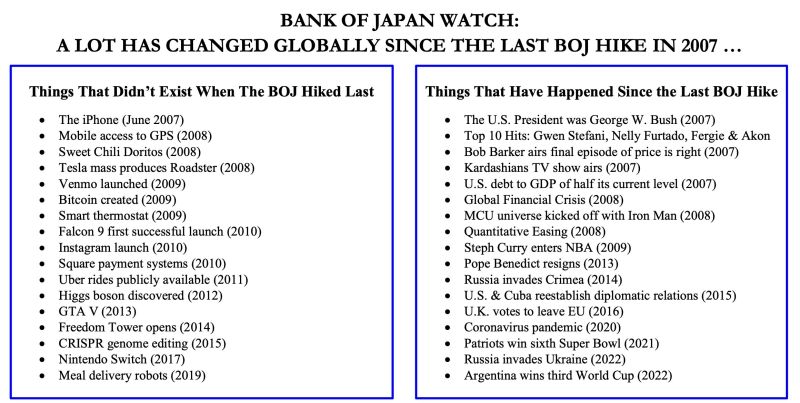

Bank of Japan is expected to end its negative interest rates this week

Marking 1st rate hike since February 2007 in a turning point for hashtag#BoJ's long-running monetary easing pol. A lot' has changed globally since last ³BoJ hike 17 years ago. SRP has a great overview... (through HolgerZ)

China kicks off the year on strong note as retail, industrial data tops expectations - CNBC

- Retail sales rose 5.5%, better than the 5.2% increase forecast in a Reuters’ poll, while industrial production increased 7%, compared with estimates of 5% growth. - Fixed asset investment rose by 4.2%, more than the forecast of 3.2%. - Online retail sales of physical goods rose by 14.4% from a year ago during the first two months of the year.

Nikkei reported BOJ conducted a gensaki (reverse repo with JGB collateral) operation Monday for the first time in about a month.

*Article cited broad upward pressures on rates amid heightening expectations of an imminent BOJ rate hike, leading traders to conclude the measure was meant to prepare for market reactions Source: C.Barraud https://lnkd.in/e8c8ubcx

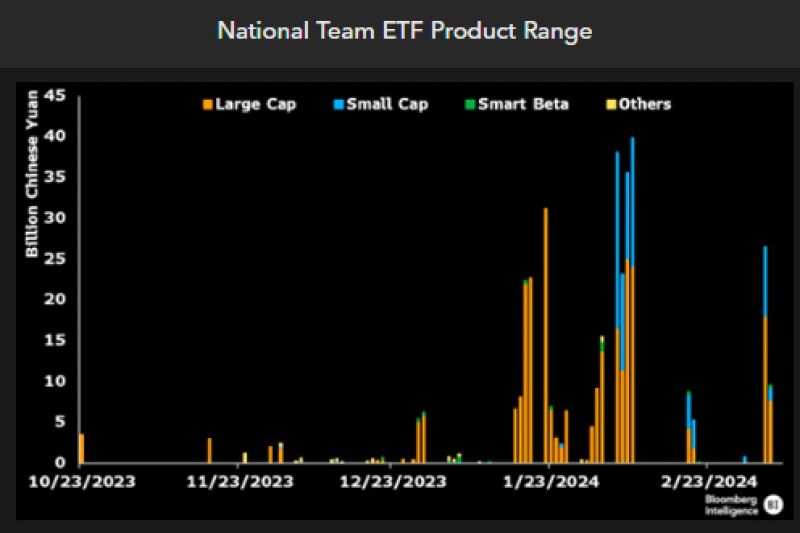

The Chinese government has gone "Full BoJ style", purchasing $45b of ETFs in the past 2 months to pump up market.

They already own like 1/5 of all equity ETFs. They moved to buying small caps because it moves stocks more. Purchases could reach $100b this year. Source: Bloomberg, Eric Balchunas

A great thread by The Kobeissi Letter ->

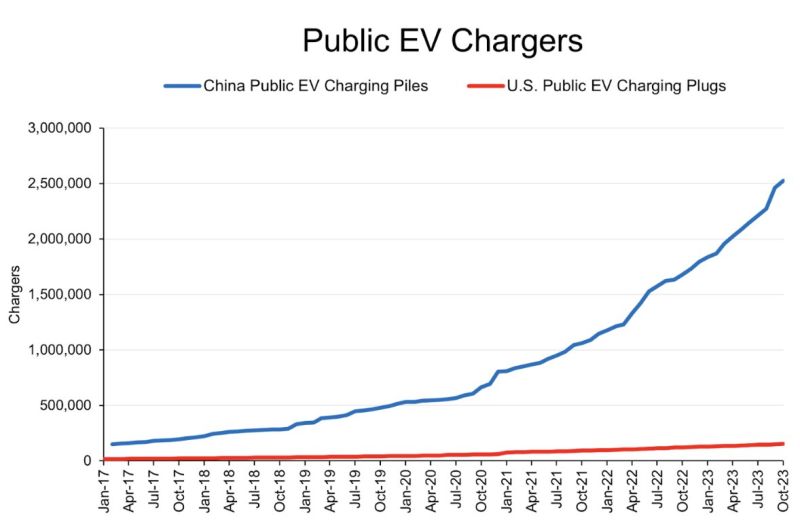

While everyone is focused on AI, China has taken electric vehicles (EVs) to a whole new level. China currently has 2.5 MILLION EV chargers compared to just 130,000 in the US. China has an EV charger for every 7 cars while the US has an EV charger for every 18 cars. Meanwhile, China's EV chargers provide 4 kilowatt per hour compared to 1 kilowatt per hours in the US. To put this into perspective, the energy difference is like powering 17 standard light bulbs in the US versus 67 bulbs in China. Is China the new leader of EV technology?

Japanese companies boost wages in departure from 'lost decades'

Japan's largest employers announced record pay increases on Wednesday. Every spring, unions and management hold talks, known as shunto, to set monthly wages ahead of the start of Japan's fiscal year in April. Toyota Motor, Hitachi and Panasonic Holdings were among the companies that on Wednesday fully met labor unions' demands to raise wages. Nippon Steel's response exceeded the union's demands, raising monthly wages by a record 35,000 yen ($237), or 14%. Toyota did not disclose details of its wage increases but said it fully met union demands. The Toyota Motor Workers' Union has demanded a record bonus payment worth 7.6 months of salary, citing the company's all-time high annual operating profit forecast of 4.5 trillion yen for the current fiscal year. The union has also proposed specific demands for each job category, up to a 28,440 yen monthly wage increase. Hitachi and Toshiba said their pay hikes are the largest since the current negotiation style was introduced in 1998. According to the Japan Council of Metalworkers' Unions (JCM), an alliance of unions in the manufacturing industry, 87.5% of member organizations had their demands either fully met or exceeded. source : nikkeiasia

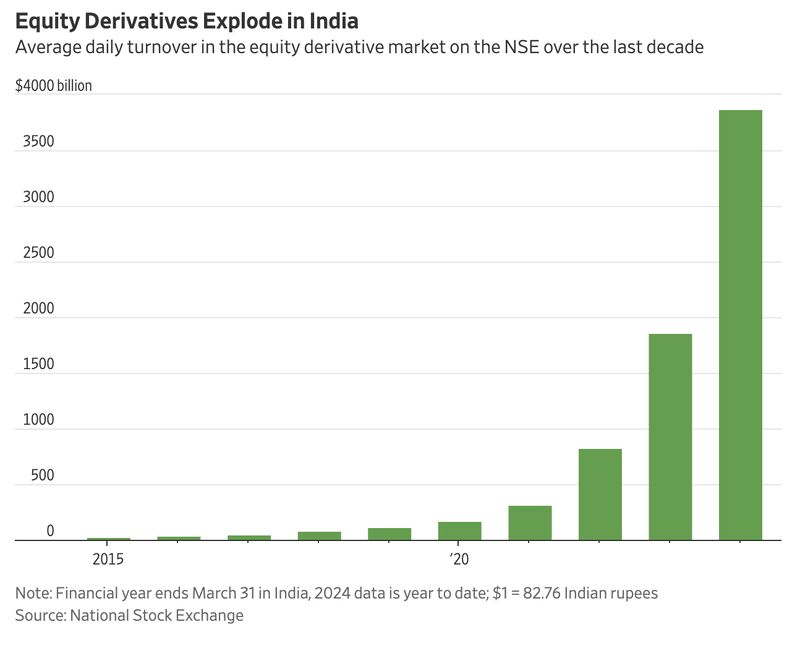

78% of equity options throughout the world were traded in India last year.

Look at this growth since the onset of Covid! Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks