Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China copper demand surge 📈

What is China going to do with all this copper? Source: CEO Technician

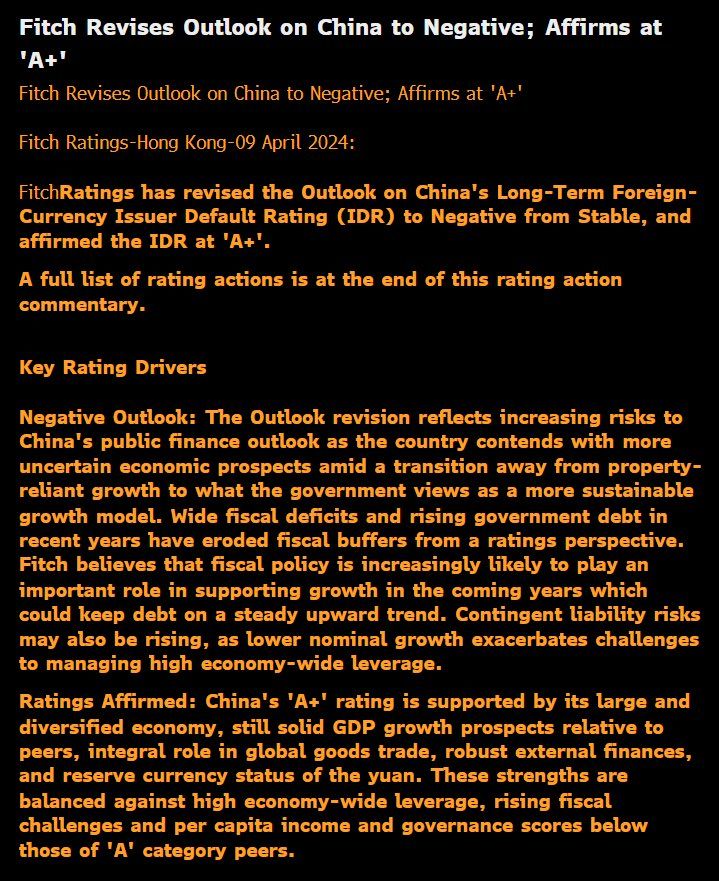

Breaking News: Fitch revises outlook on china to negative

Source: Bloomberg, David Ingles

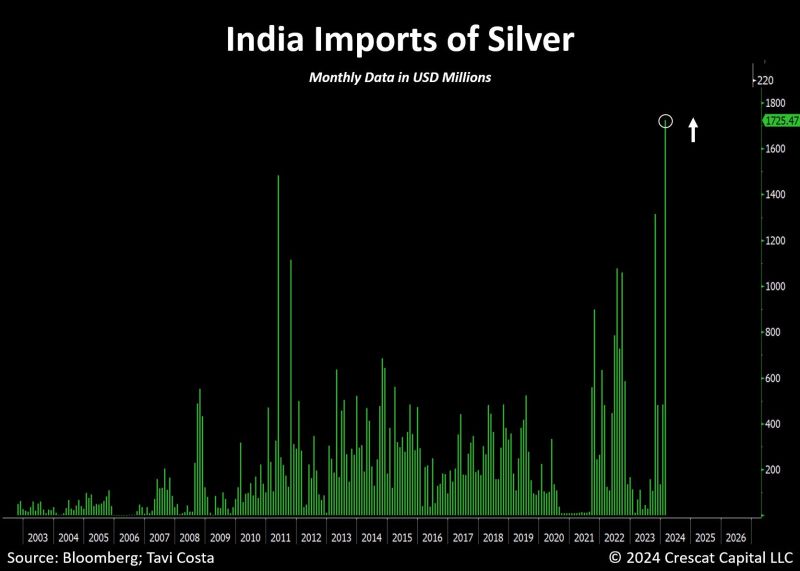

India just reported record monthly imports of silver.

Source: Tavi Costa, Bloomberg

The Imminent Inclusion of Indian Sovereign Bonds in EM Bond Indices is Attracting Huge Foreign Inflows👇

Source: Neha Sahni, JP Morgan

China and Hong Kong stocks lost nearly $5 trillion in 3 years — more than India’s market cap

Stocks in China and Hong Kong sold off a massive $4.8 trillion in market capitalization since 2021, which according to HSBC, is more than the value of the Indian stock market. Indian stocks have rallied amid broader optimism about the country’s growth. Despite a subdued global IPO market, research from EY showed Indian stock exchanges also had the most IPOs in 2023. https://lnkd.in/eFCFMe2s Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks