Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

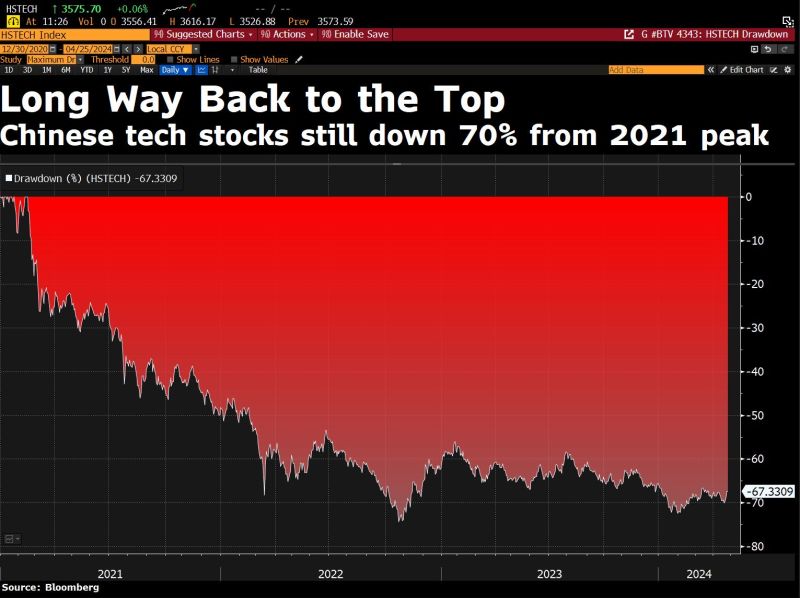

China stocks: still a long way to come back to the top...

Source: Bloomberg

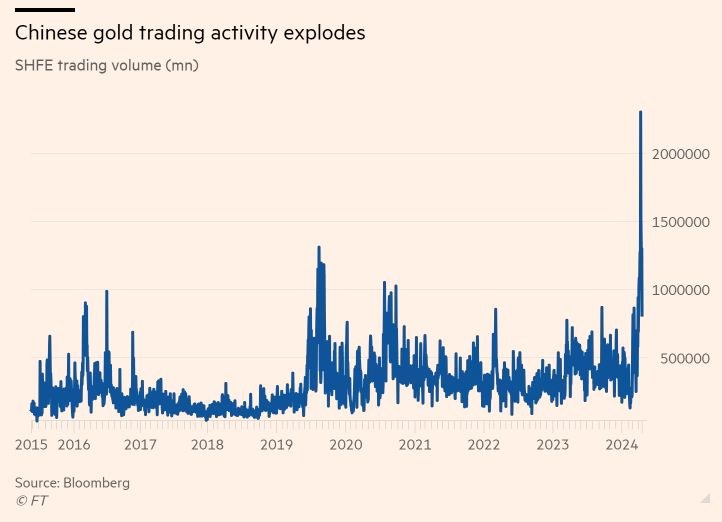

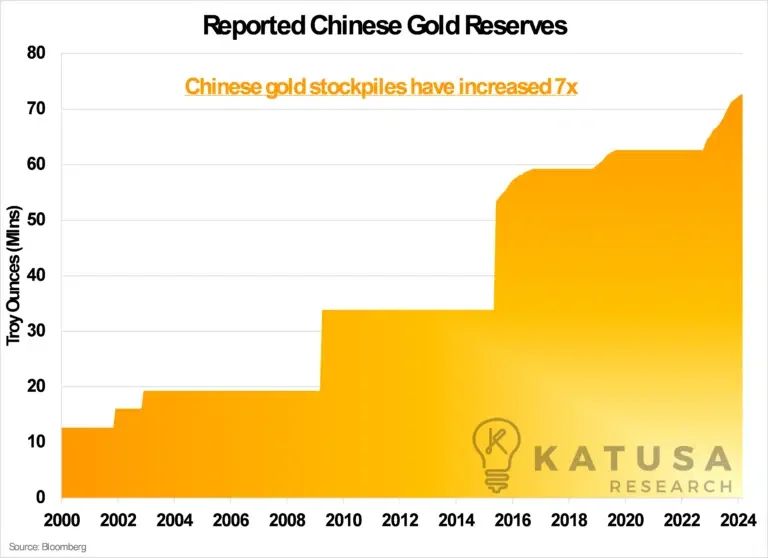

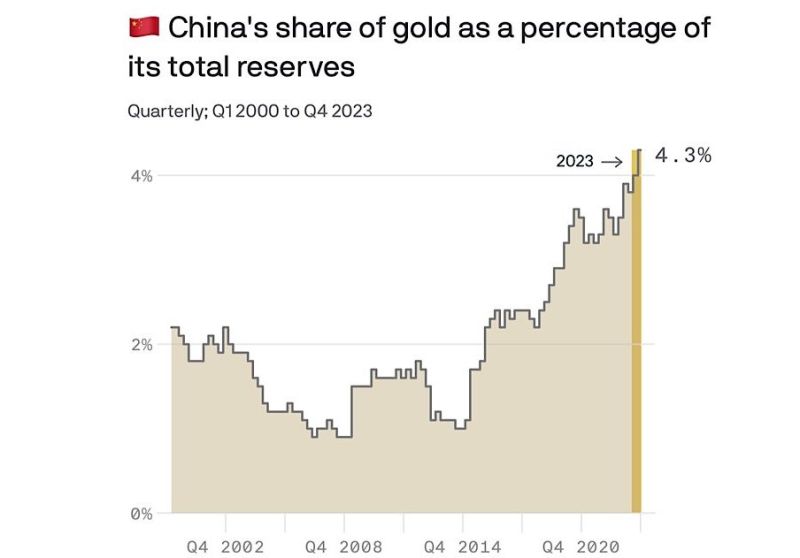

China has quietly accumulated large quantities of gold for 17 straight months – to the tune of 72.7 MILLION ounces (about 2,250 tonnes).

Despite its rise as an economic power, China’s vast reserves are predominantly in USD, an exposure it aims to minimize. To reduce this reliance, the People’s Bank of China is diversifying by increasing its gold holdings. Since 2011, China has decreased its dollar reserves by a third, down to approximately $800 billion. Meanwhile, China’s gold reserves have skyrocketed. China’s economic strategy involves diversifying away from the US dollar, which dominates global trade and commodity pricing. Source: Katusa Research

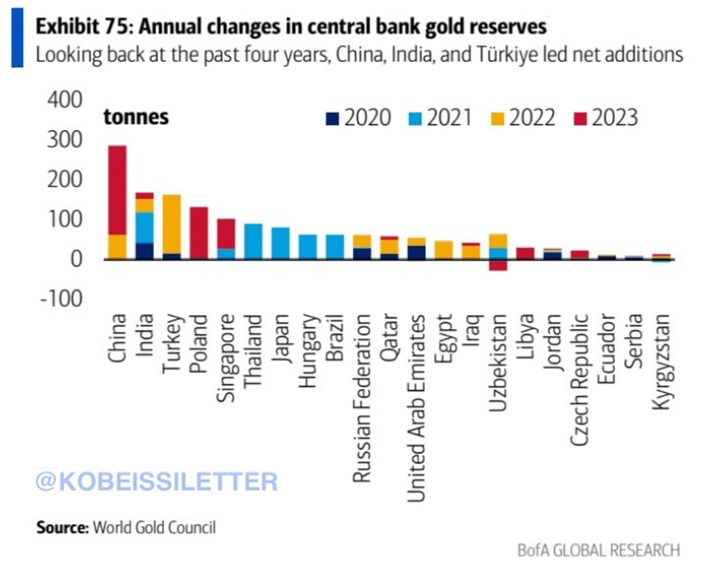

Central banks are STOCKING UP on gold:

Since 2022, China has bought a record ~290 tonnes of gold. Last year alone, China acquired more than 225 tonnes of the metal. China's central bank increased its gold holdings for 17 straight months. In 2022 and 2023, world central banks bought 1081 and 1037 tonnes of gold, respectively. Prior to 2022, there was never a year in history with 1,000+ tonnes of central bank gold purchases. Source: The Kobeissi Letter, BofA

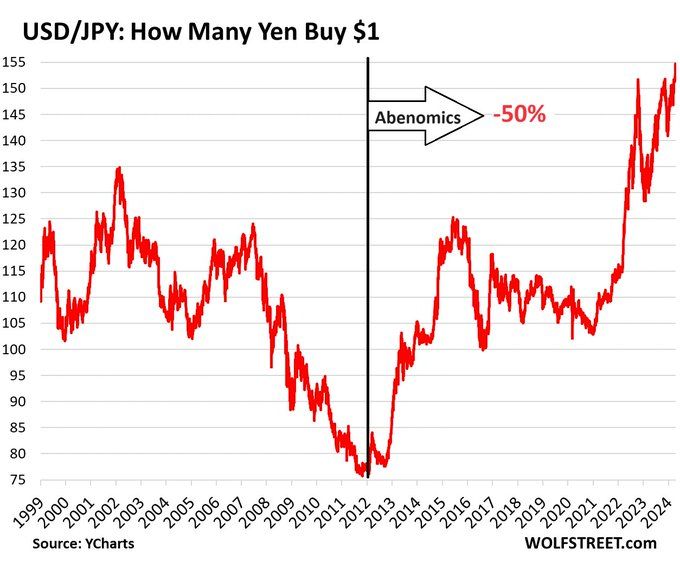

The YEN is COLLAPSING and Abenomics has taught us some lessons:

After years of money printing, Yen now trades to 155 against USD: -32% against USD since 2021, -50% since 2012 The Bank of Japan has been buying over half of the national debt with freshly created yen, plus a bunch of other securities. But there is a price to pay after all: the destruction of the currency: Source Wolfstreet

China’s economy in the first quarter grew faster than expected, official data released Tuesday by China’s National Bureau of Statistics showed.

Gross domestic product in the January to March period grew 5.3% compared to a year ago, faster than the 4.6% growth expected by economists polled by Reuters, and compared to the 5.2% expansion in the fourth quarter of 2023. On a quarter-on-quarter basis, China’s GDP grew 1.6% in the first quarter, compared to a Reuters poll expectations of 1.4% and a revised fourth quarter expansion of 1.2%. Beijing has set a 2024 growth target of around 5%. https://lnkd.in/eNZgs7zp Source: CNBC

The "East-West divide" in one cartoon.

China is dumping their US Treasury debt and buying hard assets. Many other countries around the world are doing the same. Source: WallStreetSilver

Investing with intelligence

Our latest research, commentary and market outlooks