Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Wall Street is turning less negative on China stocks

Source: Daily Compounding

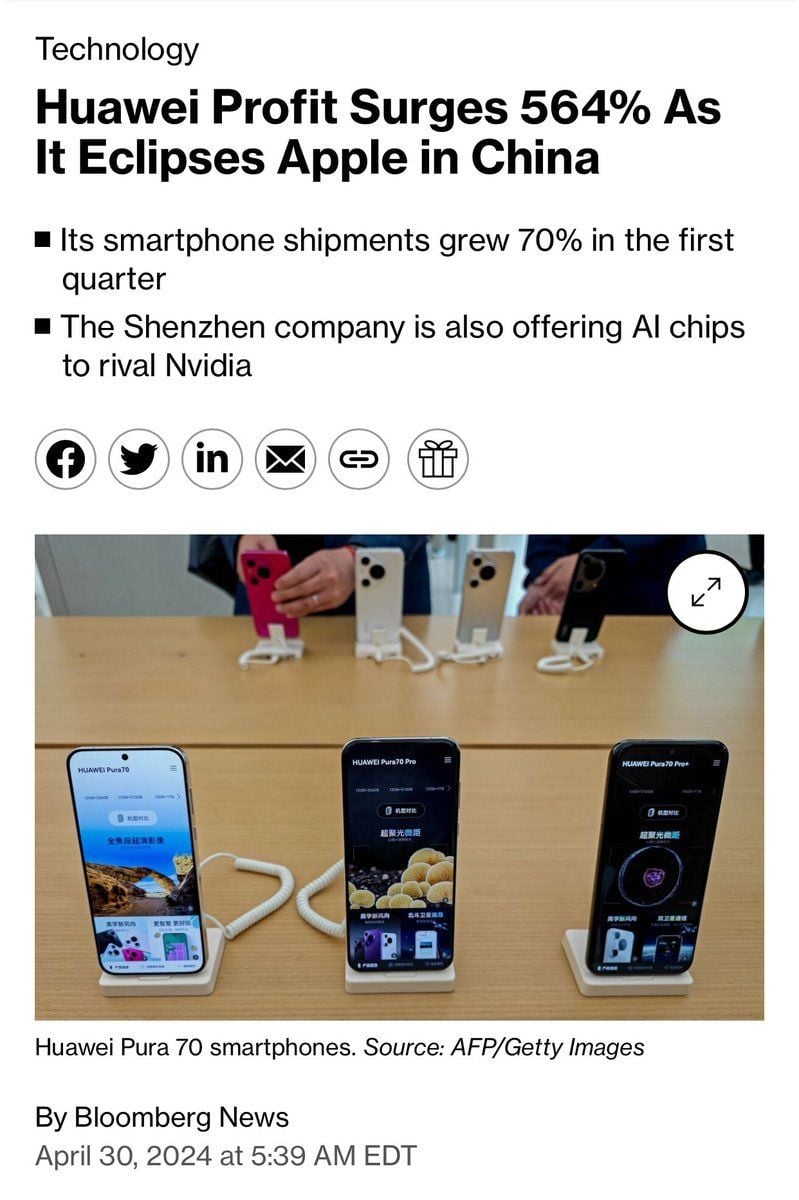

Meanwhile in China...

What if China starts doing to US "tech champions" what China did to US Rust Belt "industrial champions", US unions, & the US working class 2001-10? Source: Bloomberg / Luke Gromen

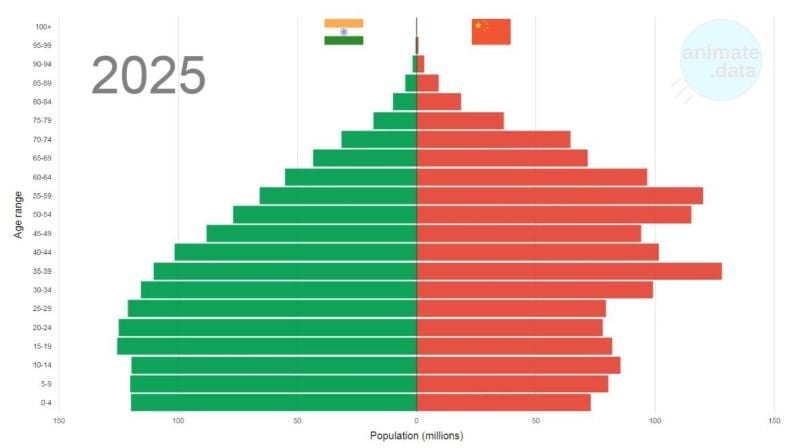

Demographics of two Asian heavyweights. Which country would you like to invest?

Source: Michel A.Arouet

Hong Kong growth beat estimates by the most in 13 years in the first quarter.

Source: David Ingles, Bloomberg

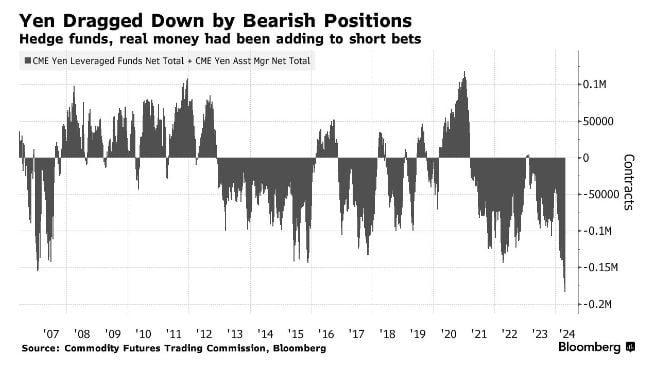

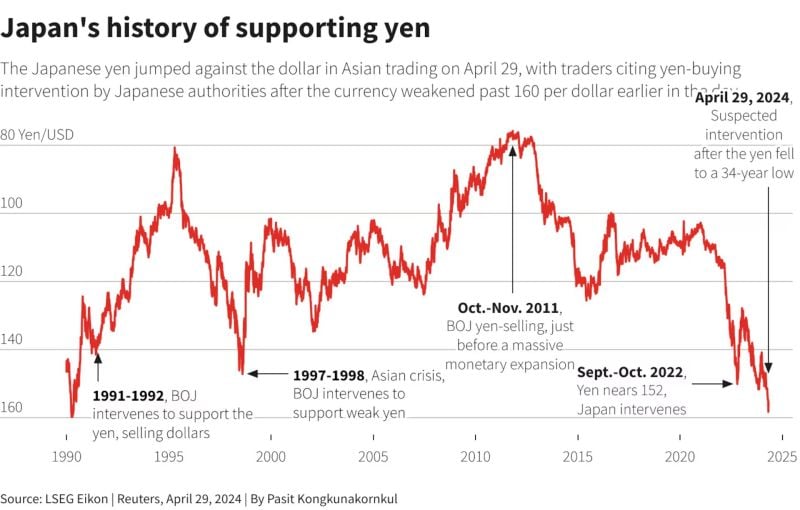

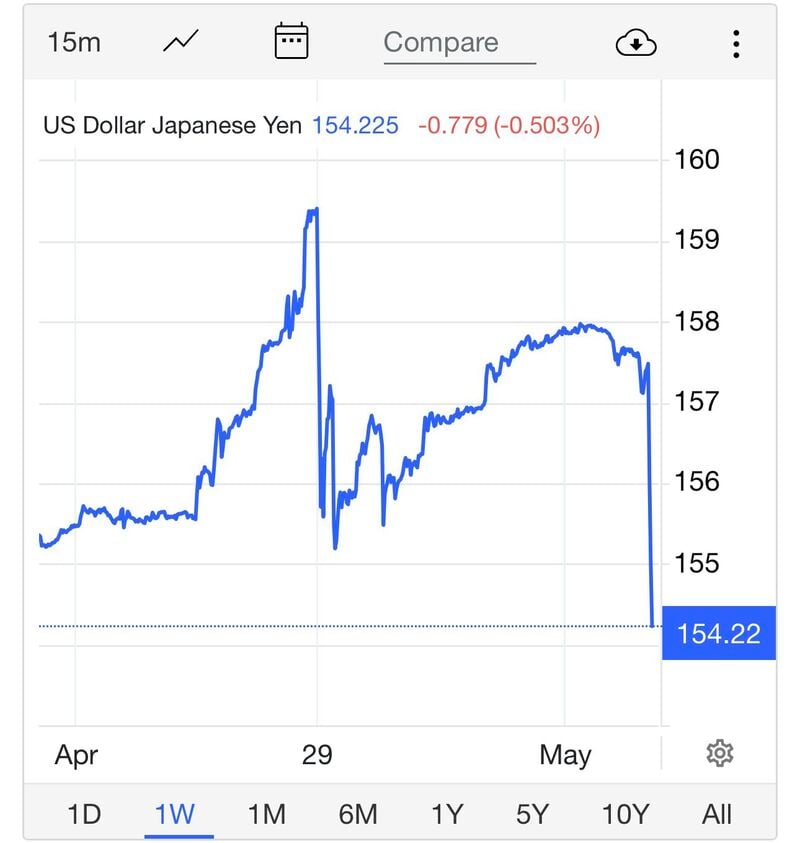

It's clear, Japan is intervening to support the Yen:

Twice this week, we saw the Yen fall to its weakest point against the US Dollar since 1990. This was the first time in 34 years that 1 US Dollar converted to 160 Yen. Immediately after the Yen neared 160 twice this week, we saw a steep drop in the conversion rate, strengthening the Yen. The BOJ reported Tuesday that its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD. This was clearly due to intervention equating to 5.5 trillion Yen, which we last saw in 2022 and 2011. The third largest currency in the world is in trouble. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks