Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

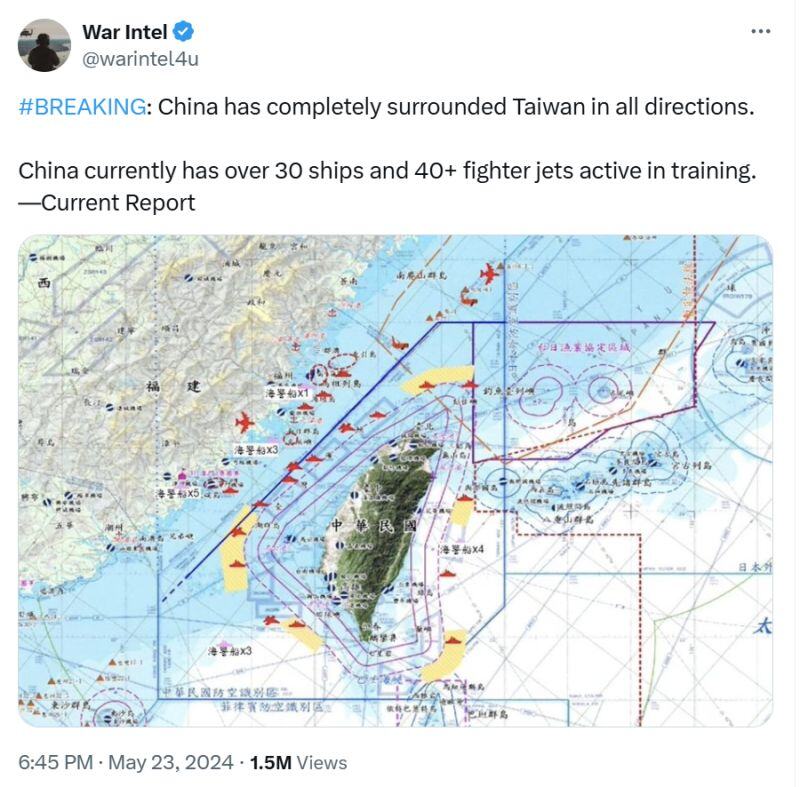

BREAKING 🚨: China

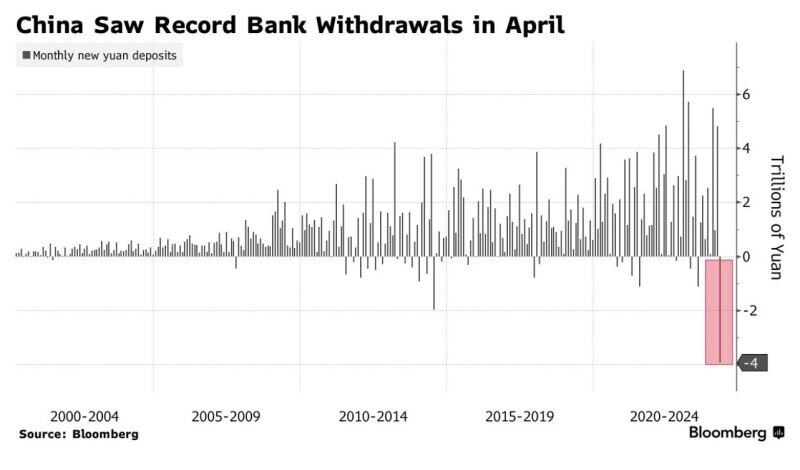

China sees largest bank withdrawals in history last month of just under 4 trillion yuan Source: Bloomberg, Barchart

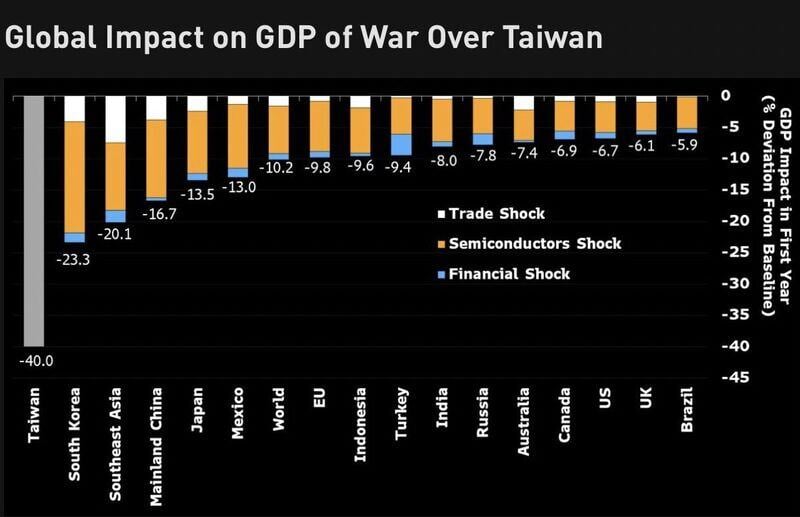

A scary chart... the global impact on GDP of a war in Taiwan...

Source: Bloomberg, Michel A.Arouet

Solar stocks are rallying, with a boost from China.

China's Solar Industry Group calls on members to crack down on low-price competition to stop a price war. Invesco Solar ETF (TAN) jumped almost 9%. Source: HolgerZ, Bloomberg

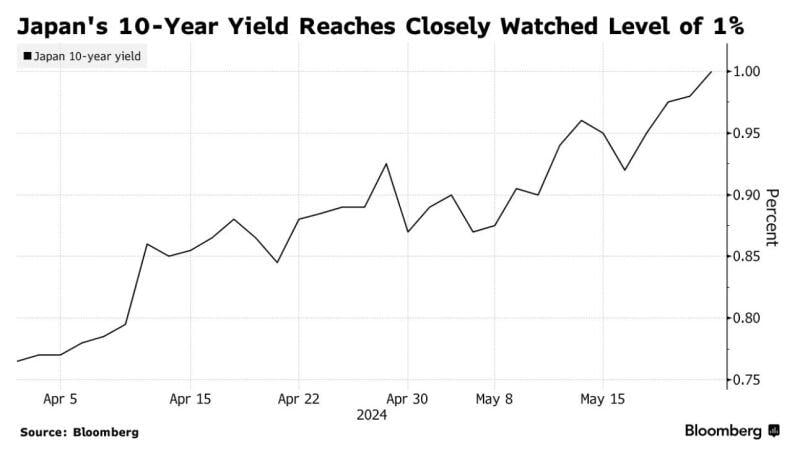

Japan's 10-Year Bond Yield hits 1% for the first time in more than a decade

Source: Barchart

China may well be the world leader for de-risking trade ties

• Chinese firms have been developing ties with emerging markets over past ten years • This reduces China's reliance on unfriendly markets (🇺🇸🇪🇺), shielding Beijing from geopolitical tensions Source: FT, Agathe Demarais

China now settles half of its crossborder trade in renminbi, up from zero in 2010

• Rise in RMB use highlights sanctions-proofing strategy of Beijing and its allies, such as Russia • China's promotion of CIPS, its homegrown alternative to Swift, may support rise in RMB use Source: Agathe Demarais

🚀 Chart of the Week: Japan's Yield Curve is Steepening Again! 📈

Big moves in the Japanese bond market! The Japanese yield curve, which tracks the difference between 2-year and 10-year yields, has dramatically steepened since late March and surged even more in May. It's now at 63 bps, a level we haven't seen since January! 📊 10-year and 30-year Japanese yields are hitting decade highs, approaching 1% and surpassing 2%, respectively. As the Yen weakens, the Bank of Japan stepped in to support the JPY and recently cut its bond-buying program for the first time this year. What’s next? The BOJ might sell off its US Treasuries holdings, potentially driving US Treasury yields up in the coming months. Higher Japanese yields also mean US Treasuries are less attractive to Japanese investors, who are key players in the US market. Last summer, a sharp steepening of the Japanese yield curve coincided with a major sell-off in US Treasuries...🤔 #Finance #Investing #Bonds #JapaneseEconomy #GlobalMarkets #Economics #Investors #FinancialMarkets #BankofJapan #USTreasuries Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks