Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

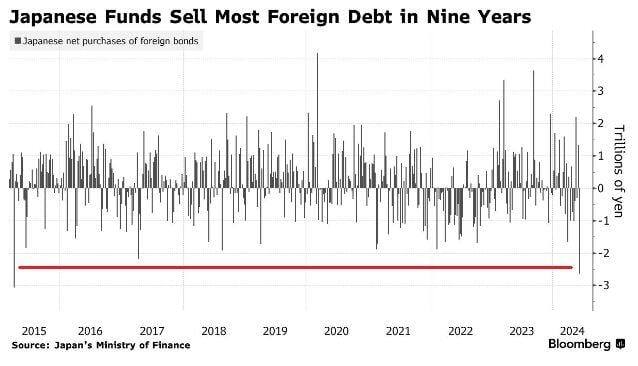

japan just sold $17 billion worth of Foreign Debt, the largest sale in 9 years...

Source: Bloomberg, Barchart

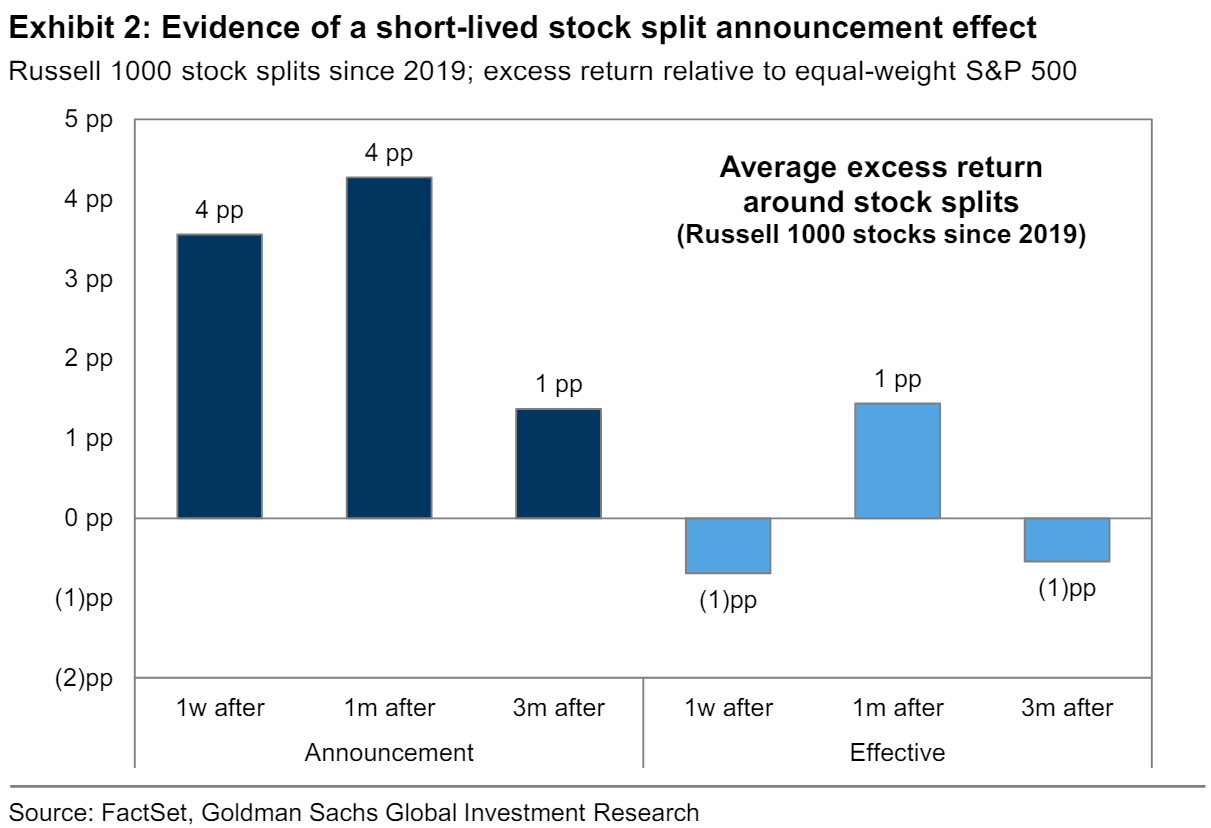

Goldman Sachs on the mixed impact of corporate stock splits

“Share prices typically rise after a firm announces a stock split. In theory, there is no change in the underlying value of a company when it splits its stock. However, empirically, the academic literature has generally found positive announcement effects around stock splits. We consider a sample of 46 Russell 1000 firms that completed stock splits since 2019. On average, these stocks generated a 4 pp excess return vs. the equal-weight S&P 500 in the week following stock split announcement. However, the stock price did not evidence a clear reaction after the stock split took effect. In addition, because many companies announce stock splits alongside earnings releases, it can be challenging to know how much of the stock rallies are due to the stock split as opposed to strong earnings results”. Source: Goldman Sachs

Goldman and Bank of America expect another bounce as July Communist Party meeting seen including more support measures.

Source: South China Morning Post

BREAKING: SPOT GOLD PRICE TUMBLED BY $20 PER OUNCE AS CHINA'S PBOC STOPPED GOLD RESERVES BUILDING.

China's end-May forex reserves are $3.2320 trillion, higher than the previous $3.2008tln. Gold reserves were unchanged at 72.80 million ounces, and the value of gold reserves was $170.9bln vs the previous $167.9 bln as gold price increased in May. Source: CN Wire

Ray Dalio says benefits of investing in China outweigh risks

Source: South China Morning Post

India’s stock markets erase $371 billion after ruling BJP falls short of election expectations

India’s markets saw their largest one-day loss in four years after the electoral performance of Prime Minister Narendra Modi’s ruling Bharatiya Janata Party fell short of expectations. The All India Market Capitalization index, tracked on the Bombay Stock index, dropped over $371 billion on June 4 alone. The losses on Tuesday meant the Sensex index erased all its gains this year in a single day, going from a 5.85% year-to-date gain on Monday to a 0.22% loss position. Source: CNBC https://lnkd.in/df_9zjkZ

Japan owns $1.2 trillion of US Treasuries.

As Japanese yields rise, the domestic market will attract dollars away from US debt. "Rising long-term interest rates in Japan put upward pressure on long-term US Treasury yields:" Apollo's Torsten Slok Source: Bloomberg, Lisa Abramowitz

Investing with intelligence

Our latest research, commentary and market outlooks