Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

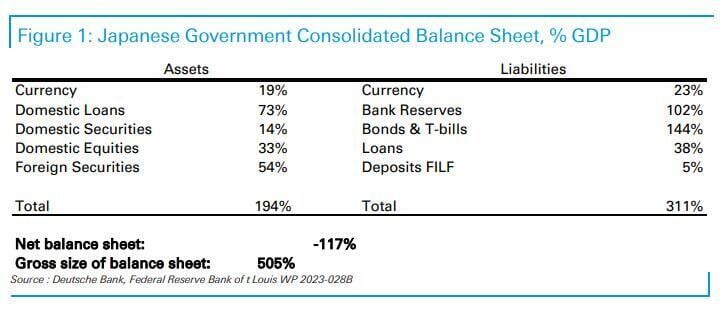

Deutsche Bank: "Why the BOJ has no choice and is merely prolonging the inevitable*

"at a gross balance sheet value of around 500% GDP or $20 trillion, the Japanese government's balance sheet is, simply put, one giant carry trade."

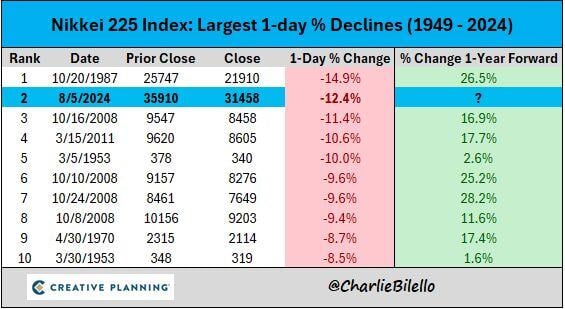

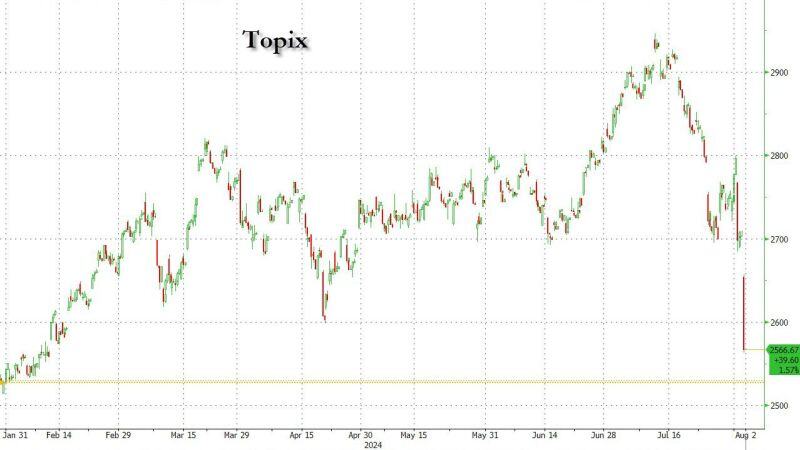

Japan Equities Crash, how significant?

Nikkei 225 lost 20% or more within a 3-week period? 1. 1990: -21%, (February 14 - March 7), asset price bubble plunge in Japan. 2. 2008: -23%, (September 26 - October 16) post the Lehman collapse. 3. 2013: -21%, (May 22 - June 13), economic stimulus panic. 4. 2020: -23%, (February 21 - March 13), the COVID pandemic panic of 2020. Source: Lawrence McDonald, Bloomberg

Almost all Japanese stock gains for 2024 wiped out in 3 days...

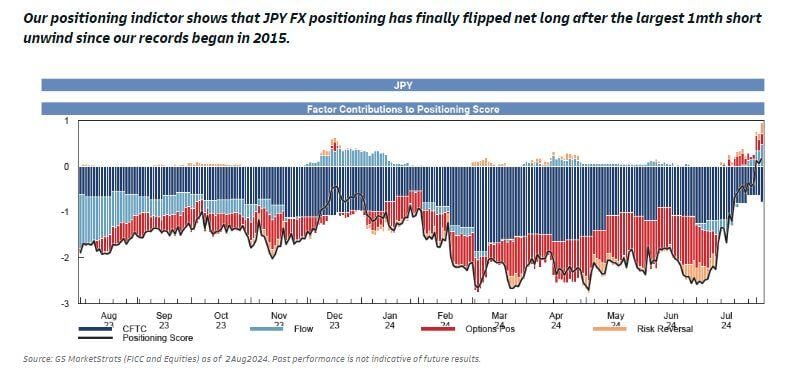

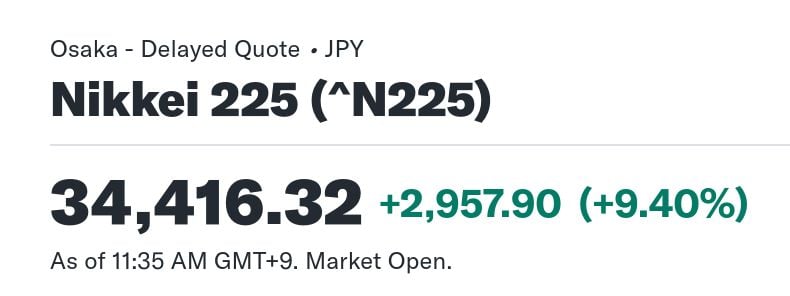

Today was an absolute chaos in Japan as stocks plummeted more than 6%, the largest decline in 8 years, and experienced 2 circuit breakers during the session... What will the BOJ save first? The Yen, Japanese stocks or the JGBs (of which they already own 50%)? Source: www.zerohedge.com

India is set to welcome billions of dollars of foreign inflows when JPMorgan adds the country’s sovereign debt to its emerging markets index on Friday

A move that some analysts say will leave it more vulnerable to fickle flows of hot money. The inclusion of India marks the first time the bonds of the world’s fastest-growing large economy have been included in a major benchmark and is the latest move to open up a once closed-off market. It was only in 2020 that India removed foreign ownership restrictions on some rupee-denominated debt. The inclusion of 28 government bonds worth more than $400bn will give India a 10 per cent share of the widely tracked measure, according to JPMorgan. About $11bn has flowed into Indian bonds as investors position themselves ahead of the formal inclusion, according to Goldman Sachs. The bank expects a further $30bn to arrive as the bonds are gradually incorporated into the index over the next 10 months, raising foreign ownership from around 2 per cent to about 5 per cent. Source: FT Link to the article >>>

Investing with intelligence

Our latest research, commentary and market outlooks