Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

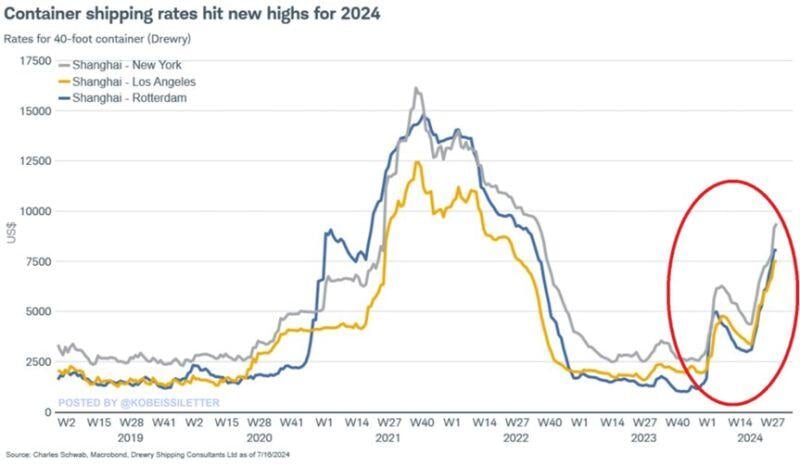

BREAKING: Container shipping costs from China have spiked to their highest levels since 2022

Since the beginning of 2024, shipping rates have more than TRIPLED. It now costs ~$9,000 to ship a 40-foot container from Shanghai to New York and ~$8,000 to Los Angeles. This has been driven by a sharp drop in Suez Canal transit volume, disruptions at some ports in Asia, and demand increase due to inventory restocking. Rising shipping costs should be considered as an upside risk to inflation. Source: The Kobeissi Letter

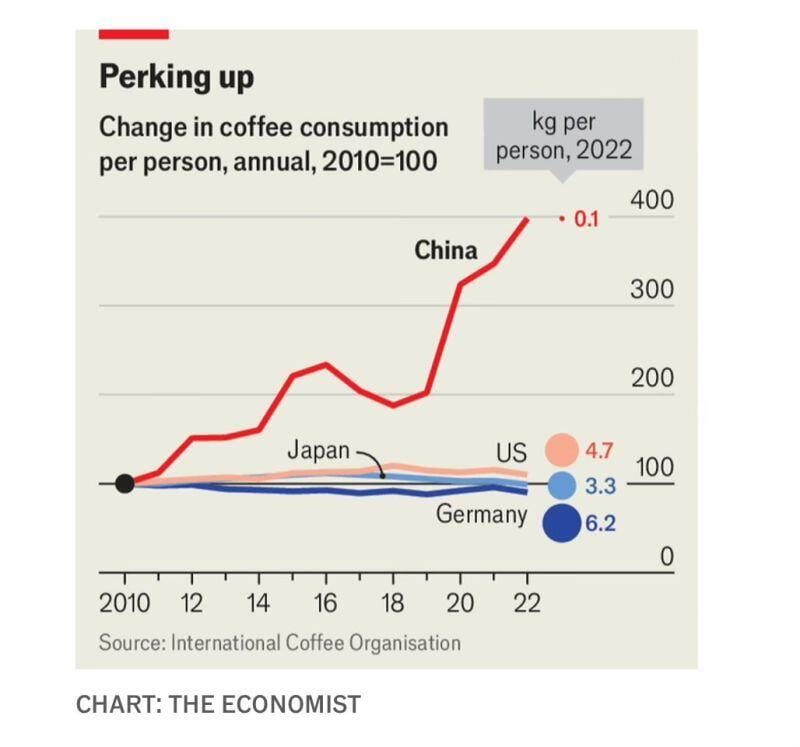

China’s rise in coffee consumption

Bullish cocoa ? Source: Eugene Ng, The Economist

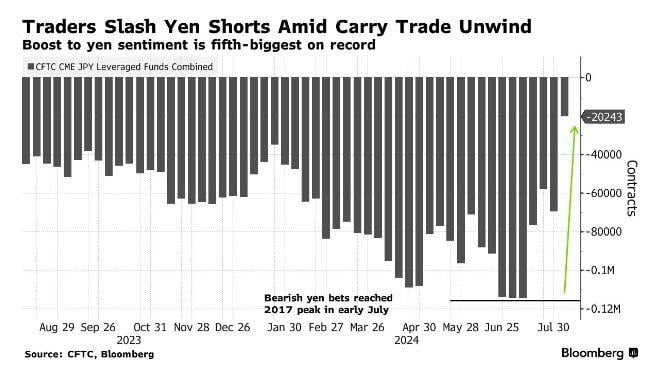

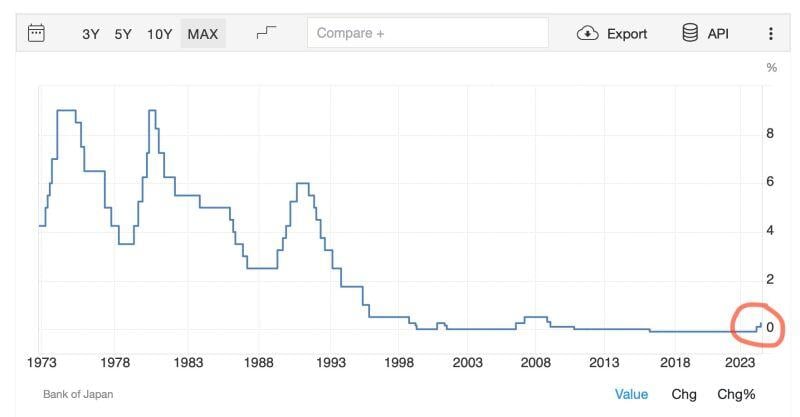

This is what triggered a global-scale sell-off of every major asset class...

A harsh remainder how shaky the global financial system is... Source: Bank of Japan, Sina 21st Capital on X

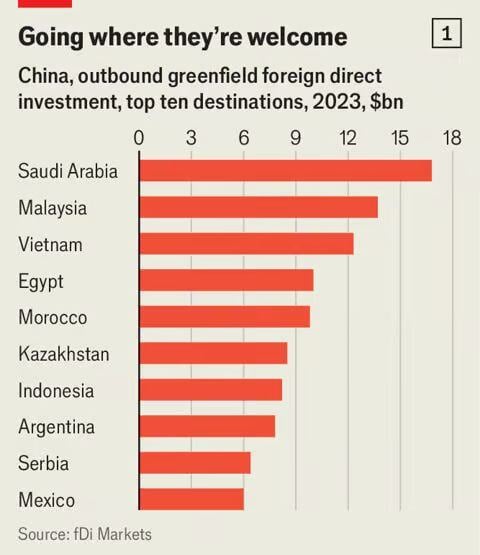

Chinese firms are fast turning away from US and Europe for greenfield FDI

• China is de-risking, too, by reducing reliance on western markets for trade and investment • In countries 👇 imports from China of intermediate goods used in manufacturing have tripled since 2013 Source: Agathe Demarais, The Economist

The Japanese Yen Carry Trade unwinding is only 50% complete warns JP Morgan

Source: Win Smart

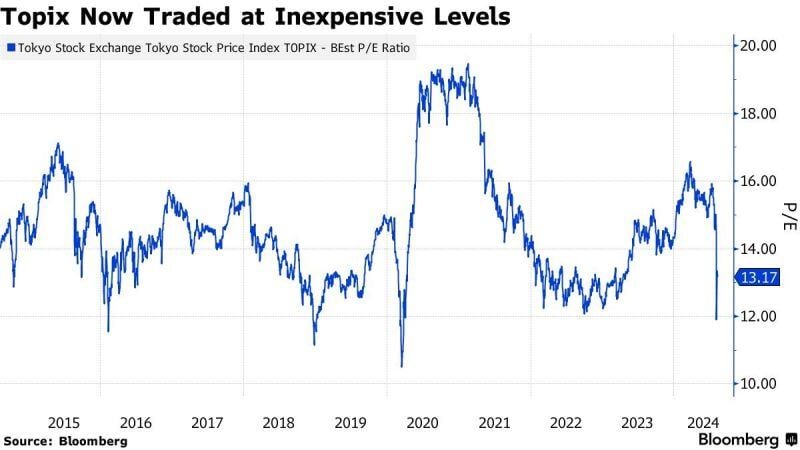

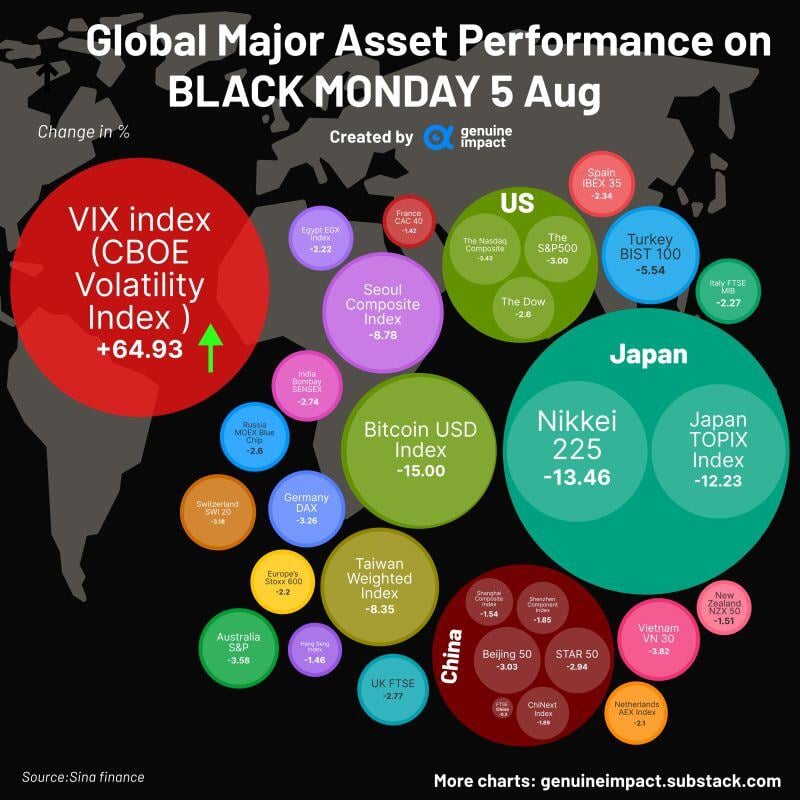

A historical market session summarized in one chart

Japan’s stock market posted its worst drop since Wall Street’s Black Monday in 1987, contributing to fears of global turmoil in the markets. Concerns about a slowing U.S. economy and the unwinding of the global yen "carrytrade" are battering stocks. Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks