Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

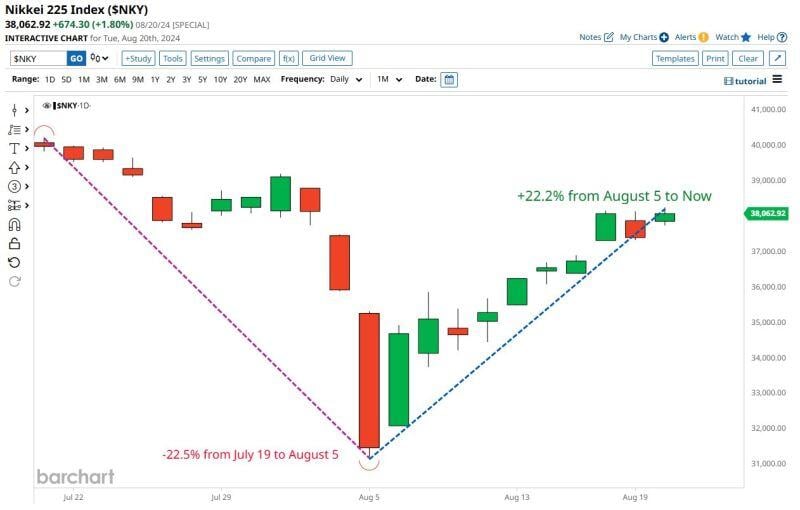

Japanese Stocks have both fallen and risen more than 20% in the last month

Source: barchart

China names healthcare, education, tech as likely venues for more foreign investment

Source: South China Morning Post

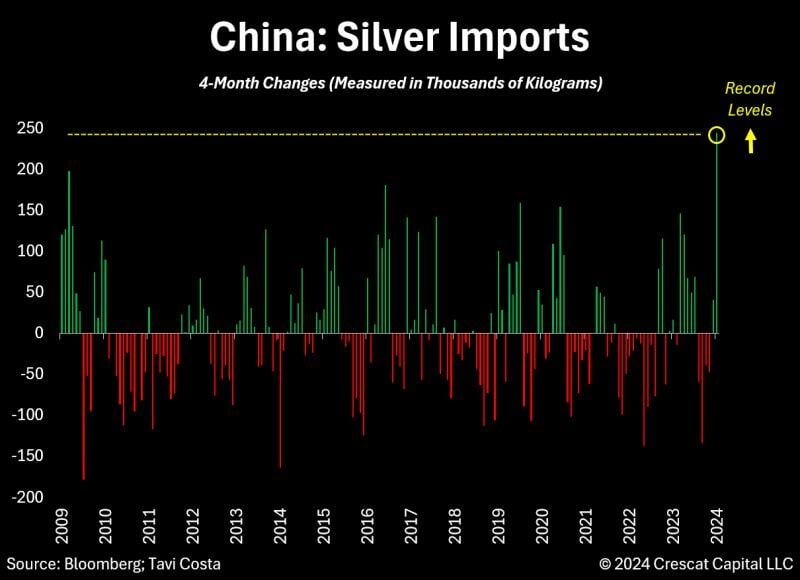

China reported record levels of silver imports.

Source; Tavi Costa, Crescat Capital, Bloomberg

BREAKING: China

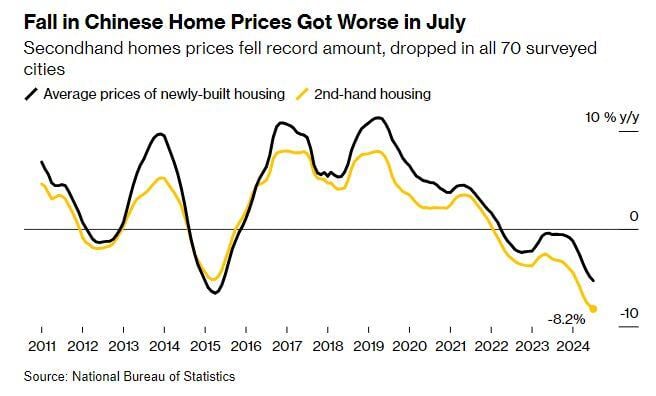

Chinese Home Prices declined by the largest amount in history last month Source: Barchart

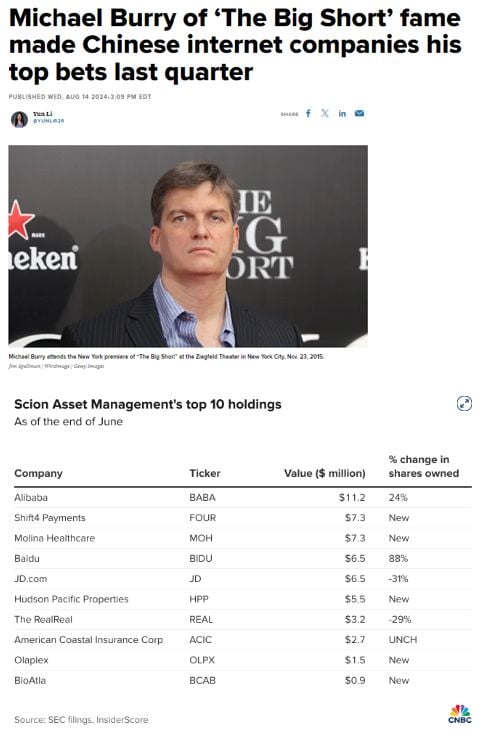

Michael Burry has made Chinese Internet Stocks his biggest holdings

His #1 holding is Alibaba which was worth $11.2 million at the end of the last quarter. Source: Barchart, CNBC

The scariest China chart

Source: TS Lombard, Bloomberg, Win Smart

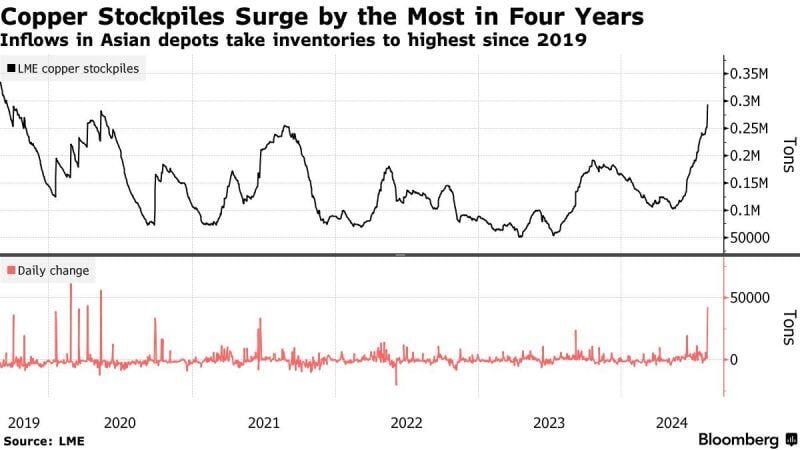

Copper Inventories have jumped to the highest level in more than 4 years signaling weak demand in Asia!

Source: Bloomberg, Barchart

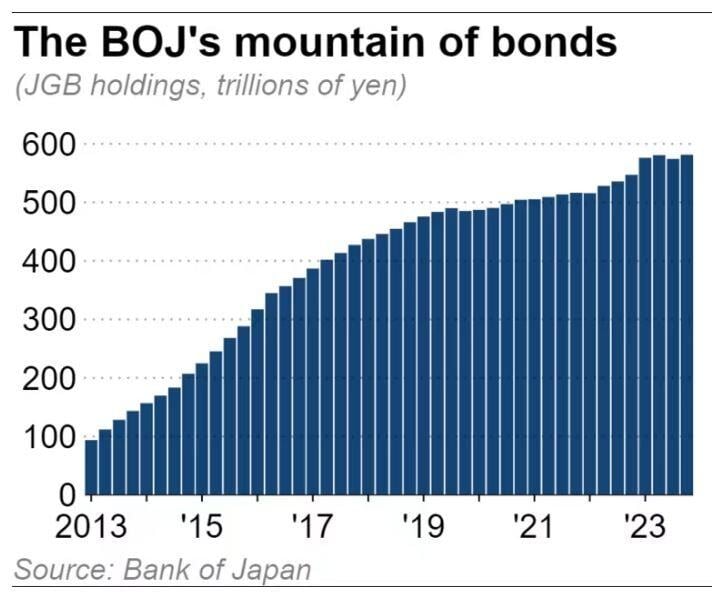

Bank of Japan owns ~80% of the country's ETFs and 7% of the entire Japanese stock market, according to Morningstar and the Tokyo Stock Exchange data.

Moreover, the BoJ holds ~55% of the Japanese government bonds. Huge distortions 👇 Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks