Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

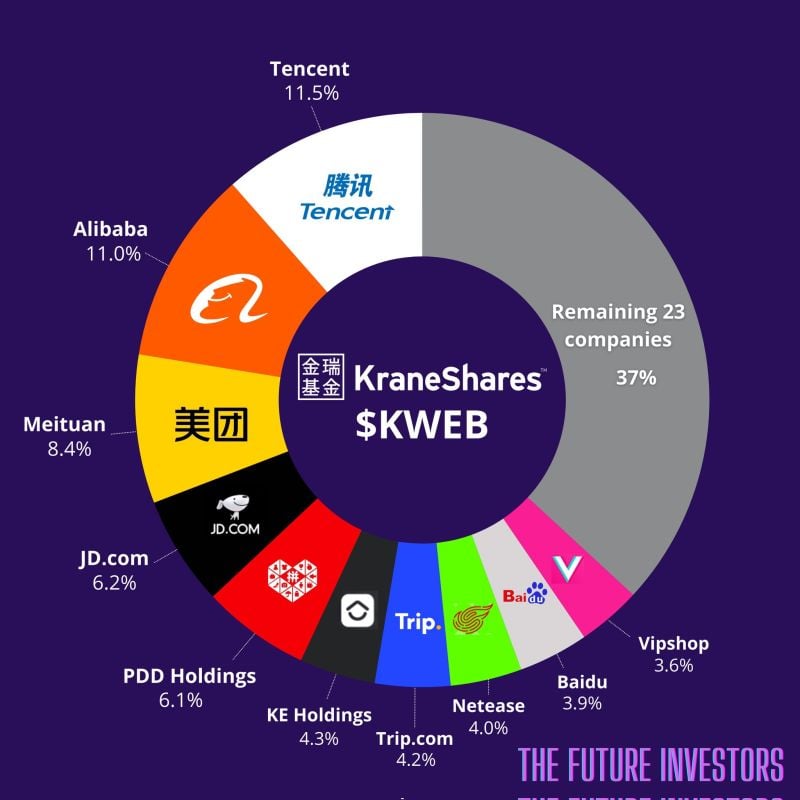

Many investors consider the KraneShares CSI China Internet ETF $KWEB as the best instrument to get exposed to China.

Here is the breakdown of this ETF. Do you invest in China?

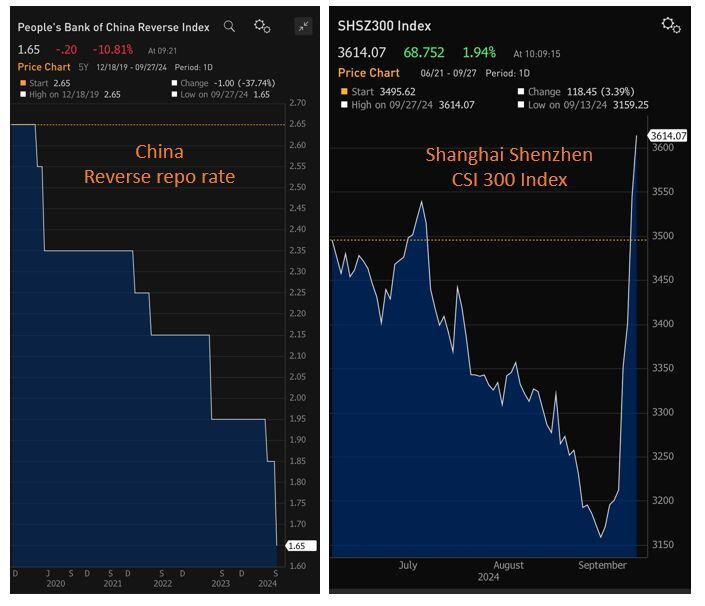

China keeps giving. Another rate cut today >>>

*PBOC CUTS 14-DAY REVERSE REPO RATE TO 1.65% FROM 1.85% Meanwhile, Chinese stocks going vertical Source: Bloomberg, David Ingles

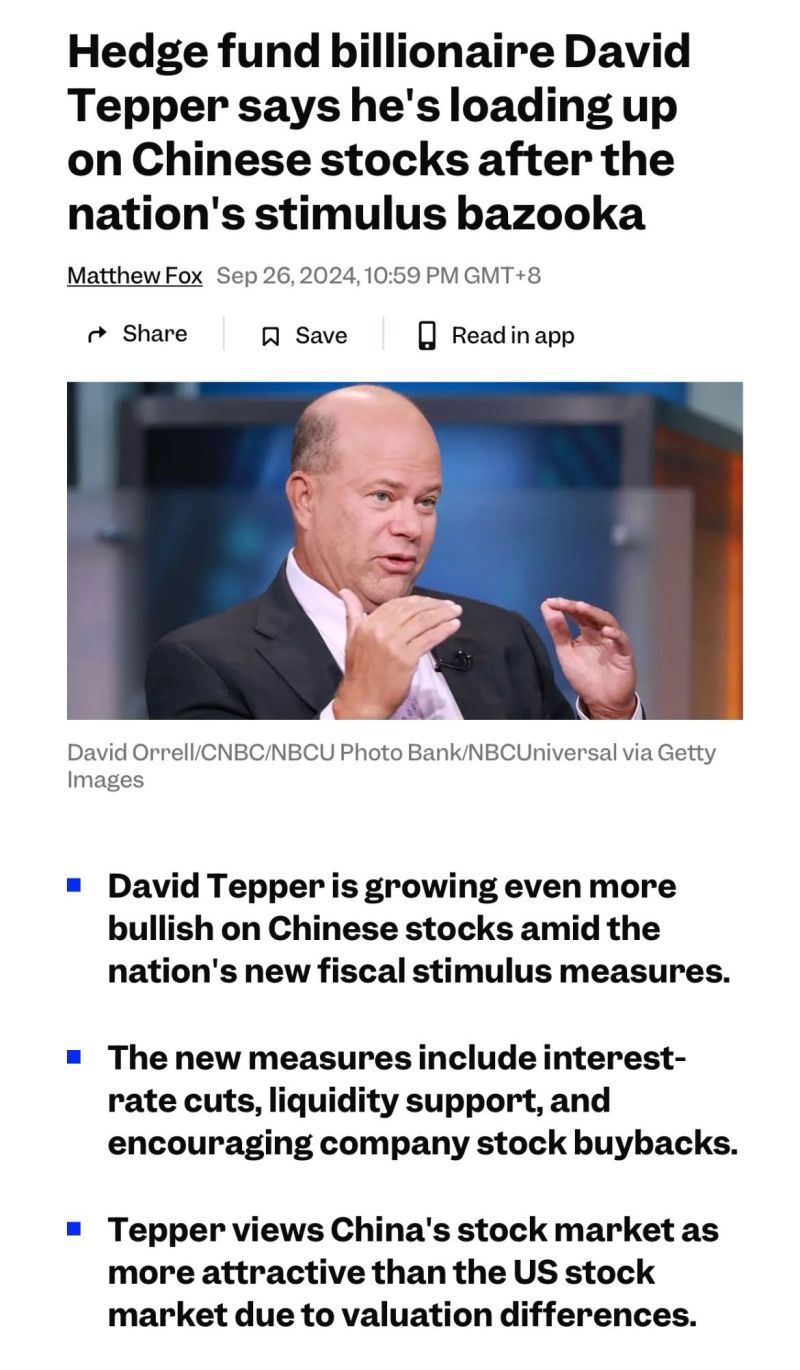

David Tepper, who runs the $6 billion hedge fund Appaloosa Management, is growing even more bullish on Chinese stocks amid the nation's new fiscal stimulus measures.

Tepper views China's stock market as more attractive than the US stock market due to valuation differences. Source: Markets Insider

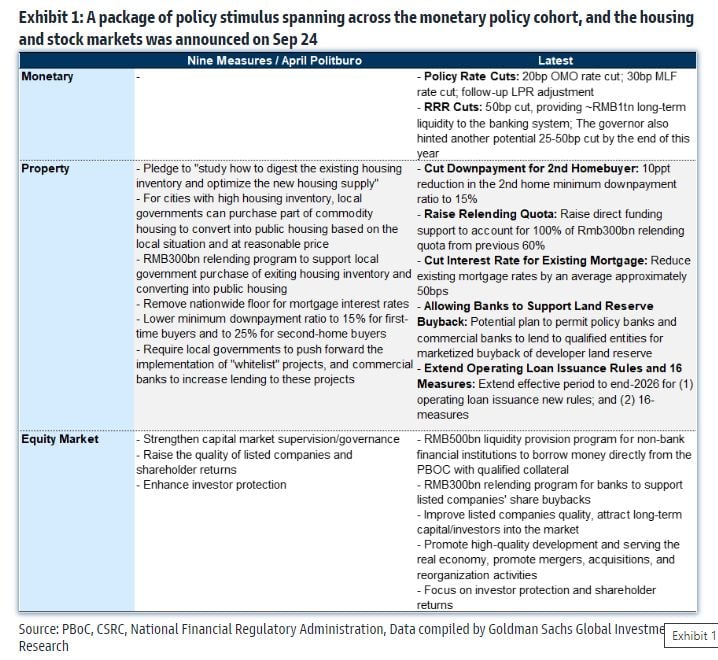

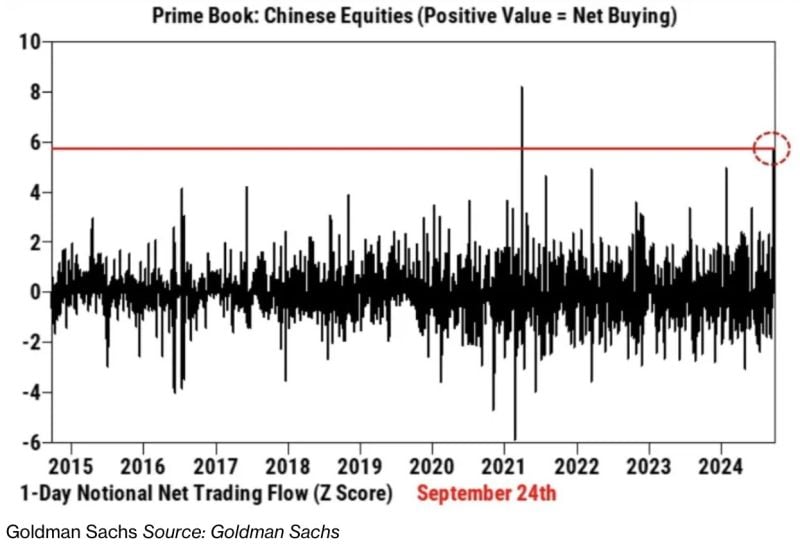

GS: China ... Better late than never..

A package of policy stimulus spanning across the monetary policy cohort, and the housing and stock markets was announced on Sep 24 Source: Goldman Sachs through Mike Zaccardi, CFA, CMT, MBA

Investors bought the most amount of Chinese Stocks on Tuesday in 3.5 years 👀

Source. Barchart, Goldman Sachs

China's stock market is having its best week in nearly a decade.

Source: (((The Daily Shot))) @SoberLook

📢 CHINESE INVESTMENT FIRMS CAN NOW BORROW FROM CENTRAL BANK TO BUY STOCKS.

WILL WE SEE A TRUE RECOVERY OF CHINESE STOCKS OR WILL IT BE ANOTHER FALSE START? Source: Radar

Investing with intelligence

Our latest research, commentary and market outlooks