Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

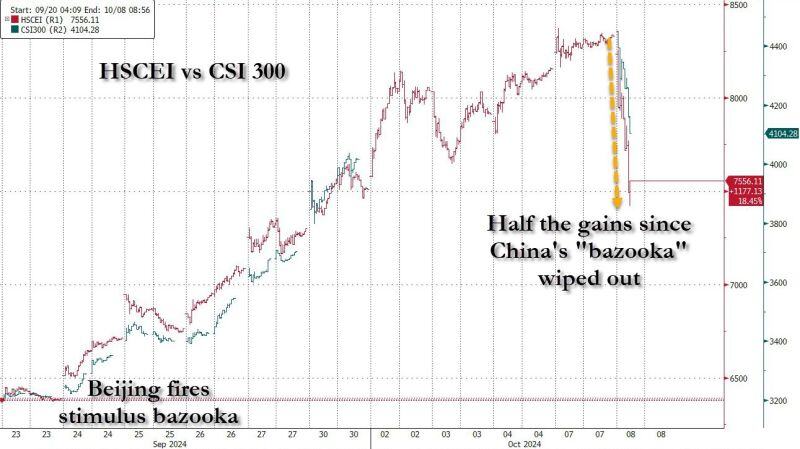

Half the gains since China's bazooka wiped out in an hour as authorities disappoint markets; Hong Kong stocks plunge more than 6%.

The rally in Chinese markets lost steam on Tuesday after a briefing from the country’s National Development and Reform Commission provided few details on further stimulus. While mainland China’s CSI 300 skyrocketed over 10% at the open Tuesday in its return from the Golden Week holiday, the index pared gains to a 5% rise later in the session. Hong Kong’s Hang Seng index briefly plummeted over 10%, before recovering slightly to a smaller loss of 6.4%. Zheng Shanjie, chairman of China’s National Development and Reform Commission, on Tuesday pledged a raft of actions to bolster the country’s economy during a highly-anticipated press conference. But he stopped short of announcing any new major stimulus plans, underwhelming investors and weakening the rally in the mainland Chinese markets. China will speed up special purpose bond issuance to local governments to support regional economic growth, the senior NDRC official said. Zheng said ultra-long special sovereign bonds, totaling 1 trillion yuan, have been fully deployed to fund local projects, and he vowed that China will continue to issue ultra-long special treasury bonds next year. The central government will release a 100 billion yuan investment plan for next year by the end of this month, ahead of schedule, a senior official added. Zheng also promised that more measures are coming that aims to support the property market and boost domestic spending. Source: CNBC, zerohedge

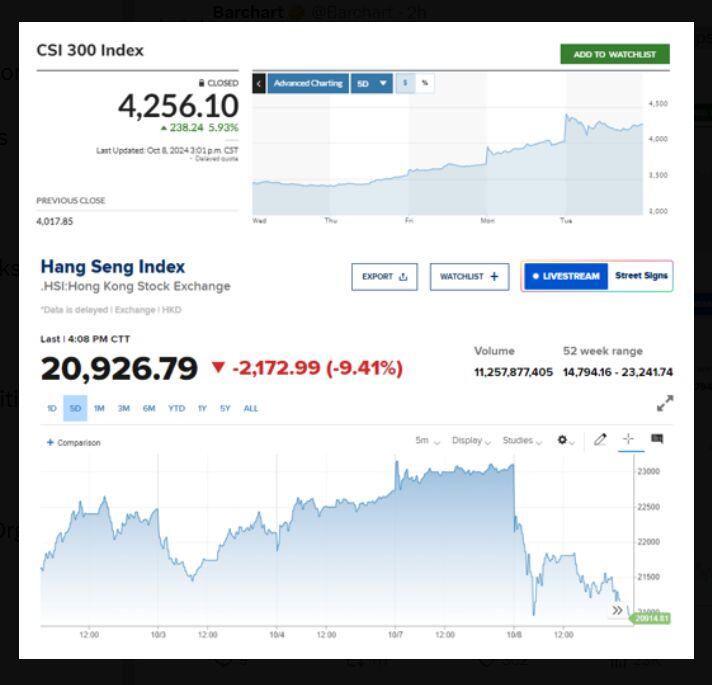

😱 The shocking chart of the day: Chinese stocks surged by 5.93% while Hong Kong Stocks collapsed by 9.41%, the largest single-day divergence in history 😱

Source: Barchart

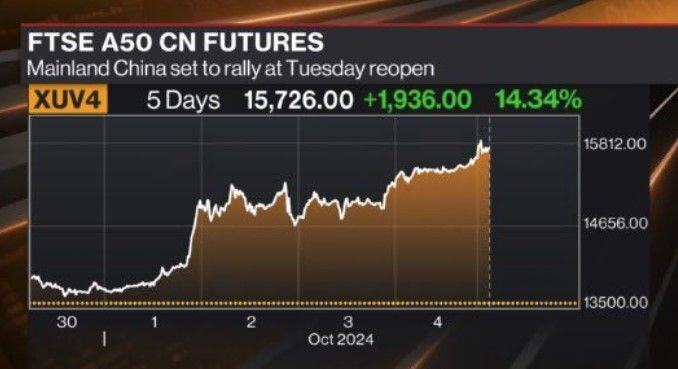

If futures are any indication, Mainland Chinese stocks are going through roof at the Tuesday reopen from the week-long holiday.

Source: David Ingles @DavidInglesTV on X, Bloomberg

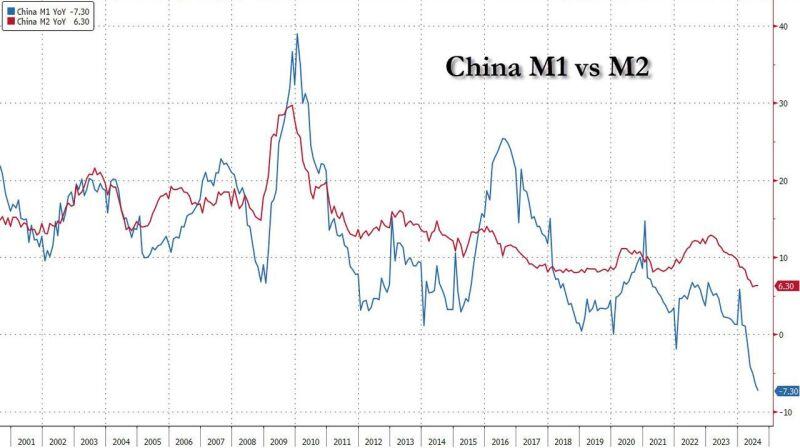

Goldman: to escape deflation and for the rally to be sustainable, China's M1 has to overtake its M2.

For that to happen, China will need to unleash a historic credit impulse (record new debt creation, launch QE) and global inflationary shockwave. Source: zerohedge

GS: South Africa, Commodity heavy EMs (Peru, Chile), and North Asian equity markets have the highest sensitivity to China growth

Source: Mike Zaccardi, CFA, CMT 🍖, Goldman Sachs

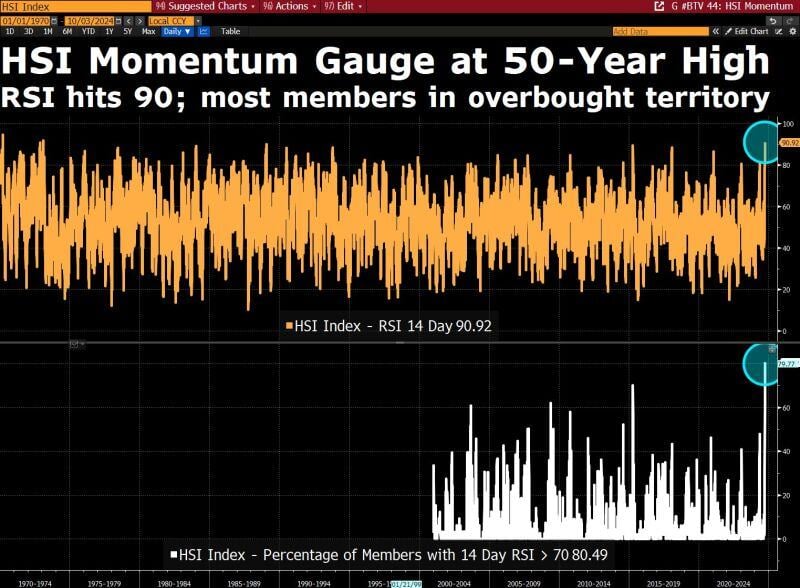

Here's a crazy stat on this Chinese equity rally.

A momentum gauge of the Hang Seng Index just hit the highest level in 50 years. The % of members signalling overbought conditions is at a record. Source: Bloomberg, David Ingles

Investing with intelligence

Our latest research, commentary and market outlooks