Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

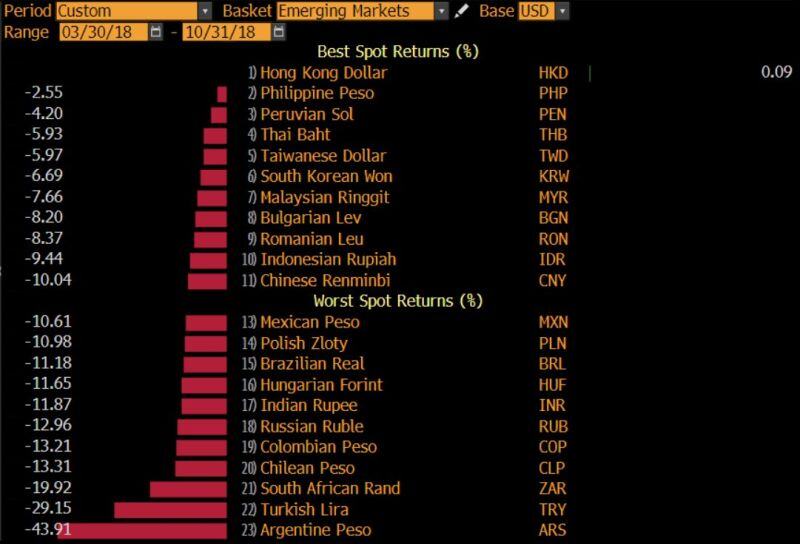

As a reminder... From April to October 2018, the US announced tariffs on half of all imports from China at 25%.

The Yuan fell 10% in an almost full offset. Turkey and Argentina had their own crises at the time and were blowing up constantly. But all of EM got hammered. Brazil was down 11%... History doesn't repeat but often rhymes... Source: Robin Brook, Bloomberg

According to the best source of Chinese gold and silver data – @oriental_ghost – China is on a silver consumption BENDER

Source: ale Gold great again

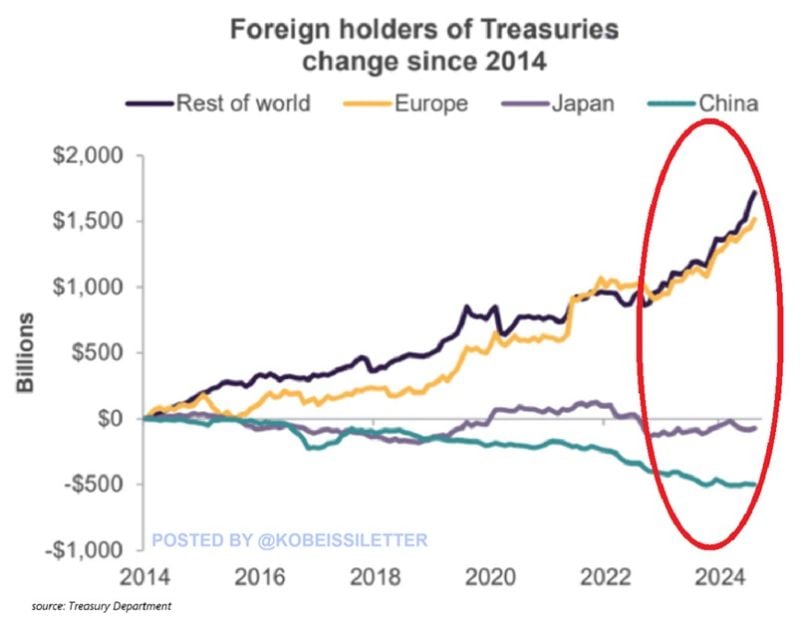

Foreign holdings of US Treasuries have jumped by $2.6 TRILLION over the last decade.

Europe’s Treasury holdings have risen by $1.5 trillion with the rest of the world acquiring $1.7 trillion of bonds. On the other hand, China and Japan's holdings have shrunk by ~$500 and ~$100 billion, respectively. Overall, total foreign holdings as a share of outstanding federal debt have dropped from 35% to 24%, near the lowest level in 18 years. This is the consequence of rapidly rising public debt with the supply of Treasuries rising ~$15 trillion over the last decade. Foreign demand for Treasuries cannot keep up with skyrocketing US debt. Source: The Kobeissi Letter

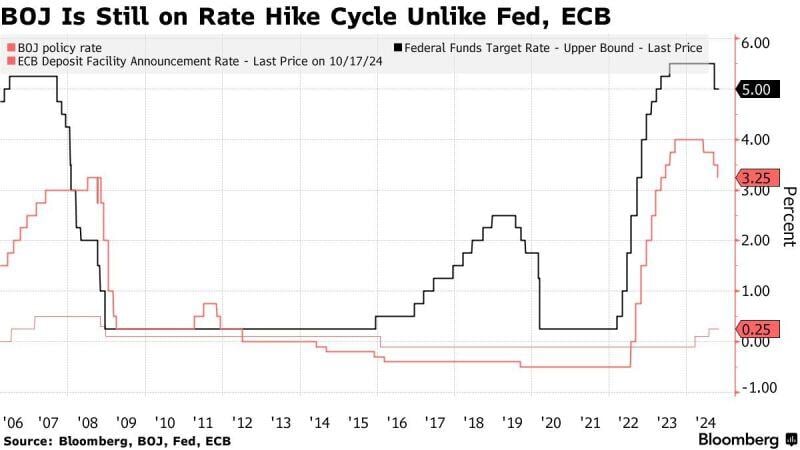

The BOJ kept interest rates steady on Thursday

The BOJ roughly maintained its forecast that inflation will hover near its 2% inflation target in coming years, signaling its readiness to continue rolling back its massive monetary stimulus. The Yen climbed as much as 0.9% on Ueda comments.

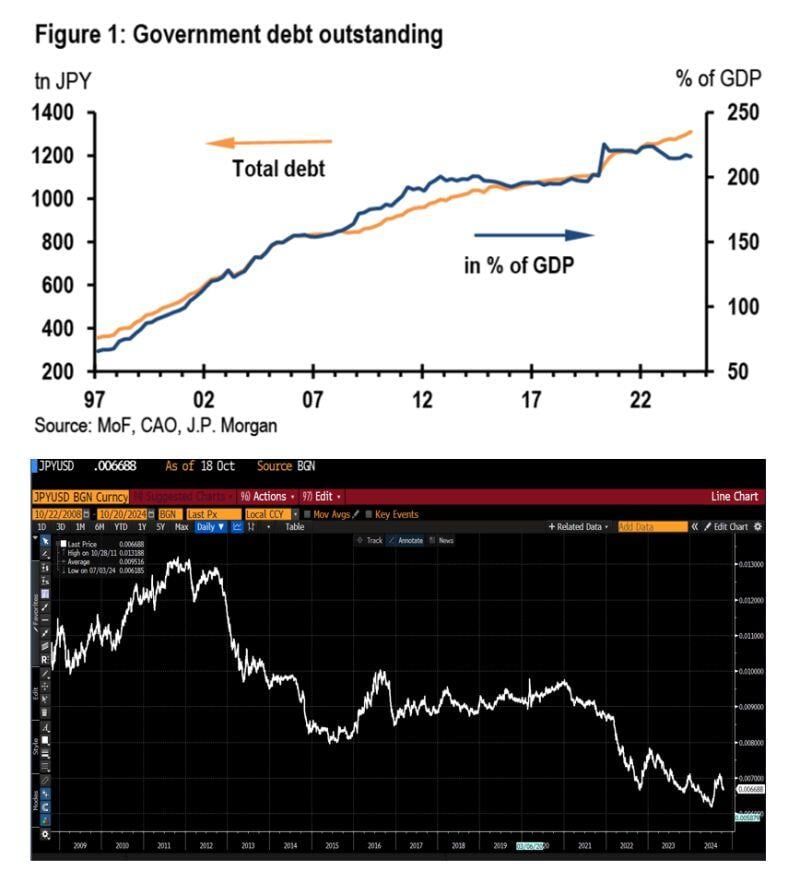

Japan is the perfect example of the failure of Keynesian policies.

More government spending only generates more debt and stagnation, and with years of printing, the yen keeps depreciating. Graphs JP Morgan and Bloomberg thru Daniel Lacalle on X

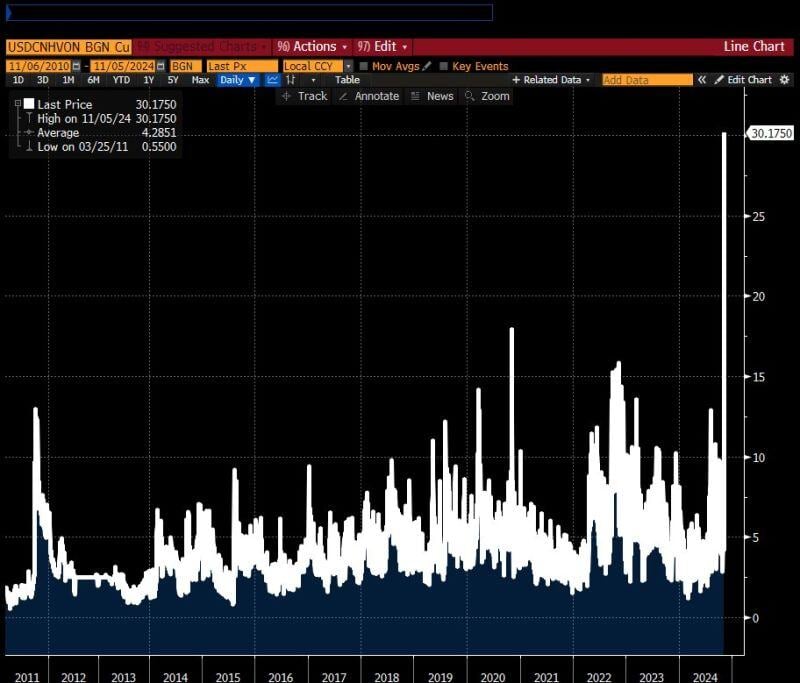

BREAKING 🚨: The "Yen carry trade unwinding risk" is unwinding

Japanese Yen has fallen through the 150 level against the U.S. Dollar for the first time in 2.5 months Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks