Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

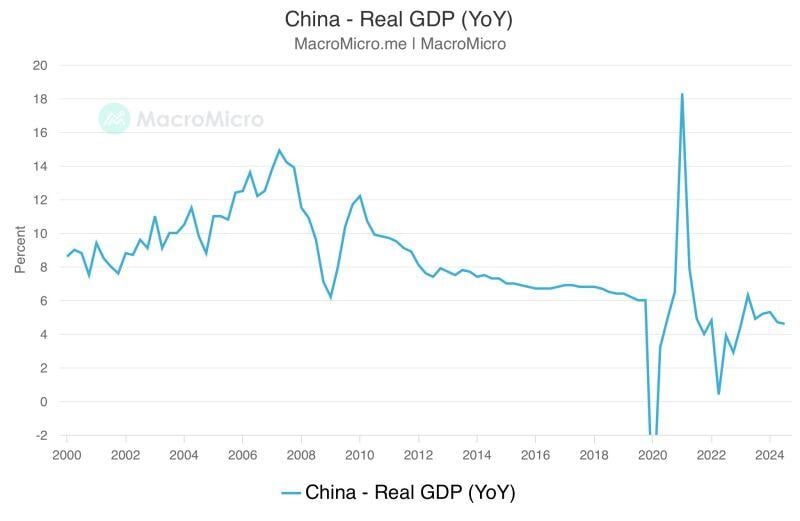

China's Q3 GDP hits weakest pace since early 2023, backs calls for more stimulus

China's economy grew at the slowest pace since early 2023 in the third quarter, and though consumption and factory output figures beat forecasts last month a tumbling property sector remains a major challenge for Beijing as it races to revitalise growth. See below key China GDP data: Q3 GDP 4.6% y/y [Est.+4.5%] Q1-Q3 GDP 4.8% y/y [Prev.+5.0%] Sept retail sales 3.2% y/y [Est.2.5%] Sept industrial growth 5.4% y/y [Est.4.5%] Jan-Sept fixed asset investment 3.4% y/y [Est.3.3%] Sept Unemployment 5.1% [Prev. 5.3%] Source: Reuters, MacroMicro

BREAKING 🚨: Chinese Stocks enter technical correction after falling more than 10% from the October 8th high

Source: Barchart

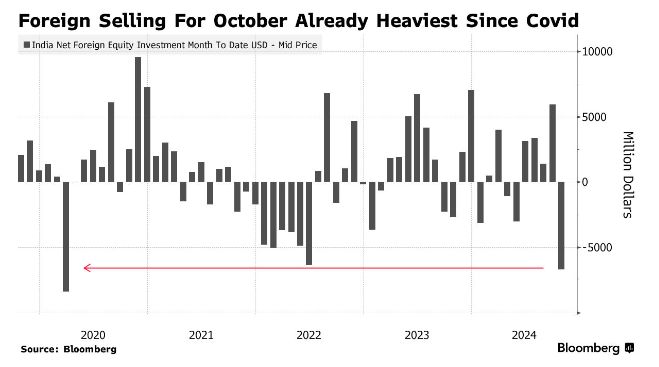

India stocks foreign selling

Foreign Investors have dumped Indian Stocks EVERY SINGLE day this month for a total value of $6.7 billion. This month's selling is on track to surpass even March 2020. Source: Barchart, Bloomberg

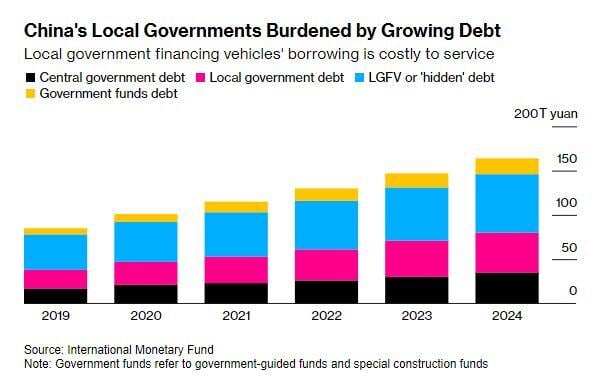

China Weighs $853 Billion Debt Swap to Rescue Local Governments

Source: - Bloomberg

Chinese e-commerce giant $BABA Alibaba’s international arm launched an updated version of its artificial intelligence-powered translation tool

It says, is better than products offered by Google, DeepL and ChatGPT. 👉 The product supports 15 languages: Arabic, Chinese, Dutch, English, French, German, Italian, Japanese, Korean, Polish, Portuguese, Russian, Spanish, Turkish and Ukrainian. 👉 “The idea is that we want this AI tool to help the bottom line of the merchants, because if the merchants are doing well, the platform will be doing well,” Kaifu Zhang, vice president of Alibaba International Digital Commerce Group and head of the business’ artificial intelligence initiative, said https://lnkd.in/eJrhxVrM Source: CNBC

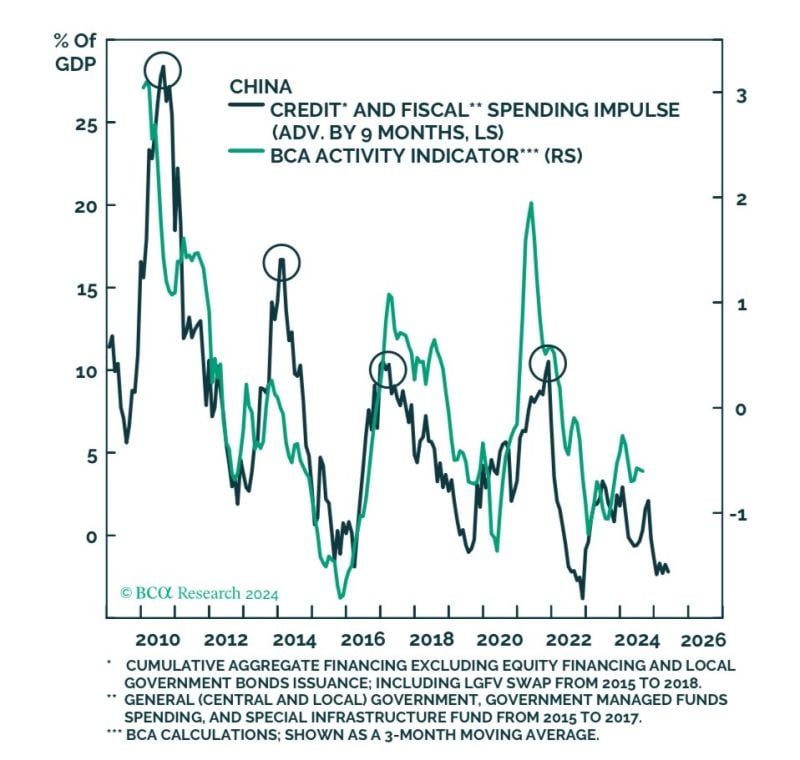

Are investors underestimating just how behind the curve China is in stimulating its economy?

Looking at the chart below (courtesy of BCA), it seems that a 5% of GDP stimulus package is the minimum needed just to prevent growth from weakening further...

JUST IN 🚨 : China expected to announce a new stimulus package of $283 Billion

Investors are on tenterhooks as Beijing prepares to deliver fresh policies over the weekend that could jumpstart its economy. China’s Finance Minister Lan Fo’an is set to hold a press conference at 10 a.m. on Saturday local time on “intensifying” fiscal stimulus policies, the country’s State Council Information Office said. With Beijing at risk of missing its full year economic growth target of 5%, some analysts are confident that authorities are ready to deliver major fiscal stimulus at the highly anticipated event, while others remain skeptical. Most economists expect some sort of additional stimulus, but there are many differing views on its size as well as the priorities of the package. Some have floated a figure between two and three trillion yuan (the equivalent of $282.8 billion to $424.2 billion), while others have suggested 10 trillion yuan ($1.4 trillion). Source: Barchart, CNBC

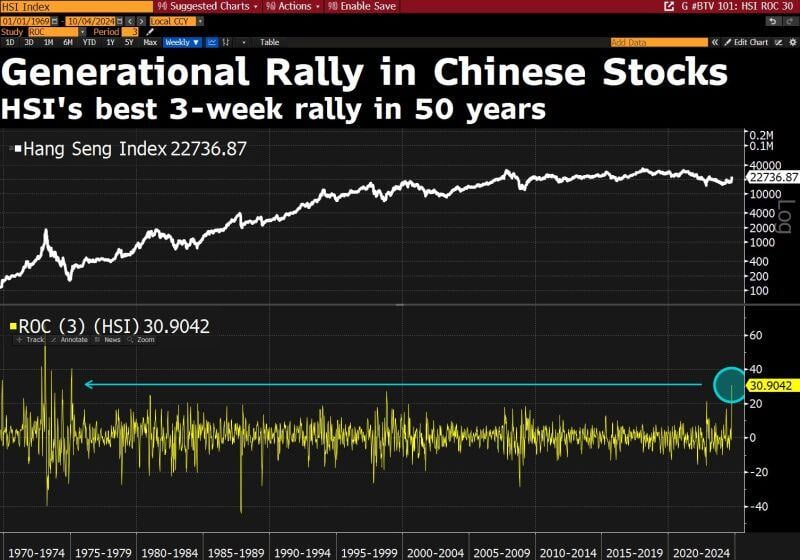

Hang Seng Index capped its best 3-week stretch since 1975

Source: Bloomberg, David Ingles on X

Investing with intelligence

Our latest research, commentary and market outlooks