Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

😱 The shocking chart of the day: a 128% INTRADAY increase for a HK-listed ETF !!!

The China equities rally look unstoppable... 😱 The Hang Seng Tech Index expanded its gains to 9%, while the Hang Seng Index surged by 6%. The FTSE China A50 Index futures rose by over 8%. As shown on the chart below, the HK-listed Science and Technology Innovation Board 50 ETF, surged dramatically, with an intraday increase of 128%. In the previous trading day, it closed with a rise of over 21%. Source: CN Wire

HedgeFunds are buying Chinese Stocks at the fastest speed in history

Source: Barchart

STILL BREAKING 🚨 China Short Sellers

This just got exponentially worse for Hedge Funds shorting Chinese stocks! Source: Barchart

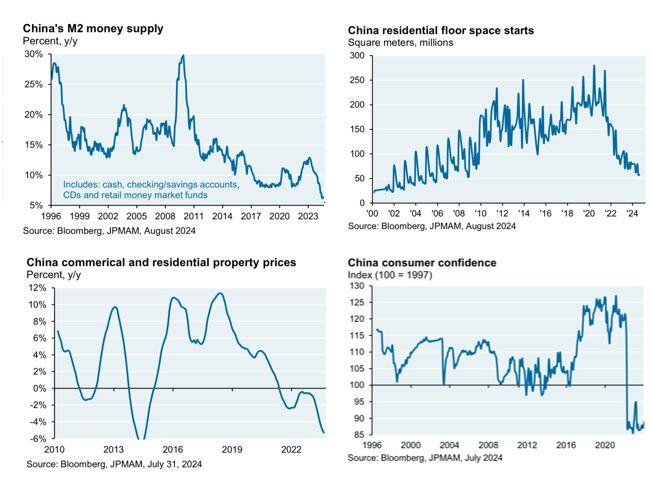

JPMORGAN, on China stimulus:

“.. I don’t think it’s an exaggeration to say that China is acting somewhat out of desperation given the severity of the declines shown in the charts below.” [Cembalest] This is very close to our thesis >>> We view this stimulus package as an emergency policy adjustment designed to halt the downward trend, NOT to engineer a higher level of economic growth going forward. The package addresses short-term risks, but medium- and long-term challenges remain: Unfavorable demographic dynamics Households’ sentiment has been hit hard in the past four years and will need time to recover durably, a necessary condition for higher domestic consumption Business and investors’ sentiment has equally been damaged by the succession of regulatory crackdowns and anti-bribery campaigns. The latest announcements are an encouraging sign for domestic and foreign equity investors, but only a small first step in rebuilding the confidence toward Chinese listed companies. Trade barriers have already increased for China’s exports to the US and Europe and this trend is unlikely to reverse, especially if Donald Trump is elected Source: Carl Quintanilla on X

China's Stock Market Today as China’s factory activity contracts less than expected in September.

1. Chinese stocks up 6% today and 18% in 5 days 2. Beijing 50 index posts RECORD 15% intraday jump 3. RECORD 1 trillion Chinese Yuan traded in 30 minutes 4. Brokerages open 24/7 to accommodate retail traders 5. Commerce Ministry says it will "improve policy effectiveness" 6. Chinese brokerages crashing due to high traffic China up 25% in just over 2 weeks. Source: The Kobeissi Letter, David Ingles, Bloomberg

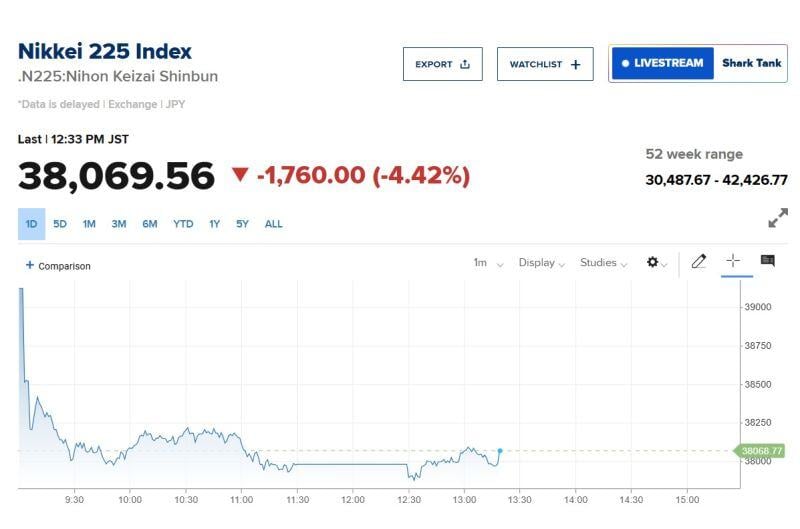

Nikkei is DOWN -4% following Ishiba's victory

The background: On Friday (after the close of Japan's markets) Ishiba, a 67-year-old former defence and agriculture minister, was elected LDP president on his fifth attempt and will succeed Fumio Kishida as Japan’s prime minister after a parliamentary vote on October 1 Immediately after Ishiba’s victory was declared on Friday, the yen surged more than 1 per cent against the dollar on market perceptions that he would not resist efforts by the Bank of Japan to normalise monetary policy and to push ahead with interest rate increases. Japanese equities had risen earlier on Friday amid expectations that one of Ishiba’s more market-friendly rivals would win. But Nikkei 225 now slumps more than 4 per cent as a response to the stronger yen.

Investing with intelligence

Our latest research, commentary and market outlooks