Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Not a bad week for Dr Burry who is heavily invested in China stocks Alibaba $BABA, Bidu $BIDU and JD.com $JD...

Note that another big bet from Burry - Shift4 payments $FOUR - has also been doing great recently... Source: Guru Focus, Yahoo Finance

In case you missed it... Some major breaking news out of China today.

People’s Bank of China Gov. Pan Gongsheng announced a flood of support measures in a rare press conference Tuesday amid a deepening economic slump, including the biggest package yet for housing. Measures went beyond most expectations targeted at property, banks and directly, the equity market. Beijing will cut the amount of cash banks need to have on hand, known as the reserve requirement ratio, or RRR, by 50 basis points in the near term, he said. Pan also said the PBOC would cut the 7-day repo rate by 0.2 percentage points, and signaled that a 0.2-0.25% cut in the loan prime rate could follow. Stocks are flying led by brokers and property. Some other China proxies like iron ore and Aussie are also trading higher. Source: David Ingles

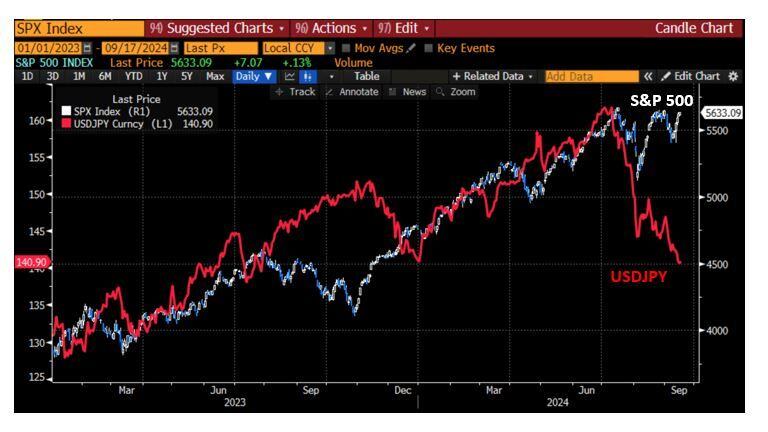

Remember when early August the strengthening of the yen and ensuing carry trade unwinding was seen as a huge threat for the equity market?

Fast forward to mid-September: the S&P 500 and USDJPY are taking two opposite directions. The market doesn't seem to care anymore about the yen... Source: Bloomberg, RBC

One of the most striking charts this year: China’s startup ecosystem has almost completely collapsed in the last 5 years

Source: FT thru Alec Stapp on X

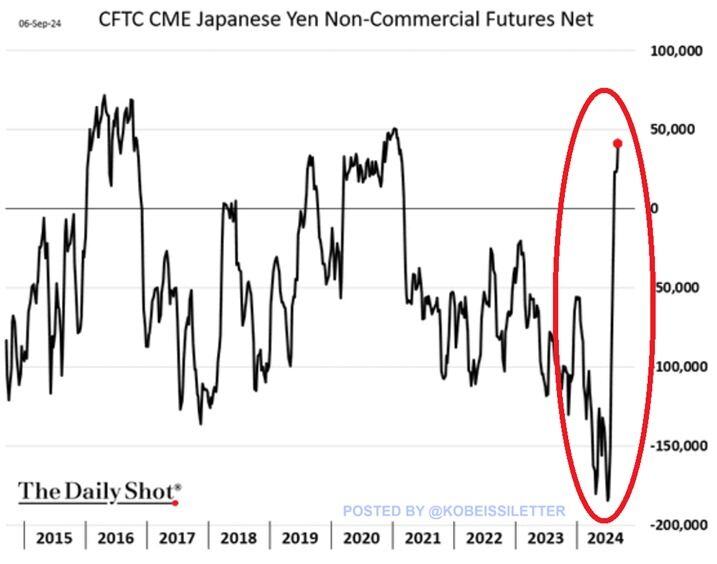

Net long positions on the Japanese yen hit ~45,000 last week, the highest level in 3.5 years.

By comparison, in early August, speculative positions reached net short ~180,000 contracts, the most in at least 20 years. The las time such a sharp reversal from short to long occurred was during the 2008 Financial Crisis. This comes after the Japanese Yen has strengthened against the US dollar by 12% since July as the carry trade has scaled back. The $USDJPY pair is flat year-to-date and is trading at its lowest level since the first week of January. Japanese Yen volatility is still here. Source: The Kobeissi Letter

The Bank of Japan (boj) is still on a path toward higher interest rates provided inflation and economic data continue in line with its forecasts

“If we are able to confirm a rising certainty that the economy and prices will stay in line with forecasts, there’s no change to our stance that we’ll continue to adjust the degree of easing,” Ueda said in response to questions in parliament Friday. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks