Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Interesting article by The Wall Street Journal ->

US dollar stable coin BOOST DEMAND for US government bonds and help the US keep up with China... Source: Radar, WSJ

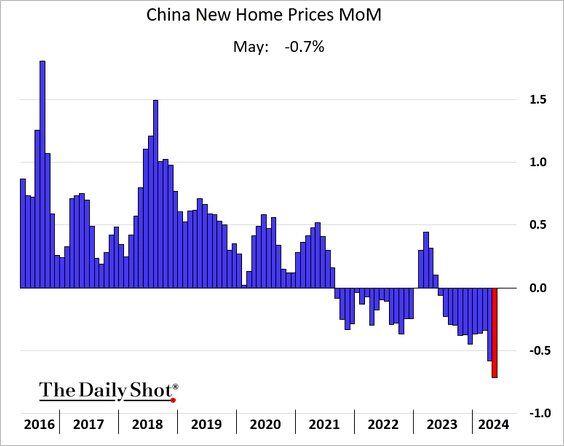

#china #macro: Retail sales beat expectations

The strong growth in retail spending is particularly notable given the continued pressure on the property sector, with negative spillovers to household sentiment. It’s probably a relief to a government looking to reset the economy over time. Source: CNBC. Bloomberg, Mohamed El Erian

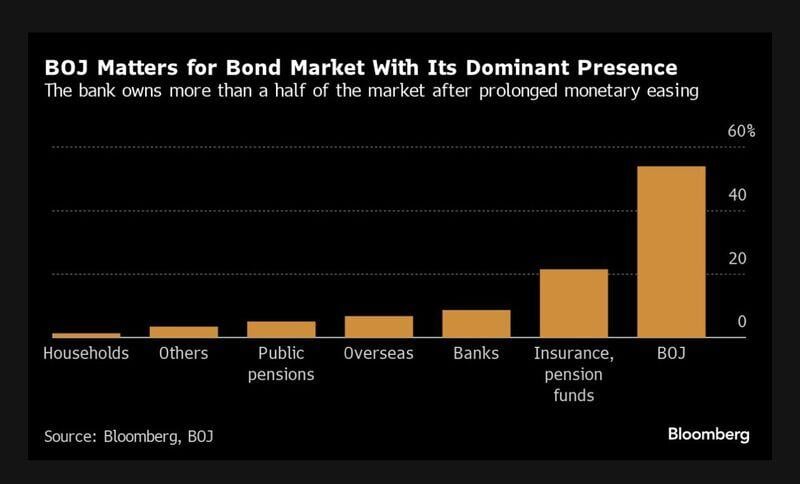

📢 📢 📢 The Bank of Japan kept its benchmark interest rate unchanged on Friday, but indicated it’s considering the reduction of its purchase of Japanese government bonds.

The central bank left short-term rates unchanged at between 0% to 0.1% at the end of its two-day policy meeting, as widely expected. But notably, the bank said in its statement it could reduce its purchases of Japanese government bonds after the next monetary policy meeting, scheduled for July 30 and 31. QE tapering in Japan has a lot more potency than in the U.S., sheerly because of how much of the bond market the BOJ owns. Following the BOJ decision, the Japanese yen weakened 0.5% to 157.8 against the U.S. dollar, while the yield on 10-year JGB fell 44 basis points to 0.924. So absolutely no panic... Source: Bloomberg, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks