Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

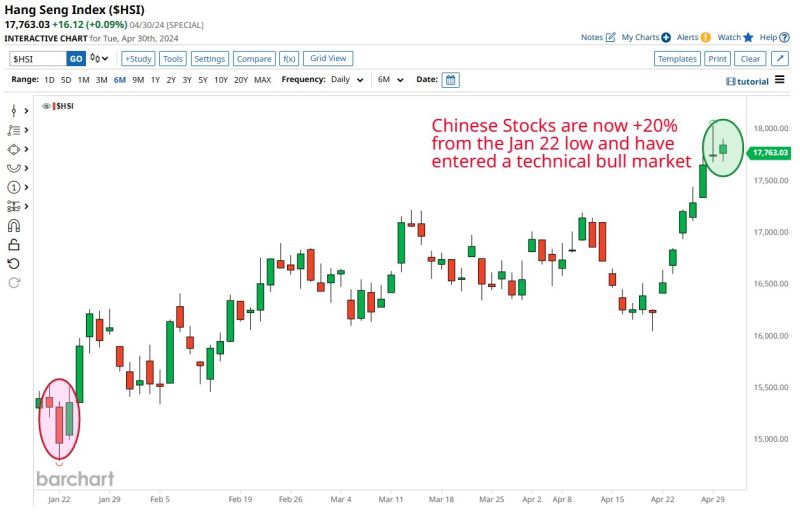

Chinese Stocks enter technical bull market after rallying 20% off the Jan 22 low

Source: Barchart

Goldman Sachs and HSBC are saying that funds and global investors are rotating out of US and Japanese stocks

To reposition on the Hong Kong stock market which appears to offer significantly better opportunity. Hong Kong listed companies mainly do business across Asia with limited interference from the Chinese government. Source: Bloomberg

Chinese stocks catching a very strong bid Monday.

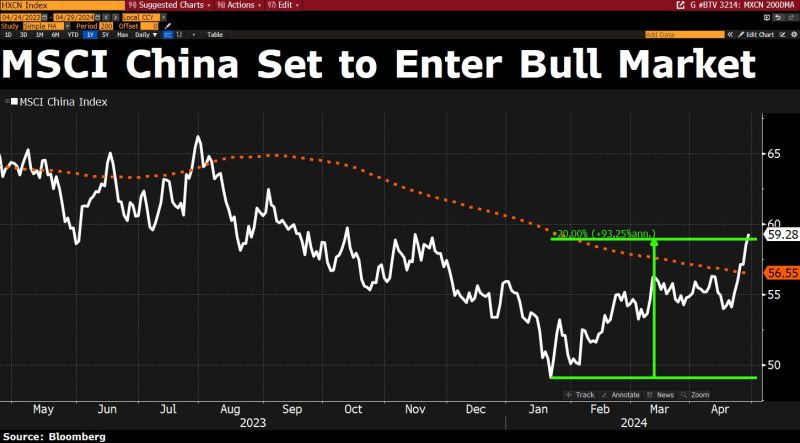

The most-followed China stock index globally (MSCI China) is set to enter a bull market (note though it’s still a long way back to the top) Source: David Ingles, Bloomberg

Intervention? At 9:30 PM ET, the Japanese Yen weakened to 160 against the US Dollar for the first time since 1990.

Exactly 2.5 hours after the headlines came out, the ratio just crashed from 160.20 to 156.50. That's a ~2.5% swing in one of the biggest currencies in the world in a matter of minutes. Clearly, something is happening here and it comes just days after the Bank of Japan left rates unchanged. Did someone just intervene? Source: The Kobeissi Letter

Japan's currency official declined to comment regarding possible intervention

Japan's Masato Kanda says "No comment for now" when asked whether Tokyo had intervened in the currency market Today following a sharp move in the market that sliced more than 2% off the dollar-yen exchange rate shortly after the Japanese currency went over 160.

Source: Bloomberg

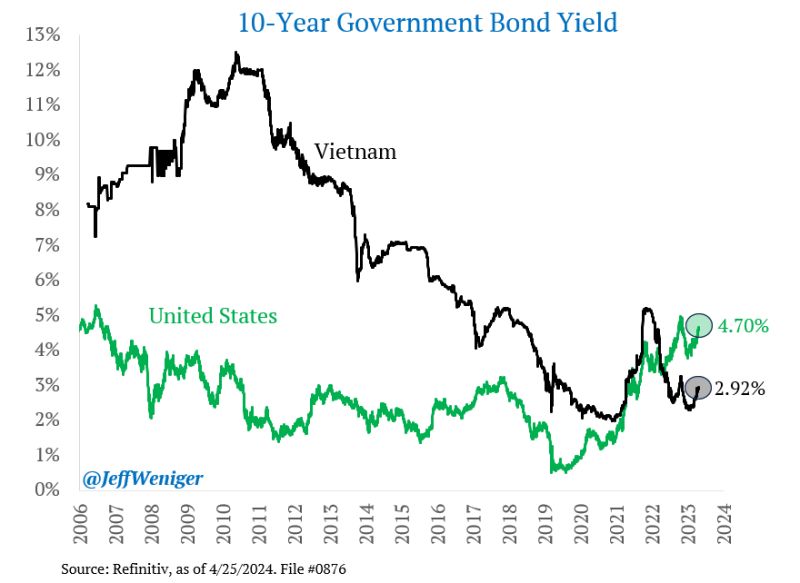

In case you missed it... U.S. 10-year government bonds yield 4.70%, about two percent more than Vietnam's 2.92%.

Source: Jeff Weniger

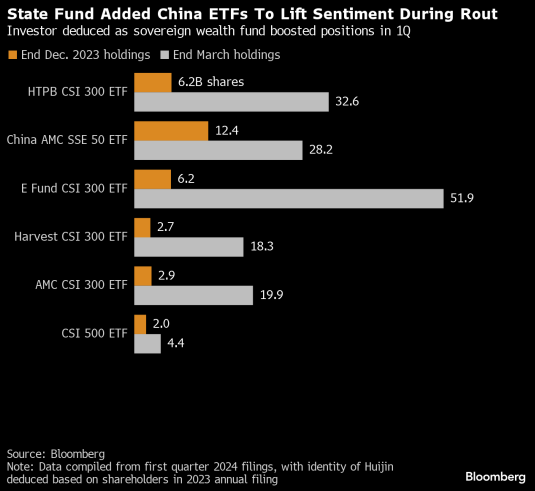

State Fund added China ETFs to lift sentiment during rout

According to Bloomberg, China’s sovereign wealth fund has “likely bought at least USD 43 bn of onshore exchange-traded funds in the first quarter” vs. USD 6.8 bn in the second half of 2023. The extent of the buying provides insight into the government willingness to stabilize the markets during challenging periods.

Investing with intelligence

Our latest research, commentary and market outlooks

%203%202024-04-29%2010-25-14.jpg)