Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

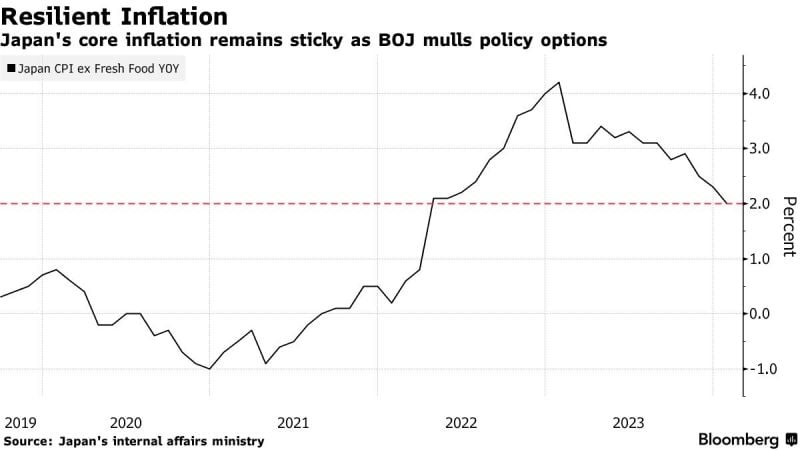

In case you missed it: Japan’s Jan CPI overshoots expectations, w/headline coming in at +2.2% (vs. +1.9% expected and vs. +2.6% in Dec) while core rises 3.5% (vs. Street +3.3% and vs. +3.7% in Dec).

While these numbers pèrove that inflation remains sticky, inflation continues to come down and hit a 22-month low! Source: Bloomberg

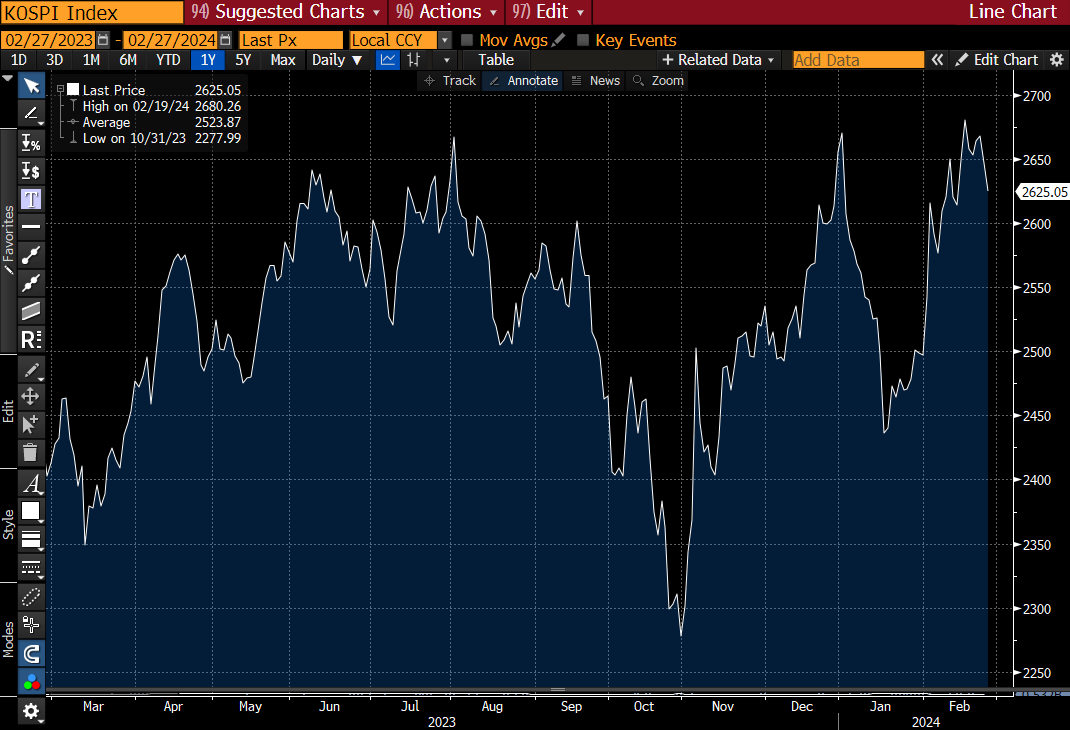

Just like Japan last year, yesterday, the Korean authorities have officially launched a corporate reform plan named the “Corporate Value-Up Program” in order to address the “Korean discount” issue.

Companies trading below book value have been asked to improve shareholders returns, albeit on a voluntary basis. Stricter measures could follow. For the time being, the country is benefiting from the semiconductor recovery cycle. Source : Bloomberg

China and India have signed agreements to restructure their holdings of Zambian debt

The bankrupt southern African nation’s president has said, raising hopes that a delayed effort to exit a long-running default is back on track. Hakainde Hichilema said Zambia planned to resume talks with private creditors to resolve a “terrible debt mountain” of more than $13bn in external debt that Africa’s second largest copper producer stopped paying in 2020. Source: FT https://lnkd.in/exZS4E5d

BYD Co. debuted its most expensive car on Sunday

A 1.68 million yuan ($233,450) high-performance fully-electric supercar pitted against gas-guzzling options offered by rivals such as Ferrari NV and Lamborghini. The Yangwang U9 will initially be for the China market, the company said at a live-streamed event in Shanghai. The car can hit 100 km/h (62 mph) in 2.36 seconds and reach a top speed of 309.19 km/h, it said. Source: Bloomberg

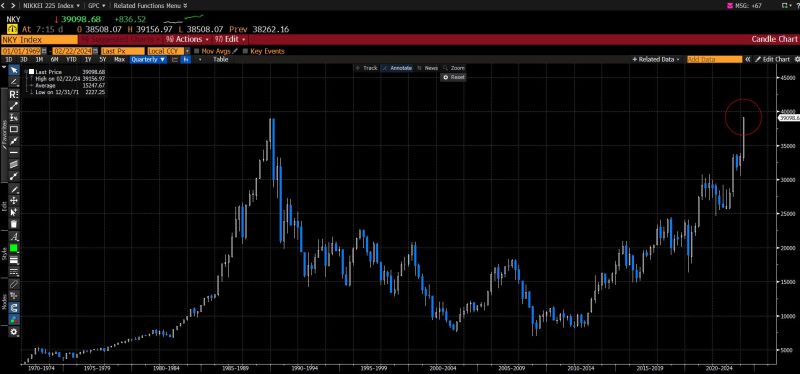

The Nikkei has just surpassed its highest level in 35 years.

Japan being the birthplace of one of the oldest forms of technical analysis (Heikin-Ashi candlesticks), will this new-high signal reignite domestic investors’ long lost interest in their market?

China to send more pandas to US

China's Wildlife Conservation Association is working with the National Zoo in Washington in an arrangement that could bring more pandas back to the United States, signalling improving diplomatic relations between the two superpowers. China has lent its beloved bears to zoos in various countries over the years as goodwill animal ambassadors and also fostered a modern Sino-U.S. "panda diplomacy" with the gesture.Back in November, the National Zoo in Washington returned three pandas to China as part of a more than 50-year-old legacy, leaving Georgia's Zoo Atlanta as the only one in the U.S. with a giant panda program. Source : reuters

In case you missed it. Chinese stocks have now fully recovered from all year-to-date losses and are now green on the year.

Source: Barchart

Nikkei Parties Like It's 1989

A lot of attention has been focused on the Nikkei 225 index, which topped its all-time high, surpassing 39,000 and breaking the previous record of 38,957 set on the final trading day of 1989. The 34 years it has taken to regain its footing is also a record for a major market, and it's a decade longer than Wall Street took to recoup its losses from the 1929 crash and the Great Depression. source : bloomberg, reuters

Investing with intelligence

Our latest research, commentary and market outlooks