Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China vs. Japan in one chart! Japanese stocks have outperformed their Chinese counterparts by a whopping 63% since the start of 2023.

Source: Jeroen Blokland

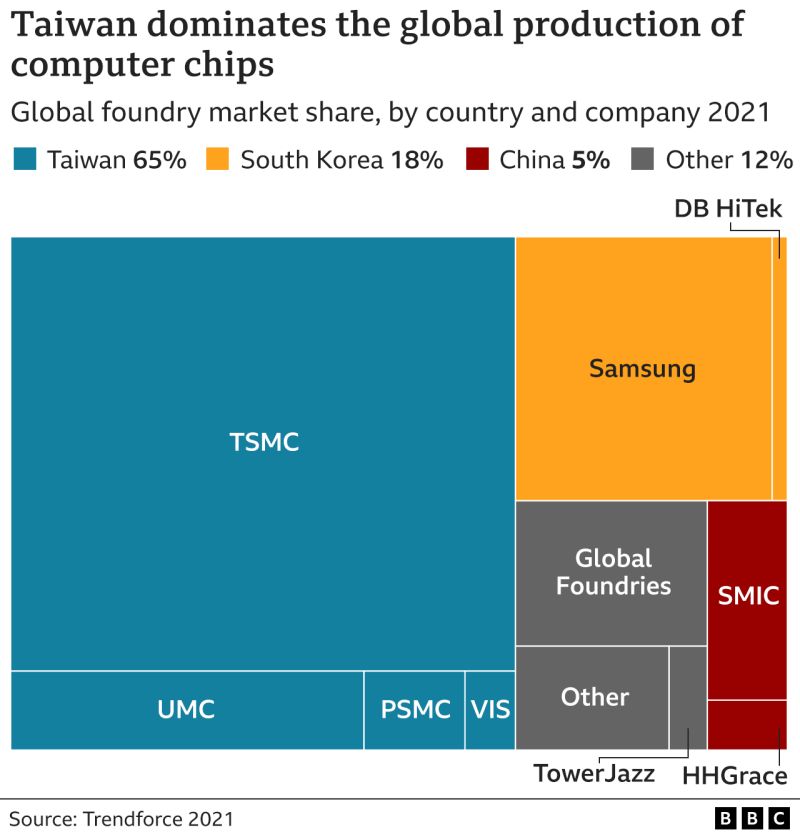

A few days ahead of Taiwan election... Taiwan: the island that matters - or why Taiwan is important to China, USA and the rest of the world...

Imagine the implications of any blocade or invasion on the semiconductor value chain and the magnificent7... Source: BBC

BREAKING: Japan's Nikkei 225 stock index rises above 34,000 for the first time since March 1990. Breakout from a 30-year base!

- Breakout + test from 30-year base (blue circle) - Successful test of 2nd base (purple circle) - $NIKKEI now trading at 34-year high - Still below ATH recorded in 1989 - Yen is undervalued by ~40% on PPP-basis (source: ) Along with hitting a fresh 33-year high, Japan's stock market is now up 120% from its low in 2020. Both technology and health care stocks have been the main drivers. Recently, Warren Buffett began betting on a recovery of Japan's economy. Japan is back in a bull market.

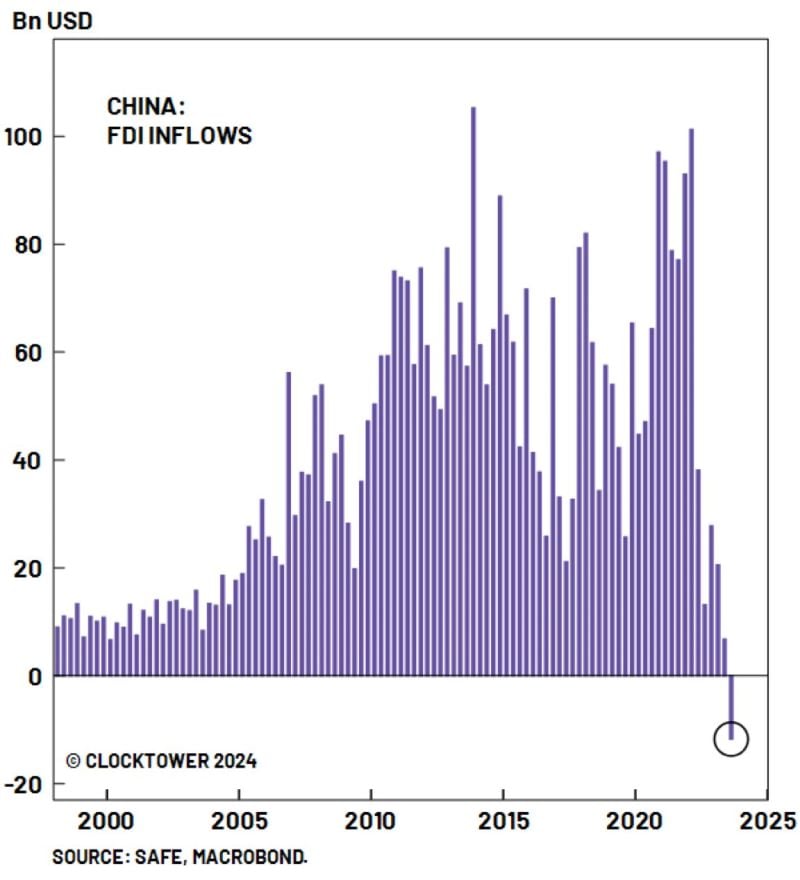

Money is flowing out of China for the first time in over 25 years

Source: AnilVohra1962, Safe, Macrobond, Clock Tower

A new all-time-high for Nvidia $NVDA up +6.4% on the day

The chart looks rather bullish with an ascending triangle breakout as the weekly MACD begins to cross to the upside... The big news of the day was Nvidia planning to begin mass production of its AI chips designed for China that comply with U.S. export rules starting in Q2 - Reuters Source chart: Jake Wujastyk

New Year, New Low!

After a shallow rally, Chinese hashtag#equities just made a new low. Down 15% from their peak in May last year, down 22% from their 2021 peak. Sources: Jeroen Blokland, Bloomberg

Chinese stocks are trading near all-time lows relative to GDP, while US stocks are trading near all-time highs relative to GDP

Perhaps for good reason... but that's a massive spread. Source: Swordfishvegetable

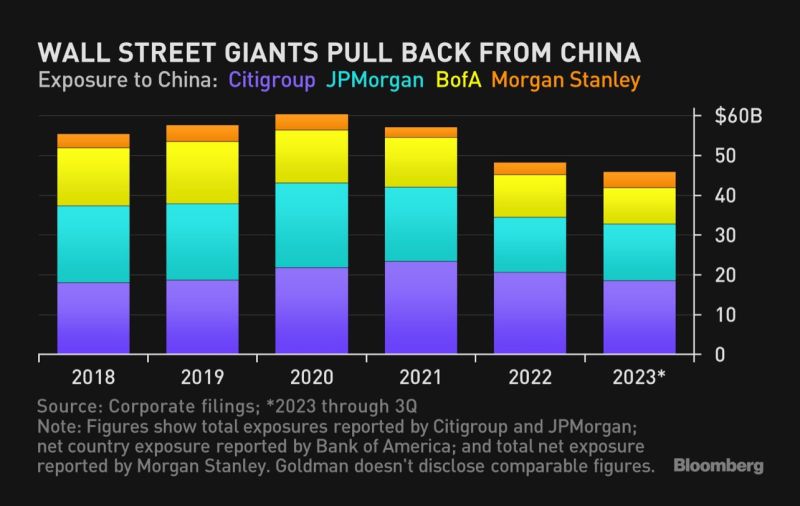

Citi, JPMorgan, BofA and Morgan Stanley have collectively reduced their exposure to China by about a fourth since 2020

Source: Lisa Abramowicz, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks