Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

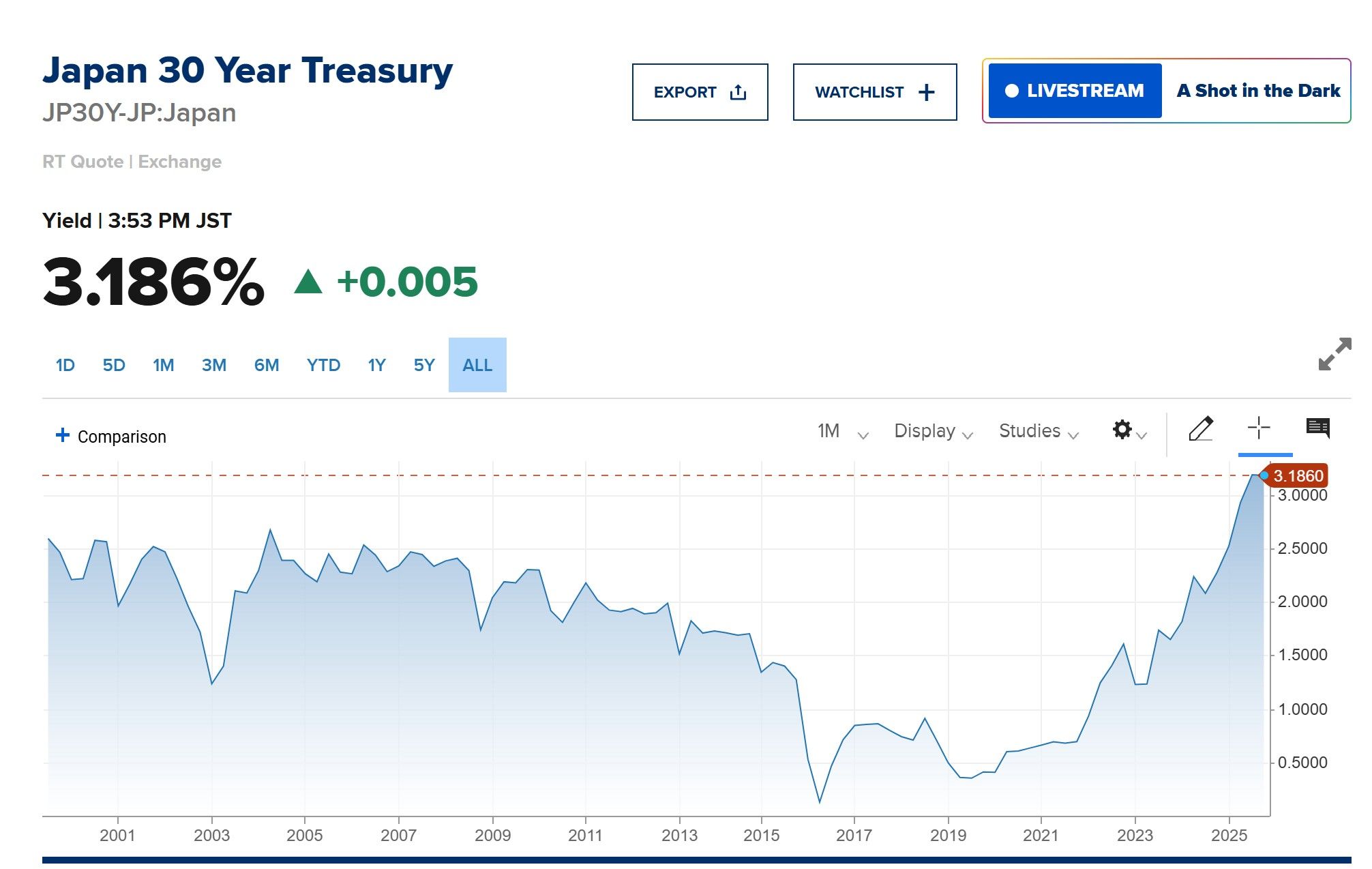

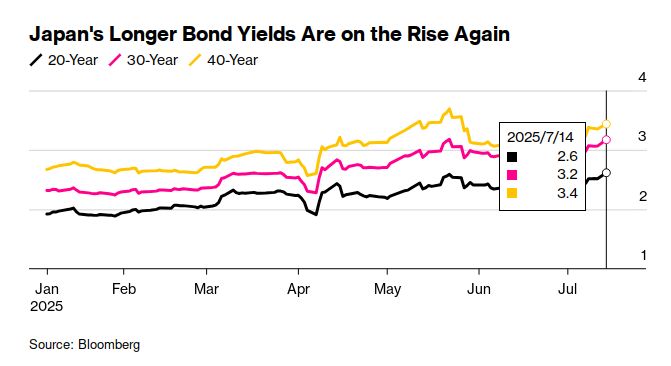

Japan’s 30-year bond yield has spiked to 3.18% - the highest level on record.

A preview of what’s coming for the US if we they don’t get our deficit/debt spiral under control ? Source: CNBC

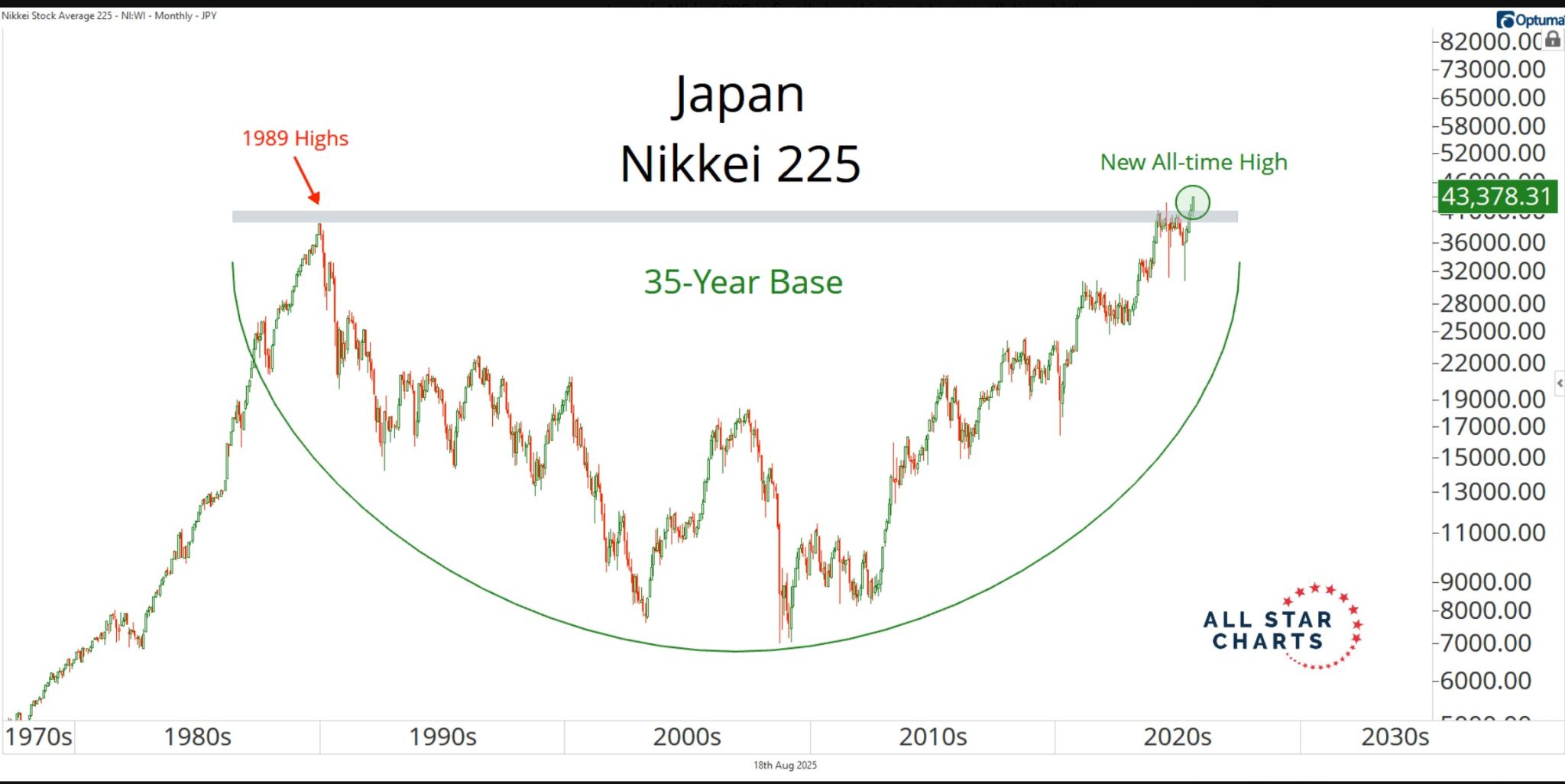

Japan’s Nikkei 225 is finally breaking out to new all-time highs.

It took 35 years to surpass the 1989 highs. Source: J-C Parets

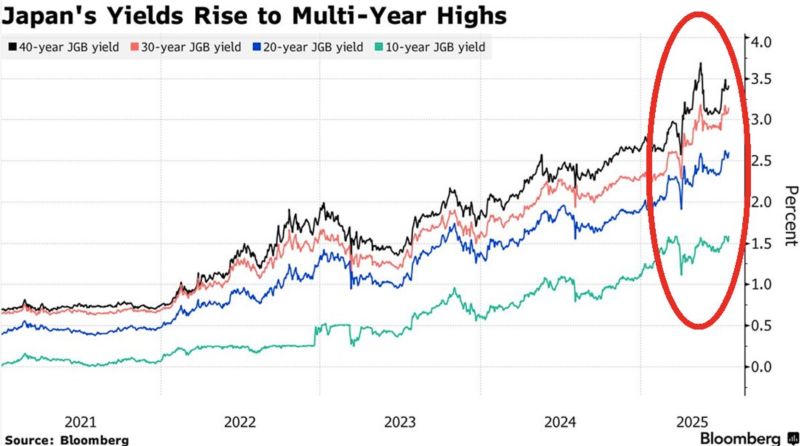

This is a GLOBAL DEBT CRISIS: Japan’s 40-year bond auction just saw its weakest demand since 2011.

The bid-to-cover ratio fell to 2.127. Yield surged to a record 3.375%. Cracks are forming in the world’s 3rd-largest bond market. Source: Bloomberg, Global Markets Investor

Japan’s 10y bond yields have jumped to their highest level since 2008, driven by growing fiscal concerns.

The spike came after President Trump announced a trade deal w/Japan. It appears Japan may be covering part of the cost of US car tariffs by using its own investment funds–essentially a partial bailout to smooth the deal. Source: Bloomberg, HolgerZ

Japan PM Ishiba Vows To 'Stay On' Despite Ruling Coalition Facing Major Loss; Exit Polls Show

The governing coalition of Prime Minister Shigeru Ishiba is likely to lose a majority in the smaller of Japan's two parliamentary houses in a key election Sunday, according to exit polls, worsening the country's political instability. Voters were deciding half of the 248 seats in the upper house, the less powerful of the two chambers in Japan's Diet. Ishiba has set the bar low, wanting a simple majority of 125 seats, which means his Liberal Democratic Party, or LDP, and its Buddhist-backed junior coalition partner Komeito need to win 50 to add to the 75 seats they already have. That would mean a big retreat from the 141 seats they had before the election. The LDP alone is projected to win from 32 to 35 seats, the fewest won by the party, which still is the No. 1 party in the parliament. Source: www.zerohedge.com

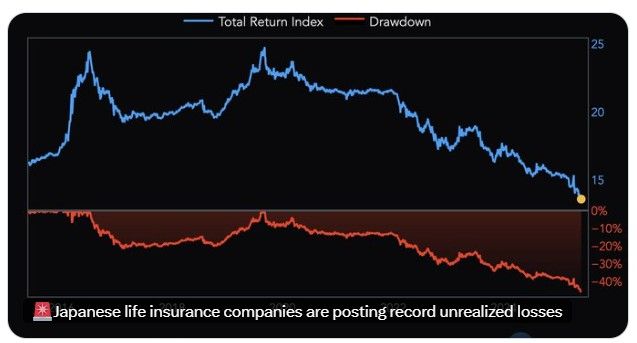

🔴 Japanese insurers' unrealized LOSSES are HUGE

▶️ The biggest insurers’ paper losses on their domestic bond holdings hit a record ¥8.5 TRILLION ($60BN) in Q1. 💥 Nippon Life, the largest insurer and the world’s 6th-largest saw ¥3.6TN ($25BN) LOSS. Source: Global Markets Investor

Yield on Japanese government hashtag#bonds are back to the highs they reached in May.

Japan was always held up by the MMT (Modern Monetary Theory) crowd as an example for how debt doesn't matter because governments can always cap yields. That view needs to be retired along with MMT. Fiscal space seems to be finite. Not infinite. Source: Robin Brooks, Bloomberg

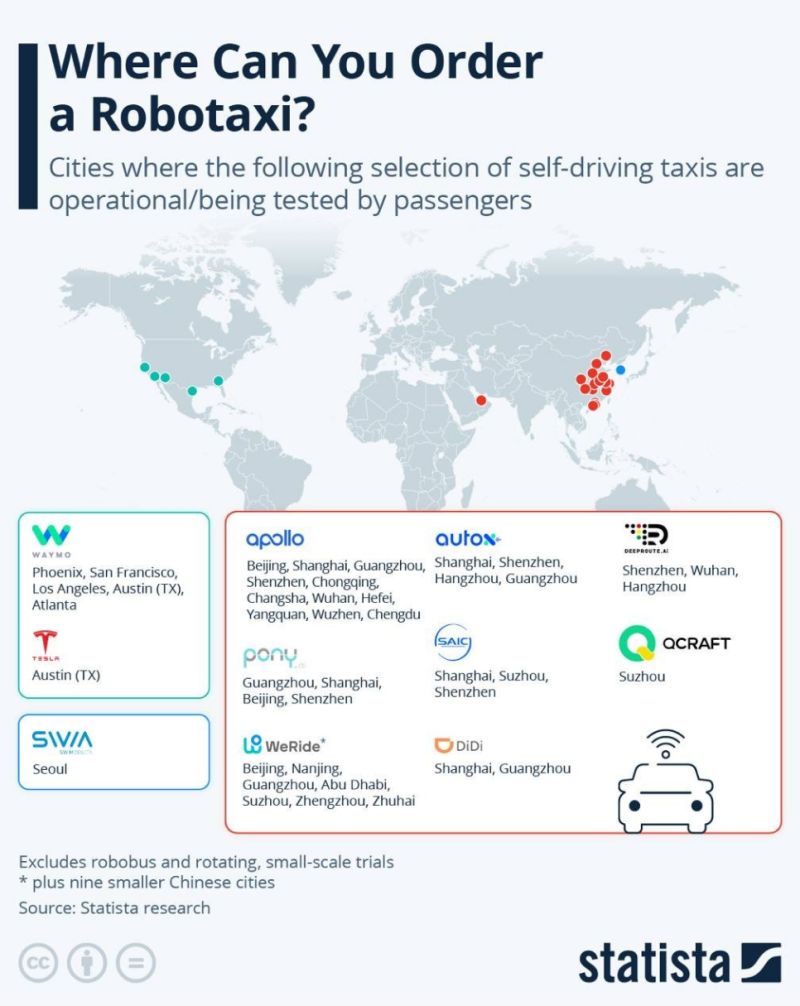

ROBOTAXIS ARE ALREADY OUT THERE

You can literally order a car with no driver in Phoenix, Shanghai, or even Seoul. No driver, no small talk, just you, a robot, and your questionable playlist. This isn’t sci-fi. From Austin to Abu Dhabi, robotaxis are creeping onto real streets. Watch your Uber driver sweat. Source: Statista thru Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks