Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 REMINDER: Bank of Japan expected to hike rates 25 bps Friday

Nobody knows when the real consequences will materialize, but after a prolonged period of extremely low rates, this continued shift will likely drain liquidity from markets, potentially causing a ripple effect through margin calls and other forced deleveraging. Rates will probably rise to 0.75%, which is still low by global standards. However, what matters most here is the rate of change, rather than the absolute level of rates. Higher Japanese rates = stronger yen → yen carry trade unwinds → investors sell foreign assets (U.S. Treasuries) → upward pressure on U.S. yields → global liquidity contracts Will it happen? Or is it already priced by the market? Source: Guillaume Tavares, Bitcoin Archive

Japan 10 year - US 10 year: the big crocodile jaw

Japan might have to use yield curve control again to save its bond market Source chart: The Market Ear

Japan's government says it may "intervene" before the Japanese Yen to US Dollar ratio reaches 160.

Over the last 2 months, the Yen has gone from 145 to 157 as a $110B+ stimulus package is coming. We are ~2% away from "intervention." Source: The Kobeissi Letter @KobeissiLetter

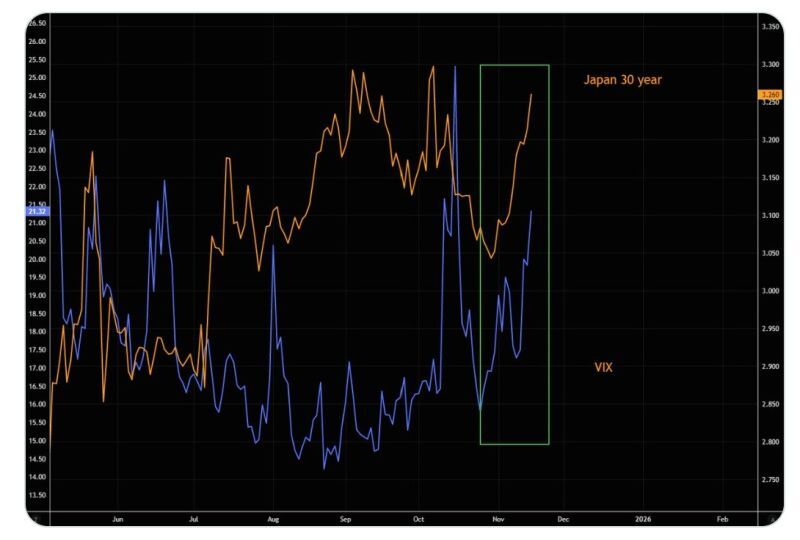

Why You Always Watch Japanese Rates.

Source: The Market Ear @themarketear

Japan's economy contracted 1.8% annualized in Q3, the first decline in six quarters.

You can pin most of it on a hit to exports from U.S. tariffs hammering demand. Consumer spending barely moved at 0.1% growth. Business investment held steady at 0.3%, suggesting corporate confidence hasn't completely evaporated yet. Source: StockMarket.news

🚀 Japan just dropped a $110 BILLION economic stimulus — its boldest move in years.

And it’s coming with a major shift in strategy. New Prime Minister Sanae Takaichi isn’t tiptoeing around slow growth or budget pressure. She’s going all-in with: ✅ Tax cuts ✅ Help with rising utility bills ✅ Direct support to local communities — even food aid But here’s the real story 👇 Japan isn’t just trying to ease short-term pain. It’s placing massive strategic bets on the industries that will define the next decade: 💡 Artificial Intelligence 🔧 Semiconductors 🚢 Shipbuilding 🛡️ Defence & advanced manufacturing This is about future-proofing Japan’s global competitiveness — especially in Asia’s fast-moving tech ecosystem. 💼 What does this mean for investors? This stimulus could be a major tailwind for: 📈 Japanese equities 🛍️ Consumer-focused sectors 💻 Tech, AI, and semiconductor plays But there’s a twist: expect some yen volatility. With the government coordinating closely with the Bank of Japan to keep interest rates low, markets will be watching every move. 🔍 The big question Will this $110B push spark sustained long-term growth — or just a short-lived burst of momentum? The world is watching closely. Because how Japan executes this plan could reshape Asia’s tech supply chains and become a blueprint for how far government spending can go in revitalizing an economy. Source: StockMarket.news

Hong Kong’s IPO Comeback

Chinese IPOs in America have collapsed 93% since 2021, raising just $875 million this year vs. $13 billion at the peak. Meanwhile, Hong Kong is reaping the rewards — Chinese listings there surged 164% to $18.4 billion across 56 deals. The turning point came after Beijing’s regulatory crackdown on Didi’s 2021 New York debut — a short-lived listing that ended with a forced delisting. Since then, companies in “strategic industries” face a regulatory maze for U.S. approval. The Nasdaq has raised the bar with a $25 million minimum for Chinese IPOs, while Hong Kong introduced its “Technology Enterprises Channel” to fast-track tech listings. source : cnbc

Sanae Takaichi on Tuesday created history, winning Japan’s parliamentary vote to become the country’s first woman prime minister, with domestic stock markets cheering her ascendancy.

Takaichi garnered 237 votes in the first round of voting, negating the need for a runoff vote in the 465-seat Lower House, according to public broadcaster NHK. Her victory comes after the ruling Liberal Democratic Party allied with the Japan Innovation Party and reportedly signed an agreement over the weekend to form a coalition government. Takaichi agreed to back JIP policies such as a reduction in parliamentary seats, free high school education and a two-year pause on food consumption tax, according to Reuters. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks