Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Beijing has warned it will retaliate against countries that negotiate trade deals with the US “at the expense of China’s interests”

The statement by the commerce ministry, which was responding to reports that US President Donald Trump’s administration planned to use trade talks with multiple countries to try to isolate China, called on them to instead join Beijing to “resist unilateral bullying”. “China firmly opposes any party reaching a deal at the expense of China’s interests,” the ministry said on Monday. “If this happens, China will never accept it and will resolutely take countermeasures in a reciprocal manner.” China has become the focus of Trump’s trade war after the US president paused a wave of unilateral “reciprocal” tariffs on most countries but left levies on Chinese goods as high as 145 per cent in place. Beijing has retaliated, imposing its own tariffs of 125 per cent on US goods.

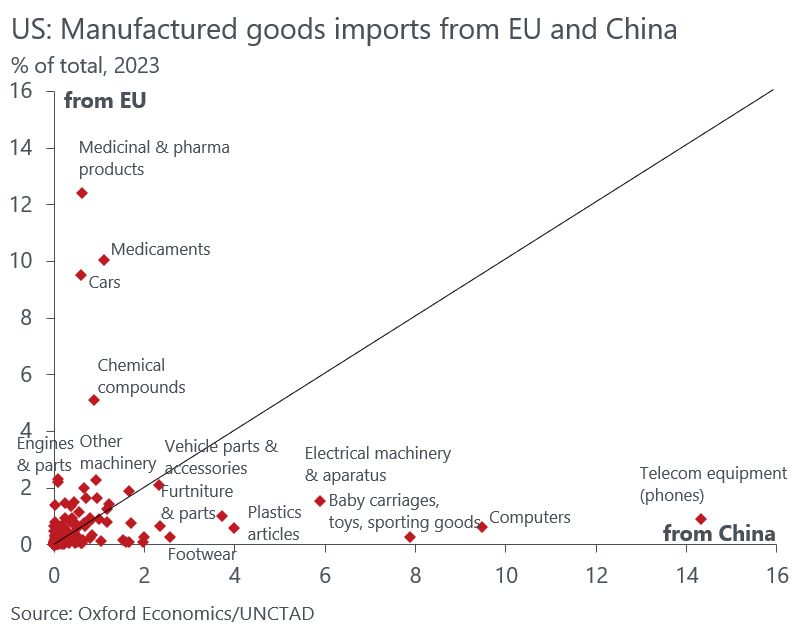

Remarkable how little overlap there is between the main categories of 🇺🇸 imports from 🇪🇺 (pharma, cars, chemicals) & 🇨🇳 (phones, computers, semi-durable consumer goods).

This means limited scope for 🇪🇺 to supplant China imports, which face prohibitive tariffs (main beneficiary is Vietnam). Source: Daniel Kral @DanielKral1

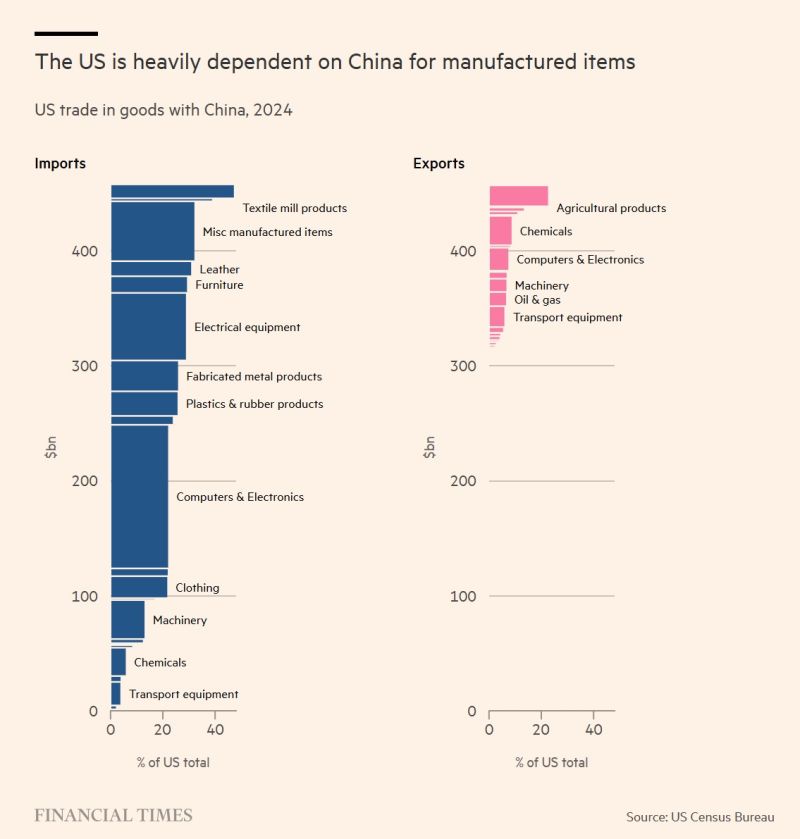

Trade, tech and Treasuries: China holds cards in US tariff stand-off - by FT

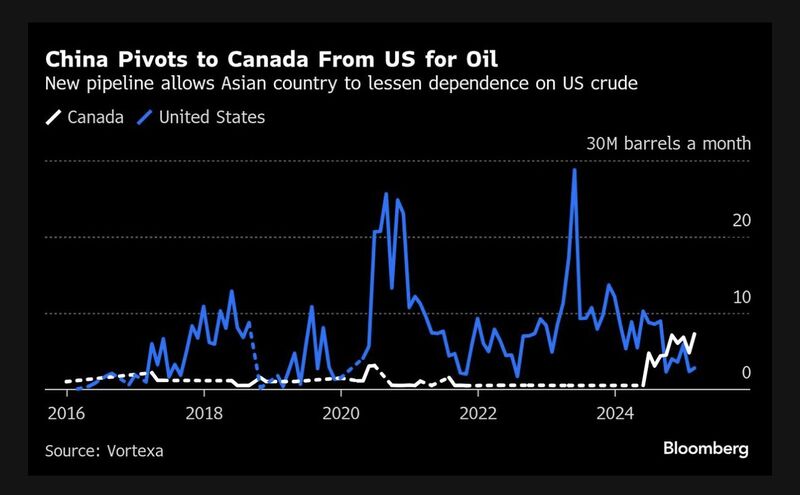

Marta Bengoa, professor of international economics at City University of New York, said that while the US and China remained heavily interdependent in trade, this meant the ultimate balance of risk was on the US side. “US dependence on China is higher, because China can source agricultural products from elsewhere more easily than the US can replace electronics and machinery,” she said. “Beijing is already buying up soyabeans from Brazil, for example, so in the end China has a bit more leverage.”

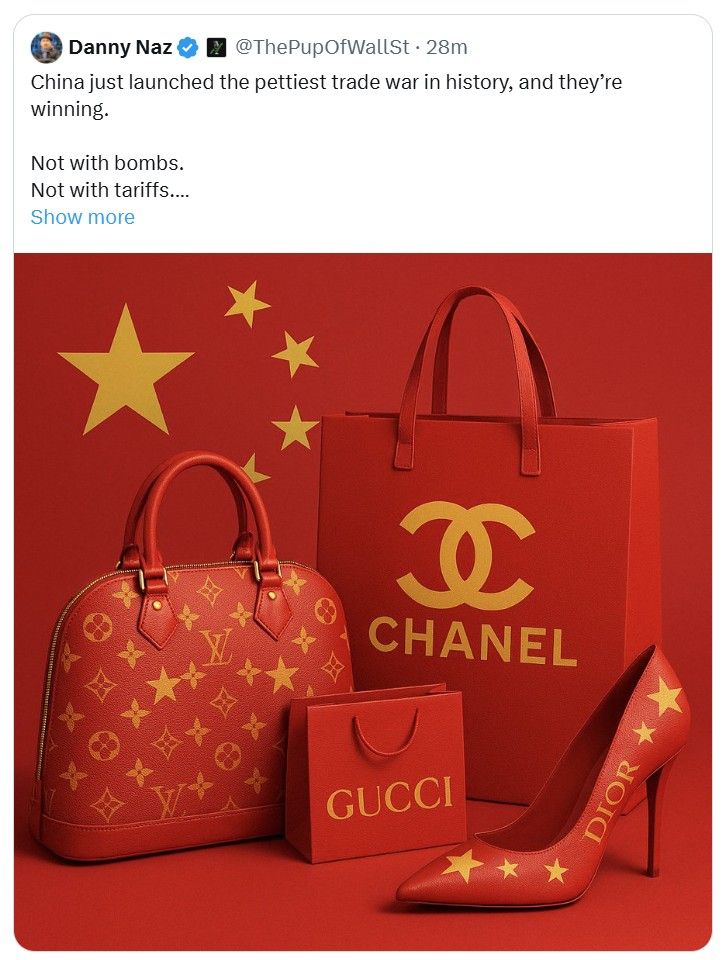

Interesting thread on X

China just launched a new kind of trade war. "The U.S. slapped tariffs on Chinese goods. China didn’t retaliate with weapons. They retaliated with information. The kind that makes $1,000 handbags look like $10 scams. TikTok is now flooded with Chinese suppliers exposing the truth: 👜 “You want a Birkin? We make them.” 🧘♀️ “Those $100 Lululemons? They’re $6 here.” 👟 “Your Nikes? Same factory.” Made in China. Shipped to Europe. Stamped “luxury.” Sent back. Marked up 1,000%. You thought you were buying European craftsmanship. You were buying a logo, a story, and a markup fantasy. China just ripped the mask off the entire Western luxury machine and showed you the receipts. And they’re being petty with it. 😏 They’re not just selling you knockoffs. They’re showing you the exact factory. Telling you the production cost. And teaching you how to fly in, shop direct, and skip tariffs altogether.

🚨BREAKING: TARIFF NEWS

State companies exporting from China face UP TO 245% Tariffs *Except if you are Apple $AAPL Source: @realDonaldTrump

China on Wednesday appointed Li Chenggang as vice minister of commerce and a top representative for international trade negotiation, according to an official statement, replacing Wang Shouwen.

The appointment makes Li a key member of China’s trade negotiation team as Beijing deals with trade disputes with the U.S. So far, there have not been any sign of near-term trade talks as both sides have ratcheted up tariff tensions. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks