Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: China unveils 0.6 cm mosquito-like spy drone designed for stealth missions.

Source: BRICS News

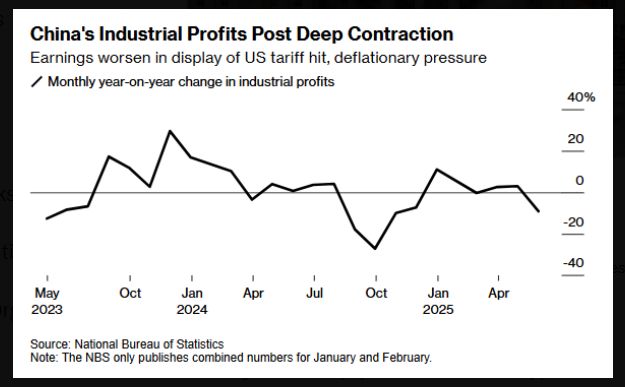

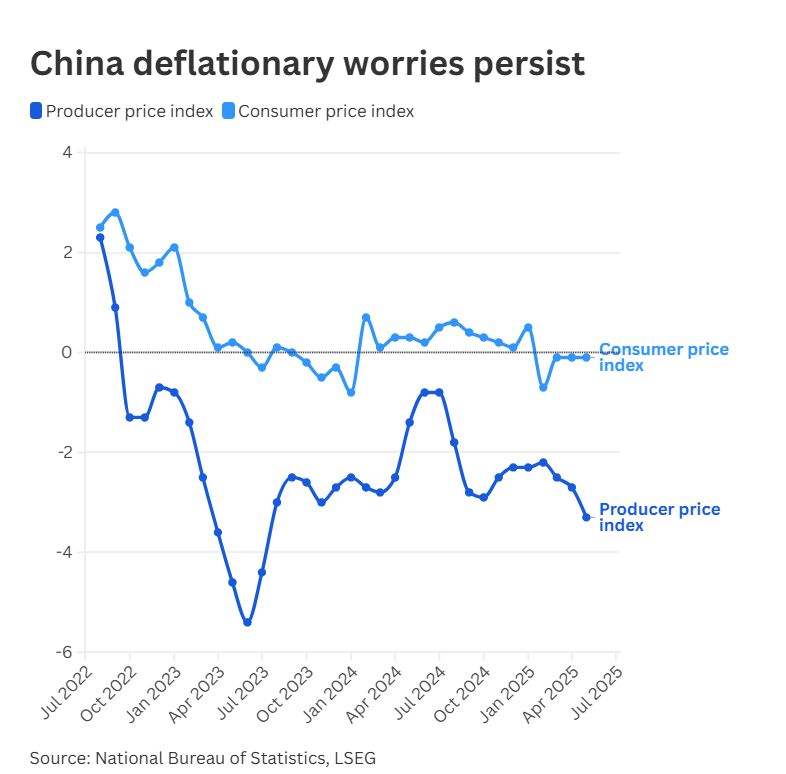

China’s industrial profits sink on US Tariffs, deflation woes - Bloomberg

China's industrial firms saw their profits drop the most since October, illustrating weakness in an economy strained by higher US tariffs and lingering deflationary pressure. Industrial profits fell 9.1% last month from a year earlier, according to data released Friday by the National Bureau of Statistics.

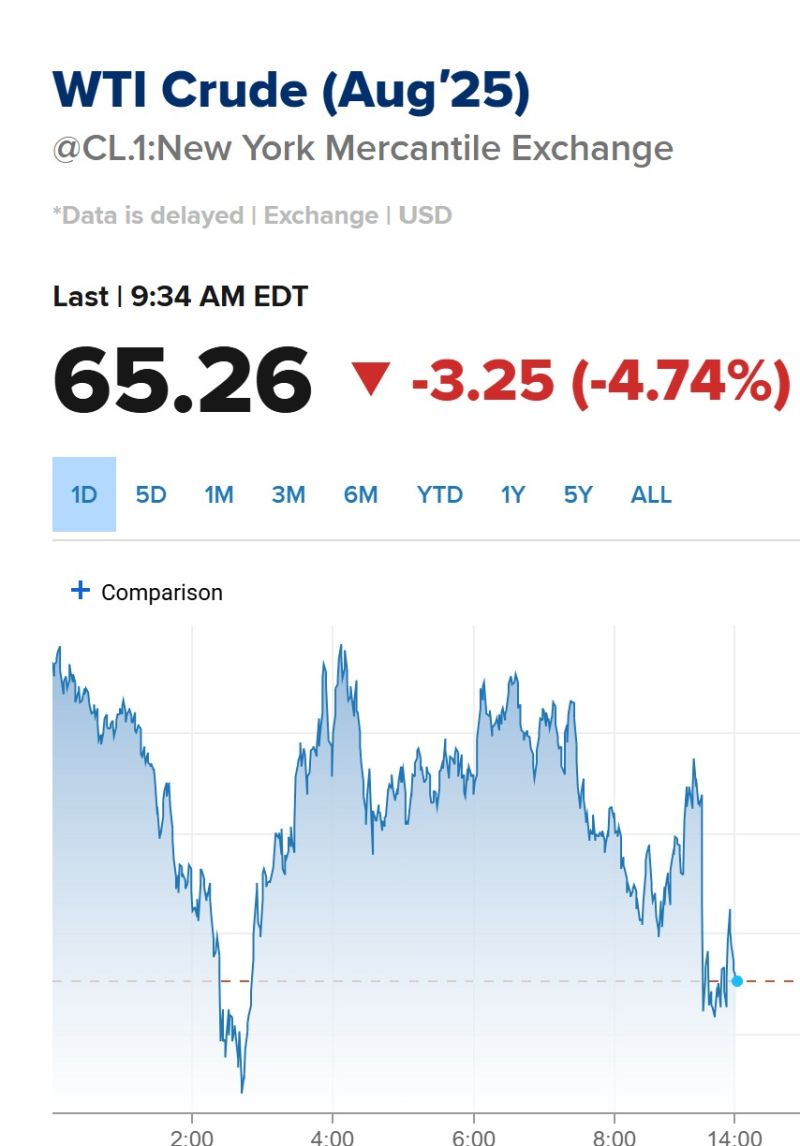

Oil prices fall 5% after Trump says China can continue buying oil from Iran.

“China can now continue to purchase Oil from Iran,” Trump said in a post on his social media platform Truth Social. “Hopefully, they will be purchasing plenty from the U.S., also. It was my Great Honor to make this happen!” Trump threatened in May to ban any country that buys Iranian oil from doing business with the U.S. China purchases the vast majority of Iran’s oil exports. Source: CNBC

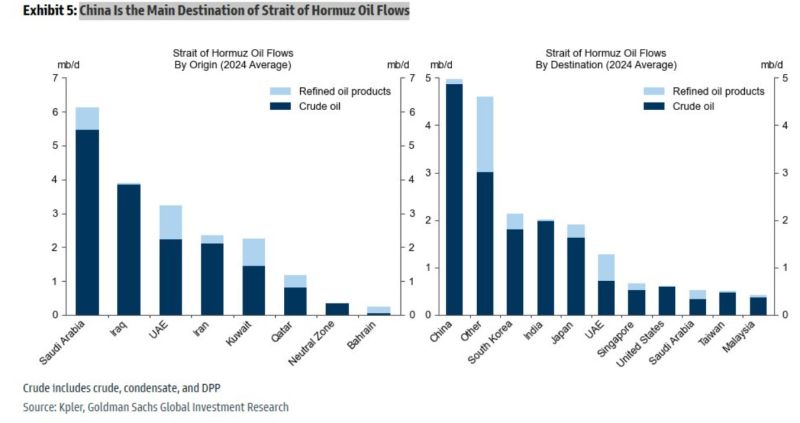

GS: China Is the Main Destination of Strait of Hormuz Oil Flows

Source: Mike Zaccardi, CFA, CMT, MBA

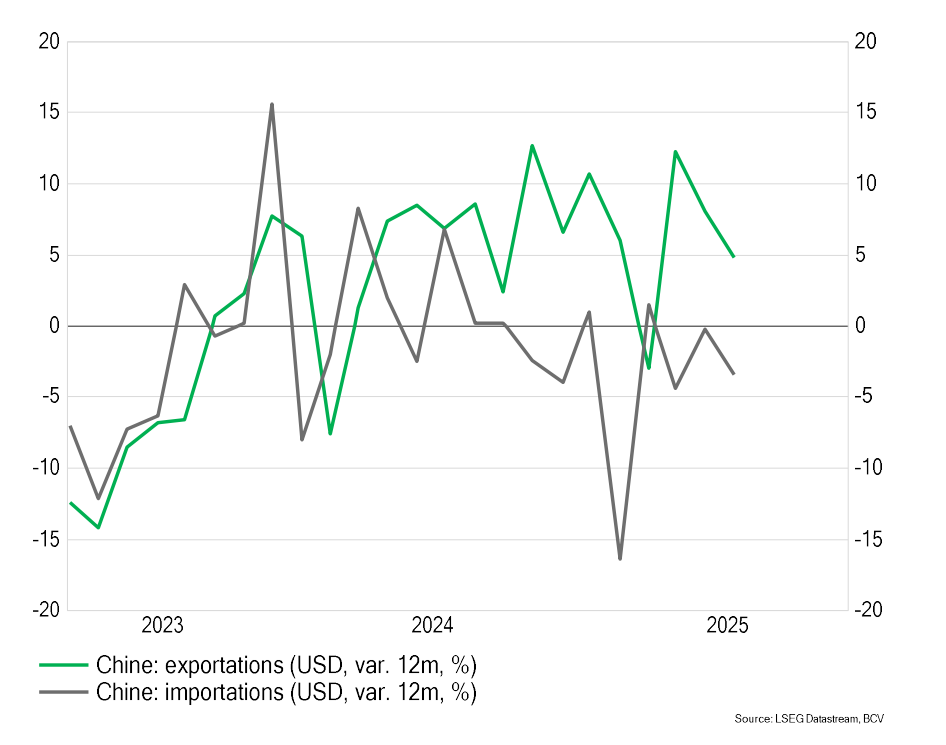

China: The trade war is starting to weigh on activity

Trade balance figures for the month of May reveal a notable slowdown in exports. Source: BCV

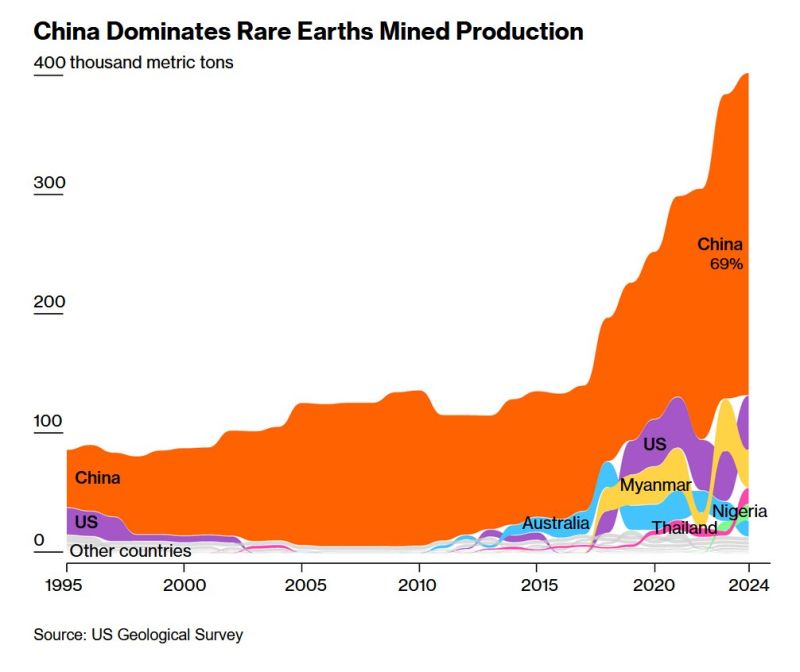

China dominates global rare earths production:

China now produces nearly 400,000 metric tons of rare earths a year. This is a massive 69% of the global output, per the US Geological Survey. The US is seeking to restore flows of critical minerals in today's trade talks. Source: Global Markets Investor

China’s exports growth missed expectations in May

dragged down by a sharp decline in shipments to the U.S., with analysts saying effects of a Beijing-Washington trade truce will be visible in June data. 🟥 Chinese exports to the U.S. plunged 34.5% from a year ago, marking the sharpest drop since February 2020, according to Wind Information, when the Covid-19 pandemic disrupted trade. Imports from the U.S. dropped over 18%, and China’s trade surplus with America shrank by 41.55% year on year to $18 billion. Overall exports rose 4.8% last month in U.S. dollar terms from a year earlier, customs data showed Monday, shy of Reuters’ poll estimates of a 5% jump. 🟥 Imports plunged 3.4% in May from a year earlier, a drastic drop compared to economists’ expectations of a 0.9% fall. Imports had been declining this year, largely owed to sluggish domestic demand. That was largely offset by its shipment to the Southeast Asian bloc, which jumped nearly 15% from a year, and those to European Union countries and Africa, which rose 12% and over 33%, respectively. Source: CNBC

China’s consumer prices fell for a fourth consecutive month in May

Beijing’s stimulus measures appear insufficient to boost domestic consumption, with price wars in the auto sector adding to downward pressure. 🟥 The consumer price index fell 0.1% from a year earlier, according to data from the National Bureau of Statistics released Monday, compared with Reuters’ median estimate of a 0.2% decline. 🟥 CPI slipped into negative territory in February, falling 0.7% from a year ago, and has continued to post year-on-year declines of 0.1% in March, April, and now May. Core inflation, excluding food and energy prices, however, rose 0.6% in May — highest since January this year, according to Wind Information. Separately, deflation in the country’s factory-gate or producer prices deepened, falling 3.3% from a year earlier in May, marking the steepest decline since July 2023 and a sharper drop compared with analysts’ estimates of a 3.2% fall, according to LSEG data. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks