Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump has extended a trade war truce with China for another 90 days, two US officials have said, just hours before his Tuesday deadline to steepen tariffs on the world’s biggest exporter.

Source: FT

Nvidia and AMD agreed to pay 15% of China chip sales revenue to US government

According to this FT article, Nvidia and AMD have agreed to give the US government 15 per cent of the revenues from chip sales in China, as part of an unusual arrangement with the Trump administration to obtain export licenses for the semiconductors. ▶️ The two chipmakers agreed to the financial arrangement as a condition for obtaining export licences for the Chinese market that were granted last week, according to people familiar with the situation, including a US official. The Financial Times reported on Friday that the commerce department started issuing H20 export licences on Friday, two days after Nvidia chief executive Jensen Huang met President Donald Trump. The US official said the administration had also started issuing licenses for AMD’s China chip. ‼️ The quid pro quo arrangement is unprecedented. According to export control experts, no US company has ever agreed to pay a portion of their revenues to obtain export licences. But the deal fits a pattern in the Trump administration where the president urges companies to take measures, such as domestic investments, for example, to prevent the imposition of tariffs in an effort to bring in jobs and revenue to America. Link to article: https://lnkd.in/eZXmhSBP Source: FT

China’s July exports top expectations, rising over 7%; imports record biggest jump in a year ‼️

▶️ Exports climbed 7.2% in July in U.S. dollar terms from a year earlier, customs data showed Thursday, exceeding Reuters-polled economists’ estimates of a 5.4% rise. ▶️Imports rose 4.1% last month from a year earlier, marking the biggest jump since July 2024, according to LSEG data. The data also indicated a recovery in import levels following June’s 1.1% rebound. Economists had forecast imports in July to fall 1.0%, according to a Reuters poll. ▶️On a year-to-date basis, China’s overall exports jumped 6.1% from a year earlier, while imports fell 2.7%, customs data showed. China’s trade surplus this year, as of July, reached $683.5 billion, 32% higher than the same period in 2024. Source: Augur Infinity @AugurInfinity, CNBC

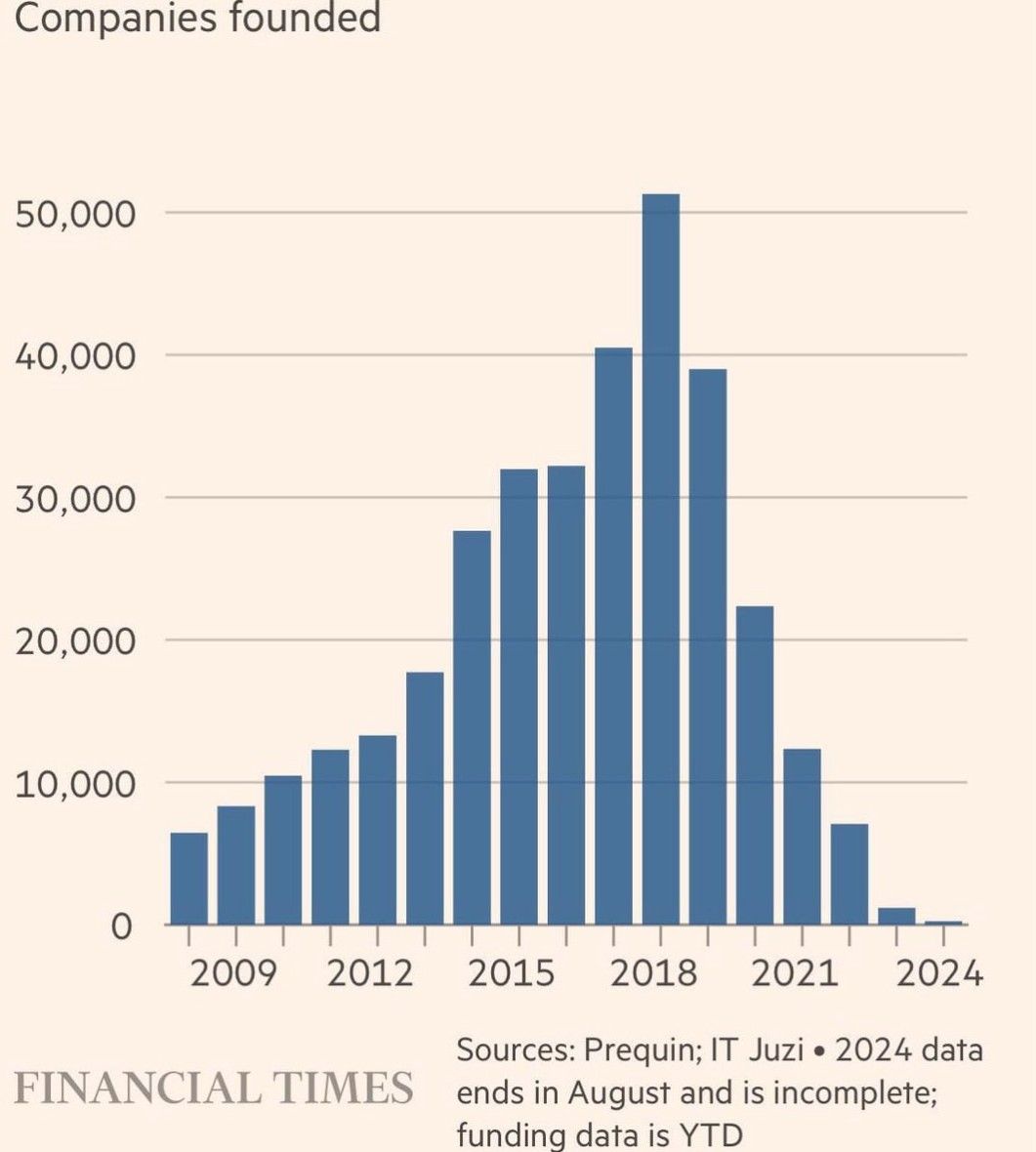

The chart below shows the number of companies founded in China each year.

Private entrepreneurialism fueling China’s economic rise has come to a full stop there. Time will tell what will be the consequences of a pivot to a state run economy again. Source: Michel A.Arouet, FT

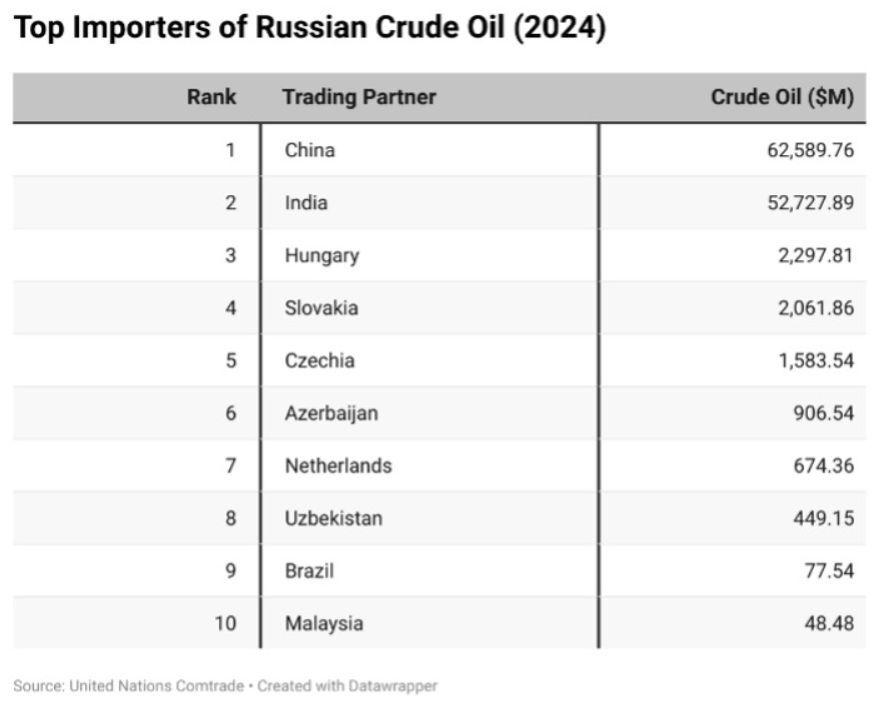

If you put a punitive tariff of 25% on India for importing Russian oil, you have to do the same for China, which is an even bigger buyer.

That means China tariffs go from 50% to 75% (and 20% in Jan. '25). Will it be applied on China as well??? Source: Robin Brooks

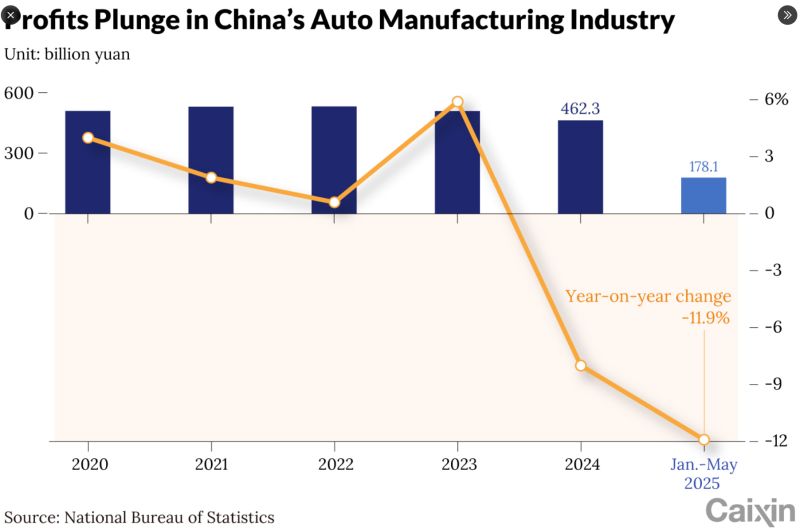

China's auto industryis a massive below-cost, state subsidized statecraft masking as trade

This is Beijing trying to put the world's auto producers out of business even as domestic carmakers teeter on the verge of collapse, but are propped up by state money. Source: zerohedge, Caixin

Investing with intelligence

Our latest research, commentary and market outlooks