Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

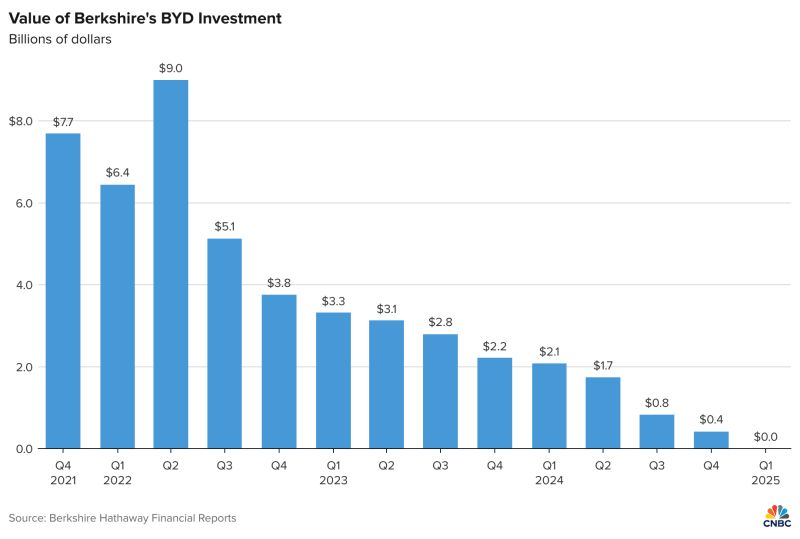

Warren Buffett and Berkshire Hathaway $BRK.B no longer own any shares of BYD - CNBC

Source: Evan

Interesting theory...

The Shanghai Gold Exchange (SGE) has activated two overseas vaults—one in Saudi Arabia, the other in Hong Kong—marking a direct expansion of RMB-denominated gold trading beyond mainland borders. This move represents a strategic move to enhance China’s gold trading infrastructure and strengthen the SGE’s role in global gold price discovery. These aren’t symbolic moves. They’re operational. They’re live. Source: Alasdair Macleod @MacleodFinance

China economic slowdown deepens in August

➡️ Retail sales rose 3.4% in August from a year earlier, missing analysts' estimates for a 3.9% growth and slowing from July's 3.7% growth. ➡️ China’s industrial output growth slipped 5.2%, the worst performance since August last year. ➡️ Fixed-asset investment, reported on a year-to-date basis, expanded just 0.5%, a sharp slowdown from the 1.6% expansion in the January to July period. ➡️ China's survey-based urban unemployment rate in August came in at 5.3%. Source: CNBC

China’s shipments to the U.S. plunged 33% in August

While overall exports growth slowed to its weakest level in six months, and President Donald Trump’s policy targeting trans-shipments weighed on exports and businesses, frontloading activity lost momentum. 👉Imports from the U.S. also dropped 16% from a year ago, customs data showed. 👉China’s total exports climbed 4.4% in August in U.S. dollar terms from a year earlier, customs data showed Monday, marking their lowest growth since February while missing Reuters-polled economists’ estimates for a 5.0% rise. That growth slowed from the prior two months, in part reflecting the statistical effect of a high base last year when China’s exports grew at their fastest pace in nearly one-and-a-half years. 👉Imports rose 1.3% last month from a year ago, missing Reuters estimates for a 3% growth. Imports rose for a third straight month after returning to growth in June, albeit still muted due to the persistent real estate slump, rising job insecurity, among other things. ➡️ China has increasingly relied on alternative markets, particularly Southeast Asia and European Union nations, Africa and Latin America, as U.S. President Donald Trump’s trade policy has pressured U.S.-bound shipments. Nonetheless, no one country has come close to the U.S. which remains China’s largest trading partner on a single-country basis, absorbing $283 billion of Chinese goods this year as of August. Exports to the EU stood at $541 billion over the same period. Beijing and Washington on Aug. 11 agreed to extend their tariff truce by another 90 days, locking in place U.S. tariffs of around 55% on Chinese imports and 30% Chinese duties on U.S. goods, according to Peterson Institute for International Economist. But bilateral talks appear to be struggling to reach a breakthrough, with a late-August visit to Washington by top Chinese trade negotiator Li Chenggang yielding little progress. Source: CNBC

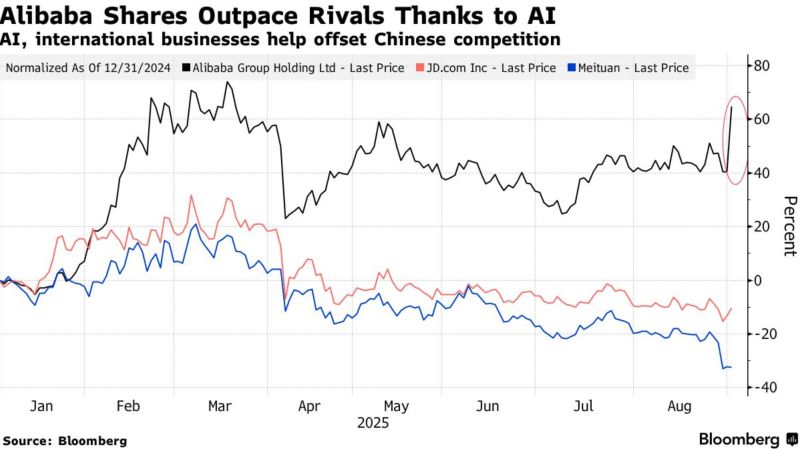

$BABA Alibaba shares are jumping +18%

The most since 2022, after China’s e-commerce leader posted a triple-digit percentage gain in AI-related product revenue as well as a better-than-anticipated 26% jump in sales from the cloud division. Alibaba’s rally also helped energize the broader AI sphere: Ernie developer Baidu gained as much as 5.8%, while Tencent Holdings also climbed. “Alibaba’s breakout reinforces a broader theme in Asia: while global tech remains preoccupied with geopolitics and valuations, parts of China tech are quietly REACCELERATING—driven not by hype, but by real revenue growth in AI and cloud,” said Charu Chanana, chief investment strategist at Saxo Markets. “This isn’t a broad-based rotation yet—but the divergence is real.” Source: Bloomberg, @neilksethi on X

Nvidia $NVDA CEO Jensen Huang just said this about China

"The China market, I've estimated, to be about $50 Billion opportunity for us this year" ... "you would expect it to grow say, 50% per year" "It is the second largest computing market in the world, and it is also the home of about 50% of the world's AI researchers, the vast majority of the leading open source models are created into China. And so it's fairly important, I think, for the American technology companies to be able to address that market." Source: Evan

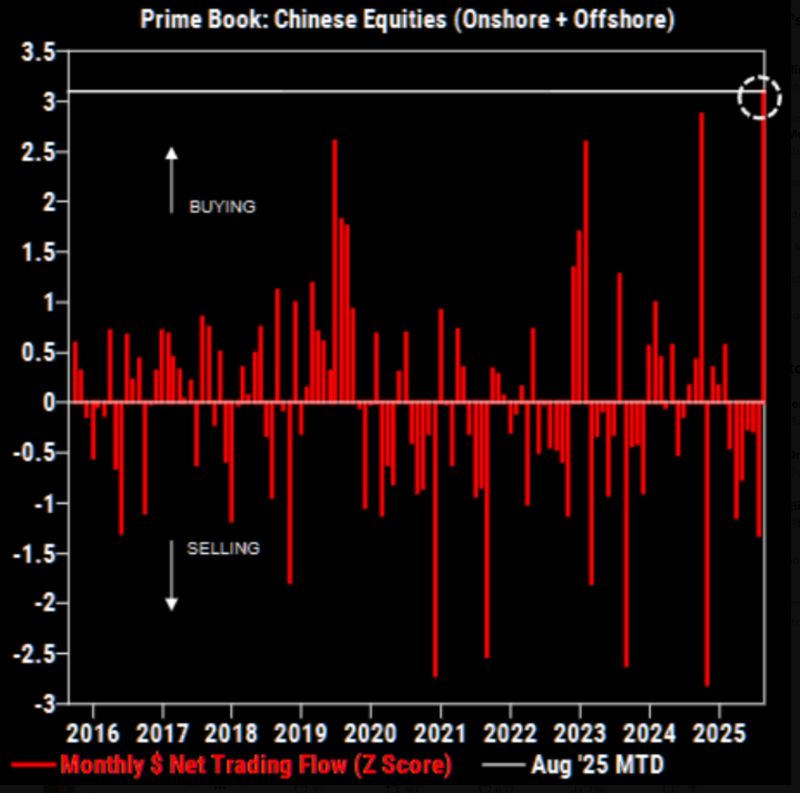

Chinese stocks on track for the largest monthly inflow from Hedge Funds in history

Source: Barchart

China’s chipmakers are seeking to triple the country’s total output of artificial intelligence processors next year, as Beijing races the US to develop the most advanced AI.

One fabrication plant dedicated to producing Huawei’s AI processors is scheduled to start production as soon as the end of this year, while two more are due to launch next year, said two people with knowledge of the plans. While the new plants are designed to specifically support Huawei, it is not clear who exactly owns them. Huawei denied having plans to launch its own fabs and did not provide further details. Chinese companies are also racing to develop the next generation of AI chips adaptable to a standard advocated for by DeepSeek, which has emerged as the country’s leading AI start-up. Huawei’s latest products are seen as among those that would satisfy DeepSeek’s requirements. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks