Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

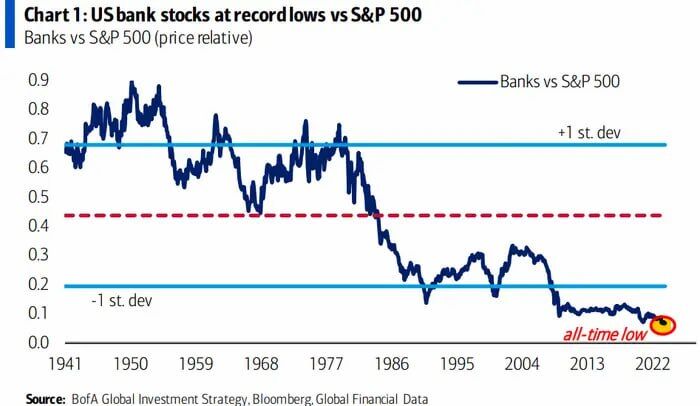

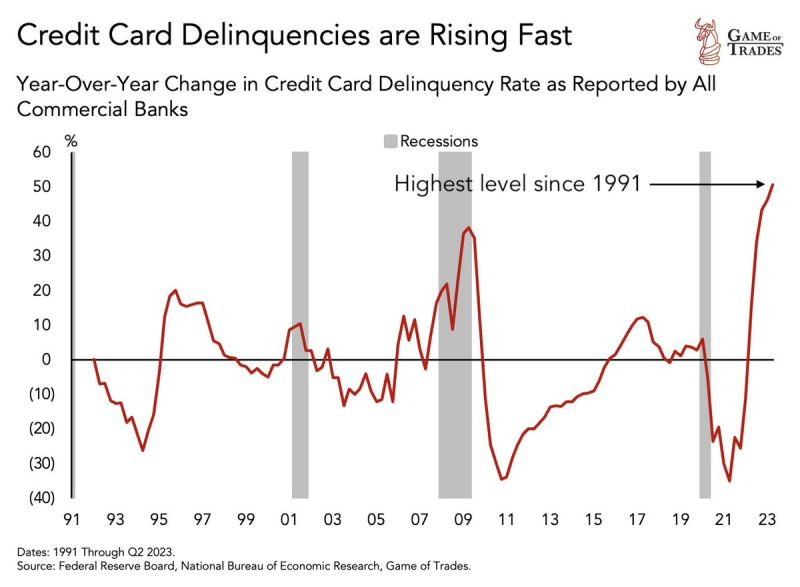

US bank stocks never recovered from the regional banking crisis. Currently, US bank stocks are at record lows relative to the S&P 500

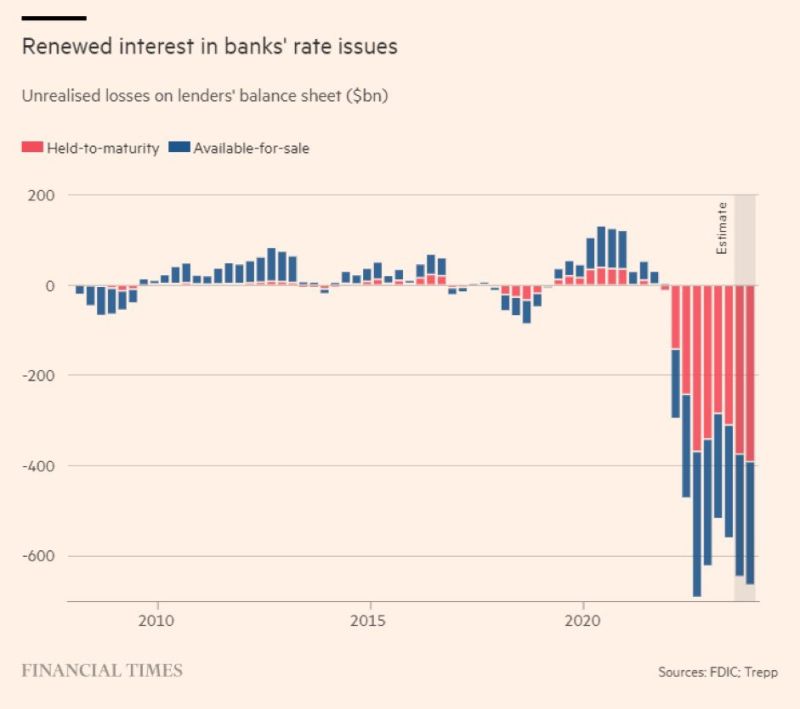

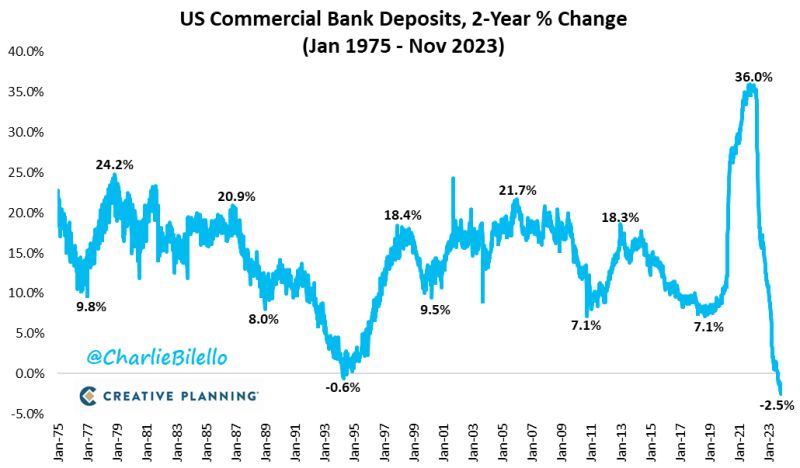

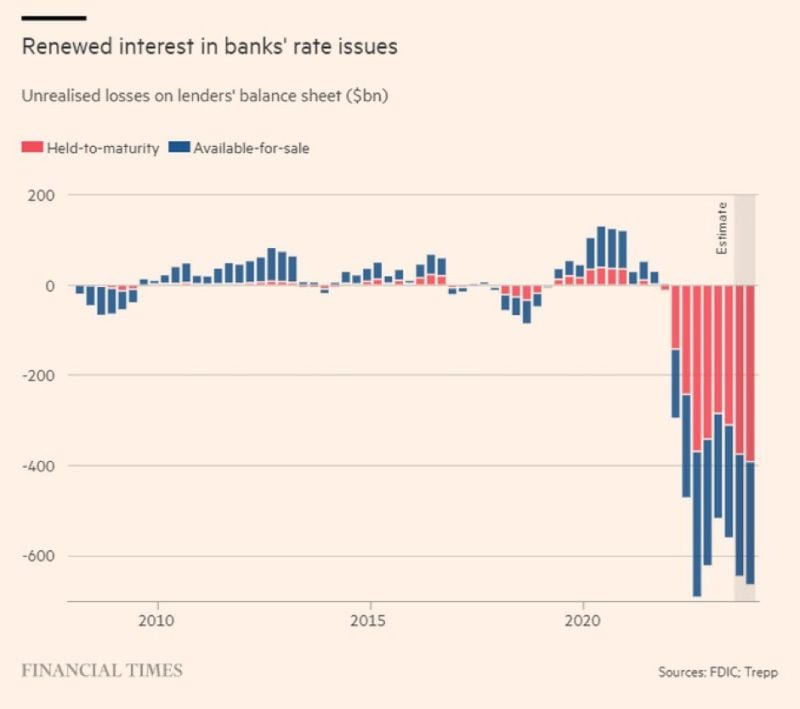

According to Moodys, major US banks are sitting on $650 billion in unrealized losses. Meanwhile, the looming commercial real estate (CRE) crisis has small banks in question. Small banks currently hold ~70% of all CRE loans in the US, $1.5 trillion of which need to be refinanced by 2025. Source: BofA, The Kobeissi Letter

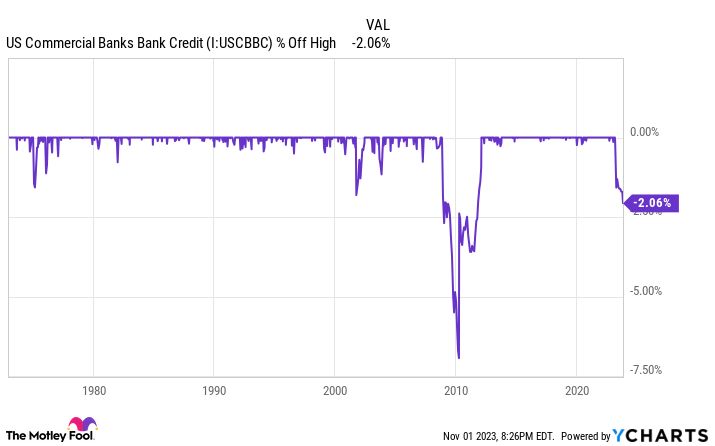

For only the 3rd time in the last 50 years, commercial bank credit has declined by more than 2%

The other 2 times were the peak of the Dot Com Bubble and the aftermath of the Global Financial Crisis. Source: barchart

4 of Wall Street's biggest banks have recently plummeted to levels not seen since the devastating March Banking Crisis

YTD losses are staggering, with 📉 ranging from -15% to -24% causing significant concerns for investors & overall market Source: The Coastal Journal

Investing with intelligence

Our latest research, commentary and market outlooks