Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

In case you missed it...

Citigroup $C closed at its lowest price in more than 3.5 years Source: Barchart

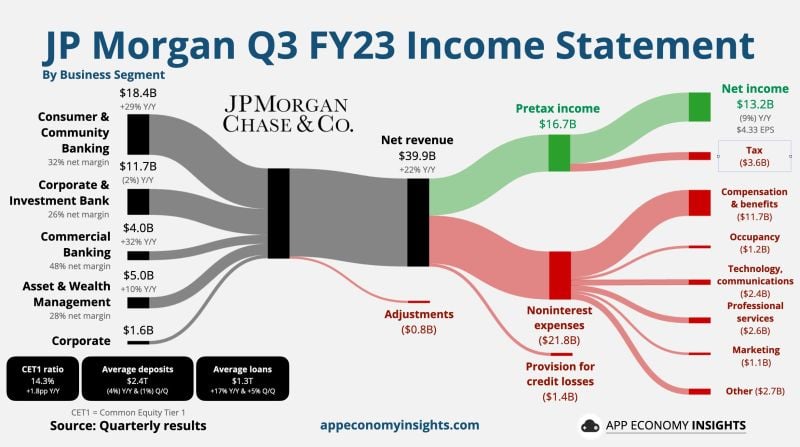

$JPM JP Morgan Chase Q3 FY23

CEO Jamie Dimon: "Now may be the most dangerous time the world has seen in decades." • Net revenue +22% Y/Y to $39.9B ($0.5B beat). • Net Income $13.2B. • EPS: $4.33 ($0.39 beat). • CET1 ratio of 14.3%. Source: App Economy Insights

JPMorgan Debuts Tokenization Platform, BlackRock Among Key Clients According to a report by cointelegraph

United States banking giant JPMorgan debuted its in-house blockchain-based tokenization application, the Tokenized Collateral Network (TCN), on Oct. 11, according to Bloomberg. TCN settled its first trade for asset management giant BlackRock. The Tokenized Collateral Network is an application that allows investors to utilize assets as collateral. Using #blockchain technology, investors can transfer collateral ownership without moving assets in underlying ledgers. In its first public collateralized trade between JPMorgan and BlackRock, the TCN turned shares of one money market fund into digital tokens, which were then transferred to Barclays bank as security for an over-the-counter derivatives exchange between the two companies. Source: www.zerohedge.com, www.cointelegraph.com

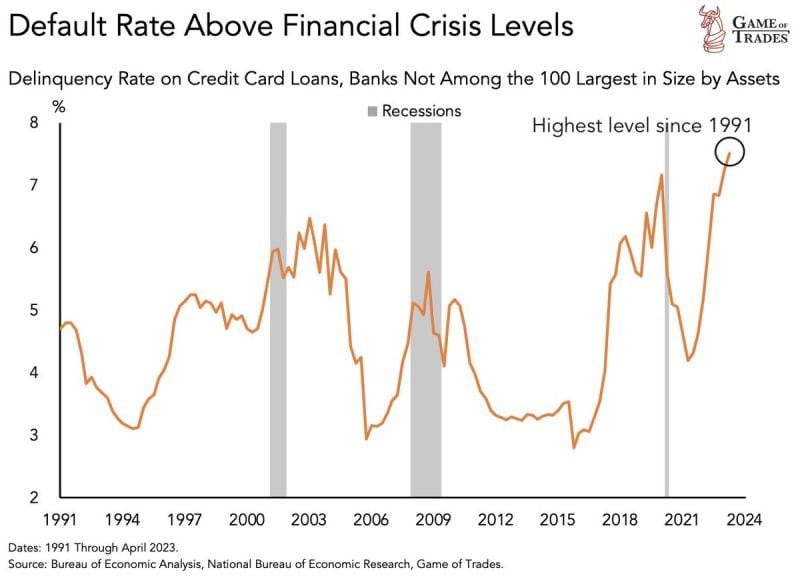

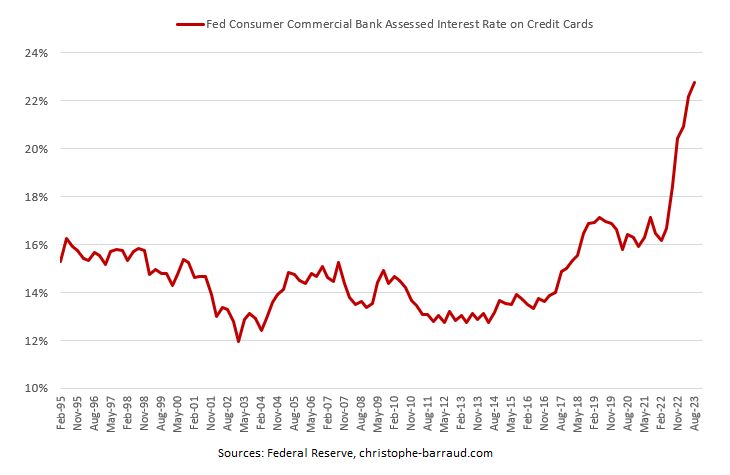

The consumer is borrowing more than they can afford to pay

The consumer default rate on credit card loans from small lenders has seen a sharp spike to 7.51% This level is higher than the: - Dot Com bubble - Financial Crisis - C-19 With credit card interest rates still above 20%. Consumers are going to continue feeling the pressure. Source: Game of Trades

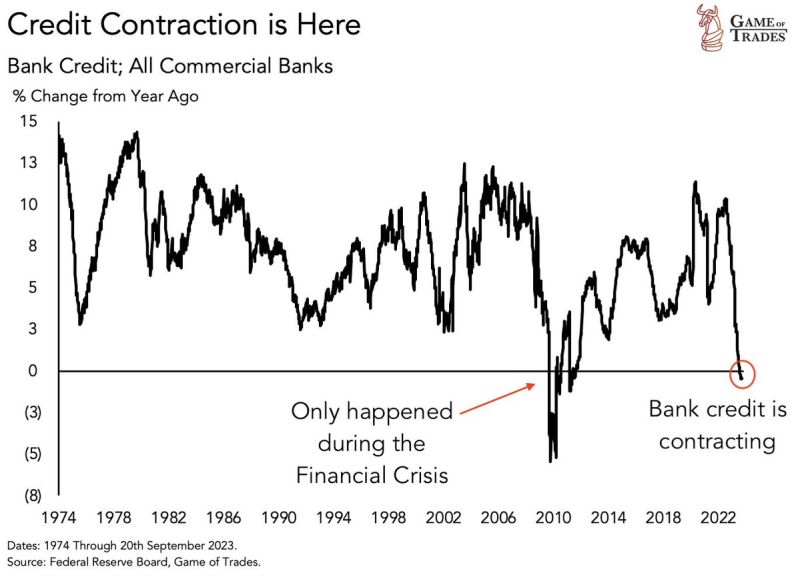

Bank credit has now entered contraction territory. After witnessing one of sharpest declines on record

Since 1974, this has only happened ONCE: → The Financial Crisis. Back then, this metric reached levels as low as -5%. At the current rate, the risk of a credit event is on the rise. Source: Game of trades

CDS traders are sending default swaps on the big US BANKS sharply wider

- Deutsche Bank believes the rise in yields could propel Banks' Unrealized losses $140 Billion higher to a record $700 Billion. DB strategist Zeng warns the Q3 explosion in rates has no doubt widened the unrealized losses in US banks bond portfolios, which was already the catalyst for multiple bank failures this year at a time when #rates blew out to far more normal levels.

BREAKING: UK Metro Bank shares plunge 50% as it tries to urgently raise £600m capital

- Metro Bank is seeking to raise up to £600mn after its share price fell almost 50 per cent in recent weeks, said people with knowledge of the plan. The UK challenger bank is in talks with investors about raising £250mn in equity funding and £350mn in debt to shore up its balance sheet, the people said. - The talks came after regulators last month failed to approve a request from Metro to lower the capital requirements attached to its mortgage business. - Bank Crisis - Round II ? Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks