Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

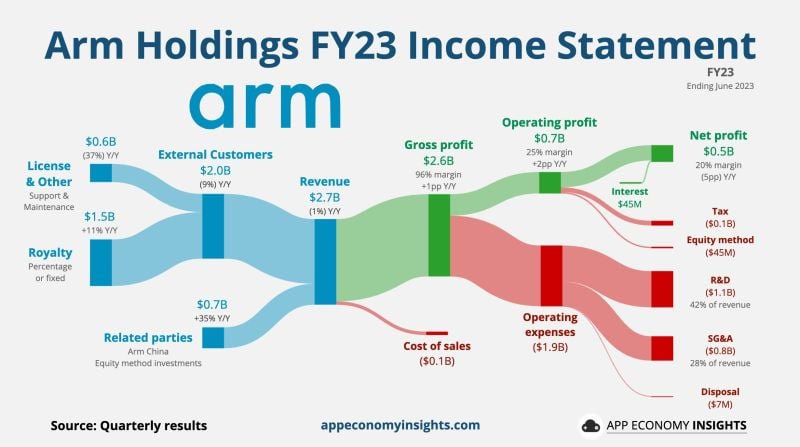

SoftBank's $ARM IPO is coming up

The chip designer aims to raise ~$5B, targeting a valuation of $50B-$55B. It's the largest US IPO since $RIVN in 2021. Note that SoftBank’s $50bn flotation of Arm is more than five times oversubscribed, according to bankers pitching investors on the biggest initial public offering in nearly two years, as the UK-based chip designer forecast accelerating revenue growth boosted by the artificial intelligence boom. Despite investor concerns about a drop in profits in Arm’s most recent quarter amid a smartphone industry slowdown and the company’s exposure to multiple risks in China, advisers working on the Nasdaq listing said there was “little price sensitivity among investors”, many of whom would be forced to buy because of Arm’s inclusion in indices. Here's a snapshot of its FY 2023 income satement by App Economy Insights

Usage of the Fed's emergency bank funding facility jumped by $328 million last week

It now stands at a new record high of $108 billion, even as the regional bank crisis is "over." The current rate banks are paying the Fed on these loans is an alarming ~5.5%. i.e . the banks that almost collapsed are now borrowing record levels of expensive debt from the Fed. Is the US regional banks crisis really over? Source: zerohedge, Bloomberg, The Kobeissi Letter

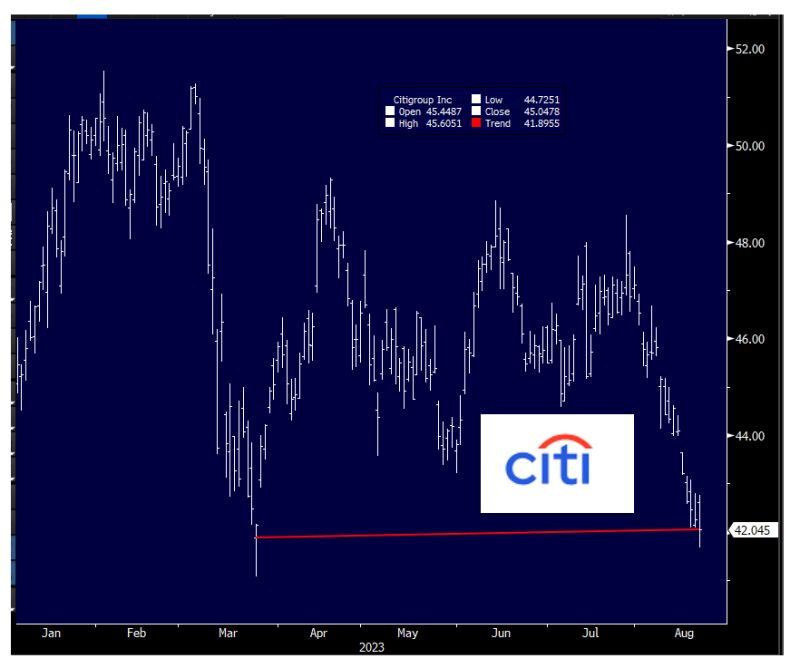

The KBW Bank Index fell by 8.8% in August, the weakest bank in the index is Citi with a -13.4% decline

Source: Bloomberg, HolgerZ

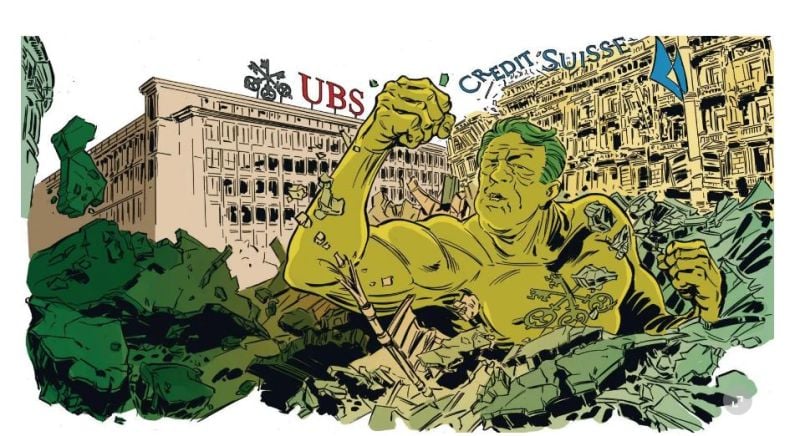

UBS Group AG posted a $29 billion second-quarter profit in first results since Credit Suisse takeover.

This is the biggest-ever quarterly profit for a bank in the second quarter as a result of its emergency takeover of Credit Suisse, and confirmed that it would fully integrate the local business of its former rival by next year. Key takeaways: - UBS said the result primarily reflected $28.93 billion in negative goodwill on the Credit Suisse acquisition (i.e this huge profit is due to a huge one-off gain that reflects how the acquisition costs were far below Credit Suisse's value). Underlying profit before tax, which excludes negative goodwill, integration-related expenses and acquisition costs, came in at $1.1 billion - The accounting gain for the quarter eclipses JPMorgan Chase & Co.’s $14.3 billion profit in the first quarter of 2021, the modern record for US and European lenders; - Analysts had projected a net profit of $12.8 billion for the three months to the end of June, according to a Reuters poll. Source: Bloomberg, CNBC Source illustration: Sonntagzeitung / Melk Thalmann

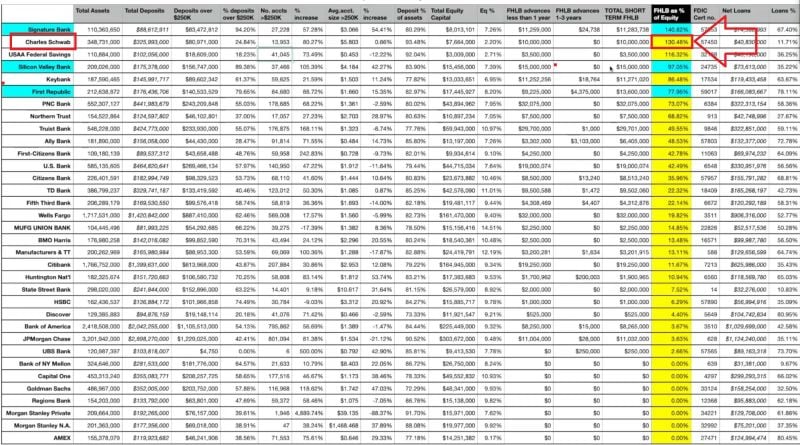

In case you missed it... Charles Schwab owes 130% of their total equity capital to short duration FHLB* loans that have to be paid back soon

Total assets $350 billion... Source: FinanceLancelot * What Is the Federal Home Loan Bank System (FHLB)? The Federal Home Loan Bank System (FHLB) is a consortium of 11 regional banks across the U.S. that provide a reliable stream of cash to other banks and lenders to finance housing, infrastructure, economic development, and other individual and community needs. (source: Investopedia)

In case you missed it...what's going on with Citigroup?

Yesterday it had its lowest close of 2023, back to the panic levels of mid-March when Silicon Valley Bank failed. Source chart: James Bianco

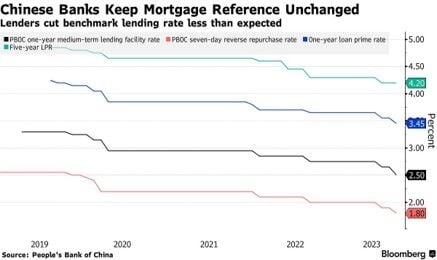

Overnight, Chinese banks made a smaller-than-expected cut to their benchmark lending rate

(cut 1-year rate by 10bps; no change in 5-year while the market was expecting a 15-basis-point cut on both rates) and avoided trimming the reference rate for mortgages, despite the PBOC urging lenders to boost loans. Banks’ failure to follow the central bank suggests they were unprepared, but that cuts to their lending rates may still arrive in the coming months.. Meanwhile, The Hang Seng Index declined as much as 1.8% and was set for its lowest close since November. Shares in mainland China also dropped into a second day, with finance stocks among the worst performers. Source: Bloomberg

China Shadow Banking Giant Alarms Investors With Missed Payments

One of China’s largest private wealth managers is triggering fresh anxiety about the health of the country’s #shadowbanking industry after missing payments on multiple high-yield products. Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plan to make clients whole, indicating troubles at the embattled Chinese shadow bank are deeper than previously known. Wang Qiang, board secretary of the firm partly owned by financial giant Zhongzhi Enterprise Group Co., told investors in a meeting earlier this week that the firm missed payments on a batch of products on Aug. 8, adding to delays on at least 10 others since late July, according to people familiar with the matter. At least 30 products are now overdue and Zhongrong also halted redemptions on some short-term instruments, one of the people said. Source: bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks