Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

In case you missed it. Citigroup $C yesterday closed at its lowest price since the onset of Covid...

Source: barchart

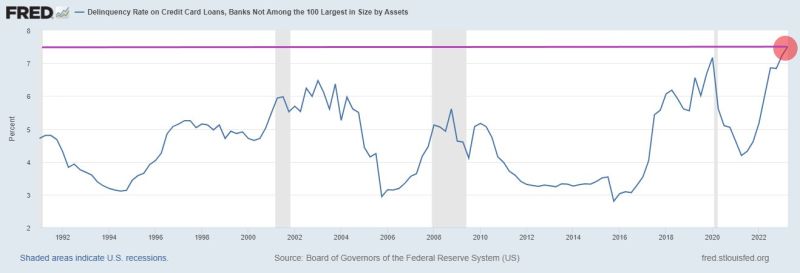

Credit Card Delinquency rates at small banks have reached 7.51%, the highest level ever recorded

Source: FRED

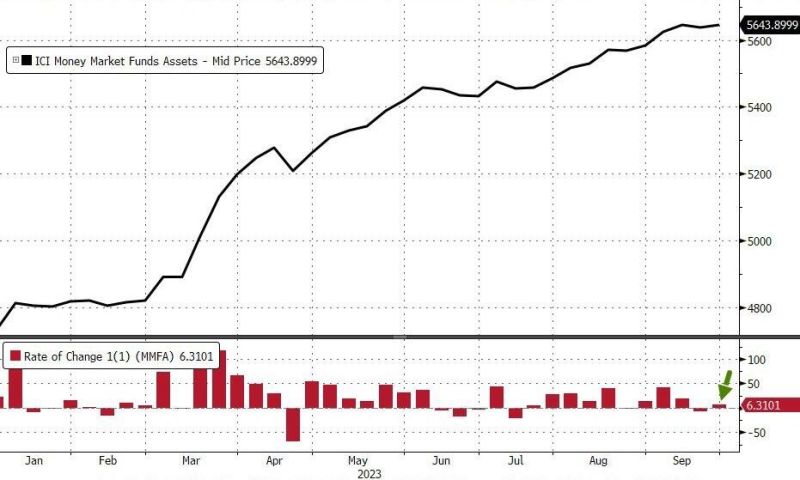

A lot of US banks deposits are going into money market funds which saw a $6.3 billion inflow last week, up to $5.64 trillion

Money market funds paying 5%+ interest rates have become the new safety trade. Source: www.zerohedge.com, Bloomberg, The Kobeissi Letter Activate to view larger image,

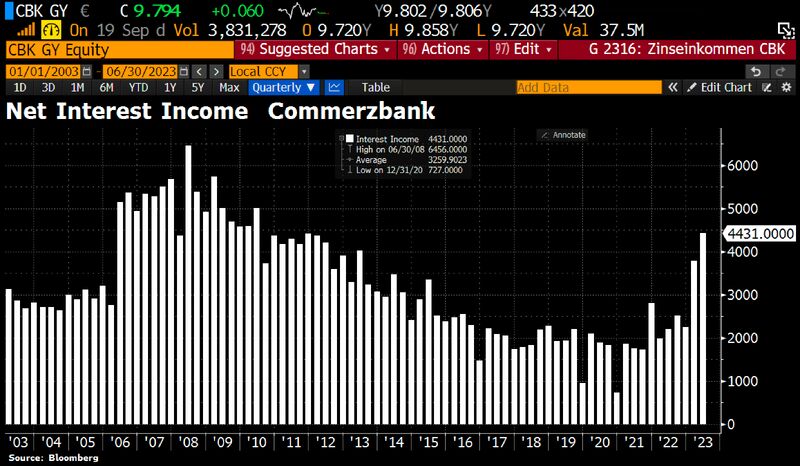

German banks are NOT passing on the increased interest rates to their customers

Commerzbank, Germany's 2n-largest retail bank, has announced it will increase net interest income to €8bn. Commerzbank has increased its deposit beta - a measure of how much of a rate increase it passes along to savers - slower than initially expected. The bank will end this year with something around a deposit beta of avg 40%. Source: HolgerZ, Bloomberg

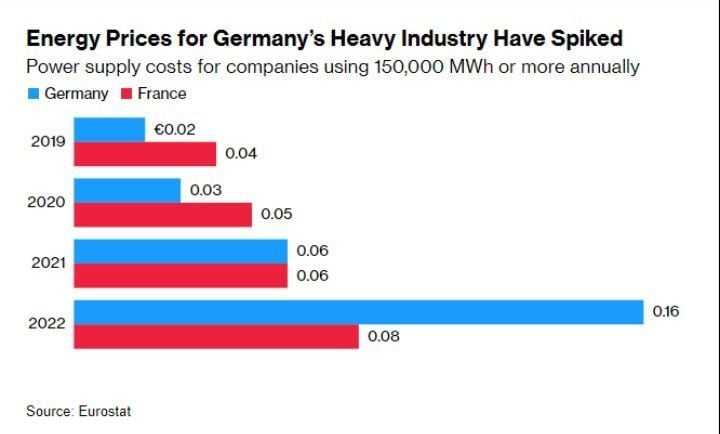

Why German industrial model is at risk in one chart...

Without reliable access to affordable power, Germany fears energy-intensive companies will invest elsewhere, and “we will lose this industrial base,” vice-chancellor Robert Habeck said. Source: Eurostat, Gustavo Philippsen Fuhr

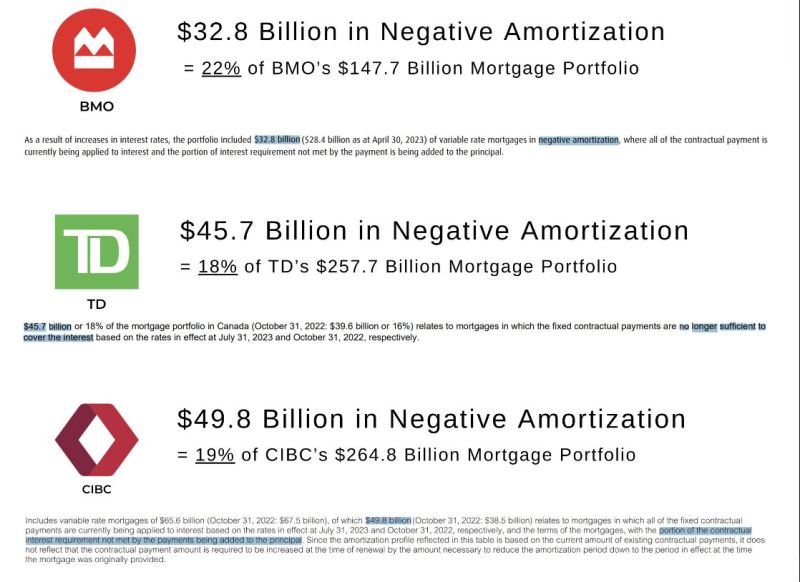

Have you ever heard about mortgages in negative amortization?

As highlighted by The Kobeissi Letter, three of Canada's largest banks are seeing ~20% of their outstanding mortgages in negative amortization. What does this mean? Monthly payments on ~20% of mortgages at BMO, TD, and CIBC are no longer enough to cover interest expense. This means you end up owing more than your original loan amount over time. Typically, variable rate mortgages with fixed payments experience this in a rapidly rising interest rate environment. These homeowners may begin to foreclose over the next few months. This is an important trend worth watching.

Investing with intelligence

Our latest research, commentary and market outlooks